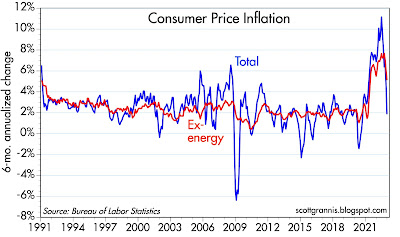

The December CPI report released today supports everything I've been saying for months. Inflation pressures peaked in June, with the year over year CPI registering 9.0%, the 6-mo. annualized rate 11.2%, and the 3-mo. annualized rate 11.0%. As of December those same measures were significantly lower, registering 6.4%, 1.9% and 1.8%. Quite an impressive decline! Inflation is no longer a problem.

The ex-energy version of the CPI showed the same decline, only on a smaller scale, with the peak also occurring in June: YOY 6.6%, 6-mo. 7.6%, and 3-mo. 8.6%. As of December, those same measures were 6.4%, 5.1%, and 3.5%.

The core version (ex food & energy) declined as well: June 5.9%, 6.8%, and 7.9%. December: 5.7%, 4.6%, 3.1%.

Some observations:

1) Energy prices traditionally are by far the most volatile component of the CPI, and this past year was no exception. Ex-energy and ex-food & energy measures of inflation were lower overall than the total and much less volatile, which means a lot of the inflation we experienced was of energy origin and temporary.

2) Any change in the trend of a measure of growth over time (e.g., inflation, disinflation) should show up first in the 3-mo. annualized numbers and later in the year over year measures. This is exactly the pattern we have seen with the recent surge in inflation which began in January 2021, when year over year inflation was 1.4%, 6-mo was 2.9%, and 3-mo. was 2.9%. We haven't come full circle yet, but we're getting pretty close, since the 3-mo. annualized measures of inflation (total, core and ex-energy) are now in the range of 1.8% to 3.5%.

Check out these posts from last year, which show I was way ahead of the crowd in seeing the peak in inflation pressures. Moreover, I have consistently argued that the Fed did not need to crush the economy in order to bring inflation down and that is even more true today.

Fed tightening need not result in a recession (June)

Market to Fed: no need to panic (July)

Inflation pressures cool, economic outlook improves (August)

M2 says the Fed doesn't need to crush the economy (August)

More predictors of lower inflation (September)

Fed's Rx for the economy should be a tincture of time (October)

Higher interest rates have solved the inflation pr... (December)

As for the Fed, I would hope they realize that inflation pressures were worse in the first half of last year at a time when the economy suffered two quarters of negative growth (inflation adjusted), while inflation declined significantly in the second half of last year, when the economy enjoyed two quarters of roughly 3% growth (inflation adjusted). This, of course, runs completely contrary to Phillips Curve thinking, which holds that just the opposite is true: namely, that a weaker economy is a prerequisite for reducing inflation.

Moral: the Fed doesn’t need to crush the economy to bring inflation down. Why? Because inflation is caused by too much money, not too much growth. M2 growth started slowing early last year, and the Fed raised interest rates in an unprecedented fashion; that combination worked to bring inflation down because it reduced the excess supply of money and at the same time gave the public a strong incentive to hold on to their unusually large money balances instead of spending them (which would have aggravated inflation pressures). From a broader perspective, stronger economies almost always go hand in hand with low inflation, while chronically weak economies (e.g., Argentina) suffer from persistently high inflation.

There is every reason to think that inflation will continue to cool without the need for further Fed rate hikes. And contrary to what so many pundits are fond of saying these days, the unemployment rate needn’t have to rise in order for inflation to fall. Inflation has been falling quite nicely, thank you, even as the unemployment rate has fallen to historically low levels.

And don’t overlook the unique fact that, despite the Fed’s aggressive monetary “tightening,” credit and swap spreads have been declining for the past three months. If “tight” money were a problem, we should have seen credit spreads widen. But they haven’t. Why? Because higher interest rates are not necessarily bad for the economy, at least to the degree we have seen this past year. What’s so bad about 4-5% interest rates? I’m so old I remember when it was heresy to predict that 10-yr Treasury yields would decline to 7%. And at the time the economy was doing just fine.

“Tight” money came to have that moniker not because the Fed drove interest rates higher, but because in order to push rates higher the Fed had to drain reserves from the banking system. That made money scarce, and that was why monetary policy came to be known as “tight.” The Fed restricted liquidity and that caused marginal players to go bankrupt, which eventually slowed the economy and caused the demand for money to skyrocket, which in turn brought inflation down, but at a huge cost.

