On the surface, conditions in the US look pretty fantastic these days. Prices for lots of goods and services are soaring. Job openings are at record highs. Financial markets are awash in liquidity, and financial market conditions in general are about as good as they have ever been. Debt service burdens for most people are at all-time lows. The stock market is on the cusp of new all-time highs. Corporate profits are booming. Air travel is surging. The economy has recovered just about all it lost to the Covid-19 crisis. Household net worth is at all-time highs in nominal, real and per capita terms. Private sector jobs have recovered almost 70% of what they lost due to the Covid-19 shutdown. Vaccines and natural immunity have all but vanquished Covid-19. Conditions are improving daily, with no near-term end in sight. On the inflation front, expectations currently remain reasonably anchored at around 2.5%.

We are not free of problems or worries, of course. Is Biden of sound mind and body? Is Kamala capable of running the country? Will Congress pass, by the thinest of partisan margins, another round of trillion-dollar spending boondoggles and a permanent and massive expansion of the welfare state? Will the Fed wait too long to reverse its enormous QE efforts? How many of the 10 million workers currently sitting on their hands will want to return to work when emergency unemployment benefits expire in a few months? How long will it take for the Fed to boost short-term rates to a level that once again offers a positive real rate of return? What will happen, in the meantime, with the nearly $5 trillion in savings that have accumulated in the banking system since March 2020? Does the historically low level of real risk-free yields on TIPS suggest that US economic growth will be anemic at best for as far as the eye can see? Are equity valuations dangerously over-priced?

My sense of the news is that several potentially worrisome initiatives are now unlikely to prevail. Thanks to the opposition of the G7, Biden's proposal to unify and raise corporate tax rates to a higher level is dead; instead, the best he can hope for is an agreement to create a new, lower minimum tax rate (15%) that is uniform among developed economies. Even that looks dodgy, however. Senator Manchin appears to be standing firm against nuking the filibuster. Biden's spending plans, which are looking more extreme by the day, are facing growing pushback among the saner elements of his party.

As for the ugly, the Libertarian-leaning Tax Foundation recent issued a report that says Biden's tax hikes and spending proposals (billed as all-in stimulus) would in fact hurt the economy (the WSJ has more details). I agree: Biden's tax and spend agenda is the last thing this economy needs right now.

The charts that follow flesh out several of these arguments and developments. In the end, I remain near-term bullish but still quite worried about the potential for 1) higher-than-expected inflation down the road and 2) more outrageous and destabilizing fiscal "stimulus" and tax-hike proposals, all of which could end up derailing what for now is looking like a classic boom-type recovery.

Chart #1

Chart #1 illustrates the bizarre developments in the labor market. Many millions of people have returned to work, but there are still millions more on the sidelines. The number of job openings has exploded because employers are unable to find workers who want to work. The obvious culprit is the emergency unemployment benefits which create an enormous incentive for people to remain unemployed until these benefits expire in early September. While this is mostly a temporary problem, it is unnecessarily holding back the recovery and continuing to balloon the deficit.

Chart #2

Chart #2 has both good and bad news. Good: more companies are looking to increase their hiring than ever before. Bad: There's a huge shortage of willing workers which is stymying efforts by millions of companies to grow.

Chart #3

Chart #3 illustrates the dramatic improvement in airline passenger traffic. However, the number of people passing through US airports is still about 30% below the prevailing levels at this time in 2019.

Chart #4

Small businesses employ the lion's share of US workers, so it is concerning that their confidence has sagged from the heady levels of the Trump years, as Chart #4 shows. Undoubtedly several factors are at work: emergency unemployment benefits which pay people not to work, the prospect of rising tax rates on corporate profits and individual incomes, renewed growth in regulatory burdens, and the knowledge—which will not soon fade—that state and local officials can turn off their business at a moment's notice should a new virus surface.

