As a postscript to my post earlier this weekend (Healthy households), I offer updated versions of the following charts that illustrate the dramatic improvement in consumer finances since the Great Recession:

The 2008 financial crisis and deep recession taught consumers that having a lot of credit card debt was not a smart thing to do. Credit card debt outstanding now is about the same as it was 12 years ago, despite the fact that personal incomes have increased over 60% since 2003. As a percent of personal income, credit card debt was 7.4% in 2003, and it fell continuously to a low of 4.5% today.

By eschewing credit card debt, consumers have become much less likely to be delinquent on their credit card debt payments. Delinquency rates are as low as they have ever been since data was first collected in 1991.

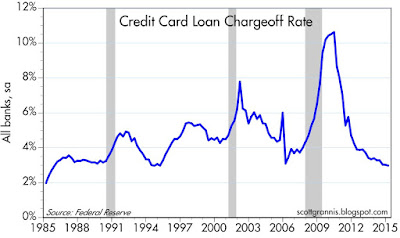

With lower delinquency rates, it is not surprising that credit card companies wrote off only 3% of their outstanding loan balances in the first quarter of this year. That was the lowest chargeoff rate since 1985.

Today's consumer is a lot smarter, and a lot more careful with taking on debt. This reinforces the theme that I've been emphasizing for years: the Great Recession was so traumatic that its memory still lingers, making this the most risk-averse recovery in modern history. Risk aversion has been one of the hallmarks of this recovery, and that is one of the reasons why the recovery has been so tepid. It is also a good reason not to fear another recession: optimism is in short supply. The time to be worried is when everyone is optimistic and taking on lots of risk.

Friday, June 26, 2015

Subscribe to:

Post Comments (Atom)

14 comments:

Not sure if Federal Reserve G19 has started to track the installment / personal loans (3, 5 years) originated by the "P2P Marketplace" lenders like LendingClub and Prosper. While credit card (revolving) debt has not resumed 10%+ CAGR type growth as seen in past cycles, P2P marketplace loans have grown very quickly. There are even exchanges created to trade these loans after origination, and a new closed end fund is being launched to buy these loans. Private equity funds are even buying P2P loans and creating derivative product (e.g., 4:1 leverage). Even Goldman Sachs wants to play in consumer lending originations as an alternative lender.

Other types of alternative marketplace lenders are also growing exponentially, including small business (e.g., Ondeck, Kabbage, Funding Circle), student loan refi (e.g., SoFi), subprime auto (e.g., 7-year loans to FICO < 600), payday loans rebranded as "responsible lending" installment loans to re-buid credit, and even medical loans left behind by GE Capital.

So, not sure if consumers are starting from such a low leveraged financial position if all of these "off balance sheet" loans are tracked and calculated into debt service burden of the main borrowers (bottom 90% of US households).

Do you have access to numbers for all these alternative loans? I'd be surprised if they were more than a relatively small fraction of credit card debt outstanding (currently just under $700 billion).

A quick search tells me that LendingClub has originated a total of just over $9 billion in loans, Prosper claims $3 billion, and SoFi claims $3 billion. No question they have grown at a very fast rate, but they are still only 2% of credit card debt outstanding. If I had to guess, I'd say these alternative loan programs at best total only $30 billion. If that's true, then the thrust of my post remains intact.

Anyway, thanks for bringing this to my attention!

In your other post, WimpyInvestor (rightly I think) questioned if using aggregate debt / income numbers gave meaningful insight to the bottom 90%. Using credit card debt may be a better measure of financial health of bottom 90%. Presumably the top 10% would not carry a lot of credit card debt before or after 2008 anyway?

Interesting question: if investors are truly risk-averse, then why are PE's a little bit above historical norms?

And what explains all-time record house prices in Orange County?

Scott,

Some resources for you to consider, in case you want to start tracking the alternative lending space.

http://www.orchardplatform.com/blog/2014520orchard-lendscape-online-lending-ecosystem/

http://www.lendit.co/assets/presentations/Peter-Renton-Lend-Academy-LendIt-2014.pdf

VC funding in FinTech has accelerated and former high profile bankers are now angel investors / advisors for FinTech start-ups (e.g., Vikram Pandit, Hans Morris, Larry Summers, Mohammad El-Erian, Joe Saunders, Nigel Morris, to name a few). Jamie Dimon made comment recently about Silicon Valley disrupting Wall Street / traditional banking. Large banks are now partnering with start-ups and acquiring them (e.g., BBVA and Capital One buying Mobile PFM start-ups).

