In my view, market-based data are better indicators of what is going on beneath the economy's surface than official statistics. Market-based data are usually available in real-time, and they are derived from the interactions of millions of participants from all over the world—the wisdom of crowds distilled into one number. They aren't seasonally adjusted, and they aren't subject to revisions after the fact. But they do require some interpretation, so here is a collection of 10 market-based indicators that I'm paying attention to, and why. On balance, I think they all reveal a gradual improvement in the economic and financial fundamentals, but the persistence of a general aversion to risk.

Gold and commodity prices tend to track each other over time, but gold is much more volatile (note that the range of the y-axis on the right is about twice the range of the same y-axis on the left). Gold tends to lead other commodity prices, being the most speculative of them all. Gold also is unique among commodities since all the gold ever mined throughout history is still held by someone somewhere, whereas most other commodities are either incorporated into other stuff, consumed, or deteriorate with time.

Gold is the classic refuge from inflation, geopolitical risk, and just plain uncertainty. It's a darling of speculators, perhaps because it's price can go up or down enormously and it's widely held. What the chart above tells me is that gold overshot the prices of commodities in the early years of the current recovery—in part due to concerns that the Fed's QE program would lead to hyperinflation—and is now in the process of realigning since inflation remains low and stable. Industrial commodities have been relatively stable for several years now, and gold looks to be in the process of coming back down to a level that is more consistent with the current level of industrial commodity prices. I note that over the past century, the real price of gold in today's dollars has averaged just under $600/oz.

The two charts above zoom in on the prices of gold and industrial commodities over the past 5 years. Gold looks like it's having a tough time maintaining its current lofty levels, while industrial commodity prices have been unusually stable for the past two years.

Gold prices have tracked the inverse of the real yield on 5-yr TIPS amazingly well over the past seven years. (Think of the inverse of real yields as the price of TIPS.) The world was willing to pay ever-higher prices for gold and TIPS through 2012 because—as I see it—the world was desperate for safe assets that also offered protection against inflation. Prices for both were bid up to extremely high levels (corresponding to strongly negative real yields on TIPS) which reflected deep-seated pessimism and very bearish expectations for the future. Instead of doom and gloom, we have since seen inflation remaining low and economic growth fundamentals in the U.S. improve on the margin. Both TIPS and gold are thus facing selling pressure. Still, at current levels both reflect a fairly strong demand for risk-free assets, and thus reflect a market that is still moderately risk-averse.

The two charts above track nominal and real yields on Treasuries, and the difference between the two which is the market's expected inflation rate. If anything stands out, it is that expected inflation hasn't changed much in the past 16 years. The market currently expects inflation over the next 5 and 10 years to average a little over 2%, and that is very close to what inflation has actually averaged over the past 5 and 10 years. This tells us that the market does not see believe that the Fed's QE policy will be inflationary. Should that change, and if expected inflation were to begin rising, that would be very significant, since it would presage a significant increase in interest rates and a more rapid than expected shift by the Fed to tighter monetary policy.

Real yields on TIPS should tend to track real growth expectations for the U.S. economy. Very strong real growth inevitably leads to strong real investment returns, and TIPS need to compete with that by offering higher real yields. For the most part this has been the case, as the chart above shows. Currently, however, there is a rather large gap between the two, which to me suggests that the market worries that U.S. growth will slip below 2% in the next few years. I take this to mean that the market is pessimistic and risk-averse. But if real yields continue to rise, that would be a clear sign of a return of optimism and/or a decline of pessimism. The higher real yields on TIPS go, the more optimistic the market is about the prospects for U.S. growth.

The Baltic Dry Index measures the cost of shipping bulk commodities in the Asia/Pacific region. It is a function of two major variables: the supply of shipping capacity and the demand for shipping capacity. Prices were depressed for most of the past several years because of a significant increase in shipping capacity. More recently they have rebounded rather strongly, presumably because economic activity is continuing to increase (e.g., Chinese demand for coal from Australia) while shipping capacity is relatively constrained. As such, this appears to be signaling a somewhat stronger global economy, which would in turn support a stronger U.S. and Eurozone outlook.

The chart above shows that there has been a very strong inverse correlation between the value of the yen and the Japanese stock market. The yen was extremely strong from 2007 through 2011, and the Japanese stock market lost over half its value. That tells me that the yen was so strong (and by inference, Japanese monetary policy was so tight) that it damaged the outlook for real growth by creating deep-seated deflationary expectations and disrupting Japan's ability to compete. Consumers could make money just by holding on to their cash, for example, rather than spending it. Japanese manufacturers faced extreme difficulties competing with overseas rivals due to the incredibly strong yen, which made Japanese goods uncompetitive.

