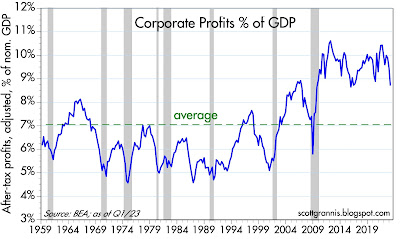

Also released today were estimates of corporate profits for the first quarter, and these were somewhat disappointing, having fallen from a high of 10% of GDP last summer to now 8.7% of GDP. In nominal terms, profits fell 8% from last summer's level to $2.31 trillion. Despite the recent weakness, however, corporate profits as a percentage of GDP are nevertheless rather strong considering they have averaged only 7% of GDP in the post-war period.

Chart #1

Chart #1 compares the level of real GDP to historical trends. The green line represents the trend growth rate the economy averaged from 1965 through 2007 (3.1% per year). The red line is the trend that has held since the current recovery started in mid-2009 (2.1% per year). A one percentage point difference per year doesn't sound like much, but over time it really adds up. If the economy had remained on a 3.1% annual growth path, it would be 25% larger today.

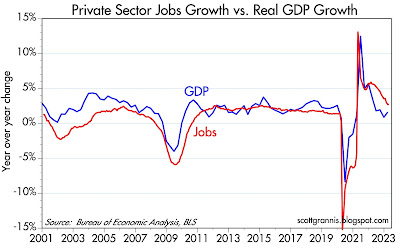

Chart #2

Chart #2 compares the year over year growth of real GDP (blue) to the year over year growth in private sector jobs. Not surprisingly, these two series tend to track each other, since it usually takes more workers to generate more growth. Over long periods, GDP growth tends to be greater than jobs growth because worker productivity tends to average about 1½% per year (i.e., the average worker generates about 1½% more output per year thanks to productivity-enhancing technology and machinery) . What's interesting here is that jobs growth has been stronger than GDP growth in the past year or so. Although the pace of jobs growth has slipped to 2.1% in the most recent six-month period, that could theoretically support real GDP growth of at least 3%. Considering the myriad problems facing the economy these days, it's not unreasonable to expect real GDP growth to remain around 2% per year for at least the next six months—a result not at all out of line with historical experience.

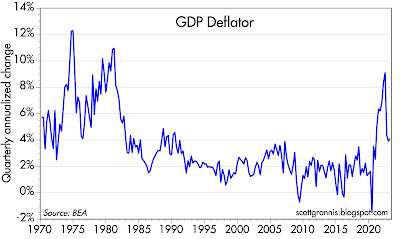

Chart #3

Chart #3 shows the quarterly annualized rate of inflation according to the GDP deflator. Although painful, the recent spike in inflation has been much less, and of much shorter duration, than what we experienced in the 1970s.

Chart #4

Chart #4 shows corporate profits as a percentage of nominal GDP. What stands out to me is that corporate profits during the current business cycle expansion (2009 - today) have been substantially stronger than they were in prior decades, despite the fact that the economy averaged 3.1% annual growth in the pre-2009 period.

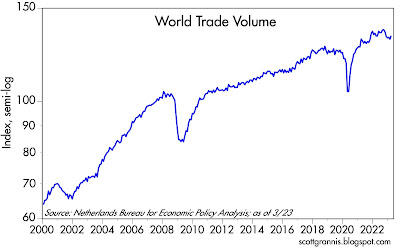

Chart #5

My best guess as to why corporate profits have been so strong? I think it's explained to a great degree by globalization. US corporations today can market their products and services to a vastly larger market today than they could a few decades ago, which means that successful businesses can greatly leverage their market reach. World trade volume (Chart #5) has expanded by more than one-third since 2007. And that's just trade in goods; including services (e.g., technology, data, entertainment) the growth would surely be an order of magnitude larger. (sources for this dataset are welcome)

29 comments:

Two items about recent corporate profits.

