The demand for money—as measured by the ratio of M2 to nominal GDP—currently stands very near to an all-time, eye-popping high (see Chart #1). The turmoil and fears which characterized the Covid-19 era caused the public to seek out and hold trillions of dollars of extra cash, and the Fed correctly obliged this demand for money and money equivalents by greatly expanding its balance sheet— transmogrifying notes and bonds into T-bill equivalents (aka bank reserves). (I've explained this all in detail over the course of many previous posts.) Conveniently, increased savings on the part of a terrified and sheltering public provided most—if not all—of the money that Treasury borrowed to fund Covid relief spending.

Chart #1

Chart #2

But as Chart #1 suggests, the surge in money demand has passed. Confidence is returning and the economy is regaining lost ground. It stands to reason that the demand for money should begin to decline, and it has already declined, as we see in Chart #2, driven mainly by a sharp rise in nominal GDP. This is quite likely to continue; the main question going forward is how much of the increase in nominal GDP will be real and how much will be inflation.

Chart #3

Chart #3 shows the daily volume of airline passengers (white) screened by TSA, with the magenta line being the 7-day moving average. Notice the sharp increase in air traffic in the past two months. Compared to the levels which prevailed 2 years ago at this time of year, air traffic is now down only 40%, whereas at the lows of last April, air traffic had plunged by an astounding 96%. With the rapid pace of vaccinations and increasing signs of optimism, there is every reason to expect air traffic to grow rapidly in coming months and the economy to grow as well.

The resurgent demand for air travel almost certainly is driven in large part by increased confidence. And with increased confidence, the rationale for the public continuing to hold a huge portion of their annual incomes in cash (i.e., the public's demand for money) surely is fading. But since the Fed has taken no steps to reverse its note and bond purchases, the M2 measure of money supply can't simply evaporate. And with the recently passed Covid relief bill, deficit-funding spending is going to ratchet up once again, which could add yet more money to the financial markets, especially since the Fed plans to continue to its purchases of notes and bonds.

Unwanted money can't disappear, but it can fuel an expanding economy and it can bid up the prices of other assets.

Chart #4

Chart #4 provides some clues as to how this works. The bars represent the current yield on a variety of investments. The green line is the market's expected average annual increase in the CPI over the foreseeable future (about 2.3%); think of that as the average increase in the prices of all goods and services over the next 5-10 years. Owning cash, short-term Treasuries or mortgage backed securities is very likely to give you a loss in terms of purchasing power. On the other hand, yields on real estate trusts, high-yield debt, emerging market debt and the S&P 500 promise to deliver a purchasing power gain. Unwanted money (much of which is held in very short-term investments such as T-bills, bank deposits and 2-yr Treasury notes) will naturally want to seek out the much more attractive returns on just about all other assets. And as prices for other assets rise, their yields will decline.

This is another way of saying that a tsunami of unwanted cash likely is going to lift the prices of just about everything, and that is another way of saying we are going to see more inflation in the years to come, UNLESS the Fed reverses course. Which they have promised not to do for at least another year and a half.

Chart #5

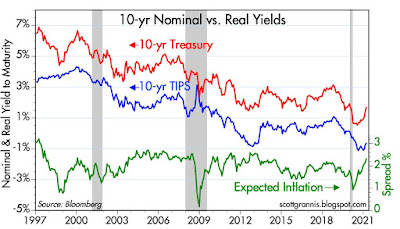

Chart #5 shows us the bond market's way of expressing the view that inflation is likely to average about 2.3% per year for the foreseeable future. The difference between real and nominal Treasury yields gives you the market's expected rate of inflation. Note that most of the increase in inflation expectations of late has come from a rise in nominal Treasury yields. Real yields are still very low.