The outlook for Japan has brightened considerably in the past year, however, since the Bank of Japan adopted an aggressive policy easing stance. This has allowed the yen to return to non-deflationary levels, and that in turn has allowed Japanese manufacturers to more effectively compete in the global marketplace, and convinced consumers to save less aggressively. If the yen were to strengthen again, that would be a bad sign for the stock market and the global growth outlook.

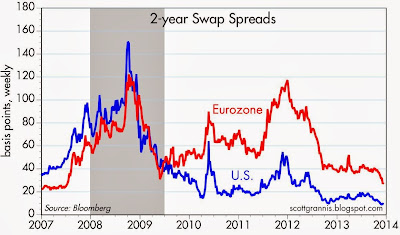

Swap spreads have been very good leading and coincident indicators of the health of financial markets and the economy. U.S. swap spreads have been exceptionally low for the past year or so, a reflection of abundant liquidity and extremely low systemic risks. Eurozone swap spreads have been substantially higher, in contrast, reflecting ongoing problems with sovereign default risk. However, the recent decline in Eurozone swap spreads stands out: this is the lowest they've been since pre-recession days. Fundamentals in the Eurozone are likely improving significantly on the margin, and that is good news for just about everyone.

Corporate credit spreads continue to decline, and that suggests that the outlook for the U.S. economy continues to improve. Spreads are still somewhat high relative to pre-recession periods, however, suggesting that the market is still somewhat cautious. The persistence of risk aversion in U.S. markets suggests that risk assets are not yet in a bubble.

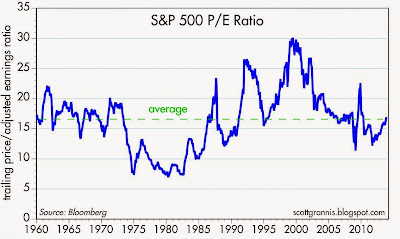

The PE ratio of the S&P 500 is only slightly higher than its long-term average, despite the fact that corporate profits are at all-time highs, both nominally and relative to GDP. This is another indicator that risk aversion persists and that equity valuations are still somewhat attractive.

As the chart above shows, Eurozone equities have significantly underperformed their U.S. counterparts in the past few years. The Eurozone economy has been in a recession for most of that period, so this is understandable. The Eurozone economies are now emerging from recession but are still plagued with sluggish growth. Nevertheless, the 12-month trailing PE ratio of the Euro Stoxx index is about the same as the PE ratio of the S&P 500 (both are just under 17), but the forward PE ratio of the Euro Stoxx index is 13, as compared to 15.4 for the S&P 500. This suggests that caution and risk aversion are somewhat more pronounced in the Eurozone, which makes sense given the problems that persist in many of the weaker Eurozone economies. On balance, I don't see that Eurozone stocks are more attractive than U.S. stocks, but there could come a time when the relative valuations of U.S. and Eurozone stocks reveal an attractive investment opportunity.

11 comments:

Scott with regard to a possible rise in inflation, I was wondering if you follow the Velocity of M2? From time to time you show how M2 has grown but I don't recall you mentioning its velocity which has continued to fall since the Great Recession began.

I recently read an article by James Paulsen Ph.D.of Wells Capital Management entitled: "Will 'Velocity' Change the Conversation?" He discusses how since WW II, M2 Velocity typically falls for a few years after the onset of a recession then eventually turns up again which soon afterward is followed by an inflation scare and a change in FED policy to tightening and a significant stock market correction.

Here is the .pdf file:

http://www.wellscap.com/docs/emp/20131111.pdf

It is probably premature to say this, but it looks like the decline in M2 velocity is slowing down. It's an important topic, though, and I think it deserves a separate post which I hope to do soon.

The Russell 2000 is currently sporting a PE of 84...

The returns since 1999 (15 years) is 92.48% through 11.27.13...

Six out of those 15 years, the index lost money..

I am sure what the average PE of the 2000 is, but this is certainly very elevated..

@ Hans: What is your source of the PE of 84 for the Russell 2000?

Other signs of unwarranted enthusiasm are apparent: a flurry of low-quality initial public offerings; stunningly robust valuations, with the Russell 2000 index of small-cap companies at over 30 times earnings; the Tobin Q ratio (market value/book value) at 2.5x, when over 2 is considered overinflated; and the median price to sales ratio of the Standard & Poor's 500 higher today than in 2000. And to complete this picture, the S&P index has risen sharply over the last six quarters, when operating margins have been flat to down. Investors have chosen to overlook the fact that the improvement in net margins is the result of lower interest charges and tax rates.