Everything changed in late 2008, because that was when the Fed decided to pay interest on bank reserves and simultaneously adopted a policy of abundant reserves (aka Quantitative Easing). Money today is not scarce, bankruptcies are not exploding, yet inflation is coming down. Why? Because higher interest rates have served to balance the demand and the supply of money, and when that happens, inflation declines. Money in the bank pays 4% or so today, and that’s a lot more attractive than the 0% you could earn on money balances a year ago.

That, in a nutshell, is why inflation is down and the economy is still OK. Chairman Powell, are you listening?

UPDATE, Jan.14: I have access to my charts again, so I want to post just this one to illustrate the above text:

Chart #1

It's true that the year over year growth of CPI is still way above the Fed's target (i.e., 6.4% vs. 2%), but that ignores the much more important changes on the margin. If an MBA teaches you anything it is that you must always focus on the changes that are happening on the margin, not what has happened over the past year. On the margin, the housing market is definitely turning down. Yet about one-third of the CPI is based on the government's calculation of what homeowners would be paying if they were renting the house they own, and that is a very lagging indicator—as much as a year behind the reality of today's housing prices. We know for a fact that housing prices are turning down all over the country, so homeowner's rent will soon be subtracting significantly from the CPI.

34 comments:

Well, I always say about monetary policy, "If you are not confused, then maybe you don't understand the situation."

But Scott Grannis seems to make good point here.

China just posted 1.8% inflation on Dec. CPI and deflation on their PPI, yoy. Other nations coming down too.

Man, fighting COVID-19 through economic disruptions was the worst idea in a long time...but its looks like we can squirm out of this era....

Hard to find much M2 commentary, but Wesbury also does a good job on this. He is more pessimistic of late. You may have discussed this before, apologies if I’m being redundant, but Wesbury was less confident in lower inflation, and we should soon expect a rebound in M2. This was the explanation:

“ So in the past the Federal government would keep its money at commercial banks, because of this when you would get taxed that money wouldn’t get removed from the M2 measure of money which is just a measure of checking/savings account balances across the economy. Post 2008 though the government began using what’s called the Treasury general Account (TGA) which is at the Fed. Because balances at the Fed aren’t counted as part of M2, when you are taxed now and that money is put in the TGA it removes those dollars from M2 even though nothing is really functionally different from before.

Recently deposits in the TGA have been extremely volatile which is distorting M2 numbers. They got as high as 1.8 trillion, but are still roughly 4x higher than they ever where in the past. It makes readings on M2 less reliable.“

Cool the pride, Scott. We read your previous posts and remember that "pride goeth before the fall.

I learn so much from this site and Scott. As demand and supply of M2 come into balance is there not an argument that policies that increases supply for goods and services would also lower inflation, the opposite of the "shutdown" policy. Is this a secondary effect.

Agree with Steve. I have been quite impressed with your prescient calls. As Dizzy Dean said, "It ain't bragging if ya done it," but probably better to let others talk up your skills. Facts are stubborn things.

Roger

re: "Money in the bank pays 4% or so today,"

Link: https://research.stlouisfed.org/publications/economic-synopses/2022/12/16/where-do-you-keep-your-liquid-wealthbank-deposits-or-t-bills?utm_medium=email&utm_campaign=202301%20Research%20Newsletter&utm_content=202301%20Research%20Newsletter+CID_1ba3df63ac1953a5f66eb400c2be3149&utm_source=Research%20newsletter&utm_term=New%20analysis%20covers%20the%20characteristics%20of%20cash%20and%20bank%20accounts%20vs%20liquid%20financial%20assets

Scott thank you. I learn so much from your wisdom. Can you just clarify is it not typo and the "DEMAND" suppose to supply? " The Fed restricted liquidity and that caused marginal players to go bankrupt, which eventually shut down DEMAND and caused the demand for money to skyrocket

If ANYONE deserves a victory lap, it is most assuredly Scott Grannis. Add in the fact that the matters he was correct on deal directly with public health and prosperity, and just imagine how much better off many things would be if someone this smart had control of the machine.

I think Scott should go full Muhammad Ali. He IS the greatest!

Inflation is not our problem, as the astute like Scott have noted.

Our problem is economic growth. And it seems like all our policies are hostile to economic growth. I see a prolonged period of economic slog. Healthy credit and liquidity would auger against a cliff-like drop, at least for the time being. But policies that make the ground fertile for strong economic growth just don't seem to be in the cards.

