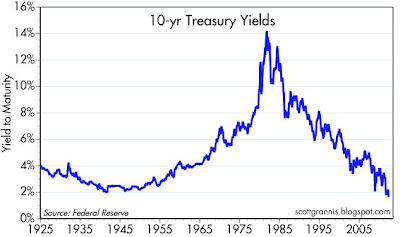

As shown in the top chart, 10-yr Treasury yields have never been lower than they are today (1.62% as I write this). Ordinarily, you would expect low Treasury yields to be a sign of low inflation and/or low inflation expectations, but this time around, that's not the case. As the second chart shows, forward-looking inflation expectations, as derived from the pricing of TIPS and Treasuries, are near the upper end of their 15-year historical range and have been rising of late. Forward inflation expectations are slightly higher than the increase in the CPI over the past year (2.3%), and about equal to the average annual increase in the CPI for the past 20 years. In other words, inflation and inflation expectations are alive and well, so the decline in nominal Treasury yields must be symptomatic of something other than inflation. It's also worth noting that real yields on 5-yr TIPS are -1%, and this means that investors are happy to lose 1% of their annual purchasing power in exchange for the privilege of avoiding what they fear will be even bigger losses on just about everything else over the next 5 years.

The only explanation that fits these facts is that the market is behaving as if economic growth is going to be severely depressed, but without having any negative impact on inflation. That alone is very unusual, since the biggest hit to growth in recent memory (the 2008-9 recession) also produced the lowest inflation expectations ever: 5-yr, 5-yr forward inflation expectations plunged to almost zero in late 2008. This makes sense, however, since the biggest thing happening on the margin is the sovereign debt crisis that is roiling the Eurozone. Europeans are extremely worried about a collapse of the Euro and a return to individual currencies (particularly the Drachma). The collapse of the Euro could bring with it a financial crisis like we saw in the wake of the collapse of Lehman Bros. in 2008, which in turn resulted in a sudden and deep global recession. Plus, it goes without saying that any spin-offs from the Euro are almost certain to result in substantial devaluations, and big devaluations invariably bring with them big increases in inflation.

So the threat of a euro breakup has raised fears of a deep recession accompanied by rising inflation, and with those fears in mind, 10-yr Treasuries yielding less than 2% look like a fabulous safe haven. Europeans are piling into Treasuries since they look like the only lifeboat that's likely to survive. Investors should understand that when the price of safety is extremely high, as it is today, then buying Treasuries in the expectation of making a profit will only work if the future ends up being even more catastrophic than what the market currently expects. By the same logic, buying anything risky in the expectation of making a profit will work as long as the future is less catastrophically bad than is currently expected. In other words, you don't need a robust economy to make money taking risk these days, you just need an economy that avoids disaster. Even a measly 2% real rate of growth in the U.S. economy would be like manna from heaven for investors in risky assets.

So how to explain the fact that, in the face of tremendous uncertainty and expectations of continued inflation, the price of gold (see above chart) has declined by 18% in dollar terms since last September?

My answer to that rather difficult question is that the market is beginning to realize that the massive central bank easings that we have seen over the past 5 years have not been nearly as inflationary and destructive as the market had feared. At $1900/oz., gold prices had incorporated enormous quantities of fear that have not yet been justified by reality. The future, in other words, has turned out to be much less dire than expected.

Even after its sharp decline since September, gold has risen by an annualized 14.6% since its low 13 years ago. That's a far cry from Apple's 45% annualized return over the same period, but it beats just about anything else you could hope to have owned. Gold has been priced to very traumatic conditions for quite some time. In real terms, gold today is worth about one-third less that it was at its very brief peak in mid-January 1980, which marked the worst of double-digit inflation fears and a collapsing dollar. But compared to its value at the end of January 1980, gold today is only down 19% in inflation-adjusted terms. In short, gold today is priced at levels that are roughly equivalent to the conditions that prevailed in early 1980, when the world feared recession, a collapsing dollar, and a continuation of double-digit inflation. Conditions might not be all that much better today, but they are almost surely no worse.

In inflation-adjusted terms and against a broad basket of trade-weighted currencies, the dollar is actually a bit weaker today than it was in early 1980, but inflation and inflation expectations are significantly lower.

If I had to sum up what all this means, I would say that the evidence of market prices points to a very high level of fear, uncertainty and doubt among global investors. Today's record-low 10-yr Treasury yield is just the latest sign that investors are consumed by fears. When emotions reach such heights, as they did in the early 1980s and in late 2008/early 2009, investors willing to bear risk stand a good chance of being rewarded, provided the future turns out to be less awful than the market expects.

17 comments:

Look around -- this is what depression looks like, albeit along Main Street USA -- the devastation of lives has only just begun -- my prayers go out to those who are economic suffering...

Thank you Scott for a well reasoned analysis. Here in Richmond, VA, things aren't looking so bad. Unemployment is 6.5%, housing has stabilized and in the elegant 1910 - 1920s Fan District of Richmond City very few homes are for sale now - the peak number appears to have been in 2009.

In Richmond, I don't sense all the anxiety which is present elsewhere. The restaurants are doing well and the Malls' parking lots are pretty full on the weekends.

But this is a financially conservative state, the state budget is in good shape and housing prices didn't go to the extremes as in other places in the Sunbelt - not even in Northern VA (NOVA) or Virginia Beach.

I know that some people are hurting and probably quite a few a still under water on their recent home purchases, but there is scant evidence of Depression.

