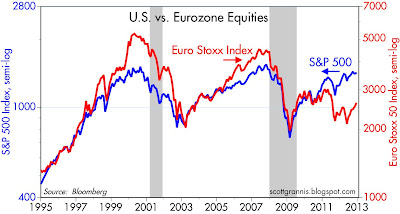

The Eurozone is still in terrible shape, but Eurozone equity prices are up 27% from their June 1st lows. Eurozone equities, in fact, have risen more than twice as much as the S&P 500 over this same period. Are markets turning irrationally exuberant? Not by a long shot.

As I argued in my previous post, with all the bad news and pessimism that's out there, it doesn't make sense to think that markets are even slightly optimistic at current levels. What's happening is that valuations have been so deeply depressed that the market is essentially priced to the expectation of another deep recession—but a recession keeps failing to show up. So even modest growth of 2% or so with continued high unemployment ends up being better than the market expected, and that forces the price of risk assets higher.

Here's a recap of the evidence of pessimistic market sentiment:

Sovereign yields in all developed economies are at extremely low levels. Plus, they are converging with the extremely low yields that have marked Japan's long economic slump. In a sense, the market is saying that the Eurozone and the U.S. economies are destined to suffer the same fate as Japan: prolonged, very weak growth.

Real yields on inflation-indexed bonds are negative. Negative real yields are a strong sign that markets expect very weak growth in the years to come. As the chart above suggests, negative real yields on TIPS are pointing to years of zero growth in the U.S.

PE ratios are below average, even though corporate profits are at record-high levels. This can only mean that the market believes that profits cannot maintain current levels and are almost sure to decline significantly in the years to come.

Earnings yields on equities are substantially higher than corporate bond yields. It's rare for the market to allow earnings yields that are substantially higher than the yield on corporate bonds. Investors are apparently willing to sacrifice a significant amount of earnings yields on stocks in exchange for a much lower yield on corporate bonds, since bonds are senior in the capital structure and thus more secure. In normal environments, equity investors are willing to accept lower earnings yields because they expect future capital gains to more than make up for those low yields. It's also a strong sign of pessimism that investors have stashed $6.6 trillion in bank savings deposits paying almost nothing, when stocks are earning 7%. That huge gap is a good measure of the market's extreme risk aversion today.

Stocks are edging higher because the market is becoming slightly less pessimistic.

16 comments:

this piece ties in well with the prior one in that the reason the market looks so cheap is that pessimism reigns-and for good reason.

one could be lulled into thinking that cheap prices equal opportunity until you realize we've NEVER faced these cumulative headwinds before. runaway debt and deficits further than the eye can see. rising taxes on the successful (those nasty mean people) increased regs on small biz etc...kinda looks like japan circa mid 90's?

you've been essentially writing the same post for over 4 years. everyone is dumb and grannis is clear eyed. dull.

marcusbalbus: Yeah, I know, it's been pretty boring following my advice to buy and hold just about anything but cash and Treasuries for the past 4 years.

Total/Annualized Returns, past 4 years:

S&P 500 78.5%/15.6%

HY Bonds 103.2%/19.4%

REITS 153.7%/26.2%

Emerging market bonds 220.4%/33.8%

AAPL 475%/54.8%

And the alternative, "safe" strategy:

Cash (3-mo. Libor) 2%/0.5%

7-10 yr Treasuries 27.1%/6.2%

Me, I prefer boring and dull as long as it pays off.

Another terrific post by Scott Grannis.

This is a particularly keen observation:

"Sovereign yields in all developed economies are at extremely low levels. Plus, they are converging with the extremely low yields that have marked Japan's long economic slump. In a sense, the market is saying that the Eurozone and the U.S. economies are destined to suffer the same fate as Japan: prolonged, very weak growth."

Exactly.

We know from the Japan model, that sustained tight money just does not work. Forget the theories, forget the platitudes, forget the pompous posturing, forget blah,blah about a "strong currency," forget the Austrians.

The Euro. Central Bank has an official target of 0 percent inflation That was the Bank of Japan's target for the last 20 years.

This is a catastrophe underway.

We can make our own future in the USA, but only if the Fed concentrates on economic growth and not fighting inflation.

Fiscal policy is inert---Japan proved that, especially if the central bank is asphyxiating the economy.

Pray for a central bank brave enough to shove aside encrusted shibboleths, and aggressively pursue growth.

It would be fine if Scott's arguments were not as paper-thin.

Let's start with Europe: the "zone" re-entered a recession in Q3/Q4. European equities rise due to correlation with US markets and thanks to continued US trade deficit, allowing German exporters to continue to do well.

Next: bond yield levels. Why would low bond yields (or high prices) be a sign of pessimism among equity market investors? Why do you take a government-manipulated rate (the Fed and other central banks absorb more than 100% of net issuance in certain maturities) as a litmus test for pessimism? If you go back a bit further in history, dividend yields have exceeded bond yields for 50 years.

P/E ratio: take CAPE10 and stocks look expensive. Take out non-GAAP "one offs", and stocks are 15% more expensive. Take 5 stocks out of the S&P 500 and profit growth is cut in half.

