Chart #1

Chart #2

Chart #1 compares the ISM manufacturing index with the quarterly annualized growth of GDP. The manufacturing index is about as strong as it has ever been, and in the past, numbers like this have been consistent with GDP growth of at least 4-5%. Expect Q3/18 to be at least 4%, which in turn would make year over year growth in GDP the strongest in 13 years. Meanwhile, Chart #2 shows that the service sector remains quite healthy as well, more so than in the Eurozone.

Chart #3

Chart #3 shows the ISM new orders index, which is also rather strong. The October 2016 reading was 53.3 (just before the November '16 elections), and it has since jumped to 65.1. This is a good sign that business confidence has surged and that businesses are ramping up spending on new plant and equipment. This is the seed corn of future productivity growth and an excellent portent of a stronger economy to come.

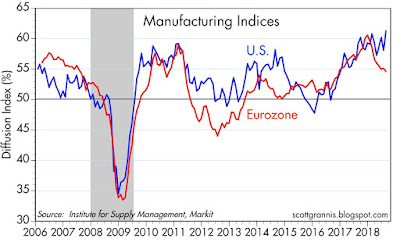

Chart #4

Chart #4 compares the ISM manufacturing index to its Eurozone counterpart. Things aren't looking so good overseas of late, which is unfortunate. But this could simply be a reflection of the fact that with the big drop in corporate tax rates in the U.S., businesses are pouring resources into the US at the expense of Europe, where tax rates are still high.

Chart #5

Chart #5 shows the ratio of after-tax corporate profits (as measured by the National Income and Product Accounts, which in turn are based on data submitted by corporations to the IRS) to nominal GDP. By this measure, corporate profits have rarely been so strong. This is of course due in large part to the reduction in corporate tax rates. Skeptics will say that lower tax rates have simply lined the pockets of the fat cats, and that little or none of this will trickle down to the little guy. I think this is a very short-sighted way of looking at things. What is the first thing that corporations do when they find that their profits are growing? From my experience, having known and worked with many senior corporate executives, increased profits are the trigger for increased investment. No one wants to leave profitable activities unexploited.

Chart #6

Chart #6 compares the yield on BAA corporate bonds, which I use as a proxy for the overall yield on all corporate debt, to the earnings yield (the inverse of the PE ratio) of the S&P 500, which I use as a proxy for the earnings yield of all corporations (i.e., the rate of return on a dollar's worth of investment in US corporations). As the chart shows, the past decade or so has a lot in common with the late 1970s; during both of those periods corporate bond yields and equity yields were very similar. During the boom times of the 80s and 90s, however, the earnings yield on stocks was much less than the yield on corporate bonds.

If the economy was humming along and confidence was high, you would expect the earnings yields on stocks to be less than the yield on corporate bonds. Why? Because corporate bonds have the first claim on corporate earnings—it's safer to own bonds than it is to own equity. Equity investors have a subordinate claim on earnings, but they are generally willing to give up current yield in exchange for greater total returns.

The fact that earnings yields and corporate bond yields are roughly equal these days tells me that investors aren't too confident that corporate profits will remain as strong as they have been for much longer. That's a sign of risk aversion, and risk aversion has been one of the hallmarks of the current business cycle expansion. I've been arguing for a while that risk aversion is slowly on the decline, and I expect that to continue.

Looking ahead, earnings yields will probably stay flat or decline (i.e., PE ratios will probably remain steady or rise), while the yield on corporate debt should rise in line with rising Treasury yields, which in turn will be driven by more confidence and less risk aversion.

Chart #7

Chart #7 shows the current PE ratio of the S&P 500. This is calculated by Bloomberg using 12-mo. trailing earnings from continuing operations. At just under 21 today, PE ratios are somewhat higher than their long-term average.

Chart #8

Chart #8 shows the PE ratio of the S&P 500, but using the NIPA measure of all corporate profits instead of reported GAAP earnings. Here we see that equity valuations are only slightly higher than average, and far less today than they were during the "bubble" of 2000.

