The Fed last week released its Q2/18 estimates for Household Net Worth and related measures of prosperity. Of note, households' leverage (liabilities as a % of total assets) fell to a 33-yr low, and households' net worth hit hit a new all-time high in nominal, real, and per capita terms. Total household net worth is now almost $107 trillion, up over 50% from pre-2008 highs, whereas liabilities are up only 7% from their Great Recession highs. Housing values have increased by about 15% since their 2006 bubble highs, but are still about 6% lower in real terms. Households have been busy deleveraging, saving, and investing, and the housing market is back on its feet and healthy. Major trends are all virtuous and consistent with past experience.

Chart #1

As Chart #1 shows, private sector (households and non-profit organizations) leverage (liabilities as a percent of total assets) has now fallen 36% from its early 2009 high, and has returned to levels last seen in early 1985, when the economy was in full bloom. Our federal government, in contrast and very unfortunately, has borrowed with abandon, raising the burden of federal debt (federal debt owed to the public, as a percent of GDP) from 37% to 83% over the same 33-year period. If our government were run with the same discipline as households have displayed, that might be termed nirvana. We're as well off as we are today

despite the ministrations of our government.

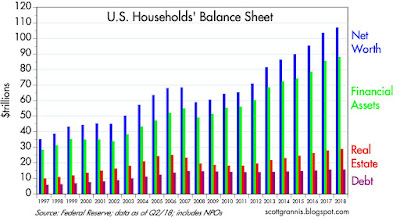

Chart #2

Chart #2 summarizes the evolution of aggregate household balance sheets. Note the very modest increase in liabilities over the past decade, the gradual recovery of the real estate market, and the strong gains in financial assets, driven by increased savings and rising equity prices.

Chart #3

Chart #3 shows the long-term trend of real net worth, which has risen on average by about 3.5% per year over the past 66 years. Note that recent levels of real net worth do not appear to have diverged appreciably from this long-term trend. That wasn't the case in 2000 or 2007 however, when stocks were in what we now know was a valuation "bubble."

Chart #4

Chart #4 shows real net worth per capita. The average person in the U.S. today is worth about $327K, and that figure has been increasing by about 2.2% per year, adjusted for inflation, for the past 67 years. (Note: the difference in the trends of Chart #3 and #4, 1.3%, is the average rate of population growth over this period.)

To be sure, there are lots of mega-billionaires these days who are skewing the statistics upward, but that doesn't imply that the average person's living standards have declined. Virtually all of the wealth of the mega-rich is held in the form of equity or real property investment, and all of that is available to everyone on a daily basis. A person making an average income in the U.S. enjoys all the advantages that our nation's net worth has created. Regardless of who owns the country's wealth, everyone benefits from the infrastructure, the equipment, the computers, the offices, the homes, the factories, the research facilities, the workers, the teachers, the families, the software, and the brains that sit in homes and offices all over the country and arrange the affairs of the nation so as to produce over $20 trillion of income per year. Would the average wage-earner (or, for that matter, the average billionaire) in the U.S. enjoy the same quality of life if he or she earned the same amount while living in a poor country? I seriously doubt it.

13 comments:

Are the liabilities matched with the assets within households in Chart #1? Or is it simply total household liabilities for all households divided by total household assets for all households?

If it is the latter, then it could easily hide many seriously overleveraged households. Extremely wealthy households, such as Jeff Bezos, could easily distort the picture.

Scott,

Can you tell us what the median family net worth is, and does that number bode well for retirement? I have read that real estate represents a smaller percentage of the net worth of the super wealthy and that that helped them when the Great Recession occurred. In other words, it was those who owned real estate that were hurt the most in terms of net worth. I also understand that a good part of the net worth of the really wealthy is in businesses and securities, both of which have helped them since the Great Recession ended.

As I always say, great blogging by Scott Grannis and let the good times roll, baby.

