Tuesday, July 29, 2014

Confidence rises to its long-term average

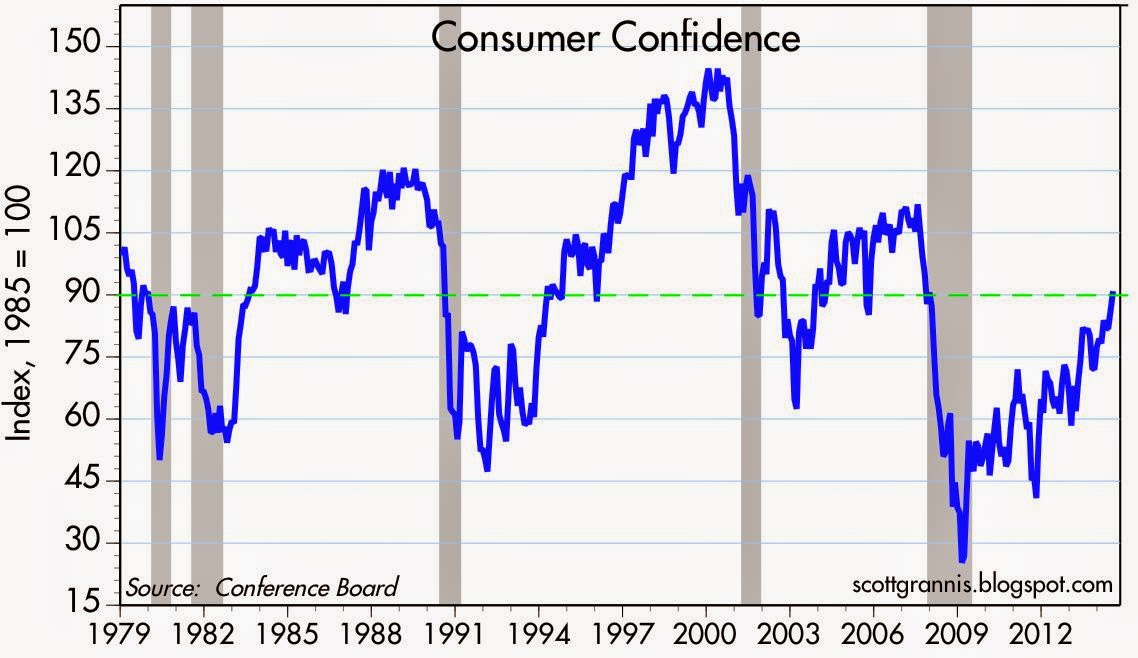

The Conference Board's July survey of consumer confidence came in much stronger than expected (90.9 vs. 85.4), and marked a new post-recession high, as seen in the graph above. I note that the July value of this index is now equal to its average since 1970. The current business cycle set the all-time low-water mark for confidence in February, 2009; from the depths of depression and fear we have now recovered to something akin to "normal." It's taken over five years to get back to normal, but at least things continue to improve.

From this it follows that we are no longer in a risk-averse recovery. As confidence returns, risk aversion is declining. We see evidence of this in gold trading at $1300, down significantly from its all-time high of $1900 three years ago. We also see it in real yields on TIPS now at -0.36%, up significantly from their all-time low of -1.77% 16 months ago. And in the S&P 500's PE ratio, which has risen to 18.1, somewhat above its long-term average of 16.6, and up significantly from its low of 12.2 in September, 2011.

Is the equity market in a bubble? Doesn't look like it to me. We'd need to see a lot more confidence, much higher PE ratios, and much higher interest rates.

Subscribe to:

Post Comments (Atom)

9 comments:

Do you happen to know what the real employed and unemployed numbers look like currently? and the number of bodies that are simply not seeking jobs in this current environment? Thanks

RE: Household Net Worth Up

A third of consumers with credit files had debts in collections last year

"About 77 million Americans have a debt in collections, a new report finds. That amounts to 35 percent of consumers with credit files or data reported to a major credit bureau, according to the study released Tuesday by the Urban Institute and Encore Capital Group's Consumer Credit Research Institute. "It’s a stunning number," said Caroline Ratcliffe, senior fellow at the Urban Institute and author of the report. "And it threads through nearly all communities."

http://www.washingtonpost.com/blogs/wonkblog/wp/2014/07/29/a-third-of-consumers-had-debts-in-collections-last-year/

Lower gold prices stem from higher dollar prices over the intermediate and longer term. Also on expectations of future confidence in the dollar. This goes for oil too.

Since we know there is no money sitting on the side lines, the lack excitement in the stock market is due to no reason to sell. That may seem counter intuitive but with such high correlation of everything low volatility ensues. The market gets exciting when people sell to buy something else. Right now, there is zero reason to sell except for few special situations.

This morning, right after Zero Hedge posted a story of the great risk from EMP (electro magnetic pluse) the market took a dive which lasted 14 minutes. Traders are desperate. I am so bored. And I haven't make such little money in my adult life.

Risk aversion doesn't seem to be the problem for the stock market. Lack of any real risk is the problem.

Stable monetary policy brings boring equity markets. And monetary policy has been stable, as evidenced by the (relatively) stable gold price, for over 12 months. I know, I know, I don't think it'll last either. But it's tough to argue with the recent past.

Glacial recovery...business class does not like Obama and an ossified Fed is asphyxiating the economy...many local governments are essentially anti-growth, see Newport Beach...

My worry: the USA has created gigantic "disability" class of 12 million SSDI and VA recepients who have less incentive to work again...ever. This dwarfs the unemployment insurance population...

As Scott Grannis anticipated:

"WASHINGTON (MarketWatch) - Inflation as measured by the Federal Reserve's preferred price index surged in the second quarter to the highest annual rate in three years, potentially making the central's bank effort at managing the U.S. recovery more difficult. The PCE index rose at a 2.3% annual rate in the April-to-June period, compared to 1.4% in the first quarter. That's the fastest pace since the second quarter of 2011. And the core PCE that excludes food and energy climbed at a 2% clip, up from 1.2%.

http://www.marketwatch.com/story/us-inflation-accelerates-sharply-in-second-quarter-2014-07-30?dist=beforebell

" Inflation as measured by the Federal Reserve's preferred price index surged..."

and yet bonds are having a muted reaction. the 10 yr is at 2.5%. people just aren't SELLING

"Surged" is probably a poor choice of words. Inflation has been running at about a 2% pace for some time now (filtering out the noise of quarterly fluctuations), and inflation expectations have been 2-2.5% for many years. So today's news was not a surprise at all.

GDP growth exceeded most expectations, however, and the market has now revised its expectation for the Fed's first tightening move, bringing it forward by a month or so, to May-June 2015.

U.S. 10 yr Treasury Note 7/30/14

Yield at 4 pm 2.558

Day change in yield +0.097

Pretty big move after all, up 97 basis points on the day.

Post a Comment