Despite recent and prospective rate hikes, it's important to note that the Fed is not yet "tight," and monetary policy today is probably best described as "neutral." The economy has been picking up a bit of late, optimism is up, and the demand for money consequently is softening. The Fed is correctly offsetting these developments with a minor boost to short-term rates designed to bolster the demand for money.

Chart #1

The Fed's record on inflation speaks for itself: for the past 10 years, consumer price inflation has averaged 1.8% with impressively low variance. As Chart #1 shows, the average level, range and variability of CPI inflation in the current decade is lower than in any other decade in the past century. (To read the chart, the red bars show the range of year over year readings in the CPI, The yellow line represents the annualized rate of CPI change over each decade, and the blue bars represent the average plus or minus one standard deviation.) Abstracting from energy prices, which have been extraordinarily volatile in recent decades, the ex-energy CPI has averaged 1.7% in the past year, 1.8% for the past 5 years, 1.8% for the past 10 years, and 2.1% for the past 20 years. On the inflation front, things haven't been this good for generations, and the Fed deserves credit for doing a great job.

Chart #2

An important part of the Fed's mandate is to maintain the dollar's purchasing power. As Chart #2 shows the dollar today is pretty close to its long-term average against other currencies, after adjusting for inflation. A relatively stable dollar vis a vis other currencies is one important way to ensure the dollar maintains its overall purchasing power.

Chart #3

As Chart #3 shows, the market's expectation for inflation over the next 5 years is currently 1.8%. That is just about exactly the prevailing rate of inflation in recent years, and very much in line with historical experience. Although some worry that this is below the Fed's "target" of 2%, I think most economists and consumers would prefer 1.8% to 2%.

Chart #4

As Chart #4 shows, the real yield on 5-yr TIPS has a strong tendency to track the economy's underlying trend rate of growth, for which I use the 2-yr annualized change in real GDP. Real yields have been rising slowly and very gradually in recent years, suggesting the market is pricing in a modest increase in real growth. Real growth has averaged about 2.2% per year for most of the current recovery, but the market now seems to be pricing in something in the range of 2.5-2.8% growth over the next year. That also happens to be in line with the FOMC's forecasts. I note also that the Atlanta Fed is now projecting 3.3% annualized growth for the current quarter, which would result in a 2.7% annual rate of growth for the current year.

This is encouraging, of course, but as I argued last week, the market is not yet pricing in a significant boost to growth from the pending tax reform package.

Chart #5

As Chart #5 shows, 2-yr swap spreads are quite low. This strongly suggests that market liquidity conditions are excellent, systemic risk is low, and the economic fundamentals are generally rather healthy. That's not surprising, actually, since the Fed has yet to withdraw a significant amount of bank reserves from the system, as it did in prior tightening cycles.

Chart #6

As Chart #6 shows, Credit Default Swap Spreads are also quite low. These instruments are very liquid, and are excellent proxies for short- to medium-term credit risk in the corporate bond market. Conditions look pretty good right now.

Chart #7

Chart #7 tells the same story by showing indices of credit spreads in the broad market for corporate bonds of investment grade and high-yield ratings. The market has a good deal of confidence in the outlook for the economy.

Chart #8

As Chart #8 shows, all postwar recessions have been preceded by a significant tightening of monetary policy (as evidenced by a sharp rise in the real Fed funds rate) and a flattening of the yield curve (as evidence by a negatively-sloped Treasury curve). Currently, inflation-adjusted short-term rates are close to zero, which is hardly punitive. And while the yield curve has flattened substantially, it is still reasonably positive. Taken together, these two conditions suggest that the Fed is at least a year or two away from delivering monetary policy tight enough to begin to hobble the economy.

Chart #9

Chart #9 focuses on the outlook for the real yield curve (which also has inverted prior to past recessions), by comparing the current real funds rate (blue) to what the market expects that real rate to average over the next 5 years (red). Although the real yield curve is rather flat, it is not inverted, and real yields are not projected to be very high. Indeed, both the Fed and the market expect that the Fed funds rate will be increased only modestly, in line with a modest pickup in real growth.

