Friday, July 29, 2011

Reading the bond and stock market tea leaves

Today's deeply disappointing GDP report has helped 10-yr Treasury yields to their lowest level of the year, and there's little doubt that the problems Congress is having over increasing the debt limit are contributing to the market's malaise. As my chart suggests, the current level of 10-yr yields is indicative of a market that expects a recession. The last time yields were this low or lower the market was last summer, when concerns about a double-dip recession were rampant.

10-yr yields are strongly influenced by the market's expectation of the future path of the Fed funds rate, and with the economy so weak and expectations for future growth so dismal, the market is now expecting the Fed to keep rates near zero throughout this year and most of next year; in fact, the market currently doesn't see much chance of any meaningful Fed tightening until the first half of 2013.

Are the bond and stock markets out of synch? Bonds are priced to a recession, but the S&P 500 is only 5% below its recent highs, and over 20% above last summer's lows.

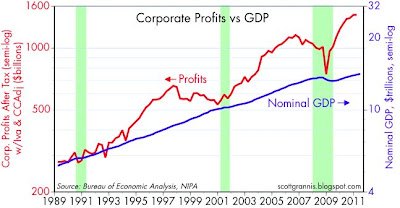

These two charts help explain what's going on. As a result of the recent revision to the past several years of GDP, corporate profits were revised to be much higher than before. First-quarter after-tax profits (which are based on corporate tax filings from the IRS) are now reported to be running at an annualized rate of almost $1.45 trillion, compared to the $1.26 trillion previous estimate. Relative to GDP, corporate profits are now at a new all-time high. Even though the recovery that began two years ago has been downright dismal, corporate profits have surged by almost 50% to record-setting highs.

Using NIPA profits as a proxy for all corporate earnings and the S&P 500 index as a proxy for the value of corporate equities, I've constructed the chart above. This shows that PE ratios have rarely been so low in the past 50 years. The market may be depressed by the economic outlook, but it's hard to ignore $1.5 trillion of corporate profits. If anything is sustaining the level of equity prices today, it's profits, not optimism. As a result, for those who believe that the debt limit will be raised and fiscal policy will improve—even marginally—current valuations represent real bargains.

Subscribe to:

Post Comments (Atom)

23 comments:

40% of the profits from the S&P

500 are derived from abroad....

I think brodero's point about the increasing percent of S&P 500 corporate profits bering derrived from abroad is at the root of their record high relative to GDP. I wonder, however, if this also makes those profits less valuable (in terms of forward projections) due to their greater exposure to currency fluctuiations?

I don't think the source (domestic or foreign) of profits is really that important. But foreign profits that haven't been repatriated haven't paid tax, so this would argue for discounting foreign profits by some amount.

I want to take a moment and express how impressed I am that Boehner did not revert to the use of earmarks to try and buy votes for his proposed debt ceiling compromise (yesterday). I am also very proud of those members of congress that refused to sign on to a compromise that does not address the fiscal crisis we are facing in the years ahead. I am still skeptical that this nation is prepared to accept its fiscal reality, but at least 25 or so members of the house did yesterday and that is something.

brodero is right. Compare the corporate profits as a % of GDP chart to a trade-weighted dollar chart over the same time period.

Or to a chart of the 10-year yield for that matter.

I don't understand the concern with profit from abroad.

I'd think German, Japan, China and other export oriented countries are in similarly situations too. I've never heard of a country complained that they made too much money from the rest of the world. The rest of the world has complained but that is different.

Maybe brodero and others who are concerned could elaborate?

Terrific set of charts by Scott Grannis, and excellent analysis.

We will see what happens between the GOP nihilists and the lazy big spenders of both parties.

I am not sure the bottom of a recession is the time to start balancing the federal budget, but since the budget was not balanced in good times during reagan, Bush and Bush jr. maybe this is the best we can do.

Side note: If having a D-Party president can convert the R-Party to fiscal responsibility, I propose a permanent D-Party president, and a permanent R-Party Congress.

