Thursday, November 10, 2011

Oil prices remain firm

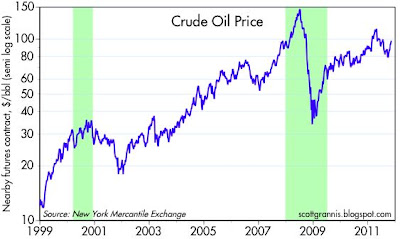

If the price of crude oil tells us anything about the resilience and underlying strength of global demand, then it would appear that the global economy is doing just fine—no sign here of any collapse in demand. On the contrary, crude oil futures prices are up almost 30% since Oct. 4th, which also marked the year's low for equity prices.

The agonizing over Europe is over what might happen if Greece and Italy default, but to date the evidence from real-time prices suggests that day-to-day activity, around the globe, remains unaffected.

This is consistent with what I argued in this post from last July, namely that debt defaults do not destroy demand: they mainly result in a wealth transfer from lenders to debtors, and "much of the disruption that can be expected from debt problems has already happened."

Subscribe to:

Post Comments (Atom)

10 comments:

Deleveraging is painful (especially for creditors) but not damaging--unless central bankers magnify problems by not goosing economies with lots of fresh supply.

If central bankers engage in pompous pettifogging about inflation while asset values collapse--then look forward to years of gloom.

Totally agree, but of course BRIC country now account for half the world oil demand, up from 20% a decade ago. So yes growth continues, just not around here

Haven't we had 9 quarters of growth in the US? Slow growth, but growth nevertheless.

If BRICs are still enjoying very strong growth, this can only be good news for the US and Eurozone economies as well. The more the BRICs grow, the more they must inevitably buy from the rest of the world. What's good for the BRICs is good for the world.

why don't you take a look at the metal you used to love - dr. copper. you always pick what pleases your eyes.

Copper is doing just fine at $336 today, which is better than its 5-yr average price of $322.

Prag,

Scott had a detailed comment on copper and other commodities on Oct. 2.

Scott,

Are you worrid about Apple?

Bill: not in the least

Exactly, barely above 5 year average. What does it tell you about growth?

The other piece carries the same bias. When commodities are up, they point to economic growth. When they are down, it's all because of the damn speculators. Heads you win, tails I lose. It's a perfect world.

Post a Comment