The chart above shows the 12-month running total of federal spending and revenues. Note that since the end of 2009, spending has been almost flat, while revenues have increased steadily. Congressional gridlock gets the credit for slowing spending growth, while the economy's ongoing recovery—regardless of how unimpressive it has been—gets the credit for boosting tax revenues. It is unfortunate that President Obama has placed so much importance on increasing tax rates for the rich in order to address the still-yawning budget gap, when tax revenues have been rising quite impressively without any assistance from higher rates. Economic recovery has once again proven to be the best source of tax revenues for the federal government. The public has not gotten this message.

This next chart shows spending and revenues as a % of GDP. Note that simply stopping the growth of nominal spending is enough to bring about a fairly impressive decline in the burden of government (i.e., spending as a % of GDP). No actual cuts are needed to effectively shrink the size of government.

This chart puts the current situation in a long-term historical perspective. Note that spending as a % of GDP is still substantially higher than its post-war average, whereas revenues are only slightly below their post-war average. In order to achieve a balanced budget, this strongly suggests that the heavy lifting of policy should be focused on restraining the growth of spending while promoting economic growth. Higher tax rates are not needed. Unless, of course, President Obama's intention is to permanently increase the size of government, and increasingly it looks like it is.

We are very fortunate as a nation that the federal deficit has declined significantly in the past three years, from a high of 10.5% of GDP in late 2009 (a level that was clearly unsustainable) to less than 7% today. 7% is still very high, but it is not unsustainably high and it is on a downward trajectory.

As this next chart shows, gains in federal revenues have accreted throughout the year. Every month in 2012 showed higher revenues than the same month in prior years.

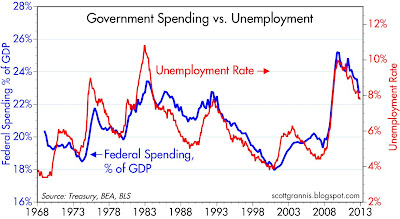

This next chart shows how there is a fairly reliable correlation between the level of government spending, as a percent of GDP, and the unemployment rate. A stronger economy reduces the need for spending of the "social safety net" variety, that much is clear. What is perhaps not so clear nor well documented is that as the relative size of government shrinks, this allows the private sector to keep more of the fruits of its efforts, and this strengthens the economy while increasing employment and reducing unemployment. This chart fairly screams its message: if we want the economy to get stronger, we need to cut back on the relative size of government! Bigger government brings with it a weaker economy, while smaller government opens up the possibility of a stronger economy. To put it another way, the private sector can spend money more efficiently and more productively than the public sector. Shrinking the public sector allows the private sector to expand, and that in turn results in more productivity and more growth.

Federal debt held by the public (including the debt that has been "purchased" by the Fed, but excluding the debt that is owed to social security and other trust funds) is now $11.6 trillion, or about 72.5% of GDP. Total debt is now $16.4 trillion, about 103% of GDP.

At the current rate, the burden of federal debt held by the public (i.e., debt as a % of GDP) will have increased by almost 25% of GDP during President Obama's first term. That handily eclipses the increased debt burden under the two terms of President G.W. Bush (15.3%) and the two terms of President Reagan (15%).

18 comments:

Don't mention Clinton - raised taxes, produced budget surplus.

Little primer on sustainability of deficits:

if deficit grows faster than economy it's UNSUSTAINABLE. Pure mathematics.

Raising taxes early in his first term wasn't one of Clinton's best moves. What really helped the economy was his strong dollar policy, his welfare reform, trade liberalization, and tax cuts in his second term. A big part of the decline in government spending under Clinton, however, came from reductions in defense spending, arguably not one of his better policies. He also pushed a little too hard on Fannie and Freddie to boost housing. Regardless, I would have to give Clinton generally high marks for his economic policies. If only Obama could have learned Triangulation from Clinton, we would be in much better shape today.

The choice between guns and butter is upon our nation -- a balanced approach to cutting guns and butter is likely, which is precisely why the military-industrial Republicans are framing the budget cuts as entitlement cuts exclusively -- the exercise of cutting government spending is agonizing for the both the big government Democrats and the military-industrial Republicans -- as far as I'm concerned, spending cuts can be balanced between both guns and butter.

Inept may be too soft a word to describe the attempts by both this administration and Congress in the budget arena.

Watching the Fiscal Cliff fiasco made me want to jump up and scream, "Term limits for both the House and Senate are needed!".