1. Profit margins are larger in tech/software/communication companies, which are new business sectors with large contributions to the economy

2. I am guessing these are "large corporations'" profits. The fraction of small business has shrunk a lot in recent decades. Too much regulation and other government barriers for the little guys to absorb. Big corporations s rule the economy, unfortunately.

Money has a ‘second dimension’’, namely, velocity . . .. ” Arthur F. Burns in Congressional Testimony.

Greenspan got rid of the transaction’s concept of money velocity in September 1996. Powell destroyed deposit classifications when he eliminated the 6 withdrawal restrictions on savings accounts in April 2020.

Because Vi is a contrivance, the FED has to now target N-gDp.

AD = M*Vt (where N-gDp is a subset). Vt, the transaction’s concept of money velocity, in the G.6 Debit and Demand Deposit Turnover release, was discontinued in September 1996 (by mistake). Neither Paul Spindt, nor William Barnett understood it. But William G. Bretz did, in “Juncture Recognition in the Stock Market”. Ed Fry was its manager, but he never polled its subscribers for confirmation bias.

See 1963:

Analysis of bank debits as a business cycle indicator (richmond.edu)

Money has no significant impact on prices unless it is being exchanged.

Link: The G.6 Debit and Demand Deposit Turnover Release

https://fraser.stlouisfed.org/files/docs/releases/g6comm/g6_19961023.pdf

In 1931 a commission was established on Member Bank Reserve Requirements. The commission completed their recommendations after a 7 year inquiry on Feb. 5, 1938. The study was entitled “Member Bank Reserve Requirements — Analysis of Committee Proposal” its 2nd proposal: “Requirements against debits to deposits”

http://bit.ly/1A9bYH1

After a 45 year hiatus, this research paper was “declassified” on March 23, 1983. By the time this paper was “declassified”, Nobel Laureate Dr. Milton Friedman had declared RRs to be a “tax” [sic].

Hussman on the O/N RRP: “This way, the Fed can keep holding the securities instead of investors and money market funds holding them. It’s as ridiculous and contorted as it sounds.”

https://hbs.unctad.org/total-trade-in-services/

Global services exports $7T in 2022 (all country service exports)

3.4 % of US GDP in 2021 (US services exports)

New Paper blames everything but the money printers

https://twitter.com/profstonge/status/1662806134485397506?s=46&t=RMHlxkwcr5wESIDLrpx9og

Scott, are you worried about the deflationary bust some are predicting? Rate hikes have a 12-18 month lag, the impact isn’t being fully realized as of now, the fed keeps hiking, etc? Truflation is now showing a “real time” inflation number of 2.8% (vs the lagging 4.9% cpi).

The “hard landing” scenario seems to be picking up steam.

Any comments? Thanks

Ai: thanks for the link to Prof. St. Onge. Of course I agree with him 100%, and it’s refreshing to find a like-minded economist these days. I am reminded of a long and detailed piece starting on the front page of the WSJ that similarly discussed dozens of reasons that inflation was rising but never once mentioned the money supply! Unbelievable. Unfortunately that seems like par for the course.

As I mention in the post, the longer the Fed delays a decision to cut rates, the more likely deflation becomes. I don’t know if deflationary necessarily brings with it a hard landing, however. A little deflation would do wonder to increase the demand for money, wouldn’t it? Mainly because it would effectively increase the real yield on money and money equivalents, thus making holding money more attractive relative to holding other things.

Many argue that deflation would be bad for the economy because it would encourage too much savings. That’s simply another way of saying that deflation is the result of an imbalance between money supply and money demand in which money becomes in short supply because of an increase in the demand for money.

To put it simply, the only thing standing between us and deflation is one Fed press conference that announces the beginning of a series of rate cuts. That would dramatically alter the demand for money and all but extinguish the risk of deflation.

Another great wrap-up by Scott Grannis.

I have said it before and I will say it again: Despite everything (and the government is not always business friendly), these are the good ol' days for corporate profits.

I might mildly disagree with SG on the reason for higher profits. After Michael Milken, the idea of a "hostile" takeover became common (hostile to management, not shareholders).