Re “Pride goeth before the fall”. I am uncomfortably aware of this, and my only defense is that I think I have been right because I have understood the situation better than most. I have focused on the supply of and the demand for money and how they are balanced. There are very few economists these days that do the same, particularly those at the Fed, and I’d like to see more in my camp. I don’t make any money on this blog and one of the reasons I do it (since 2008) is to share what I have learned over the years. I’ve received so much wisdom for free from the internet, and this is my way of giving back. It also helps me to remain intellectually honest with myself, since my views are important inputs to my investment decisions.

As for my differences with Brian Wesbury, whom I’ve known and admired for decades, this is one of the very few times we have disagreed.

Egg: Thanks for your comment. I have slightly revised the wording in the sentence you refer to in a way i hope provides better clarity.

Duncan: you are absolutely right about the lack of policies that might stimulate supply. More supply would help bring inflation down. This is what Reagan and Art Laffer realized back in the early 1980s. The Fed worked hard to reduce money supply growth, and they argued that tax cuts were essential to expand supply. The combination of the two policies worked wonders. I know, I was there at the time (at the Claremont Economics Institute).

Reply to Grechster: "

Our problem is economic growth. And it seems like all our policies are hostile to economic growth."

I read some of the academic economists' blogs. I am not sure how recent it is, but the ones on the political left (most) believe that economic growth is not a problem. Their real concern is wealth (re)distribution. If you search carefully, you will find them stating exactly that in public.

I believe that freedom/free markets, and the resulting growth are the source of our prosperity. I guess the real disagreement is that many people believe that more freedom would lead to less income inequality.

When I taught economics in college, I pounded into my students heads that inflation was a "Sustained increase in a general level of prices." Not one time increases caused by shocks; or an increase in this item or that item.

I'd play a game similar to "The Price Is Right," and have ten items on a table sellng for Ten dollars each. $100 in monopoly money, and they'd buy one of each item.

I would then ask someone to come up with $100 and pay more for EVERY ITEM. Of course this was impossible: as soon as you spent more on one, you had less to spend on the rest.

I'd boost their "cash" holdings to $110 and ask them to do the same thing. Now it was possible.

It drove home the old adage: too much cash chasing too few goods. Inflation was a monetary phenomenon; or a decrease in supply, often caused by excessive regulation and government constraints.

Under Brandon of course we had both.

Policy Error Setup, April 2023:

PCE: 4.2%

U3: 3.9%

S&P500: 4400

Fed targets s&p500 (wealth effect) and raises rates (just a little).

Moderate recession around Sep 2023. S&P500 3000 around Q4 2023.

Not a prediction, just for amusement.

M2 vs. CPI since peak

7115.2 ,,,,, 296.311 Jun

7133.5 ,,,,, 296.276 Jul

7151.1 ,,,,, 296.171 Aug

7375.7 ,,,,, 296.808 Sep

7308.0 ,,,,, 298.012 Oct

7280.8 ,,,,, 297.711 Nov

7288.5 ,,,,, 296.797 Dec

I’ve been reading this blog for over a year and have come to learn the tone. I didn’t read the first sentence to be grandiose. I shared the article with an educated friend, who mentioned he hasn’t read much of the blog, and he thought the first line came across poorly.

My opinion is people comment too often without having a very deep knowledge base, making the quality of conversation/education go down.

I appreciate the work Scott’s has done and the insights he shares.Not many people want to put in the work, they just want all the test answers.

Any tidbits on the Wesbury differences I should be on the lookout for over the next few months? The difference on opinion here is hard for me to grasp?

Thanks

Scott makes great points and has done so for years. I like Galbraith's comment that there are only two types of forecasters: those who don't know and those who don't know they don't know. Scott has been right more than anyone else I know. Hope he's right again. The people who have the worst record are those who work at the FED.

Man, if you want more supply...try a 10-year hiatus on all property zoning.

You would see so much new housing supply along the West Coast....

"The index for gasoline declined 9.5 percent and was by far the largest contributor to the monthly all items decrease."

Disinflation:

The PPI peaked at 280.251 in June. It now stands at 263.235 in November.

The CPI peaked at 298.012 in October. It now stands at 296.797 in December.

Can services inflation have a different lag than goods inflation with the change in demographics?

That’s 22 months the CPI has been above the FED’s 2% target. And in the last 21 months real wage income has fallen in concert. By that relationship maybe 2% was the appropriate target.