Millennials seem more comfortable borrowing from online / alternative installment lenders than traditional revolving credit cards. Perhaps they have learned from their parents about the risks of revolving balances ("avoid plastics"). But, 4-5 installment loans for different purposes (e.g., Lending Club for credit card consolidation, Bill Me Later for new iMac, SoFi for student loan refi, Prosper for moving expenses, and FinanceIt for new car) results in same debt troubles in the future.

Thanks for the great blog! You are like the Econ 101 professor that I never had!

Benjamin - PE ratios are slightly above historical norms but the numbers are also lower due to corporate buyback activity during the recovery.

"For the fifth consecutive quarter, over 20% of the S&P 500 issues reduced their year-over-year diluted share count by at least 4%, therefore boosting their EPS by at least 4%." Please see http://us.spindices.com/documents/index-news-and-announcements/20150625-buybacks-pr.pdf?force_download=true

So PE ratios have been altered by low interest rates allowing for high corporate buyback activity, thus altering EPS. Higher EPS alters the denominator in the PE equation therefore making PE ratios appear lower. Low interest rates flow over into other analysis too.

Definitely sensing a change in the individual sentiment from pessimism to optimism in equities. Typically means we are on the back half of the growth cycle and should see individuals getting back into the market while corporate activity slows down. Seeing a lot of individual sentiment shifting as the general public consensus has changed to bonds are going down in price as yields go up. I'm typically not convinced when everybody begins thinking something is a sure bet.

Re: PE ratios. I think the question is different: Why aren't PE ratios higher, given the reality of very low interest rates and historically high profit margins and earnings? (Per the NIPA accounts, corporate profits after tax are at all-time record high levels relative to GDP.) Answer: because the investing public is reluctant to believe that the high level of profits will continue. In this context, it would appear that risk aversion is still a factor in the asset markets, though of course much less now than just a few years ago.

randy: excellent point ("Using credit card debt may be a better measure of financial health of bottom 90%"). It's almost certain that the top 10% of income earners carry zero balances on their credit cards.

Thinking Hard and Scotf: good answers...

But I think we are seeing plenty of risk taking in real estate, both commercial and residential.

It is also true we are seeing a Mount Everest of corporate profits by any measure relative or absolute.

Corporate America has never had it so good. Deservedly!

These guys are making profits...and campaign contributions....

ManTech Awarded Contracts to Provide Knowledge-Based and Equipment-Related Services to the U.S. Army TACOM Life Cycle Management Command

2015-06-26 08:00 ET - News Release

FAIRFAX, Va., June 26, 2015 (GLOBE NEWSWIRE) -- The U.S. Army Contracting Command has awarded ManTech International Corporation (Nasdaq:MANT) the Knowledge-Based Services (KBS) and Equipment-Related Services (ERS) components of the TACOM Strategic Solution Services (TS3) family of contracts. Both multiple-award, indefinite-delivery, indefinite-quantity contracts have 5-year periods of performance. The ceiling value of the KBS contract suite is $1.8 billion, and the ceiling for the ERS suite is $1.1 billion.

The TS3 family of contracts supports the U.S. Army TACOM Life Cycle Management Command and its subordinate and supported organizations, including program executive offices; depots; arsenals; the System of Systems Engineering and Integration Directorate; the U.S. Army Tank-Automotive Research, Development, and Engineering Center; the Integrated Logistics Support Center; and the Program Manager Light Armored Vehicles.

Under the KBS contract suite, ManTech will compete for task orders to provide engineering and technical services, logistics management services, management support services, and other professional services. Under the ERS contract suite, ManTech will compete for task orders to provide machine, system, and vehicle installation; maintenance; modification; overhaul; and repair.

"TACOM is not only one of the Army’s largest R&D organizations, but it also plays a critical role in ensuring the readiness of our ground combat forces," said Daniel J. Keefe, president and chief operating officer of ManTech's Mission Solutions & Services Group. “ManTech has long-supported TACOM, both at home and in the field, and we are pleased to continue this support through the TS3 family of contracts.”