Chart #5

As Chart #5 shows, the number of private sector jobs today is about 7 million less than where they would have been if the prior trend had continued. Public jobs are more than one million less than they were pre-pandemic. Yet despite these huge job losses, real GDP today is at least as high as it was prior to the Covid shutdowns. That means that the productivity of those who have been working has shot up dramatically, as the economy was forced to find ways to produce more with fewer people. We've seen a revolutionary advance in productivity thanks to Covid. As millions of currently idled workers find there way back into the workforce, that will give GDP growth a significant boost lasting at least through year end.

Chart #6

Chart #6 is quite sobering. Prior to the Great Recession, the labor force (defined as all those of working age who are employed or looking for work) was growing at a rate of about 1.2% per year. Since then, growth in the labor force has been anemic—more so than ever before. I calculate that there are about 19 million fewer in the labor force today than there would have been at the prior trend growth rate. That's a lot of idled human capacity.

Chart #7

Chart #7, Bloomberg's Financial Conditions Index, today is about as high as it has ever been. This all but rules out a near-term recession or even a growth pause. Liquidity is abundant, credit quality is excellent, and nerves have calmed.

Chart #8

Chart #8 shows corporate credit spreads. Today, spreads are about as low as they have ever been, which is a sign that the market is quite optimistic about the outlook for economic growth and corporate profits. One factor contributing to this is the abundance of liquidity and the Fed's pledge that it will not tighten monetary conditions for a long time. Not only does this limit downside economic risk, but it also adds to inflationary pressures down the road, and inflation is something that generally benefits debtors.

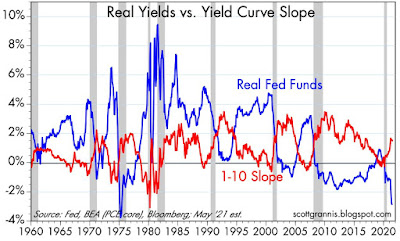

Chart #9

Chart #9 is my indispensable tool for judging the likelihood of recession. With the exception of the Covid-19 shutdown/recession, every other recession on this chart was preceded by 1) a flattening or inversion of the Treasury yield curve (red line), and 2) a high and rising real Federal Funds rate. Today the yield curve is steepening, much as it has always done during growth cycles, and the real funds rate is as low as it has ever been. This adds up to an extremely low probability of recession for the foreseeable future.

Very low real yields, such as we have today, are not an unalloyed boon, unfortunately, since they weaken the demand for money (while also actively encouraging borrowing and spending), and thus this can be harbinger of rising inflation if the Fed does not take steps to a) reduce the supply of money by reversing its QE actions and b) boosting short-term interest rates. High and rising inflation would dramatically increase the likelihood of Fed tightening and eventually lead to another painful recession. That risk is not yet imminent, however, but it is certainly worth keeping an eye on.

Chart #10

Chart #10 shows an index of non-energy spot commodity prices. Prices have soared, beginning right around the time—in late March—when federal government started pumping trillions of dollars into the economy to offset the effect of shutdowns, and the Fed ended up buying almost all of the debt that was issued, thus massively expanding the money supply. How much of the increase in prices is due to monetary inflation, and how much to the economic recovery and increased demand for goods and services which had suddenly become in short supply?

Chart #11

I've been featuring Chart #11 often over the past year, since I think it illustrates something that almost all commenters have either ignored or forgotten. The chart shows the percentage of annual income (GDP) that is held in cash or cash equivalents (M2); as such it is a good measure of money demand. As all economists should know by now, the balance between money supply and money demand is of crucial importance. When the supply of money exceeds the demand for it, inflation is the result. The Fed's massive increase in the money supply last year was matched by an equally massive increase in money demand—that's why inflation was low last year. More recently, it looks like money demand is beginning to soften. That makes sense, given the fading of the Covid crisis and the return of confidence. Yet the Fed has done nothing to reverse its massive increase in the money supply. That's why inflation has begun to rise at a troubling rate in recent months (see Charts #9 and 10 in my last post).