Chart #10

Chart #10 shows a big-picture view of the nominal Treasury yield curve, as represented by 2- and 10-yr Treasury yields and the spread between the two. I note that the current spread (54 bps) is about the same as we saw in the mid-1990s, when the economy was quite healthy.

Chart #11

Chart #12

As Charts #11 and #12 show, over the past year there has been a significant slowdown in the growth of bank savings deposits. I take this as a sign that the demand for money has dropped meaningfully. Savings deposits have paid almost nothing in the way of interest, but demand for them was incredibly strong in the years following the Great Recession. The appeal of savings deposit was not their yield, but their safety. Now, even though they are yielding more than zero, demand for them has dropped. People are no longer so interested in safety. It's not surprising that equities have done very well for the past year; as the public has attempted to pare its holdings of cash in favor of riskier assets, the price of cash has risen and the yield on equities has declined (i.e., short-term rates have increased as equity yields have decreased). The Fed would be irresponsible to not raise rates given this important shift in the demand for money.

Chart #13

Chart #14

As Charts #13 and #14 show, there has been a significant increase in confidence in the past year, both among consumers and small business owners. This increase in confidence is fully consistent with the slowdown in the growth of savings deposits. On the margin, people are deciding to put money to work rather than stashing it away in banks.

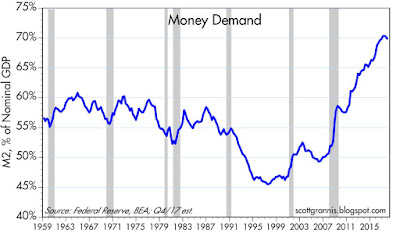

Chart #15

The counterpart to a slowdown in the demand for money is an increase in the velocity of money. Chart #15 illustrates how we may have seen the peak in money demand. Going forward, even if the supply of money in the economy grows at a slower pace, rising velocity should ensure that nominal, and perhaps also real GDP growth, should pick up. We are seeing that already in Q3 and Q4 GDP, and it should continue, especially if tax reform passes.

Conclusion: If tax reform passes in anything like its current form, the economy is quite likely to pick up by more than the market and the Fed are expecting. That's because tax reform will directly increase the incentives to invest, and that in turn means more jobs, more productivity, and higher wages. This also implies that 10-yr Treasury yields are going to have to rise by more than the market currently expects, if only because real yields should rise as the economy's real growth potential increases. Tax reform thus spells very bad news for the long end of the Treasury market. However, it's also true that rising market yields could (and should) put downward pressure on equity multiples. Thus, even though the economy strengthens and corporate profits increase, the rise in equity prices going forward could be modest rather than meteoric.

12 comments:

Those spreads are so low. Amazing

Another great post by Scott Grannis, and my new favorite chart of all time is Chart #1, Kudos and huzzahs!

That said, perhaps Scott Grannis had a large goblet of port before limning this sentiment, and he waxed a tad prolific.

"Tax reform thus spells very bad news for the long end of the Treasury market." ---SG

Very bad news! Or as our fearless leader would say, "Bad!"

Well, dump your long-term bonds if you wish, but as of now the pundits say the GOP tax bill will pass and it will lower taxes on corporations and high-income folks. So my guess is Mr. Market has priced in tax "reform."

Smart institutional traders pay what they pay for long Treasuries. The yield yesterday on 10-year Treasuries fell to 2.35% from 2.40%. What does that mean? I don't know, but it seems rather sanguine.

One could even posit corporate and high-income tax cuts will lower the cost of capital going forward, as there will more of it to invest, in a world already saturated with capital. Cap rates on class A commercial property are already lower than Hillary Clinton's charisma-rating. Or Al Franken's political future.

Yet every industry is fighting global overcapacity---autos, steel, aluminum, food, cement. Even oil, where an overt cartel plays a sinister role, and many producing nations are run by thugs and lunatics, the "problem" has been too much supply. Which American drillers and investors look to make worse in 2018.

The globe is generating oceans of capital---this is great news, but I think policy-makers and macroeconomic observers have not adjusted. All through human history, capital has been scarce. No more. You are "entitled" to a return on your investment---you are also "entitled" to a loss. The market is sating your capital is not worth much.

