As the economy celebrates six years of recovery, we should all celebrate the massive decline in the federal deficit. It's good news for the future, because the expected future burden of taxation has declined significantly, and because we've now proved that Keynesian economic theory doesn't work—the deficit collapsed but the economy didn't. The magical solution was growth, not government spending, and that should help steer the course of future fiscal policy in a more growth-friendly direction: less reliance on government stimulus and more reliance on increasing the after-tax rewards to work and risk-taking.

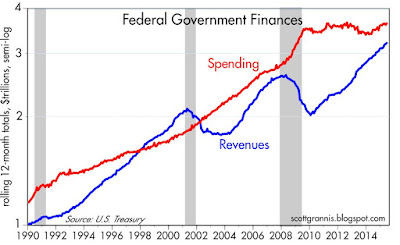

The recovery is now six years old. During that time, 12-mo. federal revenues have increased 47% (from $2.18 to $3.21 trillion) and federal spending has increased only 6% (from $3.43 to $3.64 trillion).

With spending held relatively steady while the economy grew, spending relative to GDP has declined from a high of 24.4% of GDP to 20.3%. That's only about 1 percentage point above its post-war average of 20.3%. Meanwhile, revenue growth has far outpaced overall economic growth (as it usually does during recoveries), with the result that revenue relative to GDP has risen from a low of 14.2% of GDP to 18.1%. That's a little less than 1 percentage point above its post-war average.

The happy result of all this is a sharply lower federal deficit. In the past 12 months, the federal deficit was $431 billion, only 2.2% of GDP. The decline in the deficit from a high of 10.2% to today's 2.2% is unprecedented in post-war history. If any Keynesian economist at the end of 2009 been asked to predict what would happen to the economy if the deficit were to fall by 8 percentage points over the next 5 ½ years, he or she would have predicted disastrous growth, and most likely another recession.

There's a huge lesson here: just as the biggest jump in the deficit in the modern era—fueled by emergency spending—failed to stimulate the economy, the huge decline in the deficit failed to crush the economy. The economy has been growing at 2-2.5% on average per year for the past six years, despite massive swings in the deficit. Keynesian theory thus been totally discredited. There is no reason to raise tax rates, and there is no reason to try to "stimulate" the economy by increased federal spending. The private sector, left to its own devices and given greater breathing room as the result of a shrinking public sector, is perfectly capable of generating jobs and delivering higher living standards for everyone in the coming years.

13 comments:

HI, Scott -

The decline in the US annual budget deficit is very impressive and, as you alluded to, is no doubt largely due to the business cycle and counter cyclical spending by the government creating added debt. The current data and recently quite low US budget deficit of 2.2% is occurring near a economic cyclical peak - per usual. That is how economic cycles go. Most things economic look much rosier near cyclical peaks and much darker near troughs.

What about total debt figures I found from various sources?

"PUBLIC debt in rich countries exploded between 2007 and 2012, rising from an average of 53% of GDP to nearly 80%."

"Today, July 13, 2015 total US government debt is about $18,602,931,901,000." US GDP is about 17.768 Trillion. Therefore, US federal debt is over 100% of GDP.

"As of June 30, 2015 total private and public debt is nearly $60 trillion."

"Domestic nonfinancial debt outstanding was $41.7 trillion at the end of the first quarter of 2015, of which household debt was $13.6 trillion, nonfinancial business debt was $12.2 trillion, and total government debt was $16.0 trillion."

I can't vouch for these figures. My point is that, as we near an economic cycle peak, today's total debt numbers compared with pre-crisis levels (2007) are dramatically higher. These data portends more severe financial problems for the indebted US government, states, private individuals and corporations during the next business cycle downturn.

William- much of the federal debt is owned in house, that is by other federal agencies such as Social Security.

The United States also has a curious ability to pay down debt through QE, evidently without inflationary results.

Private sector debt does present concerns.

I do think the US tax code should reward equity and dividends and not debt and interest payments.

But try cutting the home mortgage tax interest deduction!

I would like to see federal agency spending cut 20% across the board, and perhaps 50% at "national security" agencies.

A much smaller federal government is an ideal.

I think William's points are spot on. After nearly a decade of ZIRP, our economy is mustering 2.5% growth, with the continuing "threat" from the Fed of "lift off" and deficit spending continues.

Almost a balanced budget is not a balanced budget. The truth is we continue to spend more than we make. Our Government has grown to an insane size and I do not see that trend changing. After six years of "recovery" I would hope that the Federal budget be balanced, and we would have 3-4% growth, ESPECIALLY with interest rates at zero.