From today's NYT.

Maybe not 84 but still a worry

Scott,

"Corporate credit spreads continue to decline, and that suggests that the outlook for the U.S. economy continues to improve."

Looking at the 2005-2007 levels 'm not sure if it should necessarily be interpreted in this way. I'm not saying it shouldn't, either, just that it's somewhat selective.

The bull market has turned to bear market. The exhaustion of the world central banks monetary authority, on October 23, 2013, coming at the hands of the bond vigilantes calling the Interest Rate on The US Ten Year Note, ^TNX, higher from 2.48%, caused both the failure of credit growth, AGG, and currency growth, DBV, CEW, and which finally caused the failure of wealth growth, VT, on December 2, 2013; and will soon be a “genesis factor” in three things: 1) a fast falling stock market. 2) a fast occurring economic recession, 3) then an all out, credit bust and financial system breakdown, known as Financial Apocalypse, foretold in Bible prophecy of Revelation 13:3-4.

Please consider visiting my Stockcharts.com Chart Site found here ...

http://stockcharts.com/public/1270699

...

where I post ten charts to watch

1) AGG, Credit failed, that is it died, when the bond vigilantes called the Interest Rate on the US Ten Year Note, ^TNX, higher from 2.48% on October 23, 2013; and Credit is about to experience a complete toxic breakdown, becoming a “genesis factor” of economic recession very soon.

2) EFA:BWX,

3) EZU:EU, The December 6, 2013, Mandate of Mario Draghi that prevents lenders from using future loans the ECB provides to buy Treasury Debt, EU, has destroyed nation state investment in the Eurozone, EZU.

4) FLOT,

5) FXE:FXY, This is the EUR/JPY

6) JNK:LQD,

7) MBB, When the bond vigilantes called the Interest Rate on the US Ten Year Note, ^TNX, higher from 2.48% on October 23, 2013, most all forms of credit died; even the bonds at the center of QE3

8) SHY,

9) VT:AGG,

10) VT:GLD,

Excellent blogging, and a superb collection of charts by Scott Grannis, per usual.

My guess is that gold is a loser for a couple decades, much like after the 1980s rally. However, if incomes keep rising in China and India, and their cultural affinity for gold holds, then maybe I am wrong. The gold market is an Eastern jewelry market today.

Commodities look long-term sluggish. Many prices got bid up, and that is leading to lots of new supply and weaker demand.

Potash may crack, and corn being held up artificially by the federal government's largest green-renewable energy program, ethanol.

Longer term, look for commodities to get cheaper, perhaps excluding oil--although a much better lithium battery may be close to commercialization.

As always, the private-sector is innovating solutions continuously. Consider the trillions spent on the Mideast, when we have incredible technical talent at home and around the globe to solve nearly any "shortage."

I think Scott Grannis is right, and stocks are priced about right, and property as well.

The thing now os to work, where possible on better supply side regs and taxes and a more-aggressive monetary policy.

But---remember, Orange County, CA, a GOP bastion, nixed an international airport for a balloon park. And you need voter approval (!) in Newport Beach before you can build a structure larger than 250,000 square feet in Newport Beach.

Wake me when the supply-side eases up.

Thank you for these charts and your interesting comments.

About the equity market prospects, in the same as we have witnessed a fantastic S&P performance in the last four years with a lot of pessimism, we could see a dreadful performance with a returning optimism (for ex. when real yields on TIPS turn positive).

We should feel lucky if the S&P PE ratio behaves counter rather pro-cyclically with respect to the proportion of corporate profit in the GDP. It may damper an inevitable decline of the profit growth.

Sir William, the source is Birinyi Asso and WSJ Market Data Group.

http://online.wsj.com/mdc/public/page/2_3021-peyield.html?mod=wsj_mdc_additional_ustocks

I agree with Ben Jamin and Mr Grannis, that in general the market is not over priced...On the other hand, I do not see very many bargains either..

If you like your PEs, you can keep your PEs...

It would be interesting to see if markets declines are conditioned on expansive PE ratios...

December 11, 11:23 hours.

http://www.marketwatch.com/story/us-runs-135-billion-budget-deficit-in-november-2013-12-11-1491014?link=MW_home_latest_news

In two months the deficit is at 1/4 of a trillion dollars!

Post a Comment