Best,,,William

Thanks, William. Here is So. California there are surprisingly few homes for sale, and I'm hearing from a variety of sources that prices are no longer falling and even firming in some areas. Life goes on almost as before, with plenty of traffic at rush hour. The most popular restaurants in San Clemente (Nick's and South of Nick's) are almost impossible to get into any night of the week before 8:30. And considering this is California, "The Land of Fruits and Nuts," that is impressive.

Big cities in general are doing well as that is where the jobs are. But these city folk are not necessarily buying risk assets either. Californians pretty much ignore state problems thinking adjustments to taxes and budgets will take care of everything. We will see.

Scott so often has a good angle on things. Very helpful. I agree that stocks will rally with simply a recognition that a recession will not happen, should that be the case.

My favorite stock market analyst - Micheal Gayed - really stuck out his neck today to continue a call he made earlier in the year for a major "reflationary" period in the markets the rest of this year. He's called both the major market movements the past year - the crash last summer (which he began predicting in the spring) and the fall melt-up, which he predicted just before it began rising in late September.

Think stocks can’t rise 40% in 2012? Think again

Related to what Scott was saying, his thesis is that the bond market is so depressed it's acting as if a Lehman-type event has already occurred, even though the stock market has held up halfway decent. Since a Lehman-type event *hasn't* occurred, this likely means the bond market is wrong and the stock market is right (usually it's the other way around when they conflict), and thus the probability of a major correction involving a bond market crash and a stock market boom are high.

Unknown said...My favorite stock market analyst - Micheal Gayed..."

Good luck following his "advice". He is all-over-the-place - but mostly carefully covering his behind.

Besides, he is way too young to know what is truly going to happen in this most difficult market.

@William,

He is neither a bear nor a bull, is not afraid to change his mind on a dime if that's what the markets do, and he's said so. I believe he even repeated that in his article today. I've often thought he's a bit quick to call a new trend, which has made him early in some of his calls, and he probably writes a bit too often, making comments which sound like he's changing his mind when he really isn't, but instead is just noting that conditions have changed, but appear to be temporary. This is what seems to annoy a lot of people. Some people seem to get annoyed at someone who don't have long-term horizons. He only makes short-term market predictions (like, months, or a year at most).

But in spite of those faults, he's called all of the major market movements for the past year. His timing wasn't always perfect, but timing is a very difficult thing to do anyway. On Seeking Alpha I was discussing Operation Twist with him recently, and he admitted his Spring Switch might turn out to be more of a Summer Switch. Obviously the current correction has gone on longer than he anticipated.

Still, I admire a guy who's willing to change his mind if conditions warrant, and is equally willing to admit so.

Have you contemplated Wall St. realizes bonds are the only game in town right now?

Why take additional risk when you can borrow from the Fed on the cheap, buy treasuries and sell them back to the Fed at a profit.

This was predicted by some (Antal Fekete comes to mind). What we are seeing is not an irrational expectation of the future, but rather a rational exploitation of the present.

The end result is disastrous all the same...

"Why take additional risk when you can borrow from the Fed on the cheap, buy treasuries and sell them back to the Fed at a profit."

What happens when the Fed is no longer buying many treasuries?

That's what will happen when OT ends next month.

Last year I mostly jokingly stated "buy TBT at $15?" Now that we are actually at that level I am thinking that if any kind of Euro panic ensues, we could be in the $12 range rather quickly.

Amazing....

Scott, it's early in the day for me after a 600 miles drive, but the following portion of your post is confusing to me, so can you please explain:

"In real terms, gold today is worth about one-third less that it was at its very brief peak in mid-January 1980, which marked the worst of double-digit inflation fears and a collapsing dollar. But compared to its value at the end of January 1980, gold today is only down 19% in inflation-adjusted terms. In short, gold today is priced at levels that are roughly equivalent to the conditions that prevailed in early 1980..."

If the real price of gold is down 1/3 what it was in 1980, how can it also be down -19% and how can that be "roughly equivalent" to 1980?

I'm sure you've got it right, but I'm not understanding. Please help.

At the peak of the Great Depressioon in 1933, 75% of Americans had a job -- the parellels to today are eerie -- the key to making in today's Main Street depression is to keep a job and stay in the 75% crowd of Americans who are still working -- jobs are scarce these days, and scarcity adds value -- keeping a job is the first priority of working Americans in order to navigate today's troubled waters -- the same is true along the southern flank of Europe -- having a job is survival at this point -- and again, I pray for those who are suffering economic hardships everywhere.

As for what is happening in the US economy, the numbers reported by Scott above speak for themselves -- I get it -- I can make money in this economy...

PS: All eyes should remain on California -- either California will dramatically raise taxes early next year, or California will dramatically cut spending -- other states in the US will follow California's lead...

Re gold: Gold hit a peak of $850 in mid-January 1980, but it was very short-lived. The average for the month was $675, and it closed the month at $653. If you throw out the very brief peak and use the month-end value, then in today's dollars, gold today is down only 19%. That's almost a rounding error in my book.

Unknown,

When the music stops, the banks will sell the cr*p out of treasuries. The Fed is helpless which is why it will keep buying bonds until the game is officially over.

They are pulling on levers disconnected from the engine...

Puffer, we were thinking the same thing..We took a position at 19.14 and closed out at 18.40...

If we get a 1% yield on the 10 year, TBT will be trading at 10...

Post a Comment