This post is the optimistic counterpart to my post yesterday, Why is everyone so gloomy? Here are 18 charts, in no particular order, that document the economy's ongoing recovery. I think this amounts to a persuasive body of evidence supporting my belief that the economy is recovering, and growing, and likely to continue to do so for the foreseeable future. It's not a robust recovery, to be sure, but it is definitely a recovery and things are indeed getting better.

Housing starts as of February were up fully 70% from their 2010 year-end level. That comes after starts fell to their lowest level in recorded history, where they remained for almost three years. This allowed a huge reduction in the supply of new housing which likely corrected for the excess of housing that was built in the heydays leading up to the bursting of the housing bubble. And despite the significant increase in new starts, the level of starts remains extremely depressed from an historical perspective. There is lots of room for further increases in the years to come. In anticipation of this, the stocks of major home builders are up 270% from their recession-era lows.

The current recovery was the only one in post-war history that began without a recovery in residential construction. With construction spending now increasing, this will provide important support for the economy in coming years. If residential construction returns to the levels that prevailed prior to the housing bubble, it could add as much as 3% to the growth of real GDP.

U.S. industrial production has almost fully recovered to its previous peak after suffering its worst decline in modern times. Production of business equipment is now at a new all-time high.

The unemployment rate is still high, and the economy needs to generate about 2 million more jobs just to get back to pre-recession highs, but as the chart above shows, jobs today are growing at about the same pace as they were in the mid-2000s.

A recession has never started without there first being a significant rise in unemployment claims. Today, claims continue their 4-year downtrend, strong evidence that the jobs market is getting healthier by the day.

Corporate profits are very close to all-time highs. The corporate sector has never been so profitable. Unfortunately, corporations lack the confidence to fully invest those profits, and the federal government has obliged by effectively borrowing from the capital markets just about all the savings that corporations have contributed over the past four years. But should confidence return, and policies improve (e.g., a reduction in the corporate tax rate, which is the highest in the developing world), corporations have the wherewithal to stage a powerful investment-led recovery.

Bank lending standards are still much tighter than they were before the recession, but it is a myth that businesses are unable to get loans. As this chart shows, bank lending to small and medium-sized business has been rising at double-digit rates for more than two years. On the margin, banks are more willing to lend, and businesses are more willing to borrow. This is a good barometer of increased business confidence in the future.

After a decline in the third quarter of last year, this indicator of business investment has turned back up, and is very close to attaining a new high level.

Housing prices are up as much as 10-12% in the past year. The inventory of unsold homes is close to its lowest level ever. Bidding wars are replacing foreclosures. The housing market has had plenty of time to adjust, and is now in a general upturn.

Consumers have made plenty of adjustments, with the result that households' financial burdens are at historical lows and consumer credit delinquencies are also at historical lows. This is a very encouraging development.

Household net worth is now at a new all-time high, thanks to rising stock prices, increased household savings, reduced debt, and rising home prices. All very healthy trends.

Thanks to new fracking technology, U.S. crude oil production is exploding to the upside, up almost 23% in just the past year. This is a huge industrial revival that has created boom conditions in North Dakota and Texas. Along with a gusher of new oil has come an abundance of natural gas, whose price has fallen relative to oil by orders of magnitude. U.S. industry now enjoys some of the world's cheapest energy. It's difficult to underestimate just how important this is to industrial America. It's a new age of energy abundance that is changing the face of entire industries. We are still in the early stages of this new boom.

This chart shows an index of key indicators of financial market liquidity and overall health. Markets have now fully recovered from the devastation of the financial crisis of 2008. Healthy and liquid financial markets are a necessary condition for a healthy and growing economy.

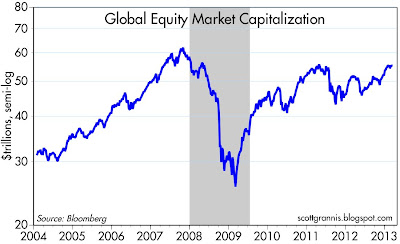

The recovery is not limited to the U.S. Global equity markets have rallied significantly in recent years (up almost $30 trillion), and are now only 11% below their pre-recession high.

Adjusted for inflation, retail sales are well into new high territory, having risen 3.2% in the past year.

