The December CPI reading showed prices up 2.1% over the past year—the highest reading since oil prices started to plunge beginning in mid-2014. Abstracting from oil, as the chart above shows, the CPI has been running very close to 2% per year on average for the past 14 years.

What happened with oil and the CPI in the past few years was remarkably similar to what happened in the mid- to late 1980s, when oil prices also collapsed and headline inflation followed suit. Once oil prices stopped declining, as they eventually did both times, then headline inflation jumped back up to where it was before the oil price shock, as the chart above shows. To the extent that the world has been worried about inflation being "too low" in recent years, it was a mistake. Inflation has been alive and well all along.

The chart above is remarkable, because it shows that there has been a very close relationship between nominal GDP and the M2 measure of money supply for many decades. This is why economists tend to prefer M2 above other measures of inflation: it's demonstrated a fairly predictable relationship to nominal GDP over long periods. But what is also apparent in the chart is the divergences of these two dissimilar variables over the past few decades. M2 "undershot" nominal GDP in the 1990s, and it "overshot" nominal GDP in the 2010s. Currently it looks like there is about $2 trillion of "extra" money sloshing around the U.S. economy. This is money that has for the most part been stockpiled in bank savings deposits which pay very little interest and which have more than doubled in the past 8 years (to almost $9 trillion currently).

As the chart above shows, M2 is now about 70% of nominal GDP, whereas for over three decades it tended to average about 57% of nominal GDP. The pronounced rise in the ratio of M2 to GDP is symptomatic of a general increase in the world's demand for dollar cash and cash equivalents. (M2 is comprised of currency, retail checking accounts, time deposits, retail money market funds, and bank savings deposits.) Not coincidentally, the dramatic rise in the demand for money has coincided with a pronounced increase in risk aversion, as I've been noting repeatedly over the years. But as I noted last week, small business optimism has improved rather dramatically of late, and consumer confidence is on the rise as well. And of course the stock market has hit new highs.

Optimism is making a comeback, and that in turn suggests that the world's demand for money is not going to continue to rise, and is more likely to begin to fall. If the demand for money does begin to fall, then the rate of M2 growth is likely to slow and/or the rate of nominal GDP growth is likely to pick up. Faster nominal GDP growth would likely include some pickup in both real growth and inflation. With inflation already running at 2% or so, any inflation pickup could—over the next year or so—begin to flash warnings signs that the Fed is falling behind the inflation curve.

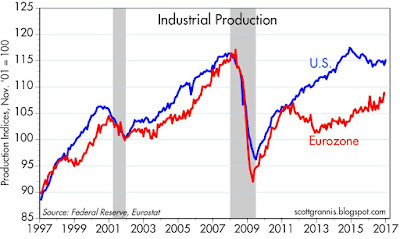

In the meantime, it's worthwhile noting that U.S. industrial production has picked up a tad over the past year, likely due to the consolidation of the oil market, and that Eurozone industrial production growth is outpacing that of the U.S. We are very likely in the midst of a coordinated increase in economic activity worldwide, even though it is still in its infancy.

Industrial commodity prices have risen more than 25% in the past year, providing decent confirmation that economic activity is indeed picking up.

As the chart above shows, it's rather unusual for commodity prices to be picking up by so much at a time when the dollar has been unusually strong. Usually commodity prices and the dollar move in opposite directions (note that the chart uses the inverse of the dollar index). One explanation for the fact that commodity prices and the dollar are moving up together is that the world has been surprised at how resilient economic activity in both the U.S. and the world economy has been (recall that everyone has been very pessimistic for years). Markets move when things turn out to be different than expected. Demand for dollars (as distinct from demand for dollar cash, I should note) has been strong because the U.S. economy and its prospects look better today than people thought they would. Commodity prices are up because producers underestimated global demand for commodities.

Circling back to measures of confidence, the chart above shows that corporate credit spreads are nearing historically low levels. This suggests that the economic outlook is improving, corporate balance sheets are healthy, and the market's appetite for risk has improved.

Confidence is clearly up, and economic activity is likely firming. The next shoe to drop should be a decline in the demand for money. That in turn should show up in the form of stronger real growth as well as a pickup in inflation. Assuming all that happens, the Fed will need to respond with higher-than-expected interest rates, and today Janet Yellen hinted as much, although only gently.

6 comments:

Superb outlook by Scott Grannis.

Quibble: the Fed says it targets an average 2% on the PCE index. That index runs about 30 to 40 basis points below the CPI. The Fed has been below its target, which is supposed to be an average and not a ceiling, for years.

For decades U.S. economists have predicted higher inflation and interest rates in the years ahead, but instead we have seen a secular decline. Maybe this time is different.

What inflation that does exist is often connected to property zoning. I see no solution pending on that front.

If the Fed goes through with three rate hikes we may see recession. They may reconsider.

Trump's federal budget and regulations? Who knows!

Superb outlook by Scott Grannis.

Quibble: the Fed says it targets an average 2% on the PCE index. That index runs about 30 to 40 basis points below the CPI. The Fed has been below its target, which is supposed to be an average and not a ceiling, for years.

For decades U.S. economists have predicted higher inflation and interest rates in the years ahead, but instead we have seen a secular decline. Maybe this time is different.

What inflation that does exist is often connected to property zoning. I see no solution pending on that front.

If the Fed goes through with three rate hikes we may see recession. They may reconsider.

Trump's federal budget and regulations? Who knows!

Heading to DC for Inauguration tomorrow!!

See you all there!!

Epic epic event!

MAKE AMERICA GREAT AGAIN!!!

JBD: looking forward to your impressions of the event.

Making America great again. Not. Otherwise known as populism accomplishing the opposite of what it intended.

"Trump Threats Could Inadvertently Encourage More Mexican Auto Investments"

http://www.cnbc.com/2017/01/19/trump-threats-could-inadvertently-encourage-more-mexican-auto-investments.html

Without aiming to intrude in Us politics, which is none of my business, Donald Trump is watched in a scary way in this part of Europe.

From my perspective, building walls and breaking commercial Treaties is a way to make America poorer, no matter how. Far away of making it great again.

Lowering taxes is a way of making americans richer, if and only only if you lower public expenditure at the same time. You need to be very careful which items you choose from the public expenditure to reduce, in order to maintain your electorate.

Otherwise, public deficit might boost and Economy could drop in recession again.

Just my thoughts

Post a Comment