I've been recommending TIPS since last November, when their real yields spiked and the market expected inflation to be negative for many years. Since then real yields have come down a lot, and inflation expectations have moved higher, and the combination of those two developments have delivered excellent returns to TIPS investors since then (i.e., the iShares Barclays TIPS fund, TIP, has more than doubled the return on the S&P 500 since the end of November, and the price of a 10-year TIPS bond today is almost 12% higher than it was in late November). Are TIPS still a good investment?

It's not so easy to answer that question now. The performance of TIPS is a function of two main variables, and neither one today is saying that TIPS are screamingly cheap, as they were back in November.

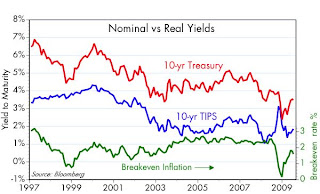

To assess the attractiveness of TIPS, let's start with the first chart above. It shows the real yield on 10-year TIPS, which is a decent proxy for the real yield on the entire TIPS market. I think of the real yield as the inherent value of TIPS, since that is the yield you will receive on top of whatever the inflation rate happens to be. Earning a positive real yield should be one of the primary goals of any investment strategy. So the higher the real yield on TIPS, the more attractive they are relative to other investments, because the real yield on TIPS is guaranteed by the U.S. government, whereas you have no way of knowing up front what the real yield on other investments will be.

The top chart shows valuation "zones" based on the level of real yields. These are subjective, of course, but they are based on my observation that when real yields on TIPS are 2.6%, then the total return on holding TIPS (the real yield plus the rate of inflation) will tend to equal the long-term nominal growth of the economy. In other words, at that point TIPS become "nominal GDP bonds." As such, their returns will come close to the growth rate of corporate profits over time, and they thus begin to present serious competition to equities on a risk-adjusted expected return basis.

At current real yields, I think TIPS are near the high end of what might be considered "fair value." The fair value zone is where I think real yields will likely tend to average over time. It's also close to what real yields on Treasuries have averaged over long periods. In other words, if you buy TIPS today, you shouldn't expect real yields to rise or fall over time, which is another way of saying that the price of a TIPS fund is not likely to be significantly higher or lower than it is today on a long-term expectational basis.

So the main thing that will drive TIPS returns going forward is the rate of inflation, not any change in the level of real yields. Now consider the third chart, which compares the actual 10-year annualized rate of change in the CPI to what the TIPS market expects that rate to be over the next 10 years. As should be obvious, the TIPS market has tended to underestimate actual inflation. Today, TIPS are priced to the assumption that the CPI will average about 1.7% a year for the next 10 years, whereas the CPI has averaged 2.5% a year for the past 10 years. In short, the bond market is betting that future inflation will be much lower than past inflation. In light of the massive expansion of the Fed's balance sheet since last September, and given the bond market's historical tendency to underestimate inflation, that seems like a courageous assumption.

If actual inflation in the future is about what it has been in the past, then 10-year TIPS will deliver annual returns of about 4.4% per year (1.8% real yield + 2.5% inflation) over the next 10 years. That is almost 1 percentage point more than you would get if you buy a 10-year Treasury bond today. On that basis, I would argue that TIPS are cheap relative to Treasuries. I think the odds favor inflation being higher than the bond market expects, so that means TIPS should deliver better returns than Treasuries.

If you think inflation is going to be a lot higher than the bond market expects, then the annual returns would also be a lot higher. For example, if the CPI averages 5% a year, then TIPS will yield roughly 7% per year.

Bottom line: TIPS are no longer a screaming buy, because real yields are not particularly high. TIPS are attractive relative to Treasury bonds, however, and they would deliver handsome returns in the event that inflation ends up being significantly higher than the market expects. TIPS are an excellent way to preserve one's purchasing power over time, while earning a moderate real rate of return. If you want your money to be safe (assuming of course that the U.S. government doesn't renege on its obligations) yet still deliver a positive real rate of return, TIPS are an excellent choice. For many investors, TIPS look superior to cash as a source of risk-free returns.

Full disclosure: I am long TIPS and TIP at the time of this writing.

2 comments:

Scott,

Appreciate your current thoughts on Tips, saw a guest on CNBC this AM, he is a new senior hire at PIMCO, he also likes tips. He describes TIPS as having a call on inflation and if you but the actual TIP you also have an imbedded put if we run into deflation since you will get your full principle back at maturity. He said you do not have the put when you buy a TIP ETF.

I know you are not too worried about deflation but I'm curious as to what you think of this idea and the pros and cons of ETF vs. actual TIPs. I'd rather not pass on free puts even if there is only a small probability of them ending up being exercised. Any thoughts on this would be appreciated. Thx.

I've posted before about the free put option in TIPS. If you own TIPS via a fund then you don't benefit much from it. To get the full benefit you have to buy newly-issued TIPS with relatively short maturities. The put on inflation (or a call on deflation) works only if you hold the securities until they mature. I've also posted about this subject, with a chart illustrating the significant premium that investors were paying for on-the-run issues when deflation fear was at its peak.

The problem with owning individual TIPS however is that the transaction costs are huge (figure 5% to buy and sell). That overwhelms the value of the put option in my view.

Post a Comment