Of course, there are still many problems the economy has to contend with. Monetary policy could become excessively easy if confidence returns and the Fed fails to take timely and aggressive steps to tighten policy. Fiscal policy continues to burden the economy with a very high level of spending relative to GDP, very high marginal tax rates, and the highest corporate tax rate in the developed world, although things are improving somewhat on the margin. Regulatory burdens are extremely high, with Dodd-Frank placing heavy burdens on the financial industry and the implementation of Obamacare threatening jobs and health coverage for millions of people across the country. Unemployment is still very high, and the labor force participation rate is disturbingly low. The unfunded liabilities of our major entitlements programs (e.g., Social Security, Medicare) are gigantic, and the current pace of spending growth is unsustainable over the long run. Public sector unions enjoy benefit packages that are bankrupting cities nationwide. Geopolitical tensions are rising in the Korean Peninsula and in the Middle East. Our federal deficit is still a shocking 7% of GDP and total debt held by the public is approaching an astonishing 80% of GDP.

And yet the private sector has dealt with the shock and disruption of a major recession and has survived, and is slowly but surely rebuilding the economy in spite of all these negatives.

It never pays to underestimate the ability of the U.S. economy to overcome adversity and grow. That's why I remain optimistic, especially because I see that markets are still obsessed by the negatives.

UPDATE: here's one more chart that I should have included before:

Auto sales have enjoyed a very strong recovery, having risen at an annualized rate of 14% from their low four years ago. Government attempts to "jump-start" sales in 2009 only caused a temporary uptick that was later reversed. The gains since then have been entirely "organic," driven largely by growth in hirings and incomes, increased confidence, and easier access to credit. No one expected sales to rebound this fast.

Friday, March 22, 2013

Subscribe to:

Post Comments (Atom)

28 comments:

This song is getting old. Can't you throw in a little bit on Argentina?

"Household net worth is now at a new all-time high, thanks to rising stock prices, increased household savings, reduced debt, and rising home prices. All very healthy trends."

Just take a look at your own household balance sheet chart. Has consumer debt really been reduced? Seems to me it's pretty much the same as 5 years ago.

Amazing. You argue and critcize on this blog with regularity, then belittle a thoughtful response to your own negativity with another complaint. Perhaps you (and several other regular posters) could start your own blogs and educate your admirers there. Scott's "old song" is the only place I have found where I can read an optimistic analysis of the economy from a conservative, small-government thinker. Scott also happens to have practical, real-world credentials that far exceed most pundits, journalists and academics. Reading his work has benefitted my wallet, blood pressure, outlook, and life, and for that I am extremely grateful.

Note: My comment was a response to Gloeshci, but I guess it can apply to Pragmatic Investor as well. And by the way, my household balance sheet actually does look better than it did five years ago.

The recovery has been underway for 3.5 years and is quite solid. In fact the only slack left is residential construction. We are one year and half a million additional housing starts away from full recovery. Layoffs are very low and job creation equals the rate of growth in the labor force plus growth in construction employment.

Now why are people so unhappy? Well, there is a very large number of people who are persistently unemployed and underemployed. The hard and painful truth is that these people, given government policy, cannot be employed at a profit. The economy has been depressed onto a lower trajectory with a slower growth rate and without a fundamental change in course they will not go back to work.

Unfortunately, real working wages, real home values, and the employment to population ratio remain depressed -- in other words, Main Street USA is in economic depression -- I'm not sure how anyone could disagree with that conclusion based on these facts...

Scott, Larry Kudlow mentioned your name last night on CNBC, and mentioned that you have turned him around on his (Larrys) views on money supply growth/velocity/inflation or lack thereof.

Household net worth is at a new nominal high, and not real, but I am not complaining. Mine is at a new nominal as well as real high. Debt is MUCH reduced from 2007-2008.

I've know Larry Kudlow for a very long time. He was the one who inspired me to get into economics, way back in 1981. He tells me he checks CBP regularly.

Scott, the vast majority of us appreciate your insight and hard work despite the efforts of a few to criticize and belittle. Thank you for offering your insight. All leading and coincident indicators I follow are in uptrends. We are not currently at a business cycle peak, and with housing momentum on the rise the immediate future looks good.

You have to admire such a complete wrap-up.

But there is a still a problem of weak aggregate demand. The employment to population ratio is still down 5 percent from pre-recession.

The federal government, and the US Congress, cannot restrain runaway agency spending, or entitlements.

But worse, we have a dithering, feeble Fed. They start QE programs, then stop. The quail about inflation. The FOMC has loose cannons on deck, rolling around and firing in every direction---investors do not have confidence.

I recently interviewed about a dozen institutional real estate investors. Big guns. I asked them all about central banks. They said they cannot depend on central banks, so they do not invest assuming a central bank policy will be consistent.