The future course of inflation is of the utmost importance, yet most observers, including the Fed, insist that the recent rise in inflation is transitory—inflation has increased solely because demand has outpaced supply of late and supply eventually will catch up. That's probably true in part, but I think the more important explanation is that the Fed has allowed (and even encouraged) the demand for money to decline without taking offsetting action to either reduce money supply or boost money demand.

Chart #12

Chart #12 compares the M2 money supply to nominal GDP. For many years they tracked each other closely. But now we've seen an unprecedented surge in M2 that has so far not been matched by a similar pickup in nominal GDP, (both nominal and real GDP today are above their pre-Covid highs, but have not yet exceeded their pre-Covid trend growth rate). In the absence of a concerted attempt by the Fed to reduce the money supply, I would expect to see nominal GDP pick up significantly in future years, with most of the pickup coming in the form of rising prices. There is an awful lot of potential inflationary fuel out there, and it only needs only a return of confidence and a laggard Fed to ignite.

Chart #13

Chart #13 compares the 2-yr annualized growth rate of real GDP (red line) with the real yield of 5-year TIPS. (I've assumed that GDP growth in the current quarter will be an annualized 7%.) Not surprisingly, these two variables tend to track each other. Strong GDP growth is consistent with generally high real rates, and weak growth with low real rates. The current level of real yields is about as low as we have ever seen. I can only think that is because market participants expect the long-term rate of GDP growth to be generally anemic. Perhaps it's not a coincidence that Biden's recently proposed budget in fact assumes that despite many trillions of fiscal "stimulus" coupled with rising tax burdens the economy's rate of growth over the next decade will average only 1.7% per year, substantially lower than anemic growth of the Obama years (2009-2017), when growth averaged a little over 2% per year (the weakest recovery on record).

Chart #14

Chart #14 compares the real Fed funds rate (blue line) to the real yield on 5-yr TIPS (blue line)—the latter being the market's expectation for what the blue line will average over the next 5 years. When the blue line is below the red line, that indicates the market is expecting the Fed to increase its real funds rate target in the future, which is generally the case in normal times. When the blue line is higher than the red line, this is the market saying that the Fed is too tight and is thus likely to have to ease policy in the future. Looks to me like the Fed is plenty easy these days.

For practical purposes, a very negative real yield on cash and cash equivalents such as we have today (the blue line being a good proxy for cash yields) creates powerful incentives for people to borrow money and spend it. Why? Because borrowing at a negative real rate during a period of rising prices means you don't have to take on much risk in order to make a profit, since the price of most anything you buy will rise while your debt burden—which costs little or nothing to maintain—will shrink. Another way of looking at it: negative real rates strongly discourage people from holding money (i.e., it erodes money demand) and strongly encourage them to spend money. There's an awful lot of money being held these days which is steadily losing purchasing power. If the Fed doesn't reverse its QE efforts, unwanted money will find its way into higher prices.

Chart #15

Chart #15 compares nominal and real yields on 5-yr Treasuries, with the difference between the two (green line) being the market's expectation for the average annual increase in the CPI over the next 5 years. Note the significant pickup in inflation expectations that has occurred since March '20, when the market only expected inflation to average 0.2% per year. That expectation has now jumped to 2.5%. That's not particularly troubling, but it does represent a huge change.

Chart #16

Chart #16 shows the monthly history of the S&P 500 index of equity prices since 1950. As the chart shows, equity prices have increased by an annualized 7% per year over this 70+ year period. Add dividend yields to this, and you get an annualized total rate of return on equities of about 8.5% per year. There's a lot of variability along the way, to be sure, but a buy-and-hold strategy generally pays off handsomely. Note that the 7% trend line shows just about as many above-trend years as below-trend years. If anything, I take this to mean that the equity market today is not necessarily in a "bubble" like it was in the years leading up to 2000.