I will say this, if Powell doesn't wise up, and SOON, he should be removed from office. He totally missed the oncoming inflation wave and to miss its obvious demise and further unnecessarily raise rates is just plain stupid and deleterious.

Scott,

Can you confirm my understanding.

When the public's demand for cash goes up, they keep more money in their checking/savings/money market accounts. M2 increases. (i.e. they spend less, save more)

When the public's demand for cash goes down, they keep less money in their checking/savings/money market accounts. M2 decreases. (they spend more, save less).

Is this correct? Or is it the other way around?

Scott,

Here are some of the issues now confronting the Fed.

1.Until a couple months ago, with rising interest rates, the dollar index soared to 114, putting a damper on inflation. Over the last two months as inflation and interest rates declined, the dollar index declined to 103 which was a drop of 10%. This suggests that imported items will be rising about 10% in the future.

2. Gasoline prices which peaked around $5.00/gallon plunged to about $3.00/ gallon for a drop of 40%. As I believe gasoline prices comprise 5% of the CPI, a full 2% of the drop in CPI was due to gasoline prices. Now gasoline prices are moving up a bit, which will reverse its effects on CPI.

3. Gold which bottomed at $1620 in November is now at $1920 and close to breaking out. A move up of 17% in two months.

4. Copper which bottomed out at $3.20 in November is now at $4.20 or up 30% in two months.

5. Employment and wage gains have been minimally affected so far.

6. With employment and wage gains still strong any decrease in the feds action could reverse the decrease in inflation much like we saw in the 70’s and 80’s.

@benjamin - happy new year. Presented without comment

https://americanaffairsjournal.org/2022/11/two-cheers-for-zoning/

Let's say the Fed stops early as you suggest. What would happen then?

1. USD weakens considerably.

2. Stock markets shoot up.

3. Tech Ponzi-land bubble is back.

4. This all happens while unemployment is so low.

Inflation goes back up.

Disagree with this or not, this is why the Fed will not stop anytime soon, they want to make sure the horse is really dead before risking its revival.

As Alfred Marshall's "cash balances" explains, money is truly a paradox - by wanting more the public ends up with less, and by wanting less it ends up with more.

The length of the period over whose transactions purchasing power in the form of money is held is a function of the volume of cash held and the level of prices, ergo, the velocity of circulation.

Economics is a science of lies. The FED’s monetary transmission mechanism only became interest rate manipulation after legal reserves were discontinued. By tracking legal reserves, all recessions were both predictable and preventable.

We knew this already:

In 1931 a commission was established on Member Bank Reserve Requirements. The commission completed their recommendations after a 7 year inquiry on Feb. 5, 1938. The study was entitled “Member Bank Reserve Requirements — Analysis of Committee Proposal”

its 2nd proposal: “Requirements against debits to deposits”

http://bit.ly/1A9bYH1

After a 45 year hiatus, this research paper was “declassified” on March 23, 1983. By the time this paper was “declassified”, Nobel Laureate Dr. Milton Friedman had declared RRs to be a “tax” [sic].

Now the FED is without a rudder or an anchor. Presumably, to get a recession, there would have to be a marked reduction (negative rate-of-change) in short-term money flows (“M” as defined by, but not measured by, Shadow Stats).

I used to post that I didn't need a "disclaimer".

"According to Alfred Marshall’s “cash balances” type of analysis, the value of money or its reciprocal, the price level, depends upon the supply of and the demand for money. The equilibrium concept presumes that the height of prices at any given time is determined at a level which just equates the supply schedule and the demand schedule of money.

Over a period of time, however, it is just as logical, and justifiable, to say that prices determine the supply of and the demand for money as to say the converse. The price of money and the price of wheat are, at any given time, the net resultant of the forces operating through supply and demand, but over a period of time price is both cause and effect in determining the price of wheat or the price of money.

Unlike the supply and demand analysis applicable to commodities, the supply of and the demand for money are simply two sides of the same “coin”. This follows from the fact that the suppliers are simultaneously the demanders, and the demanders are simultaneously the suppliers If a person increases his demand form money, he is simultaneously reducing his supply of money, in the schedule sense, and if he is increasing the supply of money, he is reducing his demand for money. It may be said therefore, that an increase in the demand for money is concomitantly associated with an equal and opposite decrease in the supply of money, and vice versa.