Chart #6

Chart #6 shows how 2-yr real yields on TIPS have a strong tendency to track the growth rate of real GDP over time. That real yields are currently so low means that the market either does not have a lot of confidence in future growth prospects, and/or the market is still very risk averse (meaning that people are willing to pay extremely high prices for the relative safety of TIPS). Going forward, we are likely to see real yields rise as long as the economy demonstrates that it has the ability to grow by at least 1-2% per year for the next several years.

Chart #7

Chart #7 gives us a long-term view of the evolution of the Treasury yield curve (using 2- and 10-yr yields as the classic reference points for short and long-term interest rates). Bear in mind that short-term rates are heavily influenced by both the Fed's monetary policy target and the market's demand for safe assets. The yield curve has steepened noticeably since last summer, mainly due to rising long-term yields, which in turn have been driven by expectations that the economy will improve enough to allow the Fed to raise short-term rates in the future. This is a healthy development, since very low yields are a sign of a very weak and risk averse economy. There's no reason yet to worry that higher yields will derail the ongoing equity market rally.

14 comments:

Informative, as usual.

"This is another way of saying that a tsunami of unwanted cash likely is going to lift the prices of just about everything, and that is another way of saying we are going to see more inflation in the years to come, UNLESS the Fed reverses course. Which they have promised not to do for at least another year and a half."

-Isn't this the story line since the GFC?

Real yields have been on a down trend since 2000.

-Why should we expect anything different going forward?

The demand for money is a contrivance. M2 comprises both transaction deposits and savings' deposits. Transaction deposit turnover, as represented by demand deposits, is greater than 95:1 over savings deposits.

Economists are both vacuous and absolutely retarded. Banks don't loan out deposits. Deposits are the result of lending. So, all bank-held savings are frozen.

The expansion of real variables over nominal variables is predetermined by the distributed lag effect of monetary flows, volume times transactions' velocity.

The "taper tantrum" is prima facie evidence. Long-term monetary flows fell by 80 percent from Jan. 2013 to Jan 2016. But real interest rates rose.

Salmo: of course banks lend out their deposits! How else do you think they can earn the money to pay interest on the deposits? Today banks are lending the bulk of their deposit inflows to the Fed. In return the banks hold bank reserves, which pay 0.1% interest and are effectively T-bill substitutes.

As you note, bank lending is what allows the money supply (including deposits) to grow. Only banks can "create" dollars by making loans. But the situation today is very different than before, because the Fed is willing to buy Treasury notes and bonds in almost unlimited fashion from the banks, issuing bank reserves to pay for them, which can't be used as money.

I am absolutely convinced, beyond any shadow of a doubt, that inflation and interest rates should have been much, much higher from 1980 to 2020 than they were.

Some aspects of globalized capital markets are interesting. Depending on what you count, there are about $450 trillion in assets globally, in stocks, bonds, property. Money is fungible, and can move from class to class with the click of a mouse.

US Treasuries are in a global market, with lots of competition and substitutes. So the Fed buys a few trillion in Treasuries. Then what?

That will cause inflation?

As pointed out here, most new money that enters the economy comes from bank lending. Yes, banks have reserves, and there is IOER, but banks will lend if prudent and profitable, one way or another. While people wax long about central banks, it is commercial banks that essentially print money.

Well, we can just wait and see. If we get inflation this cycle, then maybe, at long,long last, the inflation-mongers will have a last laugh. The Chicago Cubs won the World Series in 2016, after a 108-year wait.

But if we see mild or little inflation this go 'round, I am going to say, "That inflation dog don't hunt no more."

Also, "If you are not confused, then maybe you don't understand the situation."

BTW, those of your with "unwanted money" can send it along to me.

re: "of course banks lend out their deposits!"

That's universally posited and universally an egregious error. It's a confusion of debits and credits. If you tally the inputs and outputs impacting the commercial banking system, you will find that while large in the aggregate, e.g., capital stock, Reserve bank credit, etc., they are nevertheless peripheral and offsetting in their summation. It is a fact that the banks can't engage in almost every activity with their nonbank customers without an alteration in the money stock (savings being frozen).