16 comments:

Chart 6 is both impressive and depressing. As you say, the economy is being forced to be more productive because of artificial suppression of labor force. It's depressing because a large chunk of those idled people may never work again - and that will feed into generational unemployment. Is it a "good" thing to have automation such that we don't need to work? Time to watch Wall-E again.

Scott,

Thank you for your post. It is very encouraging.

"What will happen, in the meantime, with the nearly $5 trillion in savings that have accumulated in the banking system since March 2020?"

Spent to offset higher inflation?

Relevant:

"U.S. companies are holding on to billions of dollars in cash. Their banks aren’t sure what to do with it."

https://www.wsj.com/articles/banks-to-companies-no-more-deposits-please-11623238200?st=j500koi7toesafv&reflink=desktopwebshare_permalink

I suppose it's appropriate to worry about higher-than-expected inflation in the future. As a general proposition, it's one of the things I worry about.

But in looking at market-based metrics, I think the worry of significantly higher inflation is misplaced, at least at this juncture.

Gold price

Bond yields

Yield curve

Breakevens

None of these are suggestive of worrisome inflation. Heck, breakevens are still in backwardation. Even commodity prices have come off the boil.

I think the giant worry is that once the Great Reopening is in the rear view, we're left with a low growth environment likely predicated on pathetic government policies.

I think Powell is right in thinking that the bulk of the yoy inflation readings are transitory. Another positive is Joe Manchin and the thinking he represents.

I think the world will look remarkably different come September and people start returning to work in droves.

For now, I think were in a very weird period when it comes to the inflation question, especially with respect to yoy figures. As per usual, the market is the best indicator.

How much of chart 16 is a demographics story instead of an idle worker concern? Over the last 15 years we've had rock bottom immigration. Combine that with 1000's of boomers retiring a day and it's no surprise labor force trend growth broke. Thoughts?

"Chart #12 compares the M2 money supply to nominal GDP. For many years..."

Going back memory lane:

http://scottgrannis.blogspot.com/2014/12/more-signs-of-strength.html

The assumptions then implied that nominal GDP would pick up above M2 growth as a result of more pro-business policies. Real yields were also expected to go up.

Instead the disconnect between M2 and nominal GDP has increased and real yields have been going down and now seems to be a time when the outlook for pro-business policies look less favorable (regulations, corporate taxes etc)

What is going on?

It seems that M2 growth should be the dependent variable vs growth and not the opposite. No?

@Midwest Guy

You likely refer to chart #6 (not 16). The declining growth in work force is due to both aging AND decreased participation rate:

https://fred.stlouisfed.org/series/CIVPART

Because of those two factors, it's reasonable to expect a declining (negative rate) work force within the next decade or so. We have to hope that the productivity paradox will have been solved by then..

A nation with "labor shortages" is a happy country. I am no fan of paying people not to work, but tight labor markets are wonderful. Trade and immigration policies, take note.

Regarding "people want to be in cash, and the Fed accommodated." I think I disagree with Scott Grannis on this one.

Well, I am putting on my Austrian hat, or maybe a strict free-market cap, here goes:

OK, let's say you are in cash, and 2020 rolls around. The Fed does nothing. So you stay in cash, maybe even build up cash balances. Other people want to sell assets and move into cash. But buyers are scarce, as 2020 looks tough.

So, the guy across the street for puts his house up for sale. $400k. You say, "Meh."

The guy cuts the price to $350k. You look at a sales brochure on the house.

Now the guy has his house up for sale at $300k. "Yes, times are tough, but at $300k worth a look." You tour the house, notice new faucets in both bathrooms.

The guy cuts price to $250k.

You decide to move out of cash and into real estate.

So, the free market would have solved the "people want to be in cash" problem by a decline in asset prices. When stocks traded down to 10 times earnings...buyers would have moved back in.

