Today the Fed released the M2 money supply numbers for January 2022, and unfortunately, they show continued double-digit growth. This means the Fed still has its monetary pedal to metal, and that all but confirms that we are in the midst of a genuine and ongoing period of high inflation. The Fed has made a major inflationary mistake, and it's going to take a long time to fix. If I had to guess, we will be seeing inflation rates of 10% or so through at least the end of this year.

But as the Fed continues to tell us, they plan to move very slowly to raise rates. The bond market—still a believer in the Fed's ability to keep things under control—is projecting that the Fed will need to raise the Fed funds rate to only 2% or so within the next year or so, and that will fix the problem. That projection is almost certainly going to be very wrong. As a first approximation, the Fed needs to raise short-term rates to a level that is at least equal to the rate of inflation. See my last post for a more detailed explanation.

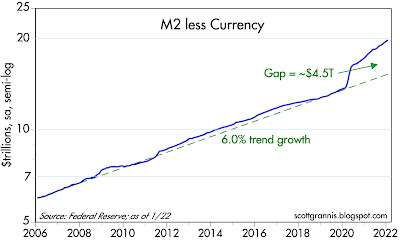

Chart #1

Chart #1 is the most important yet largely ignored chart in the financial world today. I've subtracted currency in circulation (which comprises about 10% of M2) because, as I explained earlier, currency is held only to the extent it is demanded, thus it is not a source of inflation. The rest of M2 (checking accounts, savings accounts, CDs, retail money market funds) is money that is held for the public (not institutional accounts) in our banking system. That is money that is created by the banks themselves, provided they hold sufficient bank reserves at the Fed. And as we know, bank reserves (currently about $4 trillion) far exceed what the Fed requires that banks hold. Which in turn means that banks have a virtually unlimited capacity for extending loans and thus expanding the money supply. And by the looks of the chart, they have been printing money with relative abandon for most of the past two years.

Since the pre-Covid days (February '20), the non-currency portion of M2 has increased by about $6 trillion, or 43%. Since early-summer '20, that same measure of the money supply has increased at about a 13-14% annual rate, a bit more than twice it's long-term average growth rate. Needless to say, this is all unprecedented. And very worrisome.

Recall Milton Friedman's famous dictum: "Inflation is always and everywhere a monetary phenomenon, in the sense that it cannot occur without a more rapid increase in the quantity of money than in output." To know why we have unusually high inflation today, you only have to look at this chart. Supply-chain problems undoubtedly had a roll to play (a spark, if you will), but the fuel for the broad-based rise in the general price level that we see today unquestionably has been supplied by an historic expansion of the money supply.

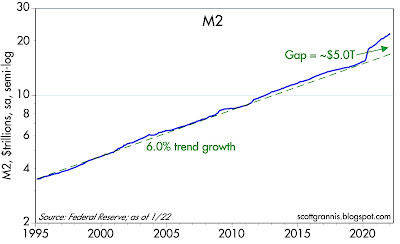

Chart #2

I have included Chart #2, which shows the total M2 money supply, because I want to dispel fears that I was massaging the numbers in Chart #1. Both charts show that over long periods the broadest measure of our money supply has tended to grow at about a 6% annualized rate. And we are soaring above that as I write.

Milton Friedman also talked about a "helicopter drop" of money on the economy, and how a sudden and massive increase in the amount of money in the economy would almost certainly result in an increase in the general price level. Well, it's effectively happened, and we can observe the results.

We should all be monetarists now.

21 comments:

Raising interest rates to 10% quickly would surely crash the economy and probably lead to a depression. Until the FED and markets believe the economy can survive without massive FED support I doubt interest rates will rise any more quickly than they are expected to in the coming months. I lived through the inflationary 70s and while it was tough, it sure beat a Great Depression.

I checked and it appears that M2 growth wasn't abnormal in the 1970's

With 1000 economists on staff (at HQ and in branches) the Federal Reserve....well, came in rather high on monetary growth?

House prices up 20% in last year.

I have an idea: let's ban property zoning and fix M2 at 6% growth annually.

Mr. Grannis, I have loved reading your analyses over the past 20 years. There's something different though now. Just like M2 replaced M1, now M2 is no longer useful, as Milton Friedman suggested in his last years. Using money supply to predict nGDP or inflation stimulus now requires money supply measure to include eurodollars, repos, liquid asset based securities. None of that is in M2, and it dwarfs M2. And each measure needs to be adjusted by actual use as liquid money. The correct current measure is the Divisia M3 or Divisia M4, and even those don't yet include all dollar liquidity.

Look at https://centerforfinancialstability.org/amfm_data.php#thumb You will see that money supply growth jumped from 5% to 20% during pandemic (necessary due to increased money demand/decreased velocity). But now it has dropped to 10%, and that may be enough correction, given the emerging restoration of good and service production. So I agree some FFR target increases are needed and coming, but probably the Fed is appropriate in being slow.

Maybe you could get someone to use Fed data to create a broad Divisia M4 incorporating the above, and that might show that the 10y Treasury futures are not crazy high. Inflation might be fine.

Thank you for your incredible blog.

I have taken this from Paul Krugman and present it in the hope that you or one of the experts on here can explain why he is wrong.

"So M1 and M2 are no longer policy variables, even potentially; they're determined mainly by demand for deposits, and the Fed can't change that through its operations. As I said, money is endogenous 12/"

He has multiple tweets that are above my level of expertise, but which clearly state that, basically, you are wrong in the way you are looking at M2. The most efficient way to judge what I am sharing is to go to Twitter and read his recent tweets on M2 for yourself. There are too many to "Paste".