I.e., the banks are credit creators. The nonbanks are credit transmitters. Every time a bank makes a loan to, or purchases securities from, the nonbank public, it creates new money, demand deposits, somewhere in the payment's system. I.e., deposits are the result of lending, and not the other way around.

All monetary savings originate within, not outside, of the payment's system. The source of interest bearing deposits is other bank deposits, directly or indirectly via the currency route (never more than a short-term situation), or through the bank's undivided profits accounts.

There is one and only one way to activate monetary savings (funds held beyond the income period in which received). That is for their owners, saver-holders to invest outside of the payment's system, or to spend either directly or indirectly.

Dr. Philip George's equations prove this. See "The Riddle of Money Finally Solved"

It's simple, but mind boggling. The Japanese economy proves this too. The Japanese save more and keep more of their savings impounded in their payment's system. And the BOJ insures all transaction deposits.

That's the reason why velocity rose from 1961 to 1981 (the monetization of time deposits), and then has fallen ever since. That's the source of secular stagnation, chronically deficient AD. The FDIC raised deposit insurance from $40,000 to $100,000 in 1980. Then it raised deposit insurance from $100,000 to $250,000 in 2008. That prevents savings from being activated.

Economists are stupid. An individual bank may seem like it's acting as an intermediary, but when viewed from the standpoint of the system, banks act entirely different.

Benjamin Cole--"beyond any shadow of a doubt, that inflation and interest rates should have been much, much higher from 1980 to 2020 than they were.

Some aspects of globalized capital markets are interesting. Depending on what you count, there are about $450 trillion in assets globally, in stocks, bonds, property. Money is fungible, and can move from class to class with the click of a mouse. "

The one word answer is what you have identified: "Globalization"

In the late '80's the Iron Curtain came down. In about 1990 trade agreements were put in place, such as NAFTA. Then China started trading with the rest of the world. The China trade ramped up for about 10-15 years.

If you have ever worked outside the US, you can see the globalization of the work force, for example. There are billions more employees out there.

The other answer (like the law of gravity): "Supply and Demand"

Capital, such as new plants and labor are in much greater supply. Demand isn't as high per capita as when the "free trading" globe was just the US, Europe and parts of Asia.

That's a recipe for deflationary pressure on wages in the developed world, as well as for prices on tradable goods (e.g. clothing, electronics, furniture, etc.)

Monetary inflation has counteracted the "real economy deflation", so we have had low inflation for about 30 years.

As I said; pretty simple stuff.

re: " inflation and interest rates should have been much, much higher from 1980 to 2020 than they were."

Hardly. The DIDMCA of March 31st 1980 deregulated all interest rates. It also destroyed the nonbanks, i.e., caused the S&L crisis and the 1990-1991 recession (as predicted in May 1980).

Velocity was also predicted to have permanently plateaued.

Blogger Salmo Truttra bellowed, blabbered, bloviated, and pontificated:

"Economists are both vacuous and absolutely retarded".

"Economists are stupid".

Thank you for informing us, Mr. Tutu.

You are certainly an expert on s t u p i d.

A lot of the classic thinking involves a concept of stable money velocity, an assumption which no longer holds because (among other factors) of central bank interference (propping up of PY by artificial ultra-low interest rate support) and because of the levels that global debt has reached (the point of no return).

As more support (supply) is provided in an increasingly leveraged economy, the velocity is likely to decrease more and eventually in a non-linear fashion.

That's what a part of the debt deflation theory is about.

A fascinating aspect is that, as the component of flight to safety kicks in, that part of the money demand will increase but, because of the liquidity trap, interest rates will go down.

Of course, contrary to the Great-Depression period, the monetary authorities feel they get it and will use the tools at their disposal to prevent this, obviously causing the eventual day of reckoning to be more impactful.

Austerity will happen no matter what. Buckle up.

Post a Comment