If the Fed really has a 2.25 percent inflation ceiling, we may never see full recovery. Why? Recoveries do not last forever. The longest one has been 10 years.

Ergo, we may enter the next recession awhile we are still in the zero bond. Then the Fed will have no tools. It cannot cut rates, and people will say QE didn't work.

Federal deficits will balloon, as they always do in recessions.

That is the United States of Japan.

The scenario I just outlined is actually likely at this point. Recessions happen, and we are already at zero bound.

I hope the Fed gets aggressive, and thus we can avoid this scenario. It will require guts, resolve, holding the line even as we approach higher rates of inflation.

I don't think the Fed has the guts to do it.

@Benjamin, QE3 and QE4 are about as good as it gets -- I believe these programs are in fact working to accelerate the US economy -- on the other hand, I do not believe QE3 and QE4 were charity -- rather, I believe that QE3 and QE4 were initiated to stave off deflation along Main Street -- mall store such as J C Penny and Sears are essentially insolvent -- durable goods stores such as Best Buy are essentially insolvent -- restaurant chains are nearing insolvency -- finally, Main Street universities are moving into recession as a result of restructuring in higher education -- add to all that the recent sequestration cuts, and the picture is not pretty -- I believe the US will have to abandon the unlucky people earning less than $300,000 annually in the coming years in order to save Federalism -- I would not be surprised to learn that the US is offering one-way tickets out of the US for the unemployed to start new lives overseas -- the US desperately needs to reduce wages significantly in order to bring salaries in line with global norms -- I personally would prefer that such cuts begin with government employees (I advocate an immediate 40% cut in government spending), however, government spending cuts have hit a wall -- said another way, the economy is going to continue to stagnate or decline, especially along Main Street USA, for the rest of the century -- the good news is that people with world-class skills are earning premium wages in the global economy, which can be converted into dividend and rent-earning equities at bargain prices -- I believe that standards of living for unlucky people in the US (anyone earning less than $300,000 annually plus a net worth of less than $1 million) will decline exponentially over the balance of the 21st century -- suicides are accelerating and I believe will hit record levels in the near future if they haven't already -- suicides accompany hopelessness, and there's no reason for Main Street dwellers to be hopeful at this point -- my best advice to the masses is to abandon the 99% crowd by acquiring world-class skills that convert into premium wages enabling acquisition of vast holdings of dividend and rent-earning equities -- there's really no other path forward for poor people except increasing destitution over the balance of the 21st century -- accredited investors in the US (and around the world) are in for great times -- everyone else should be under cover...

Near record corporate profits - despite a crushing tax burden?

The STATUTORY corporate rate may be highest in the world but what corporations actually pay that? A report by The Congressional Research Service shows the EFFECTIVE rate is about average compared to other OECD countries. And, the marginal rate on new investments is actually lower than average.

The tacit US approach to economic recovery is to starve Main Street in order to fund a Federal recovery -- that plan is working...

Scott, You made Kudlow's Saturday morning IBD column "On the Right".

I read Bernanke's book at the time he took over as Fed chairman. He was a student of the depression of the 1930's. He resolved not to repeat the mistakes that led to the 'depression within a Depression'. It was prescient/fortuitous that he was Chairman when the present events unfolded.

Tight money and low taxes would be the preferable course. But so long as tax policy is punitave/confiscatory, loose monetary policy is the card the Fed has to play.

P.S. Im glad to see Bergoglio is rattling Cristina's cage.

Bergoglio is a HUGE breath of fresh air.

John: Re corporate profits: have you noticed that corporations are keeping tons of profits overseas? Not repatriating them? It's because they've already paid taxes overseas on the money and they can't bear the thought of paying 35% more. That's the proof that our tax code is a mess. Let's lower drastically the corporate tax or even eliminate it (the corporate tax effectively falls on consumers anyway) and get rid of deductions, loopholes and tax preferences. I guarantee that would jump start the economy.

If this author can make an incorrect statement, then someone else can challenge his opinion. Was I wrong in saying household debt has barely dropped over the past 5 years? If you can't handle the truth, go somewhere else.

Pragmatic: According to the Fed's calculation of household balance sheets, total debt has declined from $14.2 trillion to $13.5 trillion over the past 5 years. That's a decline of $700 billion, or 5%. Is that "barely" a decline? Perhaps it is, but it is nevertheless a decline, and probably the first such in many decades.