What the Fed did was avert a decline in asset prices. And maybe our banking system cannot tolerate a decline in property prices, so the Fed is trapped.

I think the Fed can taper, and smaller federal deficits may be in order at this point.

Add on:

The reason our banking system cannot handle a decline in property prices is that banks are heavily exposed to real estate, but banks borrow short to lend long. In factm banks leverage up of=n short borrowings (deposits) to lend long.

John Cochrane, the economist, has pointed out the inherent fragility of the US banking system, and wants to go to a equity-heavy system, but altering the banking system...well, Don Quixote comes to mind.

So...it would by cynical to say the Fed is a creature of the financial system, and perhaps biased in favor of policies and regulations that favor the financial system.

Some might even say the Fed's interest on excess reserves policy is very nice for banks.

Re: Chart 6 -- Strange how GOP-led fiscal stagnation coupled with tax cuts for the rich after the Great Financial Crisis didn't spur employment, but now the opposite approach is going to kill employment and the economy.

The religious-like faith in supply-side voodoo and BS narrative that poverty is caused by laziness is striking.

"Is Biden of sound mind and body? Is Kamala capable of running the country? "

POTUS' last name is Biden and VPOTUS' last name is Harris, not Kamala.

Scott, based on your previous posts and comments I do realize that you must be extremely anxious of the possibility of having a woman as POTUS. Maybe you could try some deep breathing, calm down a bit.

RE: Chart 6...

Most people focus on underlying demand (what drives corporate hiring, large and small) when looking at workforce participation.

Not many people fully realize that policies (bipartisan and for a long time now) and low interest rates contribute to lower workforce participation (aggravating trends caused by aggregate aging).

The goal of low interest rate policies is to spend now vs later but also, as an unintended consequence, is to have leisure time now instead of later. This sort of goes against the American Dream.

https://www.stlouisfed.org/publications/regional-economist/april-2013/low-interest-rates-have-yet-to-spur-job-growth

Also, looking at what has been happening to the 25-34 group should be concerning (some say it's too much government and some say it's not enough and the debate is becoming increasingly bipolar). Given the right environment, people simply want to improve their lot but incentives matter. The graph below can be disaggregated for members in the 25-34 group as to education level and there is typical growing inequality there also with growing discontent. Many in the 25-34 group who are not looking for work are taking prescribed narcotics for pain. The conventional thinking here seems to be to hope that the pain eventually goes away.

https://www.edgeandodds.com/wp-content/uploads/2021/06/image-51.png

Roy: I’m pretty sure that Biden’s mental facilities are in decline. I’m almost positive that Kamala Harris is incompetent to be the leader of the free world. As for Kamala vs Harris: can you pardon an obvious resort to alliteration? In any event, their lack of competency makes me very concerned for the future of this country. The fact that Harris is a woman has nothing to do with my judgment. I can think of at least several women who would be much more capable of assuming the presidency than either Biden or Harris. I don’t care a fig for a person’s sex or color or race, all I care about is competency.

Seems awfully odd that you lived through the Trump era with little concern about competency, and now it's front and center. I wasn't reading your blog back then, but guessing you had a problem with Obama's competency too, like when he wore that embarrassing tan suit. Man that was the WORST! Much rather see my President suck up to the Russians for personal gain or launch an insurrection. Man! Those were the good 'ol days.

I don’t care a fig for a person’s sex or color or race, all I care about is competency.--SG

Amen!

The current compulsion---a peevish fixation, really----with identity politics is completely revolting.

I borrow an old phrase, just a little updated: "I never met a person I didn't like"---Will Rogers.

it actually looks like if you get rid of the blue line in chart 9, it's a more reliable indicator. each time there was a recession the red line was climbing. having a real estate background, i've learned one very important fact: when everyone starts talking about how good real estate is, you're at the top. everything seems great...until it isn't. fed tightening has been the beginning of the end following a big move in real estate.

Post a Comment