There is something about American macroeconomists that they continuously predict higher interest rates and inflation pending. Yet the secular trends are lower for the last 40 years, with a bump up here or there. Has something changed?

Japan is still is wiggle away from deflation, despite Bank of Japan actions invariably described as "hyper, super-duper, insane, wildman-crazy expansionary inflationary nuke-bomb to the moon easy."

And remember---the Fed's Beige Books manifest a near-hysterical squeamishness about tight labor markets. The Fed is promising rate hikes, they will not allow inflation to get close to a 2% red-hot ceiling on the PCE.

I contend the Fed is suffocating economic growth to obtain but small reductions in inflation, and they will tighten the noose next year (indeed they have already promised). The Fed can also shrink the balance sheet.

So…more of the same in 2018.

I hope for boom times in 2018, and fat returns for everyone reading this. I suspect another so-so, good year. But every investment is pricey!

Warning note: Employment growth in California is flat-lining. Might be a glitch, might reflect housing costs. Keep an eye on.

Thanks Scott for adding money velocity part.So far capital has been investing in labour, when the pool has shrinked it is time to start capex part of the cycle. But the business will probably target intangible assets (services enhacements) rather than fixed assets (roads, bridges) as the red tape is huge (it takes 10 years to obtain all permissions for private capital to conclude a big size PPP project).

The other side of the case illustrated by picture #12 is increasing ETF issuance (last post on dr.E.Yardeni blog)

Adam: indeed, it is now pretty clear that the demand for money is declining, and that is what is boosting the economy and the stock market. People are putting cash to work (e.g., buying stocks) instead of stashing it in the bank.

Gee, I though everyone was going from cash to bitcoins....

Well Scott, as of 12/16 looks like tax bill a fait acompli which then puts your prognostications in play. 2018 will be fascinating especially re bond market. Given recent quiescence it's hard to see rates spiking. Bond traders MUST see tax bill as a done deal. I stick by my observation that bonds (and for that matter all assets) are more driven by supply/demand which is skewed heavily in favor of demand. Theoretically the 10 year note should NOT be trading at 2.36% given imminent tax bill passage.

Re the imminent tax bill. It's important to remember what I said in my post last week (Tax reform is priced in, but not a stronger economy). By now it's virtually certain that the market has priced in a lower tax rate on business income. A lower rate will increase after-tax future profits, thus boosting the present, discounted value of those future profits, resulting in higher prices for stocks today. That's a one-time thing.

But I seriously doubt whether the market has priced in a strong economy as a result of the tax reform bill passing. That is the only rational explanation for why real yields on TIPS remain very low, and why 10-yr Treasury yields also remain unusually low. The market realizes that future profits have suddenly become more valuable, but the market does not at this point believe the economy's future growth trajectory will be significantly stronger than 2 -2.5% per year.

When the market—and the Fed—realize that stronger growth is becoming a reality, then real yields should definitely move higher, and that will result in higher nominal yields as well.

"But I seriously doubt whether the market has priced in a strong economy as a result of the tax reform bill passing." --SG

I hope Scott Grannis is right about this, as I like prosperity. Good! I want full-tilt boogie boom times in Fat City.

The Fed does not.

Indeed, curiously enough, some of the Fed's forecasts seem to assume a recession---the Fed is on record (for two years running) as being in hysterics over "low" unemployment rates. They want to shove unemployment rates higher. The Fed still embraces NAIRU, or non-accelerating inflation rate of unemployment, which up towards 5% somewhere.

The NAIRU concept is a gem: Under NAIRU, not only does low unemployment lead to higher rates of inflation, it leads to accelerating rates of inflation. That's a great bogeyman! Beat down unemployment on the road to the Weimar Republic.

https://www.bloomberg.com/view/articles/2017-12-15/recession-lurks-in-fed-s-bullish-new-jobs-forecasts

Perhaps the new Fed chief, being a GOP'er, and knowing the GOP runs the show now, will find a way not to cause a recession. I hope so,

Scott,

I am writing you to obtain written permission to use chart Real 10 Yr Treasury Yields in our newsletter.

Jessica

Jessica: you have my permission.

Post a Comment