Scott: It's a race to the bottom. Some country will always have lower taxes than the U.S. to incentivise corporations to park their cash.

If corporations don't want to pay U.S. taxes, they should not qualify for any U.S. government contracts.

2007 is the peak of the credit bubble. Right now household debt merely goes back 2006 level. That tells you whether there has been any meaningful deleveraging.

I am glad Scott Grannis admires Larry Kudlow.

Finally, the Kudlows of the world are being to "get it."

From Scott Sumner's blog---Kudlow coming onboard to Market Monetarism.

Grannis cannot be far behind.

Sumner spekaing:

And today in The National Review, Kudlow makes a stunning admission: Ben Bernanke might have been right all along.

Kudlow’s piece draws on the hot school of “Market Monetarists” who draw on the work of Milton Friedman to endorse the idea that the best Fed policy is one that pursues a Nominal GDP target.

This idea, that the Fed should pursue a stable Nominal GDP path has fans on Wall Street (Goldman’s Jan Hatzius is one), in academia (Scott Sumner, David Beckworth, Michael Woodford), at the Federal Reserve (Janet Yellen, the likely next Fed chair has all-but endorsed it), and various corners of the media (Ramesh Ponnuru, Ryan Avent, and Matt O’Brien).

Kudlow isn’t totally sold on it yet, and he’s still worried about gold prices and King Dollar, but he writes:

… if I have this story right, the market monetarists want the central bank to enforce a nominal GDP growth rule, which will avoid both deflation and inflation, and thus give fiscal incentives breathing room for a more rapid job-creating expansion.

I don’t agree with Bernanke’s unemployment target or his criticism of lower government spending. But I confess that he may have the monetary-stability story more right than I originally thought.

If gold remains soft, and King Dollar steady, perhaps the former Princeton professor deserves a little more credit. He may have gotten that story right.

In all seriousness, this is very cool. People don’t change their mind nearly enough, especially in the realm where politics meets economics.

A big share of the credit here for this shift definitely goes to Jim Pethokoukis, who has been using his perch at AEI to school conservatives about monetary policy, and to debunk the idea that Bernanke is some crazy reckless dove who is not worried about inflation at all.

In fact, Pethokoukis is holding an event tomorrow at AEI, featuring Ryan Avent, David Beckworth, and Scott Sumner on revamping the Fed and the idea of market monetarism. You’ll be able to watch it live online at noon, and hopefully get a glimpse of new monetary ideas on the right that aren’t all about hard money.

I was serious about Argentina, since this is the only topic where Scott makes sense.

Why can't the government in Argentina just "print" its way into wealth nirvana? Because nobody is going to buy their debt.

Larry Kudlow... well, if you still watch the "consumer news and business channel" and their clowns I can't help you. But I am sure the commercials are hitting the correct target group. Did you buy the "retractable sun-setter" yet from the nicely dressed couple?

Why do you (and the other deficit owls) keep separating the household and the government balance sheet? Please name one sovereign that exists without taxable constituents. A sovereign only has credit due to the power to tax its people. You can move debt from the household balance sheet towards the government, but its still there and will have to be serviced on day.

You are borrowing from the future.

Federal government debt is up $6 trillion since Q4 2007, dwarfing the 700bn in household debt reduction.

If fiscal deficits (and hence debt) didn't matter, why did it take mankind so long to figure out we could just spend and print our way into wealth?

Here's Larry Kudlow for you, on September 22, 2008. You see the S&P 500 at 1,207 points. http://www.youtube.com/watch?v=BMrqDHmDwcg

Nineteen charts presented, yes 19, but not one of GNP growth ?

Why?

Hans: good question. GDP growth is what results from all the other charts. I see enough growth in many parts of the economy to believe that overall GDP growth will be at least 2-3%. If fiscal and monetary policies improve, we could see much stronger growth.

Thank you, Mr Grannis..

The third revision of the GNP saw gains of only +.4% for the 4th quarter of 2012.

This is not reassuring!

http://www.bea.gov/newsreleases/national/gdp/gdpnewsrelease.htm

Internet Marketing has nominal effect of recession. Many people can be benefited by working from their homes online. To know how to Make Money Online you can search information on Google, there are plenty of information about it.

Regards,

Johny

We don't have heaps of different pointless payroll 2013 tax brackets.We don't have lots of special tax breaks for special interest groups!!!. Good tax rebates for donations to charities. Company tax is 28% and hopefully lowered to 25% soon. A basic capital gains tax of a simple flat rate would be a good addition

Post a Comment