Chart #9

Chart #9 shows the difference between the earnings yield on equities and the yield on 10-yr Treasuries. That's a measure of how much extra yield investors demand to bear the risk of equities instead of the safety of long-term Treasuries. In the boom times of the 80s and 90s, investors were so confident in the value of equities that they were willing to accept an earnings yield that was substantially below the interest rate on Treasuries. For the duration of the current recovery, however, that has not been the case at all. That's another way of appreciating just how risk averse this recovery has been.

Chart #10

Chart #10 shows the PE ratio of the S&P 500 using NIPA profits (instead of GAAP profits), and Shiller's CAPE (cyclically adjusted price to earnings ratio) method of calculation. (Current prices divided by a 10-yr trailing average of after-tax quarterly profits.) Here we see that PE ratios are only slightly above their long-term average. That's another way of saying that equities are far from being over-valued.

12 comments:

How do you get the PE based on NIPA profits? The BEA reports them in dollars, not EPS. What do you assume as a number of shares?

I use the S&P 500 index as a proxy for the price of corporate equity, and the NIPA value of all corporate profits as a proxy for all corporate earnings. I normalize the result so that the average is equal to the average PE (standard method) over the same period. Shares don’t enter into the equation.

Investors including myself are very afraid of the next round of tarrifs - assuming we can strike a deal with China i think the last remaining major overhang to animal spirits really kicking into gear with be lifted and hopefully it’s smoother sailing ahead

That makes sense. I looked at the two earnings series, S&P and NIPA. They are quite similar. The NIPA series is growing slightly faster, less than 1% per year. It's also less volatile. My guess is this is due to the breakdown of non-public companies, which include medical practices and legal/accounting firms. These are stable and faster growing, at least until a few years ago.

Nice scott. Thanks for the great post.

Can we get a swap spreads, cds spread update in the future? Always love those charts.

Of course the rotten apple in the basket is DT's inane stance on trade with China mostly. Really what it boils down to is telling the American consumer that they don't know what they are doing and we're going to tax you into making better decisions.

https://www.theguardian.com/technology/2018/sep/08/donald-trump-threatens-267bn-more-tariffs-on-chinese-goods

Another solid review of the economy, and I say let the good times roll.

I hope the Fed does not cause another recession, I think the US needs a long, long run of higher corporate profits and rising real wages---and I think when businesses start investing in plant and equipment, the extra productivity will hold down inflation (ala the 1990s). I also do not think 3% inflation is the end of the world.

Higher wages and tight job markets are a positive and will do more to stem socialism in America than any amount of op-eds, or pontificating on the virtues of free enterprise. If we say free markets are good for Americans, then let's bring it. I think we can, and the risks of "runaway inflation" are small and worth taking.

Trump's tariffs: Too small in the overall picture to count for much. I would like to see more manufacturing migrate to the US. The global trade picture is a lot more shadowed than the globalists are wont to admit. I am reserving judgement on Trump's tariffs.

I simply do not understand how any reasonably sane person can argue for trade tariffs which are NOTHING but a tax on US consumers. How the HELL does a government get to choose who wins and loses in a free "capitalistic" economy? DT and his minions will sink the ship in an attempt to change consumer choose. BRILLIANT.

SHAME ON YOU FOR NOT POINTING OUT THE CONTRARY POINT OF VIEW AS EXPRESSED BY JOHN HUSSMAN:

There are other critiques of the CAPE ratio in circulation. Let’s take a look at a couple of them. One widely-followed analyst argues that because companies have had large write-downs during the bursting of the tech bubble and again during the Great Recession, the reported EPS series used by Shiller’s CAPE ratio is no longer appropriate. The large losses and write-downs must be biasing the earnings data lower.

The suggested fix to the CAPE ratio entails swapping Standard & Poor’s reported earnings in the CAPE ratio with national corporate profits. This is an odd suggestion on numerous levels. National Income and Product Accounts (NIPA) profits and the S&P 500 EPS series are vastly different data series. National profits are calculated from a pool of about 9,000 companies - small and large, profitable or not, from a broad set of businesses and industries. Importantly, NIPA calculations track profits from current production. So capital gains and losses from merger and acquisition activity are not including, nor are bad debts.

