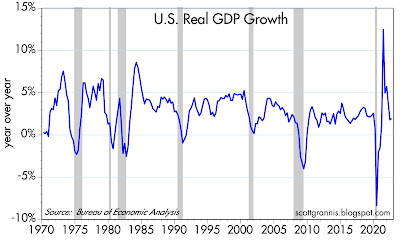

Chart #1

Chart #1 shows the year over year growth of real GDP, which was 1.94% as of Q3/22. This is very close to the growth rates the economy experienced from 2010 thru 2019. The Covid growth gyrations are now in the past. The economy looks to be on track to growth at about a 2% annual rate—nothing spectacular, but not bad considering all the problems that still exist in the world and at home.

Chart #2

Pay close attention to Chart #2, since you're unlikely to see anything like it elsewhere. To begin with, it's plotted using a logarithmic y-axis, which means that straight lines are equivalent to constant rates of growth. The dotted green line represents the annual growth trend which started in 1966 and persisted through 2007: 3.1% per year. That is, over this 56-year period the economy managed to grow by an annualized rate of 3.1%. Sometimes by more, sometimes by less, but over time it always came back to this trend line. The dotted red line shows the growth trend in place since mid-2009: 2.2%. Something happened during the Great Financial Recession of 2008-09 to put a permanent damper on growth, and it's not just demographics—demographics don't change dramatically from one year to the next. Instead, I think it has a lot to do with 1) the explosion of transfer payments during the Great Recession (see Charts #2 and #3 in this post), and 2) the general expansion of government influence, plus higher tax and regulatory burdens which plagued the economy during this period. These all work like headwinds to slow the economy.

It's tempting to speculate that had the economy pursued a 3.1% growth path until now, then the economy would be 24% bigger today, and average incomes might be 24% higher in inflation-adjusted terms. That's a lot of money that, arguably, may have been left on the table!

Chart #3

Chart #3 shows the quarterly annualized rate of change in the GDP deflator. This is the broadest measure of inflation that exists. Inflation in the third quarter slowed dramatically (from 9.1% to 4.4%), and that is consistent with my observations in recent posts that the peak of inflation occurred sometime around the middle of this year. This is most reassuring, and I would like to think it won't escape the Fed's notice.

Chart #4

Chart #4 shows the price/earnings ratio of the S&P 500, using trailing 12-month profits from continuing operations. The PE ratio of the market today is about 18.5, only slightly higher than its long-term average.

Chart #5

Chart #5 shows PE ratios for the S&P 500 using the National Income and Product Accounts as the source for economy-wide, after-tax corporate profits instead of trailing reported earnings. Like the current PE ratio shown in Chart #4, PE ratios by this measure are 19.5, only slightly higher than their long-term average. The advantage of this method is that the measure of profits used is a quarterly-annualized number, not a trailing 12-month average—thus it's much more timely.

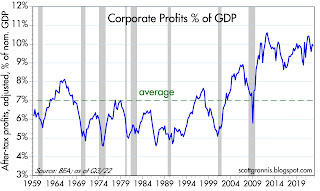

Chart #6

Chart #6 shows the same NIPA measure of profits as a percent of nominal GDP. What stands out here is the consistently high level of profits in the period following the Great Financial Recession, compared to what prevailed in prior decades. It's no wonder the stock market has been so strong this past decade or so—corporate profits have never been so consistently healthy.

I think the main reason for this is globalization, which picked up speed some years after the opening of the Chinese economy in 1995. Successful corporations today can address the entire world market, whereas before most businesses were able to address only part of global market. Apple would be successful if it were restricted to just the US market, but today it can leverage its successful products by many times since its market is an order of magnitude larger today than it would have been 15-20 years ago.

23 comments:

Hi,

Any opinion on Teppers comments?

Re 15-16x multiple implying SPX to $3300?

Thank you,

Ai

I was under the impression that productivity is declining. According to Gov. Lisa Cook

Over the first three quarters of 2022, productivity in the business sector has recorded a disappointing decline of 3-3/4 percent at an annual rate. Payroll employment in the private sector has continued to increase, yet gross domestic product (GDP) has done little more than move sideways, resulting in an outright decline in labor productivity.

