Some charts I find of interest to the general public, and which you're unlikely to find elsewhere:

Chart #1

Chart #1 sheds light on an important input to the dollar's value: real yields. The red line shows the level of real yields on 5-yr TIPS. These are true real yields, since TIPS are bonds whose principal is adjusted by the CPI, and whose coupon is a "real" yield. (Their return to the investor is equal to the rate of consumer price inflation plus a real yield.) Real yields on TIPS are determined by market forces, and are in turn influenced by the market's expectation of future Fed policy. TIPS are not only safe from default, but also safe from the ravages of inflation.

The blue line is an index of the dollar's value vis a vis other major currencies. That the two tend to move together suggests that higher real yields enhance the value of the dollar, while lower real yields detract from the dollar's value. The situation today suggests that the dollar is trading on the weak side of where it would normally be given the current level of real yields. This further suggests that investors aren't entirely comfortable with the outlook for the U.S. economy (e.g., tariffs, deportations).

Chart #2

Chart #2 shows my model of the Purchasing Power Parity of the dollar vs. the euro. Currently, the model suggests that the dollar is just about equal to its PPP value against the euro. That further suggests that an American traveling in Europe is likely to find that the dollar price of goods and services there is roughly equal to prices in the U.S.

Chart #3

Chart #4

Chart #3 shows the level of credit spreads on Investment Grade and High-Yield corporate bonds—higher spreads reflecting greater credit risk, and lower spreads reflecting lower credit risk. Spreads today are just about as low as they have been for the past several decades. Chart #4 shows the difference between the two, which is a simple way of judging how nervous the bond market is. Taken together, these spreads are excellent barometers of the health of corporate profits, and by extension, the health of the economy. Conditions are looking pretty good according to corporate bond investors.

Charts #5 and #6

The dotted vertical lines mark periods of time when transfer payments ratcheted up rather sharply. That the participation rate ratcheted down each time suggests that people are less willing to work when they receive more money for not working. Funny how that works!

Note the more-than-doubling of transfer payments as a percent of disposable income from 1970 to today. Today, one of every five dollars spent by consumers comes from the government. Viewed from another angle, taxpayers are funding 20% of consumer spending.

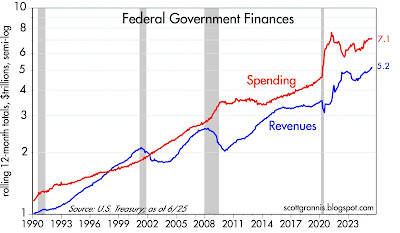

Chart #7

Chart #7 shows the breath-taking growth of federal government spending and tax receipts. Revenues today are more than 5 times what they were 35 years ago, and have increased at a 4.8% annualized rate. Spending today is more than 6 times what it was 35 years ago, and has increased at a 5.3% annualized rate. Our problem is runaway spending, not a lack of taxes.

Chart #8

Chart #8 shows the major components of federal revenues. Individual, corporate, and payroll taxes have all increased relentlessly with the passage of time. What stands out here is estate and gift taxes, which today represent a paltry 0.6% of total revenues (~$30 billion per year), and which have not increased at all over the past 25 years. The net worth of the private sector has quadrupled over the past quarter century, but estate and gift taxes haven't budged. This tax could be abolished and the impact on federal finances would be less than a rounding error. Yet this tax gives rise to an army of tax lawyers and accountants, while at the same time diverting trillions of dollars to sheltered investments. It undoubtedly costs the economy far more than the value the government collects. We would all be better off without it.

12 comments:

Credit spreads are also where they were just before the GFC. As Gary Gorton emphasized, we don't see financial crises coming.

Long-term money flows bottomed in 8/24. Peak is in 9/25?

Commensurate with CRB index

CRB Commodity Index – Price – Chart – Historical Data – News

I think I've said, a few times in the past several years, that what I worry most about is a crypto currency crash. Hardly anyone shares my concerns. Millions of crypto owners are betting there will be no crash, despite the fact that no one has been able to demonstrate the inherent value of any of these crypto currencies. Sobering facts: there are almost 10,000 crypto currencies being traded today (coinmarketcap.com), with a total market cap of $3.7 trillion.

"taxpayers are funding 20% of consumer spending." That's a business subsidy. Gas stations sell a few bananas so they can participate in the SNAP program.

By the way, one of the "transfer payments" you mention, social security? That's money people earned. It isn't "given" by the government. We who work "give" it to the government to hold in trust.

Social security has no trust fund and no lockbox other than government promises to pay. Recipients of SS have no legal right to receive those payments. SS is not an asset that you can sell or transfer to someone else. SS payments are established by Congress, not by actuaries. Think of Social Security as a supposed annuity that is managed not by actuaries but by politicians. In any event, Social Security is probably THE worst investment in the world, as measured by its return on investment. Worse still, most people are forced by the government to participate in it.

You are right. Quantum will accelerate the decrypting of crypto & expose all the money laundering which is its obvious true “purpose” despite the chattering of useful idiots. Crash imho within 2 years.

OK, so why don't Republicans put a bill on the floor of Congress, debate it, and vote whether or not to abolish it?

Charts 5 and 6 have me absolutely fuming. Since I already know the US government is broke and will never repay its debt, the day it stops the nonsense can't come soon enough.

interesting

Dollars in crypto are not being spent in the goods and services economy. I wonder the hidden consequences, possibly converting to dollars and then spent could contribute to inflation.

matka Indian matka 420 Fix Dpboss Matka Satta global website.

.

Kalyan matka 420 king satta matka dpboss awesome Matka website

Post a Comment