Long-term comparisons don’t work either. NIPA corporate profits have grown at a much faster rate than the S&P 500 EPS has, partly because of the smaller companies that make up NIPA’s sample. Plus, there is an apples-and-oranges arithmetic to dividing a per-share price index of the largest 500 publicly traded companies by the aggregate dollar value of profits for 9,000 or so public and non-public companies.

That said, there’s an important concept within this argument that’s worth considering. Should large losses and write downs be entirely ignored by investors? Here it makes sense to consider the full economic cycle – not just recessions. A write down in book equity typically occurs for two reasons. Profits already booked may have been overstated. Or executives invested the firm’s money poorly, or in some cases, too aggressively.

There are also other factors that impact EPS levels favorably. Elevated profit margins are certainly pushing current EPS higher. These profit margins have been helped by large fiscal deficits that emerged in response to the crisis. And, of course, the crisis was the catalyst for the large write downs. It is inconsistent to discard what is having a negative impact on earnings without adjusting for those factors that are having a positive impact. As John Hussman has pointed out, the Shiller profit margin (the 10-year average of earnings as a percent of S&P 500 sales) is 23 percent above its long-term average, which actually makes the Shiller P/E less extreme today than it would be otherwise.

While substituting NIPA profits for S&P EPS to calculate a P/E is inappropriate, we can use NIPA profits as a general proxy for economy-wide profits. In that way we can judge the volatility of corporate earnings among publicly traded companies. The graph below normalizes NIPA corporate profits to the beginning value of Standard & Poor’s Reported EPS series a decade ago. We would expect company profits to be more volatile than NIPA because of the different way the two profits are recorded. This is clearly supported by the data. Corporate profits at the company level are much more volatile – and importantly, in both directions. Company-level earnings grew more quickly during the 2002 – 2007 expansion, but the collapse of those earnings was more dramatic during the recession. The average company-level EPS during this period is $64. The average normalized NIPA Profit was $62.

Re Hussman and the different measures of corporate profits: I've had numerous posts over the years comparing NIPA and GAAP profits. NIPA profits are the most comprehensive measure of corporate profits, and they are more timely than 12-mo. trailing EPS. Regardless, over time both series have grown by a similar amount. I think there is value in looking at both when trying to determine valuations.

As for CAPE profits, I'm not a real fan, because I don't see wha long-ago t historical earnings have to do with today's realities, given all the things that have transpired. Nevertheless,I posted a chart using the CAPE methodology for comparison.

Here's one of my posts from 2014: https://scottgrannis.blogspot.com/2014/11/corporate-profits-juggernaut-continues.html

As for Hussman, he is a poor choice to cite as an authority on valuation. Check out the performance of his flagship fund, HSGFX. Arguably, it has the poorest performance record of all time since September '08, because Hussman has been consistently bearish and terribly wrong in his predictions, all of which center on his continued insistence that equities are over-valued. The fund is down over 60% in the past 10 years.

Someday I'm sure Hussman will be right, but it's going to be hard to recover after being wrong for 10 years.

Scott, according to the St. Louis Fed the yield on BAA corporate bonds is 4.81% as of 9/7/2018. The TTM earnings yield of the S&P 500 is 4.02%. Is this a normal risk aversion spread? Seems like it would be narrower if investors were averse to risk. I see too that the forward yield on earnings is 6.00%.

I've been watching the S&P 500 forward earnings yield versus the 10-year Treasury yield going all the way back to 1979, and these two were hugging each other from 1981 to 1999. At that time the 10-year Treasury yield jumped higher than the S&P500 until 2001. Since then the 10-year has been significantly lower than the SP500 forward earnings yield. Is this all due to QE? Since January 2017 the spread has narrowed as the 10-year has moved higher w/o much movement in the S&P earnings yield.

I think this abnormality has made it very difficult to base stock valuations on historical comparisons with fixed income. I am hoping that with the normalization of interest rates by the Fed, the old Fed Model will again be helpful in placing a relative valuation on stocks.

Good lord, that Hussman fund is down over the 15 year period, too!

Nobody has ever made money in it.

How can it possibly still have $300 million in it?

Who keeps money there?

Amazing

Post a Comment