Off topic a little bit but the Reserve Bank of Australia has a 2% to 3% inflation band target. Australia has not had a recession since 1991. Yes, they even dodged the 2008 global Great Recession

The current rate of inflation in Australia is under 2% and they have had occasional periods where it rose above the inflation band.

But the overwhelming evidence is that the 2% to 3% inflation band has been a working policy for the Reserve Bank of Australia.

I think central banks would be wise to adopt a working policy, rather than to sacralized a particular rate of inflation such as 2%

Benj, it looks to me like Australia has had only 3 years of +2% GDP since 1991. Most years it looks like less than 1% based on a graph I've seen.

For at least the first 8 years coming out of the Great Recession, it looked like the US was going to have ~2% GDP and low inflation. I'd rather have 3-4% growth with 2% inflation and very rare recessions. Can we do it? For now I agree with you: "let the good times roll, baby."

Re "Can you tell us what the median family net worth is?"

Unfortunately, I don't believe that number exists.

Market values come and go, but the book value of liabilities remain until they are compromised in a messy way.

WealthMony--

https://fred.stlouisfed.org/series/NAEXKP01AUA657S

Eyeballing the above chart, I think the Aussies are running 2% to 3% real GDP growth from early 1990s to now.

I just do not see the need for a fixation on a particular rate of inflation, such as 2%. Egads, there are different measures of inflation, that come up with different rates, so to make it point of honor to die on "Inflation Hill-CPI 2%" does not make sense. Or, in the Fed's case, "Inflation Hill 2% PCE."

I think the Aussies have a more-sane approach, and that is to keep inflation in low digits, but accommodate growth, run a little high here or there, but mostly avoid recessions.

Sydney has a great track record. Sheesh, enough with the monetary theorists.

I like what works.

Scott, while I def appreciate your optimism, at some point optimism leads to carelessness. What do you think of this piece?

https://www.themacrotourist.com/posts/2018/09/27/jesse/

Steve,

Interesting chart in your link. One metric that would be useful is to have the chart weighted for market cap. It's one thing for a 100 or so in the last 500 of the Russell 3000. It would be quite another if that was Apple, all the FANGS, etc. Maybe some folks still following Scott that remember the Gilder effect. A lot of large companies way over priced. From what I can tell, the current price to sales ratio for the 3000 index is just 2.1. I can't find what it was historically. Here are what the top 10 companies are:

appl 4.2

msft 7.9

amzn 4.7

brkb 2.2

fb 10

jpm 3.6

jnj 4.6

goog 6.7

xom 1.4

googl 6.7

Scott,

The 2016 (the latest edition) of the Federal Reserve Board’s triennial Survey of Consumer Finances provides both median and average family net worth. The document is at https://www.federalreserve.gov/publications/files/scf17.pdf. See Table 2 at page 13. Family holdings of business equity is at page 28.The data suggest increasing disparity between those at the top and the rest below the top.

The Fed report is also discussed in this article: https://www.financialsamurai.com/the-average-household-net-worth-in-america-is-huge/

Peter

If only we had heard from Lina Tan earlier.

Re "at some point optimism leads to carelessness." I think optimism CAN lead to carelessness, and I have made that kind of mistake several times in my life, to my great regret. I make no claim here to being able to "time" the market, because I know that can be treacherous. I do hope I can remain as objective as possible when analyzing current conditions. But I would not be surprised if I miss something important, or if some unexpected event changes everything.

Howard Marks is a legendary and very smart investor, and I take pains to read his periodic memos on market conditions and investing. I recommend following him: https://www.oaktreecapital.com/insights/howard-marks-memos

Like me, Howard is skeptical of anyone's ability to successfully "time" the market. He argues in his latest memo that while current market conditions are not necessarily indicative of a top, they do warrant caution. In other words, now is not the time to take on a whole lot of risk. That doesn't mean you should sell, it just means you should be very disciplined in your approach to risk. Wise words, but unfortunately hard to quantify and hard to know how this should apply to each individual.

Post a Comment