It's also very important to note the message of TIPS. Real yields on TIPS have risen a bit more than nominal yields on Treasuries, which means that the market's inflation expectations have declined a bit. That's another way of saying that the rise in Treasury yields has been dominated by a rise in real yields, not by a rise in inflation or inflation expectations. Higher real yields confirm the message of stocks: what has been happening over the past year is an improvement in the economic fundamentals. Even though (I repeat) this remains the most miserable and weakest recovery in history.

UPDATE: Reader "Sil Sanders" notes that it's not obvious from my charts and my explanation (admittedly brief) above that QE has failed to keep rates low. For a more complete explanation, see my post from last month, "Why QE was a successful failure." The chart below is an updated version of one of the charts from that post:

As I said back then, 10-yr yields ended up higher at the end of each QE program, and were unchanged at the end of Operation Twist. Yields only fell during periods when the Fed was not engaged in buying bonds—surely a counterintuitive result.

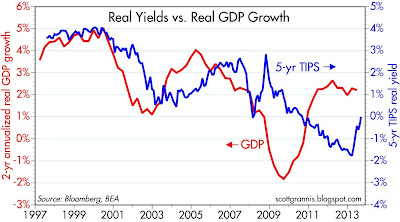

As I argued in the post linked above, and on many other occasions (here, here, here, and here), the only result the Fed could hope to achieve with QE was to raise, not lower rates, by responding to the world's demand for safe assets and thus alleviating a potential liquidity shortage which likely would have led to a weaker economy. As I've argued many times in the past, interest rates are fundamentally determined by the market's perception of economic growth and inflation. The chart above shows how real yields on TIPS tend to track the economy's growth rate, and the chart below shows how nominal yields track inflation.

I would argue that it makes much more sense to view the decline in yields over the past 5-6 years as a response to the market's expectation that economic growth would be very weak and inflation very low, rather than as the result of the Fed's bond purchases, which after all only represented a small fraction of the outstanding amount of bonds and MBS. That same logic, combined with a modest decline in inflation expectations in recent months, argues that the recent rise in yield is therefore the result of the market's improving expectations for economic growth in the years to come. As the second chart above shows, however, current 10-yr yields suggest the market now feels comfortable with economic growth of about 1% per year. Not too long ago, 10-yr yields were consistent with growth expectations of zero or even a modest recession. Even with the recent and rather impressive rise in 10-yr yields, the market's outlook for future economic growth is still quite modest.

One final point: if I'm right, and QE never artificially lowered rates nor directly stimulated the economy, then the "tapering" and eventual reversal of QE should not pose any threat to the economy as so many seem to fear, so long as the Fed's efforts have satisfied the world's demand for "safe assets."

11 comments:

My guess is that low inflation, low growth, and low employment will be persistent in the US for at least the next 25-30 years -- I regret that US citizens born before 1950 will not see another period of economic prosperity during their remaining lifetimes -- for this reason, a mass generation change in both the public and private sectors is required now -- we need a new generation of leaders Born after 1960 with life expectancies sufficient to see public and private enterprises through to the next significant growth cycle -- again, low inflation, low growth, and low employment are going to be with us for many decades to come.

Scott,

I fail to see the proof of direct causality between the recent rise in rates and the QE program which has been going on in various forms for 5 years.

The rates dropped for most of those 5 years of QE.

So it seems like a big jump in reasoning to conclude that since they have failed to keep rates low over the past 5 months, they never did anything.

Perhaps you can explain the reasoning in more detail or smaller steps for those of us who are less expert in these matters.

Important Message #1, #2 and #3 totally decimates the arguments of many "talking heads" on FOX News and CNBC and the decisions of many bond investors. Well done Scott; you have been right for 2 years at least!

Sil: I've expanded the post in an attempt to answer your question.

Well, some might disagree.

QE is used by central banks at or near ZLB, when the economy is in recession.

So, the central bank cannot lower rates anymore, and instead it starts to buy debt, called QE, or also called monetizing the debt.

As any central bank starts QE in ZLB, there is really nowhere for rates to go but up. If rates rise, that is a sign QE is working.