Thus, we may say that the prices of things will rise, ceteris paribus, and the purchasing [power of money will fall, if there is an increase in the supply of money (decreased demand for money). Similarly, the expectation of a rise in the price of things will induce a decrease in the demand for money (increase in the supply of money)." -- Dr. Leland James Pritchard, Ph.D. Economics, Chicago 1933, M.S. Statistics, Syracuse, Phi Beta Kappa

The YoY PPI fell to +6.2% (the lowest since March 2021)

Parse DT; R-gDp; inflation

01/1/2022 ,,,,, 0.235 ,,,,, 1.998

02/1/2022 ,,,,, 0.166 ,,,,, 2.011

03/1/2022 ,,,,, 0.128 ,,,,, 1.633

04/1/2022 ,,,,, 0.113 ,,,,, 1.382

05/1/2022 ,,,,, 0.110 ,,,,, 1.320

06/1/2022 ,,,,, 0.111 ,,,,, 1.231

07/1/2022 ,,,,, 0.088 ,,,,, 1.195

08/1/2022 ,,,,, 0.124 ,,,,, 1.280

09/1/2022 ,,,,, 0.072 ,,,,, 1.143

10/1/2022 ,,,,, 0.069 ,,,,, 1.094

11/1/2022 ,,,,, 0.085 ,,,,, 0.847

12/1/2022 ,,,,, 0.060 ,,,,, 0.519

01/1/2023 ,,,,, 0.056 ,,,,, 0.529

02/1/2023 ,,,,, 0.054 ,,,,, 0.473

03/1/2023 ,,,,, 0.061 ,,,,, 0.393

04/1/2023 ,,,,, 0.067 ,,,,, 0.376

05/1/2023 ,,,,, 0.031 ,,,,, 0.329

06/1/2023 ,,,,, 0.055 ,,,,, 0.266

07/1/2023 ,,,,, 0.071 ,,,,, 0.243

08/1/2023 ,,,,, 0.081 ,,,,, 0.237

09/1/2023 ,,,,, 0.088 ,,,,, 0.246

10/1/2023 ,,,,, 0.087 ,,,,, 0.227

11/1/2023 ,,,,, 0.087 ,,,,, 0.224

12/1/2023 ,,,,, 0.086 ,,,,, 0.194

The rate-of-change in inflation had never been above 1.0 before Covid.

The rate-of-change in R-gDp doesn't become negative, indicating no recession.

These ROC's underweight Vt. E.g., as money peaked in FEB, money flows didn't peak until JUN. Ergo, Vt made up the difference. Unless Vt falls, there will be no recession.

Methinks the markets have transitioned to being more concerned about recession than inflation. Therefore even if the Fed stops raising rates (they won't) I doubt stocks will rally considerably. In fact, the stock market may view it as weakness in the economy and fall! Bond yields almost certainly have to fall.

If you think about it, all the forces that caused inflation have reversed so irrespective of economic input, inflation will continue to come in.

@Steve:

There are 6 seasonal, endogenous, economic inflection points each year. The first is a downward move c. the 3rd week in Jan. But this time it comes at the juncture of the 2nd Elliott Wave top.

@Salmo just a friendly request...can you stick to the numbers and theory that have a basis in reality? You're very good at that.

I didn’t take Scott’s commentary at all as prideful. Facts are facts. 15 years ago when I followed less insightful, more politically-oriented economic commentary, I would post dismissive and derogatory comments on Scott’s Seeking Alpha posts. As time went by, I came to realize that he was far more accurate than the people I was following.

Now I check his blog out every couple of weeks and he has been so consistent, I consider him to be a national asset.

I completely agree!

Scott and Brian Westbury have been by far the two most accurate and coherent providers of commentary that I follow.

The current difference in opinion between Scott and Brian has been fascinating to watch. Brian seems to be looking for technical flaws with the decline in M2 to justify a more negative 2023 outlook. Brian has changed from tax related cash flows to a recent growth in the funds at the Treasury account as a rationale to justify not putting as much emphasis on the M2 decline. Scott, on the other hand, has emphasized the importance of banks still being active in the lending area.

From my perspective as an active PE participant in the private company banking markets, Scott's lending observation, along with the decline in M2, are the key factors to a potential soft landing if the Fed stops the interest rate increases. Given the close to 100 bps decline in the 10 year treasury rate, I believe the Fed will stop raising rates sooner rather than later if, for no other reason, to make sure their actions are consistent with the market.

Westbury: "Now more than ever, it is important to follow real-time data on the economy."

That's more like white noise. Grannis is a conceptual thinker. Contrary to Avi Gilbert, the fundamentals precede the technicals'.

Post a Comment