Some charts I find of interest to the general public, and which you're unlikely to find elsewhere:

Chart #1

Chart #1 sheds light on an important input to the dollar's value: real yields. The red line shows the level of real yields on 5-yr TIPS. These are true real yields, since TIPS are bonds whose principal is adjusted by the CPI, and whose coupon is a "real" yield. (Their return to the investor is equal to the rate of consumer price inflation plus a real yield.) Real yields on TIPS are determined by market forces, and are in turn influenced by the market's expectation of future Fed policy. TIPS are not only safe from default, but also safe from the ravages of inflation.

The blue line is an index of the dollar's value vis a vis other major currencies. That the two tend to move together suggests that higher real yields enhance the value of the dollar, while lower real yields detract from the dollar's value. The situation today suggests that the dollar is trading on the weak side of where it would normally be given the current level of real yields. This further suggests that investors aren't entirely comfortable with the outlook for the U.S. economy (e.g., tariffs, deportations).

Chart #2

Chart #2 shows my model of the Purchasing Power Parity of the dollar vs. the euro. Currently, the model suggests that the dollar is just about equal to its PPP value against the euro. That further suggests that an American traveling in Europe is likely to find that the dollar price of goods and services there is roughly equal to prices in the U.S.

Chart #3

Chart #4

Chart #3 shows the level of credit spreads on Investment Grade and High-Yield corporate bonds—higher spreads reflecting greater credit risk, and lower spreads reflecting lower credit risk. Spreads today are just about as low as they have been for the past several decades. Chart #4 shows the difference between the two, which is a simple way of judging how nervous the bond market is. Taken together, these spreads are excellent barometers of the health of corporate profits, and by extension, the health of the economy. Conditions are looking pretty good according to corporate bond investors.

Charts #5 and #6

Chart #5 shows the ratio of federal transfer payments (social security, medicaid, unemployment insurance, subsidies, food stamps, etc.) to disposable income. Transfer payments represent money the government gives people money for reasons other than to compensate for their labor. Chart #6 shows the Labor Force Participation Rate, which is the ratio of people working or looking for work divided by the number of people of working age.

The dotted vertical lines mark periods of time when transfer payments ratcheted up rather sharply. That the participation rate ratcheted down each time suggests that people are less willing to work when they receive more money for not working. Funny how that works!

Note the

more-than-doubling of transfer payments as a percent of disposable income from 1970 to today. Today, one of every five dollars spent by consumers comes from the government. Viewed from another angle, taxpayers are funding 20% of consumer spending.

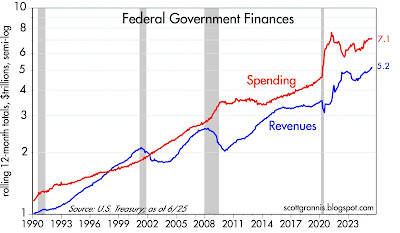

Chart #7

Chart #7 shows the breath-taking growth of federal government spending and tax receipts. Revenues today are more than 5 times what they were 35 years ago, and have increased at a 4.8% annualized rate. Spending today is more than 6 times what it was 35 years ago, and has increased at a 5.3% annualized rate. Our problem is runaway spending, not a lack of taxes.

Chart #8

Chart #8 shows the major components of federal revenues. Individual, corporate, and payroll taxes have all increased relentlessly with the passage of time. What stands out here is estate and gift taxes, which today represent a paltry 0.6% of total revenues (~$30 billion per year), and which have not increased at all over the past 25 years. The net worth of the private sector has quadrupled over the past quarter century, but estate and gift taxes haven't budged. This tax could be abolished and the impact on federal finances would be less than a rounding error. Yet this tax gives rise to an army of tax lawyers and accountants, while at the same time diverting trillions of dollars to sheltered investments. It undoubtedly costs the economy far more than the value the government collects. We would all be better off without it.