Benjamin - I'm reluctant to distract from the main topic of this thread, which is more critical, but curious what you think about SB9.

https://www.wsj.com/articles/california-free-market-housing-fix-sb9-lots-units-four-value-crisis-zoning-requirements-property-rights-11643922512?st=nth3r9im11jdi8n&reflink=desktopwebshare_permalink

EHR, re Krugman and M2. If I ever find myself in agreement with Krugman, I'll be sure to double-check my data and logic. He's been so wrong about so many things it's a wonder people still pay attention to him. In checking his tweets about M2, I see that back in May of last year he was poo-pooing the rapid increase in M2. I was not.

I think it's difficult to interpret what M2 means. It changes. Sometimes it's a measure of money demand, sometimes of money supply. You only know which one by looking at inflation. If M2 is rising rapidly but inflation is falling, then M2 is a measure of money demand. If inflation is rising, that strong M2 is a reflection of falling money demand.

So correct Scott and to make matters worse, you know damn well since stocks are cracking-ostensibly due to Russia/Ukraine, Powell will be in no rush to raise rates. In fact, we could see the opposite! More printing to "buoy" the markets. We're screwed...

The seasonally adjusted numbers are 'adjusted' to smooth trends but can miss (or fail to detect early) a changing trend. Non seasonally adjusted M1 and M2 numbers are down and trends yoy are also down.

Monetary base is also down significantly (as expected) so the adjusted M2 number, as reported, assumes that loans and leases activity will significantly and unusually pick up in the short term future, something we'll find out over the next few weeks.

Carl: non seasonally adjusted M2 is always down in January, and it fell this year just as it has in prior years. I don't think you can make much of this. February—and every month to come—will be very important. We're not out of the inflation woods yet by any stretch. Monetary base is down, and so are bank reserves, but both are still hugely up relative to any time in the past. Banks still have a virtually unlimited ability to expand their lending (and the money supply). It's going to take a long time to change this dynamic.

And in the aftermath of the Ukraine invasion, the market is responding by assuming the Fed will be less likely to tighten aggressively. Uncertainty and geopolitical risk are strong arguments for not rocking the monetary boat.

Fair enough and it's work in progress..

But even the seasonally adjusted growth in loans and leases (to private market participants) is kind of flat:

https://fred.stlouisfed.org/series/TOTLL

Randy: having lived in a couple countries where property zoning is very lax, I have been fully radicalized on the topic. I do not believe in any type of property zoning.

What seems sacred in the US, such as preserving a residential neighborhood, seems less so when exposed to other nations.

In free markets, people adapt. Perhaps they spend less on the construction of a house, knowing that it may be temporary. Perhaps they build a walled compound. Perhaps they buy first right of refusal on adjacent properties.

Yes, in another nation you might lose money on the purchase of a house. The government does not mandate that you are allowed to control development in all directions from your house, and not incidentally suppress supply.

But you know what I always say. There are no atheists in foxholes and there are no free-market libertarians when neighborhood property zoning is under review.

But if you accept property zoning, then don't whine about government intrusion into other markets.

And the Fed keeps increasing its balance sheet to new all time highs yet saying inflation will come down in 2nd half this year. Makes no sense!

Benjamin, I grew up in Houston - which is (by US standards) very lax in (commercial) zoning. Neighborhoods still rule their domain of course. In CA, I suppose SB9 - though something - is just dancing around the issues.

Zoning is one of the biggest problems for families trying to escape dystopian public schools and inequality of opportunity in general. Made worse by the social justice agendas.

Zoning- I will take a stab at it.

I consider myself a pragmatic libertarian, so want minimal government.

Question is: would be OK for your next door neighbor to start up a business that created a bunch of pollution or other public nuisance?

(see the "developing" world- I watched a documentary on the poorer areas of India; no zoning there. There was a guy who had been doing metals reclaiming right in the middle of the shack city for years. Of course the neighbors didn't like it.)

Releasing carcinogens into the air is a public hazard, not a zoning problem.

There is no constitutional right to poison the air and water that other people drink and breathe.

There will be demand for $s coming from the East for geo-political reason. If quantifiable it would soak up some of the inflationary over supply of dollars. Maybe it will show up next month in M2 or other measures

"Releasing carcinogens into the air is a public hazard, not a zoning problem.

There is no constitutional right to poison the air and water that other people drink and breathe."

As usual, words like "zoning", "right" and "poison" have very specific legal meaning.

Carcinogens are released into the air continuously (e.g. by factories and vehicles), which is legal within the clean water act and clean air act via EPA regulation in the US.

Zoning impacts land use and form- which have very specific legal meanings.

Duncan, re demand for dollars: Indeed, the evolving Ukraine crisis has undoubtedly increased the demand for dollars, and this could "soak up" some of the excess supply of dollars. But this wouldn't necessarily show up in the M2 numbers. Extra demand for dollars would effectively reduce the excess supply, resulting in less inflationary pressure, and that in turn would mean the Fed would not have to raise interest rates as much as they otherwise might have to. But so far the amounts we are talking about are not significant: the dollar is up only 1.3% from its average over the past three months against a basket of major currencies.

All- just a heads up that all asset classes I follow (Real Estate, Stocks (global), Bonds (all types!), and Commodities are sells EXCEPT for Commodities.

That only happens about 20% of the time, and these kinds of signals are about 70% accurate. That's the way reality is:.....statistical.

So, cash is looking pretty good about now. Note: it could all change in a month plus or minus!

Be careful and good luck to all.

Kevin

M2 does not represent our means-of-payment money supply. Savings deposit turnover is 1:99 vs. DDs.

Post a Comment