You thankfully show the chart with record high share of corporate profits as a share of GDP and the average rate, and you keep saying that the market seems to assume those levels are not sustainable, but you don't offer any argument why that would not be the case. Most things in financial markets are mean reverting, so why would this one, too?

Institutional investors can be as pessimistic as they want; most of them still have to be at least 95% invested according to the by-laws of their funds. Pessimism was very high in the days around the Lehman chapter 11; that didn't prevent the market from falling another 50%.

I am not sure what the objective of this blog is; sadly, an unbiased information of the individual investors doesn't seem to be one.

My advice to investors is to acquire and read everything you can in books and old magazines about the period 1920-1942 in US history -- read about the politics, the economics, monetary policy, fiscal policy, the presidential elections, the housing markets, the stock market, the prohibition amendments, and most especially, narratives about the real lives of Americans -- the clues for our times are in that literature -- lots of people made fortunes during that period -- the question is how -- just a thought for everyone...

Scott, regarding investment returns over the past four years -- I echo your sentiments...

PPS: The "buy" window of opportunity of the 20th century was 1930-1940 -- the buy window of opportunity for the 21st century is open right now...

I'm still trying to understand what is so bad about the terrible horrible Obama presidency in the eyes of the well-off.

-----------------

S&P 500 78.5%/15.6%

HY Bonds 103.2%/19.4%

REITS 153.7%/26.2%

Emerging market bonds 220.4%/33.8%

AAPL 475%/54.8%

-----------------

'Conservatives' treat this guy like a negro communist who escaped from a slave plantation. I say 'conservative' because its difficult to know what they are intending to preserve at this point, other than to say that the ladies and the brown-skinned folks are wrecking everything.

And now, god forbid, we might raise some taxes back to where the were in the terrrible years of runaway socialism in the 1990's when the banks were de-regulated by the serial-murdering Cintons.

The well-off are not suffering. It's everyone else that is suffering from our 13% output gap. (BTW, Nobel prize winner Edward Prescott agrees with me on this in today's WSJ op-ed). Living standards for everyone have been depressed. Job opportunities are hard to come by. More people are poor. Middle class is squeezed. Obama thinks he can just squeeze the rich and businesses and redistribute to the poor, but it will never work. The Law of Unintended Consequences almost dictates that Obama's efforts will make things worse for the poor and the middle class, and we are already seeing the results.

5Y 5Y forward breakevens are reaching critical levels and the Fed will probably quadruple down.

Yikes.

And so...

More tax cuts for the well-off will help the struggling?

We have been pursuing these 'supply side' policies for 30 years. These policies have coincided with working people doing less well, with less wage growth and reduced benefits. And then after de-regulating the financial sector (see Clinton socialism) they set the house on fire and burned it down. It's still going on, Michigan is now passing the "Right to Work For Less". I think that the Work for Less phrase is totaly catchy and I hope that more often.

The only time in this period where wages growth was decent WAS during Clinton's presidency. And Newt Gingrich shut the government down to try and stop the tax increases, and then there was a budget surplus. The idea that the GOP cares about the deficit if fiction. The GOP needs deficits so they can break the programs that the want to eliminate.

The drum beat that ruin is just around the corner if we let the socialist have his way is silly. We do need better policy choices. Just please don't keep saying tax cuts and deregulation will help the little people. That's a bad joke - And as Mitt Romney pointed out, the little people don't make enough to pay income taxes anyway.

Hardly anyone can escape stagnation with a Fed bent on generating 2%+ inflation every year. Except if you are very close to the origination point of the money. Hence banks, hedge funds, and money managers have done extremely well over the past 30 years. Notice this all kind of went into hyper drive when Nixon finally broke completely from gold?

If we stopped money printing and allowed prices to fall over time, the 'little' people could actually get ahead at market determined wages (even below minimum). However, that doesn’t work for the left or right. Doesn’t work for the people in charge of the Fed either.

Unfortunately, this situation will only get worse the deeper into monetary experimentation we go. Despite all the rhetoric about political gridlock etc, our history is littered with these types of episodes. Additionally, the debates around the current level of taxes and regulation is nothing new. Nor are the marginal changes proposed by either side extreme in any sense relative to our history.

It boils down to the Fed and the unintended consequences of CB policy held hostage. Held hostage by this notion banks are so valuable to society that preventing their collapse and recklessness is priceless.

And notion that ensuring bank profitability is paramount to everything else.

The future has been and will continue to be about finance unless we hold the CBs accountable for their actions.

Here we go....

By Joshua Zumbrun and Jeff Kearns

Dec. 12 (Bloomberg) -- The Federal Reserve said it will buy

$45 billion a month of Treasury securities starting in January,

expanding its asset-purchase program, and for the first time

linked the outlook for its main interest rate to unemployment

and inflation.

Squeeze the rich? Seriously? Come back and talk to me when the US's Gini-coefficient is lower than Egypt's (right now it's higher, implying that income distribution in the US is more unequal than in Egypt).

Post a Comment