It's been more than 30 years that I've been following the monthly employment report, and I've never understood why it is that the market places so much importance on a single number. Especially since that number can and most likely will be revised significantly in the future, it is subject to seasonal adjustment factors that are never completely accurate, and it is volatile from month to month. I've also never understood why the market focuses on just the establishment survey of jobs and almost completely neglects the household survey. Both have their problems, and sometimes they can diverge a lot, but over time they tell the same story, only from different perspectives. I've found that looking at both surveys can be very useful, and I make a point of doing that on this blog. The household survey is especially important to follow in the early years of a business cycle expansion, because it can pick up the growth of small start-up companies which aren't covered at all by the establishment survey until future revisions which match the survey data to tax records.

I also try to focus just on the growth of jobs in the private sector, since that is where the real action is. It makes even more sense these days, since state and local governments have been shedding jobs. In my view, the public sector has gotten way too big, and cutting it back is not only necessary but actually quite healthy, since it leaves more room for the more-productive private sector to grow.

I also try to focus just on the growth of jobs in the private sector, since that is where the real action is. It makes even more sense these days, since state and local governments have been shedding jobs. In my view, the public sector has gotten way too big, and cutting it back is not only necessary but actually quite healthy, since it leaves more room for the more-productive private sector to grow.

According to the establishment survey, private sector jobs growth has been disappointedly low for the past two months: about 85K on average. But according to the household survey, private sector jobs growth has averaged 160K for the past two months. As the charts above suggest, the household survey has enjoyed some pretty impressive growth this year, following a period of fairly slow growth. The household survey is finally doing what it usually does, which is to lead the establishment survey. (Since the low water mark in early 2010, the household survey shows a gain of 5.2 million jobs, while the establishment survey shows a gain of 4.3 million.) I think the household survey should get the benefit of the doubt here, and that's why the title of the post says that jobs growth is still "moderate" rather than disappointingly low.

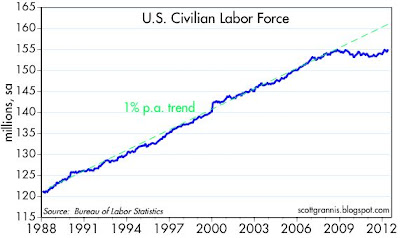

The unemployment rate ticked up last month, in part due to renewed growth in the labor force. The labor force is still way below trend, however, since some 5 million people have stopped looking for jobs, either because they have retired or have given up finding one. But if you look closely at the chart above, you will see that the labor force actually has been growing in fits and starts since last summer, and that is a positive sign. If the economy continues to slowly improve and the labor force continues to slowly expand, the unemployment rate is not likely to decline further, and could in fact rise some more, at least until the pace of jobs growth starts picking up.

So I think the market's reaction to today's news has been excessively pessimistic. I don't see convincing signs of deterioration in the outlook; I see an economy that continues to grow at a sub-par pace, and that's been the case for the most of the past three years.

14 comments:

One of my favorite leading indicators is the temporary help services versus its 12 month moving

average...it is well above this average...on the flip side the loss

of momentum in the growth in private

payrolls is something to watch...

what's funny about your post is that last month the market tanked on a job report you considered mildly encouraging and you said the market would eventually reconsider. Now the job numbers are getting worse and clearly the market has moved even lower. You continue to write if off as if the report doesn't mean anything. Look at the trend over the past few months. It's not just one number.

Establishment data non-farm private sector number of people employed seasonality goes like this: November or December is a high for the number of these people employed and January drops off to the low number employed for the year. Then February through June claws back up to the December number of people employed and more. This is followed by a flat-lining more or less the rest of the year.

Dec ’10 high to May ’11 the number of people employed increased by 776,000. This year, Dec ’11 high to May ’12 is an increase of 705,000 people employed. This shows a little slow down in the rate of increase of employment. June is the last month of big increases so we won’t know how the economy is doing relative to employment until the June numbers are in as the pattern of employment flat-lines after June.

I will have to look at the non-seasonally adjusted household data as well in the future. It IS crazy that there is so much emphasis on that ONE seasonally adjusted headline figure.