About ManTech International Corporation

ManTech is a leading provider of innovative technologies and solutions for mission-critical national security programs for the intelligence community; the Departments of Defense, State, Homeland Security, Energy, Veterans Affairs, and Justice, including the Federal Bureau of Investigation; the health and space communities; and other U.S. federal government customers. We provide support to critical national security programs for approximately 50 federal agencies through approximately 1,100 current contracts. ManTech's expertise includes cyber security; command, control, communications, computers, intelligence, surveillance, and reconnaissance (C4ISR) solutions and services; information technology (IT) modernization and sustainment; intelligence/counter-intelligence solutions and support; systems engineering; healthcare analytics and IT; global logistics support; test and evaluation; and environmental, range, and sustainability services. ManTech supports major national missions, such as military readiness and wellness, terrorist threat detection, information security and border protection.

Benjamin - I'm not sure if you have seen or read anything from Lawrence Lessig, but you would likely appreciate his take on campaign contributions.

http://www.ted.com/talks/lawrence_lessig_we_the_people_and_the_republic_we_must_reclaim?language=en

Also, if you are interested in this subject I recommend "Republic, Lost: How Money Corrupts Congress--and a Plan to Stop It" by Lawrence Lessig.

Housing is an interesting sector to look at. Scott had a good article last month “Housing market still improving” please see http://scottgrannis.blogspot.com/2015/05/housing-market-still-improving.html

When I look at housing I look at median multiples. This is the median housing price divided by median household income. Here is a good paper on international median multiples, http://www.demographia.com/dhi.pdf

The U.S. is currently at a median multiple of 3.4. This is skewed by a few markets, notably major city markets in California (San Francisco, San Jose, San Diego, and Los Angeles) coupled with New York, Miami, Boston, and Washington. Anything above 3 on the median multiple scale is deemed unaffordable.

Real median household income is down from $56,436 in 2007 to $51,939 through 2013. This is about 8% below the level seen in 2007. Please see http://research.stlouisfed.org/fred2/series/MEHOINUSA672N

In nominal terms median household income is $51,989 through 2013, slightly above the $50,203 level seen in 2008. Please see http://research.stlouisfed.org/fred2/series/MEHOINUSA646N

We are seeing real wage increases start to pick up speed which will alter the median multiple analysis. Without much in the way of real wage increases the median housing multiple will continue to float above historical norms. The multiple should be closer to 2, but between 2 and 3 would be a good target zone. Right now, median multiples show the housing market is overvalued in most major metro areas.

Homeownership is also declining to levels last seen in the early 1980s. We are now at approx 63.7% homeownership rate compared to nearly 70% in 2004. Please see http://research.stlouisfed.org/fred2/series/RHORUSQ156N

The marginal individual buyer is largely being excluded from the housing market recovery. Institutional and cash only buyers have really assisted in the recovery of home prices, but will this continue with major markets experiencing double digit price appreciation on YoY basis and now flashing the unaffordable indicator? Interest rates will likely also come into play over the next year. The WSJ did a good write up on how interest rates affect affordability last week. Please see http://www.wsj.com/articles/rising-mortgage-rates-to-test-housing-markets-strength-1434913633

The housing market is pointing to signs of “the divide” mentioned in previous posts between the top 10% and the bottom 90%. I still don’t think we are near the top, because the individual should start to reenter with lower down payment and easier financing requirements. I expect Fannie, Freddie, and the FHA to lower their mortgage insurance requirements that have hurt the marginal buyer. The FHA especially will need to rid buyers of mortgage insurance requirements over the course of the loan regardless of any equity ratio. Sources say the housing market is short on supply in many areas right now, and we are seeing bidding wars commence much like we had before the last downturn. Time on market is also coming down, showing the market is shifting in more of a seller's market than anytime during the recovery.

Thinking Hard---

I will look at the link....but regrettably, I know what it will say---that our two parties are hopelessly corrupted.

From poverty program to the GWOT, what starts as a cause becomes a movement, becomes politics, becomes business, becomes a racket...

Post a Comment