There followed a lot of alignment of management and shareholder interests (incentivized). I can tell you, up through the 1970s, some public companies in Los Angeles had board seats that looked like country club rosters.

That all changed. Today, US public companies are likely the best run large organizations on the planet.

Not perfect, no one or organization, or even economic system, is. But show me another group of large organizations that are better run.

re: "Mainly because it would effectively increase the real yield on money"

As Dr. Philip George states: “When interest rates go up, flows into savings and time deposits increase”.

The tendency of coins of the “vilest die and basest metal” to replace in circulation those of “perfect die and metal” was noted by Aristophanes (448-380 B.C.) in “The Frogs”.

“The paradox of thrift (or paradox of saving) is a paradox of economics. The paradox states that an increase in autonomous saving leads to a decrease in aggregate demand and thus a decrease in gross output which will in turn lower total saving.”

Dr. Lester V. Chandler’s theoretical explanation in 1961 was: (1) that monetary policy has as an objective a certain level of spending for gDp, and that a growth in time (savings) deposits involves a decrease in the demand for money balances, and that this shift will be reflected in an offsetting increase in the velocity of demand deposits, DDs.

1961: Edwards: “It seems to be quite obvious that over time the “demand for money” cannot continue to shift to the left as people buildup their savings deposits; if it did, the time would come when there would be no demand for money at all”

That shift ended in 1981 with the widespread introduction of NOW accounts.

Leland James Pritchard, Ph.D., economics, Chicago 1933 point of view: “This hypothesis rests upon the fact that the payment’s velocity of funds shifted into time deposits becomes zero, and remains at zero so long as funds are held in this form. (banks don't lend deposits; deposits are the result of lending)

The stoppage of the flow of these funds generates adverse effects in our highly interdependent pecuniary economy, as would any stoppage in the flow of funds however induced. It is quite probable that the growth of time deposits shrinks aggregate demand and therefore produces adverse effects on gDp.”

And: ”the stoppage in the flow of monetary savings, which is an inexorable part of time-deposit banking, would tend to have a longer-term debilitating effect on demands, particularly the demands for capital goods”.

This corroborates Dr. Philip George's "The Riddle of Money Finally Solved". Dr. Pritchard said the same thing 30 years earlier. "In a twinkling the economy suffers".

The neutrality of money has been denigrated (changes in the money supply only affect nominal variables and not real variables). "Inflation continues to outpace Americans’ rising wages – for the 25th straight month”.

Thus, we have a case for Irving Fisher's debt deflation ("the overall level of debt rising in real value because of deflation").

"The FED follows the market."

https://socionomics.net/2019/01/the-fed-follows-the-market-yet-again/#:~:text=Both%20recent%20and%20historical%20evidence%20shows%20that%20the,that%20the%20Fed%20consistently%20follows%20the%20T-bill%20market.

Two issues:

If monetization is a real contributor to inflation it must be correlated, and yet, there is no strong correlation; Europe and China have printed far more than the US (which in fact has been contracting the money supply for more than two years). Granted China is a poor example (how about Japan which has seen massive deflation...). Of course, monetization has an impact on inflation but its not determinant, sine for the past 15 years the US has been printing like mad, with little or no "measured" inflation, then covid, and massive inflation.

Second, globalization cannot be the answer to increased profits for US corporations, since trade plays such a small role in US GDP (if we exclude Canada and Mexico) it accounts for less than 7% of the total US GDP, and it has not changed over the past 15 years

I strongly believe that inflation is the reason why corporate profits have risen since they have been able to impose real price rises. Hidding price rises is difficult where there is little or no inflation. Corporations are no fools and not taking the opportunity to raise overall prices during an inflationary period would be a wasted opportunity

See: A soft landing thanks to surplus M2

Chart #4 compares the growth of M2 with the level of the federal budget deficit. Here it should be obvious that the roughly $6 trillion of Covid "stimulus" spending was effectively monetized.

see: Money, Banking, and Markets – Connecting the Dots

https://www.hussmanfunds.com/comment/mc230519/

Scott what do you think of the book "The price of time" by Edward chancellor? It basically says that the era of ultra low, zero and negative interest rates, leading to unprecedented debts, we have been living through cannot end without extreme pain and social problems.

