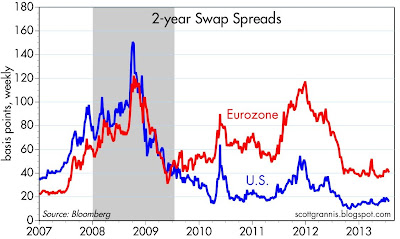

Swap spreads—proxies for AA bank credit risk and highly liquid—have been the best leading indicators of trouble ahead. The chart above provides a long-term history of 2-yr swap spreads. (See here for a more detailed explanation of swap spreads.) Swap spreads have risen in advance of every recent recession, and have declined meaningfully in advance of every recent recovery. Currently they are about as low as they have ever been. This is symptomatic of very healthy liquidity conditions in U.S. financial markets, generally low default risk, accommodative monetary policy, and very low systemic risk.

The first of the above charts focuses on the past six years, and compares U.S. swap spreads to their Eurozone counterparts. Eurozone swap spreads are still somewhat elevated, but that is not surprising given the ongoing problems with sovereign default risk in the Eurozone. It is comforting to see that Eurozone swap spreads have been relatively stable for most of the past year. This has proven to be a good leading indicator of economic conditions in Europe, which are improving, as shown in the second chart (note that swap spreads are inverted, to show that declining spreads point to improving conditions); Eurozone manufacturing is pulling out of its two-year slump and the Eurozone economy may therefore soon be emerging from recession.

Credit default swap spreads are highly liquid, generic indicators of corporate default risk. They are now very close to post-recession lows, although still higher than their pre-recession lows. This suggests some ongoing concerns, but that is not surprising given that the U.S. economy is still mired in a disappointingly slow recovery. On the bright side, however, generally low and stable credit spreads show that the corporate sector is generally quite healthy.

As the above chart shows, swap spreads were good leading indicators of junk bond spreads before and during the recession. With swap spreads very low and stable, high yield spreads should at least be relatively stable and likely have room to fall further.

This last chart gives a long-term look at credit spreads for the investment grade and high-yield corporate bond sectors. Spreads are still relatively attractive compared to their historical lows, and they have been largely unaffected by the recent 100 bps rise in 10-yr Treasury yields. This is the bond market's way of saying that higher Treasury yields pose little or no threat to the economy.

No comments:

Post a Comment