I think that employment is now at its normal non-bubble level of employment given all the aeronautical drags in the economy.

Squire: Why do you think we're at "normal" employment? I think we're a long, long way from "normal" employment. Housing has just now bottomed and has been absent during the recovery. Auto sales, while trending upward, still have room to grow.

Austerity and the decline in public sector employment is dragging down the overall number as gains in the private sector are erased by losses in the public sector.

What amazes me is that all of the other jobs data points don't seem to matter. Most of the experts just bury their heads in the sand and pretend like this headline number is as good as gold. Jobless claims don't matter, ISM employment data don't matter, ADP report doesn't matter.

As you say, its on't the seasonally adjusted and often revised BLS headline that matters.

To me this signals that the big hedgies are short and hence they'll play dumb to push the market down. Only to cover as retails sells out.

The reason I think the employment pictures is normal is that lots of jobs have gone overseas and continue to go. I am intimately knowledgeable of a large Silicon Valley Corp. who is sneaking out of California department by department one at a time. The accounting department is now in India. (The supply chain people are moving to Austin as I write, just to give some flavor to the subject of California. A senior manager said they were sick of all the crap they have to go through in this state).

Technology has brought immense gains in productivity. I took over an accounting department and over five years reduced 65% of the staff as we implemented sophisticated software. The new software in design reduced the number of designers as they became more productive. Same happened with the supply chain people.

We import lots of labor much of it that goes on welfare.

The dot com bubble and the housing bubble were false economies and we have substituting debt for real income for decades. What we are seeing today is employment without stimulus much more like it was back in the 50s and 60s as I remember it.

Agreed on the inflated employment front during the bubbles. I think manufacturing jobs are beginning to be brought back home due to rising overseas wages, however. I can't site a specific source right now, but Carpe diem and calculated risk have had articles on this.

California... That's a different story. No hate to the Californians on this blog, but on the whole the state just isn't living in reality. Many of the policies being enacted serve to sever one's foot from one's leg it seems.

You know what else is fishy about this report? During the period of the jobs survey (mid-April to mid-May), the American Staffing Association was rising quite strongly. However, temp staffing in the BLS report only rose 9,200.

I wonder if the early release date of this report had some effect on the % of returns, and maybe we got a lower response rate than usual? Not sure how it would affect the results, but when you see such big divergences between the household and establishment surveys, you have to wonder.

The markets completely disagree with the author...

Being this late in a cycle and producing such lackluster employment numbers, should be a major cause for concern...

America at best, is within 24 months of the next recession or worse in one now...

Watch the Dow, watch the S&P 500 and forget the talking heads...We are within an one hundread point of a market correction..If markets continue the decline below 12,ooo, then there is an even stronger chance of a recession...

We have gone 100% cash as of three weeks ago...Watch the price of goo and Cu...The CRB Index continues its decline...

Global growth is stagnate at best...I do wish the bulls all the best; just remember, the rendering plants are at less than full capacity.

Our stock index of temp placement firms, show the index trading closer to it's 52 week low than the 52 week high...

Again, the stock markets is clearly showing it's concerns with temp employment numbers as well...

The US employment to population ratio in May 2012 increased for the second consecutive month -- more at:

http://wjmc.blogspot.com/2012/06/us-employment-to-population-ratio-marks.html

The US employment to population ratio appears to be improving, which is good news for workers.

PI, I agree with thee...

Dr McKibbin, how could that be with such soft employment numbers...?

A 160k hires are needed each and every month to maintain an even level...

I find the title to this thread as disturbing..Job growth is horrible to say the least, especially in this point of the cycle...

The markets and investors are resoundingly disagreeing with this opinion...

Moreover, this economic life cycle is coming to an end in the near future, so 69k new hires does not make the grade..

If anyone want to believe that over five million jobs were created in the last 24 months, then be my guest...217k new hires each month over the past two years - nuts!

Does this headline matter much?

"GDP Q1 2012 Revised Down To 1.88%"

Post a Comment