Scott, do you mind to comment on this line of thinking?

https://twitter.com/bobeunlimited/status/1663311054686830599?s=46&t=RMHlxkwcr5wESIDLrpx9og

More importantly the “Core CPI” comments. He seems to worry about M/M core not moving, and says the FED does not care about Y/Y. I’m less worried about the Truflation methodology, more about why he thinks Core CPI is more important?

https://twitter.com/bobeunlimited/status/1656301816773066754?s=46&t=RMHlxkwcr5wESIDLrpx9og

Thank you as always

Scott,

It would be greatly appreciated if we may have a spreads (recession/soft landing data) update.

Charges on all debt, public and private sectors, are related to a cumulative figures; and since the multiplier effects of debt expansion on income, the ingredient from which the charges must inevitably be paid, is a non-cumulative figure, it is inevitably that a mathematical time will arrive when further debt expansion is no longer a practical or possible expedient, either to provide full employment or to keep debt charges within tolerable limits.

On US federal debt, GDP, economic growth. The debt ceiling, budget, tax, social spending debates have a date with reality.

It looks to me that the oncoming wall is the Social Security insolvency ~2032-2035. I don't know how that will be resolved, but I would guess that it will ignite the worst recession since the 1930s.

Policy makers are already taking a position that the required cuts in Social Security won't be so bad, for example.

https://www.cbpp.org/blog/social-security-is-not-bankrupt

Whether we do or do not have a recession due to the current dysfunction(s), that Social Security funding requirement will cause a much bigger issue than anything we are seeing today.

Salmo, re Hussman: I would caution anyone seeking advice from Hussman; his funds have spectacularly underperformed the S&P 500 for the past 10 and 20+ years.

Roy, re spreads: The spread story is still uniformly positive. Swap spreads are very low. CDS spreads are below their March highs and below their level of 6 months ago. Ditto for credit spreads. There is no sign anywhere in these indicators of a hard landing or imminent recession. In contrast, they are all consistent with their being abundant liquidity and a healthy outlook for corporate profits.

Scott: further to my question re have you read the book about history of interest rates: I have only known about and read your blog since the global financial crash in 2008. Which is to say, your constant refrain of "relative optimism" compared to many market forecasters and observers has come at a time of unprecedented low, no- and negative-interest rate tailwinds. Unprecedented in all of recorded financial history. So perhaps it is not surprising that your sunny (sunnier) outlook for equities has done so well. By the same token, if we are indeed entering a long-term correction / reversion to historical norms then being a perma-optimist would not seem a prudent stance ? Would be happy to hear your response, thanks.

Ps. There are many highly successful fund managers who have beaten the sp500 over many decades (eg Stan Druckenmiller) who do feel that something pretty catastrophic is coming down the line, as a result of this era of superbubbles, out of control government debt and imploding fiat currencies.

The Keynesian economists have achieved their objective, that there is no difference between money and liquid assets.

Contrary to Powell, never are the commercial banks intermediaries, conduits between savers and borrowers, in the savings->investment process. Money and credit creation is a system-wide process. The necessity of Covid-19’s Treasury’s debt-support operations should have been foreseen, and thereby offset, by raising reserve ratios – not by eliminating them.

As Dr. Milton Friedman pontificated in a letter to Dr. Leland Pritchard (his classmate in Chicago): From Carol A. Ledenham’s Hoover Institution archives: “I would make reserve requirements the same for time and demand deposits”. Dec. 16, 1959.

The US Golden Age in Capitalism was where small savings were pooled, expeditiously activated, and put back to work. I.e., the intermediaries, the nonbanks (backstopped by the FSLIC, NCUA etc._, grew much faster than the banks (making the bankers jealous, driving up Reg. Q ceilings). Economist John O’Donnell posited that velocity financed 2/3 of the economy whereas today, money finances all of the economy 1.259. The nonbanks, the thrifts, largely invested in targeted real investment outlets (residential real estate). That resulted in a demand for both labor and materials.