Japan is a distinct example of the paradox of thrift and money demand. The Japanese save a larger proportion of their earnings and keep a larger proportion of those savings impounded in their banks.

It is incontrovertible that banks don't lend deposits - that deposits are the result of lending. It’s stock vs. flow. Savings aren't synonymous with the money supply. From the standpoint of the commercial banks the savings practices of the public are reflected in the velocity of their deposits, and not in their volume.

Whether the public savers, dissaves, chooses to hold their savings in the commercial banks or transfer them through intermediary institutions will not, per se, alter the total assets or liabilities of the commercial banks nor alter the forms of these assets and liabilities.

“Japanese households have 52% of their money in currency & deposits, vs 35% for people in the Eurozone and 14% for the US.”

As predicted in 1963 in my Money and Banking book, Dr. Pritchard’s (Ph.D. Economics, Chicago 1933, M.S. statistics, Syracuse) economic syllogism posits:

#1) “Savings require prompt utilization if the circuit flow of funds is to be maintained and deflationary effects avoided”…

#2) ”The growth of commercial bank-held time “savings” deposits shrinks aggregate demand and therefore produces adverse effects on gDp”

#3) ”The stoppage in the flow of funds, which is an inexorable part of time-deposit banking, would tend to have a longer-term debilitating effect on demands, particularly the demands for capital goods.”

As Leonard Da Vinci explained:

“Before you make a general rule of this case, test it two or three times and observe whether the tests produce the same effects”.

The FDIC's expiration of unlimited deposit insurance, that caused the taper tantrum, an accelerated rise in the real rate of interest and the 1966 Interest Rate Adjustment Act are prima facie evidence.

Money demand is viewed as a function of its opportunity cost-the foregone interest income of holding lower-yielding money balances (a liquidity preference curve). As this cost of holding money falls, the demand for money rises (and velocity decreases).

As Dr. Philip George says: “The velocity of money is a function of interest rates”

As Dr. Philip George puts it: “Changes in velocity have nothing to do with the speed at which money moves from hand to hand but are entirely the result of movements between demand deposits and other kinds of deposits.”

Velocity: Money's Second Dimension - By. Bryon Higgins

"Money has a 'second dimension’’, namely, velocity . . .. " Arthur F. Burns in Congressional Testimony.

“Quantity leads and velocity follows” Cit. Dying of Money -By Jens O. Parsson

Japan has unlimited transaction's deposit insurance, like the FDIC got rid of in Dec. 2012.

see: Divisia M4 velocity

https://marcusnunes.substack.com/p/the-nominal-economy-leads

https://finance.yahoo.com/news/opinion-why-the-fed-and-jerome-powell-should-hit-the-pause-button-on-rate-hikes-130040613.html

Sheila Bair agrees with you.

See John Cochrane: “The Federal Reserve does not even pretend to control money supply, especially inside money”.

https://static1.squarespace.com/static/5e6033a4ea02d801f37e15bb/t/639dff93e4b8310262c0fa2c/1671298965476/Phillips.pdf

If you can’t define the variables, you can’t apply the math. And if you can't apply the math, you know nothing about the variables.

1. The more government taxes, prints money and spends, the less personal liberty we all have. And 2. Don't underestimate the Fed's ability to miss your point in the GDP deflator chart.

Money #s still tightening. But that will probably end after the 1st qtr.

Housing peaked when the cash-drain factor peaked.

Latest M2 update: As of Nov. 30th, M2 is flat year over year, -2.73% annualized over the past 6 months, -5.08% annualized over the past 3 months. Virtually all the weakness in M2 is concentrated in bank savings and deposit accounts. Which further implies that the demand for money is declining and has been declining for we all over one year.

The ratio of M2 to nominal GDP, which I think is the best measure of money demand, has fallen from a high of 0.923 0.81 (my estimate for year end 2022). That's a decline of 14%, which is significant. The ratio has been declining for two reasons: 1) a decline in M2 and 2) a significant increase in nominal GDP. The ratio was 0.71 pre-Covid. To get back to that level would mean a further drop of about 12%.

The decline in money demand has fueled real growth and more importantly, inflation, much as I have been anticipating for the past few years. I expect the economy to continue to grow (albeit weakly) and for inflation to decline (slowly) over the next year, heading for the Fed's 2% target.

Corrections to prior comment:

".... for well over one year."