Cut spending, cut spending, cut spending.

Cut entitlement, wipe out USDA, wipe out Labor, wipe out HUD, wipe out Commerce, privatize the VA, wipe out Homeland Security (major P.U.) cut Defense in half.

Cut, cut, cut, cut, cut.

wow. I have never seen the correlation made between govt spending and unemployment made to succinctly. the left has virtually no argument except that cutting spending is "MEAN". my retort? what's compassionate about high umemployment and saddling our future with excessive debt.

A quick way to cut Federal spending would be to fold the flags up on the USA and write a new constitution -- everything and everybody receiving payments from the Federal government would be out in the cold instantly -- just an idea...

Philly Fed President Plosser just put this post in fine literature format. No offense, Scott. You really must read it.

The Economic Outlook and Long Term Growth.

http://www.philadelphiafed.org/publications/speeches/plosser/2013/01-11-13_new_jersey_economic_leadership_forum.cfm

Last year, I predicted that California would blowup due to its deficit. However, I was apparently wrong with Gov Brown now claiming that California will have a revenue surplus this year. I guess the California miracle is real. Given that teachers, highway patrol officers, and essentially everyone working for the state of California earns much more than similar workers here in Pennsylvania (my several fold), I suspect that many Pennsylvania will want to emigrate to California to get in on the public employee extravaganza.

By all accounts, California will truly be the first state to close the pay gap between public workers and movie stars. Now is the time for milllions of Americans seeking a new life to head to California and sign up for public benefits of all kinds. California is truly a very unique state in the US, with abundance for all.

Given Gov Brown's extreme optimism, I suppose that reports like this should be rejected:

http://www.testosteronepit.com/home/2013/1/12/california-pension-death-star-approaching.html

Let's face it -- Gov Brown and the California Dems are in the spotlight as they lead our great nation into the future!

It's part of an interesting pattern of late.

Republicans claim to want to balance the budget and then create enormous deficits.

Then Democrats re-balance things after claiming that they want to increase spending on important national investments.

People just do not end up doing what they say they are going to do...

US spends more on defense than next 10 nations together, yet is virtually impossible to invade. Are the Mexicans going to march north? The Canadians onto a quick land grab?

"Clinton... reductions in defense spending, not one of his better policies". Where is the logic?

To be specific about 2012 Defense Spending:

US - $715 Billion

China - $143 Billion

Russia - $71.9 Billion

United Kingdom $62.7 Billion

France $62.5 Billion

Japan - $59.3 Billion

Saudi Arabia - $48.2 Billion

India - $46.8 Billion

Germany - $46.7 Billion

Brazil - $35.4 Billion

http://www.huffingtonpost.com/2012/08/06/defense-spending-fact-of-the-day_n_1746685.html

http://en.wikipedia.org/wiki/List_of_countries_by_military_expenditures

http://www.janes.com/products/janes/defence-business/budgets.aspx

Ok, so chop $100billion off of Defense spending. Chop $200b, Chop $300bil.

So now we'll have a $700bil. deficit.

And have a weaker defense for it.

Barking up the wrong tree.

Caveat: Yes there is waste and abuse in the Defense budges, just like there is waste and abuse in virtually every government department and agency.

The problem with America is its government.

Bob

The lessons history are that great empires are destroyed from within - not without - ultimately by ineffectual governments, mis-allocation of resources, corruption,squandering the nation's wealth on military mis-adventures,and the moral decay, materialism and loss of vitality of their populace.

Scott,

"Note that since the end of 2009, spending has been almost flat.."

That's hardly comforting considering 2009 spending consisted of supposedly one-time blowout emergency spending like the stimulus and bailouts. The fact that the budget has grown at all means all that spending has been built into the baseline.

great article destroyed by ridiculous claim that higher gov spending leads to higher unemployment. you have that backwards - higher unemployment leads to higher gov spending.

With all the focus on raising taxes (or the new preferred word "revenue"), I have never seen any analysis of the impact on future tax receipts from the vast number of baby boomers who will soon have to make Required Minimum Distributions from qualified retirement accounts.

Seems to me that there is a huge reservoir of untaxed income about to become a gold mine for the Fed Gov't.

Have you seen anything posted that estimates the impact?

I don't have the facts in front of me to back this up, but I think it's safe to assume that the taxes generated by Baby Boomers' withdrawals from their retirement accounts will be much less than the tax revenues lost as they stop working, and the extra spending required as they start collecting their social security checks.

Post a Comment