Government polices underpinned targeted real investment, aka, "the Servicemen’s Readjustment Act of 1944, the G.I. Bill was created to help veterans of World War II. It established hospitals, made low-interest mortgages available and granted stipends covering tuition and expenses for veterans attending college or trade schools".

M1's average growth was 1.5% each year (from 142.2 to 176.9). CPI inflation averaged 2.5% (because of the Korean War) during the same period (from 23.7 to 33.1). If you exclude the Korean War, 1955-1964, the rate of inflation, based on the Consumer Price Index, increased at an annual rate of 1.4 percent.

A dollar of savings (income held beyond the income period in which received), is more potent than a dollar of the money stock. R-gDp, not optimized, averaged 5.9% during 1950-1966 (in spite of the 3 recessions).

It is much more desirable to promote prosperity by inducing a smooth and continuous flow of monetary savings into real investment, than to rely, as we have done c. 1965 (with the advent of interest rate manipulation as the FED's monetary transmission mechanism), on a vast expansion of bank credit with accompanying inflation to stimulate production.

Rob: re likelihood of bad stuff happening. Thanks for pointing me to that book. I am sympathetic to most of what it says about interest rates. But whereas most observers believe that 6 years of near-zero interest rates (2011,12,13,14,15 and 2022) were a huge mistake on the part of the Fed, I'm not convinced. I do believe that it is absurd to think that a small group of men (the FOMC) can somehow divine the appropriate short-term interest rate that keeps our gigantic and incredibly complex economy functioning efficiently. History is full of examples of Fed mistakes, as we all know. But the market is also quite powerful and collectively intelligent, and to think that hundreds of millions of smart investors all over the world, risking their own money, would allow themselves to be systematically duped by an inept Fed into accepting a chronically low level of interest rates is also absurd. The Fed can certainly control short-term interest rates, but beyond 5 years of maturity the Fed's influence is questionable at best, and equity prices respond to lots of things (e.g., corporate profits) that the Fed simply cannot control. If the funds rate is set too high or too low, we should (and indeed at times we do) see that other prices begin to react accordingly. While there have been episodes of prices that might seem questionable, over the long haul the market has avoided extreme mis-valuations, in my view.

If interest rates were incredibly low for many years, it is also true that they have increased in the past year or so in unprecedented fashion. And yes, the market has suffered, but on the margin stocks have been recovering, the economy continues to grow—modestly, to be sure—and inflation is cooling rather significantly. And of course jobs have been growing in impressive fashion, and job openings (released today) are very strong.

In short, I'm not part of the chorus of those singing painful recession.

https://www.thewealthadvisor.com/article/money-doctor-says-fed-has-overcorrected

re: “Hanke made a new prediction that inflation would be running at between 2% and 5% by year end.” That’s no prediction.

The trajectory is still as money flows predicts.

Salmo: I have followed Hanke for decades, and he usually right. I sure hope he is able to help Argentina's new president. Hanke is a monetarist as am I, but I don't think he pays enough attention to the demand for money. I agree with him that the Fed is overdoing things now, but I'm not yet ready to hit the panic button since there is still am ample supply of money in the system.

In any event, the stock market is inching higher as it prices in less and less expected Fed tightening. The economy is not going gangbusters, but it is doing ok. As a Fed ease approaches (soon I hope) the outlook will brighten, and that will reduce the demand for money and thus short-circuit any deflationary pressures that may be building now.

Scott: As Edward Chancellor has noted, we have been living through unprecedented back to back bubbles. The SP500 chart went into insane bubble territory after the relatively "modest" bubbles of 2000 and 2008. Anyone can see that the market has gone to the moon because fiat currencies have been devalued. Do you seriously see more upwards trajectory for the sp500 over the next, say, decade? You just don't seem to see any of these historically unprecedented bubbles as anything other than "business as usual". I would genuinely like to know why you see things the way you do?

Post a Comment