I can only suggest that the Federal Reserve system, like Keynesian economics, is broken.

Balance the budget why bother, according to Benjamin, our debt doesn't matter because it is "owned in house" and QE has no inflationary consequences.

one more side note... It is a scary world when the US Dollar is the worlds safe haven. What a sham, the Fed Governors are the best salespeople in the history of the world! $18+ trillion and growing

Keynes has been discredited numerous times, but refuses to die. Keynes gives the bureaucrats the power to rearrange the lives of the serfs. Don't expect that to go away soon.

John---

Well....what were the inflationary consequences of QE?

I would love to see another surplus and would celebrate a reduction in our public level of debt, and, along with Benjamin, a much smaller federal government. I doubt government will shrink much, if any, but we can curtail the spending if we get entitlements under control.

As Scott has argued so often, spending is a problem but the bigger issue here is the lack of growth. 4% growth would be fabulous. The last time we saw it was in 2000and it has not happened often. I do believe the long-term trend is around 3.1%. If we could just get there and sustain it and hold spending, we could get to that surplus. I do expect to see it within the next 10 years, especially if Congress tackles entitlements.

Scott, your posts are excellent. And I always look forward to reading Benjamin's comments.

The inflationary consequences of QE are not yet realized. It seems there is a fairly high probability the Fed overshoots during the next recession and cuts the IOER below the FFR essentially forcing out excess reserves. This would increase M2V and ultimately inflation. Seems to be a higher probability of this happening from a policy standpoint than the market is currently factoring in.

https://research.stlouisfed.org/fred2/series/M2V

https://research.stlouisfed.org/fred2/series/EXCSRESNS

Also, QE can be good, but too much of a good thing can be bad. Too much QE and it destroys confidence in the dollar. Ultimately, confidence is everything to fiat currency. Japan is an example that the show can continue on for quite a long time and still maintain public confidence. But it's like pulling a trigger, the weapon doesn't fire until you hear the click and by the time you hear the click it is too late to stop it from firing. Confidence is there until one day it isn't.

Hi Scott. I enjoy your blog very much. Did you overlap with Lou Simpson at Western? If so, that is some serious investment royalty to be keeping as company.

rob w: I worked for Western from 1989 through the end of 2007, so there was some overlap with Lou Simpson, but I knew him only tangentially.

Social security debt is worse than the external debt. External debt can be rolled over which doesn't increase the debt load but social security debt requires new external debt (because they will not raise taxes to pay it when due).

Re: Social Security debt. The unfunded liabilities of Social Security are not a legal obligation of the U.S. government. I agree that raising social security taxes to fix this is highly unlikely. But adjusting the indexation formula, raising the retirement age, and means-testing benefits wouldn't be so difficult and could solve the problem. In fact, I'd say that the federal government is highly likely to resort to one or all of these measures before too long.

Social Security has major political implications attached to it. For this reason I think eliminating or raising the cap on SS wages while means testing the benefits is the most politically acceptable "fix". This way less than 10% of the population is actually effected by the changes.

Thanks to the "Party of No" ...particularly the Tea Party element, for putting their foot down and refusing to increase spending. The Tea Party getting into the House of Representatives caused the first government annual spending decrease since WW2 back in 2013. Just think of that...even when PUBs controlled the whole Congress from 1994-2007, they never achieved that. The maligned Tea Party was sent to DC to put their foot down, and refused to budge, amidst massive criticism from the administion and its media machine, and even from some fellow establishment PUBs. And notice how oil plummeted as PUBs took over Congress this Fall? That election limited the anti-drilling bias of the administration, too. Limited spending and increased energy production have saved us this cycle. Keynes failed once again.

We The People packed the House of Representatives with an immediate remedy. Turns out Jefferson and Madison were smarter than the Central Planning nannies. It's just too hard to rig voting in 435 House Districts (so far). The House is still the remedy of the People, and the People rose up. They didn't listen to the media propaganda. Our system is messy as always, but still works. We just proved it. That's the best news for our future.

As an aside...It's not so hard to rig a few well-researched important precincts in a few key swing states to control the Presidential vote. Barack is the first President in U.S. History to ever win a second term with less votes than He got His first term. If she gets access to His database and His Precinct Team, get ready for 8 years of Hillary, and 8 more years of anti-profit rhetoric, and 8 more years of risk aversion. Jeb won't be very different, policy-wise, but his rhetoric won't be as discouraging to capital. But give me a PUB Congress, and I don't really care who the President is.

Post a Comment