Last week's June CPI news surprised the market, but it didn't surprise me. The demise of inflation is playing out almost exactly as I've been anticipating for the past year or so.

Chart #1

Chart #2

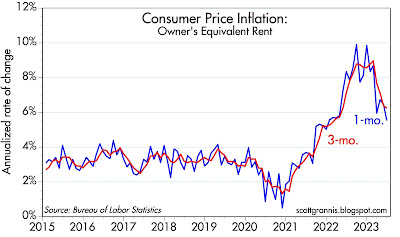

Chart #2 shows the 1 and 3-mo. annualized change in the component of the CPI. Inflation in this component has turned down in recent months (i.e., OER is still rising, but at a slower rate), but it has a long ways to go, as suggested by Chart #3.

Chart #3

Chart #3 shows that there is about an 18-mo. lag between changes in home prices and changes in the Owner's Equivalent Rent component of the CPI. Home prices haven't risen for at least a year, but the OER component of the CPI is still increasing. It likely won't turn flat or negative for at least the next 6-9 months.

The Fed needs to realize this now, and at the very least make it clear at next week's FOMC meeting that it plans no further hikes to short-term interest rates. The market, fortunately, has come to understand this, but it would be very helpful if the Fed eliminated lingering doubts.

Meanwhile, lower interest rates would be a welcome development for the economy. Mortgage rates are still punishingly high (~7% for 30-yr fixed rate mortgages) and that is making housing unaffordable for many millions of prospective homebuyers. Soaring interest rates on Treasuries have sent the interest cost of our mega-sized national debt to the moon, adding almost $1 trillion to this year's federal deficit.

19 comments:

Great post.

House prices are somewhat impervious to mortgage rates, as the house prices are also influenced by rents.

Rents are high and rising in many areas due to straitjackets on additional supply.

The Fed cannot build more housing (and ironically, when it raises rates it helps cut supply).

A true prosperity and anti-inflation program would have as its centerpiece a restoration of property rights, and an abolition on property zoning.

Free markets work better than the manacles of government diktats.

Thanks Scott. To clarify, are you suggesting that the Fed won't actually raise rates to 525-550 at the July meeting? I know you don't think they should, but will they?

Thanks, Scott.

I find the flat part confusing in " It likely won't turn flat or negative for at least the next 6-9 months." From the chart it looks like the index has reached flat, though down may take a bit.

Paul

Excellent post, as usual. Just keep hammering at this, Scott, particularly the information on shelter/OER CPI. I believe people are starting to listen and key in on this. We just need the very fallible 12 individuals of the Fed board to wake up and see the blindingly obvious as well. The 10-year Treasury is now at 3.74%. If they raise rates again (which is near 100% probability for the 7/26 meeting), they increase the probability of something big/unexpected "breaking", triggering a crisis.

Do the Fed board members not understand that there is a lag effect to the significant rate increases that have already made over the past 16 months?

Can they be this dumb?

Excellent article as well:

https://www.cato.org/blog/wasnt-lower-inflation-supposed-be-impossible-without-higher-unemployment

see: "Just 1% of U.S. Homes Have Changed Hands This Year, the Lowest Share in at Least a Decade"

Equities should top on 7/21/23, the 5th seasonal inflection point.

Some analysts point to the adverse base effects on inflation in the 2nd half of 2023 ("The base effect is the effect that choosing a different reference point for a comparison between two data points can have on the result of the comparison")

But the distributed lag effect of long-term money flows is still falling.

Re: will the Fed hike rates next week by 25 bps? According to Bloomberg's calculations, the market assigns a 96% probability to one 25 bps hike at next week's FOMC meeting (July 26th). At the same time, the market is quite confident that this will be the last hike, and that the Fed will begin to lower rates at the December or January FOMC meetings.

I think the market is clearly underestimating the likelihood that the Fed stands pat next week. If I had to guess, I'd say there is a 65% probability of no hike next week, and I think it is equally likely that the Fed begins to lower rates well before the end of this year.

The impact(s) of the hikes in place are likely already enough to do what the Fed needs. However, interest rate sensitive markets, e.g. financial markets and real estate, are still priced for lower rates.

If the stock market would lose about 20% and real estate lose about 10% in the next couple of years, they will reflect more fundamentals of the inputs to their value. (and market participants would reset their "sentiment for speculation").

If that can be done without a recession, Powell should celebrate and retire.

As they say, we'll see.

U.S INITIAL JOBLESS CLAIMS ACTUAL: 228K VS 237K PREVIOUS; EST 240K

...

One hopes in vain for a FED that doesn't believe that inflation has its origin in Too Many People Working.

The FED mismanages risk premiums/price signals. R-star is fictitious. The FED's artificial manipulation of interest rates as its monetary transmission mechanism has hammered the real rate of interest, while shrinking credit spreads, and has unnecessarily stoked asset prices (where housing prices are a principal target).

Contrary to its mandate, the FED directly affects specific assets, real-estate prices, by buying and selling MBS.

Richmond Fed studied this subject back in April 2023- When Will a Decline in Asking Rents Be Reflected in Rent CPI? https://www.richmondfed.org/research/national_economy/macro_minute/2023/mm_04_04_23

Richmond Fed's prediction time frame is similar to Scott's -

Our findings suggest that the shelter component of inflation will continue to impart upward pressure (relative to pre-pandemic norms) on 12-month headline and core PCE inflation beyond the end of 2023.

Shadowstats is apropos: "inflation pressures continued surface, with the May 2023 Money Supply reflecting still-extreme flight to liquidity. The most-liquid “Basic M1” (Currency-plus-Demand Deposits) held 119.2% above its Pre-Pandemic Level and was increasing year-to-year with intensifying inflation pressure, versus the Aggregate M2 Money Supply holding up by 34.7%, but declining year-to-year, amidst no signs of an overheating economy."

The percentage of transaction's deposits to gated deposits continues to grow. The turnover ratio for transaction accounts is much, much, higher than gated deposits. The conversion from gated deposits to transaction's deposits should continue until M2/GDP falls back to its prior trend line.

Link: https://www.frbsf.org/economic-research/publications/economic-letter/2023/may/rise-and-fall-of-pandemic-excess-savings/

"Consumer Price Inflation (CPI) in the United States provided the first clear downside surprise since the pandemic this month as the June Core print fell below 2%MoM (annualised) for the first time since Feb. 2021." -- Chris Marsh

Contrary to Dr. George Selgin, banks don’t lend deposits. Deposits are the result of lending/investing.

There is a one-to-one correspondence between interest-bearing time deposits and demand deposits, as time deposits grow, demand deposits shrink pari-passu, and vice versa.

Ergo, M2 is mud pie.

As Dr. Selgin explains: "Notice that it’s by holding on to money ("inventory") rather than by spending it that people evince a demand for the stuff.

https://www.cato.org/blog/monetary-policy-primer-part-2-demand-money

Consumers were well prepared for a recession/economic slowdown:

https://awealthofcommonsense.com/2022/06/has-the-consumer-ever-been-more-prepared-for-a-recession/

The job market will have to get bad (i.e. lots of job loss), I guess, e.g. people can't afford payments on homes, vehicles, etc., before things start to get recessionary.

It's worth considering the central bank that got the inflation story early and correctly: Brazil. Beginning in early 2021 they began a rate hike cycle that began at 2% and ended at 13.75%. In Reuters on July 13th there is an article that discusses the Brazilian central bank's intention to cut rates now by more than 25 bps.

Clay

Post a Comment