Since the Fed started open-ended QE 3, with some stated goals on employment and inflation, we have had good rallies in property and equities. This is not disputable.

Both those markets have faltered on news that QR might be tapered down. That is not disputable either.

I think QE is root, but other can make other cases.

My guess is that the Fed should really pour it on for a few years, even larger amounts of QE.

Inflation today is a very minor and unimportant concern. But unemployment, a culture growing dependent on pensions and disability payments and food stamps is a worry.

BTW, Japan seems to be having success with its QE program, and John Taylor gushed about Japan's QE program 2001-6. He thought it worked.

It sure is doing nothing for mortgage lending, which is all but collapsing..

In 2009, Fed Chairman Bernanke introduced QE1, traded out money good Treasuries, TLT, for the most toxic debt of all types held by the banks, which found their way back to the Fed as excess reserves. This interventionist policy secured investment trust, and reinflated credit worldwide, stimulated global growth and trade, and provided spectacular investment rewards, in such things as Small Cap Value Stocks, RZV, and Global Producers, FXR, through the Leverage Speculative Investment Community, consisting of Asset Managers, such as BLK, Stock Brokers, such as AMTD, Investment Bankers, such as JPM, Banks such as LYG, and Creditors, such as IX.

There is no sustainable economic boom as Jesus Christ operating at the helm of the Economy of God, Ephesians 1:10, enabled the bond vigilantes to rapidly call the Interest Rate on the US Ten Year Note, ^TNX, higher to 2.01% on May 21, 2013, which constituted a “termination event” in Emerging Market Investment, EEM, in Utility Stock Investment, XLU, and in Real Estate Investment, IYR, such as REM, REZ, ROOF, and FNIO. And the further fast rise of the interest rate on August 13 2013, to 2.71%, constituted an “apocalyptic event” which terminated fiat money, in particular Major World Currencies, DBV, and Emerging Market Currencies, CEW, both of which bounced higher in value, in response to the averting of war in Syria.

The crack up boom part of the Business Cycle is now complete as World Stocks, VT, relative to World Treasury Debt, BWX, that is VT:BWX, and Eurozone Stocks, EZU, relative to EU Debt, EU, EZU:EU, have peaked at their all time highs, on margin credit.

The 35 ETFs and Stocks seen in this Finviz Screener ... http://tinyurl.com/pd3pqsw ... are excellent short selling opportunities; these being XIV, FDN, CARZ, PBS, IGV, IBB, RZV, PSCI, FPX, IAI, XTN, SMH, XRT, PJP, PSP, TAN, RXI, FLM, EIRL, WOOD, EUFN, RWW, SPHB, FXR, IGN, BJK, PBJ, EFNL, YAO, NKY, SEA, IX, PRAA, GNW, LYG.

Jesus Christ acting in Dispensation, presented in Ephesians 1:10, that is oversight of all things economic and political for the fulfillment of every age, era, epoch and time period, has completed the paradigm of liberalism and is the paradigm of authoritarianism. Liberal policies of investment choice and schemes of credit are being replace by authoritarian policies of diktat and schemes of debt servitude, where banks will be integrated with the government, and be known as the government banks, or gov banks for short, and nannycrats will rule in statist public partnerships over the factors of production for regional security, stability, and sustainability, establishing austerity over all of mankind.

theyenguy, What did you say?

The NSA is still decoding his message..

Its weird - going through your blog entries from 2009 onwards, every dip in the markets is attributed to Obama. Well, the market up big since then but somehow none of it is due to any of Obama's actions ? At least be consistent in your causality. You think the stimulus bill did nothing, others think it helped stabilize a sinking economy. Tax increases were supposed to kill any growth but lo and behold revenues are up !!

In general you do a good job of dissecting data but your political rants leave a bad taste. Your blog is a good illustration of the principal I have learnt over the last few years that one should divorce investing from political ideals. Nobody, and that includes you and me, seems to really understand the link between specific fiscal actions and economic growth and stock market action. Reminds me of the book "Being right or making money" by Ned Davis. Still trying to get hold of it. Very rare. Currently going for $100+ on amazon.

Post a Comment