Re: corporate profits. The profits shown here are domestic profits, which contribute to GDP.

"Re: corporate profits. The profits shown here are domestic profits, which contribute to GDP."

Ah, my bad.

My main point is the denominator should

be a combination of U.S. GDP and

World GDP....

Is that profits due to cutting costs? I highly doubt these are profits due to growth. If there is growth - where?

Did you see the export numbers...

all time high...

2011 02 2096.5

2011 01 2024.1

2010 04 1935.3

2010 03 1860.6

2010 02 1813.8

2010 01 1749.5

2009 04 1699.0

2009 03 1590.3

2009 02 1520.8

2009 01 1522.2

2008 04 1711.1

2008 03 1933.8

2008 02 1922.8

2008 01 1819.3

2007 04 1761.8

To Benj,

Barrons' Leslie Norton interviews Morgan Stanley's Robert Feldman re Japan's deflation and debt issues in this weekend's issue. Thought you might find it of interest.

To Scott,

Am enjoying your many posts. You are a continuing source of terrific information and opinion. Much thanks.

Scott,

Why is GDP so meager when we've been getting good ISM numbers for the past several months? Does this suggest ISM is wrong?

John-

Please too your horn in here more. I may disagree with what you say, but I always look forward to your thoughts.

John-

I read the Barrons-Feldman piece. Man oh man, the last thing we want to is do a japan. They can't get out! They are trapped.

Feldman says we will not have deflation. "The key thing is, will the U.S. enter deflation or not? I think the answer is no. The likelihood of the U.S. falling into a Japan-like situation is low."

O hope he is right. But either the reporter didn't ask or Feldman didn't say why we won't and do not now have deflation.

From where I sit, I see commercial real estate at 2001 prices, the S&P 500 at 1999 prices, unit labor costs flat to down, office rents in Los Angeles at 1980s levels, and most real estate still headed down. Mark Perry just ran a post that house prices in Miami are down 10 percent in last year on good sales volume. This is inflation? It is a new kind of inflation in which major living and business costs go down.

We had CPI drop in June despite a 35 percent run-up in energy costs in the 12 months YOY. With fuel hitting plateau, the midget run-up in general prices is over (I think).

Add to that, many conservative economists have stated the CPI overstates inflation by perhaps one percent--meaning the CPI core for last 12 months YOY is under one percent!

Friends, we have outsourced Fed management to the Bank of Japan. At least that is what i gather , looking at the numbers.

The supply siders are in charge. Have been for awhile.

Mr. Bernanke-san: Thank you for taking us to Japan. Now we can enjoy ever-declining asset prices, and no inflation too.

True, my retirement plans are shot to hell, but hey--at least I know I can buy trinkets for the same price next year.

"For instance, this morning the yield on 5 year T-notes fell to 1.28%, the lowest rate I’ve ever seen on 5 year bonds. This is the market forecast of future rates, and an implied prediction that rates will be at zero for much longer than Fed officials believe. Here are recent monthly averages from the St Louis Fred:

2011-06: 1.58%

2011-05: 1.84%

2011-04: 2.17%

2011-03: 2.11%

2011-02: 2.26%"

The above is from Scott Sumner. I would say the market sees about zero inflation ahead.

Japan, here we come. Thank you Mr. Bernanke-san.

The economy is not a fixed pie where foreign growth detracts from US growth. On the contrary, global growth aids US growth through increased trade!

Good data. Question on C&I loans: do those show the book value of loans made? Anecdotally, it seems like loans are declining. Much of bank headline loan growth has been due to acquisition, not new loans. I am just wondering if that improvement is just an accounting improvement, e.g. a result of reversing writedowns, as opposed to a pickup in lending.

Lantern: this data represents outstanding loans on the books of all U.S. banks. Total loans are definitely on the rise.

This is not exactly the market reaction I expected to a debt ceiling agreement.

Ouch.

Post a Comment