I've had a number of posts over the years that have looked at the value of the dollar vis a vis other currencies. One common thread in these posts has been a reference to each currency's Purchasing Power Parity (PPP), which in theory is the exchange rate which would make prices roughly comparable between two countries. Since the mid-1980s I've used the same methodology for estimating this value, and I've been continually impressed with how it's held up over time. Since I started this blog in late 2008, the dollar has been all over the map: plunging to its weakest level ever in 2011, then soaring over the subsequent five years to its late-2016 high. My PPP analysis says that today the dollar is pretty close to what could be called "fair value" against most of the major currencies, with the notable exception being the Australian dollar, which I estimate to be trading about 25% above my estimate of its PPP value vis a vis the dollar.

To calculate a currency's PPP value against the dollar, I first look for a period—a base year—when prices in that country were roughly comparable to prices in the US. I then adjust the value of the currency in the base year for the difference in inflation between that country and inflation in the US over time. If a country has lower inflation than the US, its PPP value will rise over time, and if a country has more inflation than the US, its PPP value will decline. I should add that I've had occasion to visit each country over the years, and have been able to validate my PPP estimate by subjectively comparing how prices for food, clothing, hotels, etc. compare to US prices (there's an element of judgment at work here, but I think most observers would agree that my estimate of PPP is not too far off—comments pro and con are welcome). As you can see in the charts below, a currency rarely trades at or near its PPP. Instead, most currencies tend to cycle up and down relative to their PPP value, becoming alternately strong and then weak. One important caveat: although divergences between a country's PPP rate and its actual exchange rate tend to close and even reverse over time, PPP should not be used to bet on a currency's future strength or weakness, since it can take years for conditions to change. This is not a trading tool, it's a way to judge how strong or weak a currency is at any one time.

I begin with the Fed's calculation of the dollar's inflation-adjusted value vis a vis a trade-weighted basket of currencies. This is arguably the single best measure of the dollar's overall strength or weakness. The blue line measures the dollar against a basket of more than 100 currencies, while the purple line compares it to a basket of about a dozen currencies. Against a broad basket of currencies the dollar is today is roughly equal to its average since 1973. Relative to the largest currencies, the dollar is about 5-10% above its long-term average. Call it a Goldilocks dollar: neither too strong nor too weak.

The chart above shows how the Euro has tracked its PPP over time. The Euro began in 1997, but I extended its value back in time using the DM as a proxy. Note that the Euro's PPP has trended upwards against the dollar over many decades, a reflection of the fact that Europe has had less inflation than the US. Today the Euro is trading at almost exactly my estimate for its PPP. US visitors to Europe should find that prices there are pretty similar to prices here. Similarly, European visitors to the US should not be surprised to find things cost about the same here as in Europe.

As the first chart above shows, Japan has had a lot less inflation than the US since the late 1970s, and the yen has been very strong throughout most of that period. Some would say the Bank of Japan has been too tight, keeping inflation too low and the yen to strong, and that in turn has curtailed economic growth by making Japanese exports expensive, among other things. In any event, the yen is no longer too strong. As the second chart shows, the yen may now be at a level that is allowing the economy to pick up. Note that the stock market has surged in the past year or so, even as the yen has strengthened a bit.

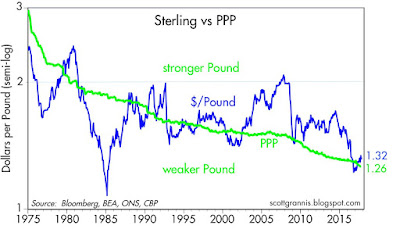

As the chart above shows, the UK has experienced a lot more inflation than the US in the past several decades; as a result the Pound has been in a long-term, declining trend vis a vis the dollar. Currently the Pound is trading very close to my estimate of PPP. Traveling to the UK in the mid-2000s, as I did frequently, was a painful experience since prices were very expensive. Today it's a much nicer experience.

As the first chart above shows, Canada's inflation has been very similar to US inflation for the past 30 years. However, the Canadian dollar has been all over the map—very weak in the early 2000s, and extremely strong in the late 2000s. The strength or weakness of the Canadian dollar has tended to be the mirror opposite of the dollar's strength or weakness, and both have been highly correlated—until recently—with commodity prices, as the second chart above shows. (Canada positively correlated, the US dollar negatively correlated)

Finally, we come to the Australian dollar, which by my calculations is trading about 25% above its PPP value vis a vis the dollar. Australia continues to benefit from strong commodity prices and from strong demand from China. But the loonie is no longer egregiously strong, as it was some 5 years ago.

At current levels, exchange rates paint a picture of a global economy that is rough equilibrium. No country, with the possible exception of Australia and a few others—is judged by the market to be inherently more attractive than others, on a risk-adjusted basis, and thus worthy of a relatively strong currency. Currency risk has ebbed, as a result, and this may contribute to a continuation of global growth (less risk tends to favor investment, which in turn is the engine of growth). Altogether, not a bad state of affairs.

Thursday, October 19, 2017

Subscribe to:

Post Comments (Atom)

2 comments:

Very interesting post. I like your measures of US dollar value.

Yes, the Bank of Japan was way too tight for way too long. One of the strangest episodes in central bank history.

There is a view that central banks are statist-inflationist institutions. A think tank I usually like, Cato, reiterates this view constantly.

But in fact, central banks in recent decades have run the opposite direction---overly tight.

Somehow this issue, perhaps like every issue in America, becomes politicized, and there are PC-right and PC-left versions of the correct thing for a central bank to do.

I don't mind some inflation as long as there is robust economic growth. I would err on the side of growth, in current circumstances. Just saying this is heresy in some circles. Let the good times roll.

I am also curious about quantitative easing, The Bank of Japan has bought back 45% of JGBs. People say Japan's national debt is huge. But then, they have effectively monetized half of it. The interest payments flow back into the national government.

Interesting times.

Thank you! You are doing yeoman's work for us mere mortals!

Post a Comment