"... from a high of 0.923 to 0.81"

re: "I expect the economy to continue to grow (albeit weakly)"

I think it would take zero growth in the primary money stock for the next 6 months for a recession to start.

Happy holidays all.

I have said it before and I'll say it again: these are the good old days for corporate profits. I do not know if it reflects globalization or that large public corporations are the best-run enterprises of scale in history.

Let us hope 2023 brings an end to pandemics and wars and brings the beginning to new prosperity.

Shadow Stats uses: “Basic M-1 is defined as Currency plus Demand Deposits (checking accounts)”

http://www.shadowstats.com/alternate_data/money-supply-charts

The difference in the “means-of-payment” money is striking.

re: "supply of currency always equals the demand for currency" - The essence of a managed currency system; it is impossible for the public to acquire more of a given type of currency without giving up other types of currency, or else demand or time deposits.

Me too. I ran rates-of-change in bank debits against rates-of-change in M*Vt in 1979; where Vt was demand deposit turnover and M included the currency component. They were almost the same.

But the "cash/drain" factor changes at inflection points.

FED wire statistics will give you approximately the same long-term rates-of-change.

see: "Why is M2 Still a Component of ECRI’s WLI?"

https://imarketsignals.com/2013/why-is-m2-still-a-component-of-ecris-wli/

"The BCI is now signaling a recession, earliest in 12 weeks but not later than 25weeks"

Not "white noise"

https://plus2.credit-suisse.com/shorturlpdf.html?v=5h1o-YP34-V&t=-6f9o9gxfcir9ldit6fbbldzzx

@Salmo

A good NYD read...

"but the market has yet to make the leap that in the emerging multipolar world order, cross-currency bases will be smaller"

"GCC oil flowing East + renminbi invoicing = the dawn of the petroyuan"

LOL! Where's the Bond market in China to go hand-in-glove with this new global currency? Barely exists. Every year we hear this nonsense about supplanting King Dollar and it's just a bunch of pap. Who's going to trade in Chinese currency when she always seems shrouded in unhelpful mystery & awkward & set to blow like a Tiananmen powder-keg? Pass. Hard pass! (Suggest Zoltan @ CS drink decaf or take a T-break!)

Since the U.S. is no longer an economically undeveloped nation, but is increasingly an international debtor, what evaluation should be places on our huge trade and current account deficits? For the very short run these deficits keep prices and interest rates lower than they otherwise would be and they subsidize our standard of living. But the deficits also are inexorably forcing the dollar down in terms of its foreign exchange value—and no consortium of central bankers, treasury secretaries, et al. can stop the process

With a chronically depreciating dollar foreigners will be much less inclined to invest in the U.S. on a creditor ship basis, thus pushing up interest rates. The rising cost and diminishing volume of imports will contribute to an increase in inflation, and the expectation of further inflation will also push up interest rates. This spells stagflation.

Kashkari (Fed person) wrote this week that the Fed models use "inflation expectations" and "gaps in the job market" to forecast inflation.

.Wow.

This is really bad stuff if they are really that simple-minded in their modeling. At least he did refer to a model and not just the FOMC's wild guesses.

A former very famous market "forecaster" (might be using the wrong term if we are being picky) used a model with over 100 variables---decades ago. He had one of the most expensive pieces of real estate in NYC, so it's obvious he was successful (I also used his work for investing). It's 2023, so the models ought to be even better now.

These Fed people are truly pitiful.

Scott. All plausible. Perhaps you forgot the huge spending bill just passed.

No impact? Unlikely

Re "the huge spending bill just passed:"

It was and is surely regrettable. But I doubt it will boost inflation, as many worry it will. If it is financed by borrowing money (the traditional way all deficits have been financed until 2020), then it needed be inflationary. But it will surely be a downer for the economy. More taxes, more regulatory burdens, more waste, more fraud. It won't contribute to economic growth, it will subtract. It's one more reason to expect the long-term growth prospects of the US economy to be sub-par. We've layered on lots of policies like this since 2009 when I first predicted that Obama's economic recovery would be sub-par (i.e., less than 3% per year) for the foreseeable future. With policies like this we are robbing our children of the prosperity they might otherwise have enjoyed.

Thanks Scott. Appreciate your comments.

Post a Comment