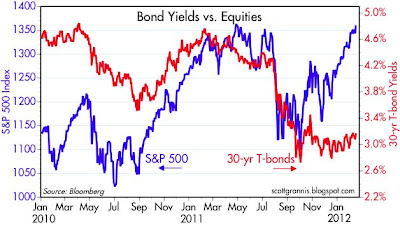

I'm always on the lookout for valuation discrepancies, and these two charts highlight the biggest potential discrepancy that I'm aware of today: Treasury yields are very low given the strength of the economy and the level of inflation. Stock prices are rising because the economy is proving to be somewhat stronger than expected. Inflation is not dead—it's been rising for the past year—and it now is close to where it's been for the past decade, around 2-3%. Yet bond yields are near all-time lows and are priced to the expectation that the economy will be chronically weak and inflation will move towards zero.

There are of course three valid explanations for why Treasury yields are so low despite the improvement in the economy and the outlook for 2-3% inflation (i.e., the market is not entirely crazy): 1) the Fed keeps insisting that it will keep short-term rates near zero for the next three years, 2) the Fed, via its "Operation Twist," is actively attempting to keep Treasury note and bond yields low, and 3) the world is willing to pay very high prices for the safety of Treasuries given the threat of Eurozone sovereign defaults and the potential demise of the Euro.

However, those rationales could evaporate very quickly, if a) the Fed becomes convinced that the economy is doing better than expected and there is little risk of inflation being too low, and b) the Eurozone survives a Greek default without any significant collateral damage. I think there is a reasonable chance we could see both of those developments within a reasonable time frame. Thus I view Treasuries as very risky investments, while equities remain relatively attractive, underpinned by relatively low PEs and strong corporate profits.

UPDATE: There appears to be some confusion regarding the market's expectation of future inflation, and I should have made that clear in my initial post. The best measure of expected inflation that I know of is that which is derived from the pricing of TIPS and Treasuries. And the Fed agrees, having annointed the 5-yr, 5-yr forward inflation expectation implied in TIPS and Treasury prices as the "best" measure of the market's inflation expectations. I show that in the chart below, with the current reading being about 2.5%. On a longer-term basis, the expectation for average CPI inflation over the next 10 years is about 2.25%. Both of these expectations are very close to what inflation has averaged in the past 5 and 10 years, so there is nothing unusual in today's expectations for the future.

You can see the same pattern in this chart as in the charts above: 10-yr yields are trading substantially below the level that has prevailed in the past, given current inflation expectations. No matter how you look at it, Treasury yields appear to be artificially depressed. And from my perspective, the pressures for higher yields are building daily.

16 comments:

Well, Scott Grannis forgot his premise might be wrong: The market does not have an outlook for 2 percent to 3 percent inflation.

The market is anticipating inflation sub-2 percent, or even a Japan scenario (perma-deflation recession).

Any number of solons have been crying inflation, from Bill Gross to Richard Fisher. And they have been consistently wrong. In fact, the CPI may overstate true inflation, and the market is adjusting for that as well.

As pointed by Krugman and Carpe Diem (Perry), inflation looks like it is again turning the corner--downward. Possibly to deflation again.

Yesteryear's hoary shibboleths about inflation and interest rates may no longer apply.

Thanks to Mr. Grannis for this awesome post. The treasury market indeed is in a state of irrational exuberance. As Mr. Greenspan's famous 1996 remarks prove, it can stay irrational longer than most participants expect. Eventually, it will return to normal and that means higher rates. BTW the futures markts show that people expect the FED to raise rates earlier than they stated the last time.

This link from Cleveland Fed ten year inflation forecast.

Cleveland Fed Estimates of Inflation Expectations

Hint: Less than you'd think. We all remember the late 70's, and keep looking for it to repeat.

According to Carpe Diem, Dr Perry, Cleveland Fed, expected inflation is the lowest in 30 years.

Expected inflation according to the pricing of TIPS and Treasuries is consistent with past experience. I don't know of any shortcomings in this. The 5-yr, 5-yr forward expected inflation rate today is 2.5%. The 10-yr expected inflation rate based on 10-yr TIPS and 10-yr Treasuries is about 2.3%.

Sir,

As you keep highlighting inflation is an ongoing problem. The Fed cynically believes it can manage this damaging, stealth inflation by conveniently switching its favorite metric. They started with a sub 2% core PCE and have slowly switched to a headline PCE north of 2%. A half dead real estate market is giving them cover for now but that may not last much longer. The Fed's stated policy is to inflate. Why so many deny that reality is beyond me.

Long term chart of Tips based 10 year inflation expectations http://bit.ly/zqrtgj

Anyone claiming that those expectations are at any kind of historic low is misrepresenting reality.

Scott --

Just out of curiosity, how much more divergence between bond yields and equities (or some other measure of bond exuberance) would you have to see before you would be tempted to take a short position on treasuries?

I use a relative strength model between TLT and TBT to tell me when to short treasuries. It has been long TLT since 4/26/11. There

are lot of investors expecting the

great rise of treasury yields and they have slaughtered over the last 3 years. TBT has lost 57% over the last 3 years. I agree its

time will come but would rather use

momentum indicators to tell me on this trade.

Interesting post. However, I suspect the inflation story is fairly simple: no serious inflation without wage growth.

Plus, the KISS rule is not in effect. The global economy is more complex, uncertain, and fraught with danger. Proceed with caution.

Treasuries remain popular because they are simple, predictable.

The good news is that the ongoing Main Street depression is an investment opportunity for long-term investors -- high quality (i.e., occupied) real estate can be purchased at a deep discount assuming the offer is cash -- also, dividend-paying stocks are still on sale in the secondary markets -- now is the time to exploit the Main Street depression by converting cash into high quality equities -- skills are also still earning premium wages along Main Street -- whatever the outcome of the Federal macroeconomc shake-down is irrelevant as high quality equities stand to earn outstanding returns regardless of whether the economy enters deflation, inflation, or stagflation -- now is the time to think with your "Main Street hat" and to put one's "Federal hat" away for a while -- the Federalists will soon find their world at risk as dollars dry up to pay public sector workers, and to subsidize Wall Street and unionized labor manufacturing -- all signs along the Federal front are horrific with real potential for decreasing Federal budgets, defense spending, and entitlement spending -- today's "deals" are all related to the much neglected and maligned Main Street row of opportunties, which are available now at bargain basement prices -- now is the time to buy Main Street, includign products and services that cater to Main Street -- now is not the time to bank on Federal bailouts, spending, and subsidies, which are all likely to collapse in the coming years -- the best place to "take cover" now is along Main Street...

Hi Scott, I would like to re-publish your commentary on two sites that I have recently launched focused on the fixed income space. I realize that this comment will be posted on your blog - so I will not mention the name of the sites. Could you contact me via e-mail to discuss mzprosser@gmail.com.

Best regards,

Marc Prosser

LIPPER FUND FLOW REPORT

(this includes ETFs)

4th Quarter 2011 -

Equity Funds Outflows of $41 Billion

Taxable Bond Funds Inflows of $40.4 Billion

Entire Year of 2011 -

Equity Funds Outflows of $50.4 Billion

Taxable Bond Fund Inflows of $178 Billion

Scott, could you remind us or post a link to a post where you explain how the expected inflation is calculated given the two bonds?

Re expected inflation: the simplest method to calculate expected inflation is to subtract the real yield on TIPS from the nominal yield on a Treasury of comparable maturity. For example, today the 5-yr Treasury is yielding 0.92%, and 5-yr TIPS have a real yield of -1.29%, for an expected inflation rate of 2.21%.

Post a Comment