A quick update on M2, GDP, and interest rates:

There is still a "surplus" of M2 money, but it is shrinking every month. Higher interest rates have boosted the demand for money, in effect neutralizing the declining M2 surplus. We know this because all indicators point to a significant decline in inflation, especially when measured at the margin (year over year growth rates can be very misleading when important changes in trends are occurring). High interest rates discourage borrowing (banks expand the money supply by lending), encourage saving and discourage spending (holding onto all that M2 keeps it from getting spent).

Inflation is not driving interest rates higher—the Fed is. Real interest rates on TIPS have surged to levels not seen since before the Great Recession. This is a sign of monetary tightness, as is the recent weakness in gold prices, the strength of the dollar, and well-grounded inflation expectations. It may also be a sign that the market has become more confident about the outlook for the economy. There's one thing that has the market worried, however, and that's the risk that the Fed will keep on pushing rates higher than they need to be.

Inflation is not driving interest rates higher—the Fed is. Real interest rates on TIPS have surged to levels not seen since before the Great Recession. This is a sign of monetary tightness, as is the recent weakness in gold prices, the strength of the dollar, and well-grounded inflation expectations. It may also be a sign that the market has become more confident about the outlook for the economy. There's one thing that has the market worried, however, and that's the risk that the Fed will keep on pushing rates higher than they need to be.

The BEA today released revised GDP statistics going back many years. Real (inflation-adjusted) GDP is now measured in 2017 dollars (before it was 2012 dollars), and the revisions show it has been growing a bit faster since 2009 than we thought (before it was 2.1% per year, now it's 2.2% per year). The much-feared recession (I've lost track of the many recession forecasts that have fallen by the wayside over the course of this year) has yet to appear, and I still see no signs that it is imminent or likely in the near future.

Chart #1

As Chart #1 shows, M2 has fallen by almost 4% since its peak in the summer of last year. The "gap" between M2 and its long-term trend growth of 6% per year since 1995 has now shrunk by half and looks set to continue shrinking. When M2 first surged there was no increase in inflation because the demand for money in the first phase of the Covid lockdowns was intense—fear was rampant, and it was difficult to spend all the money that was being showered on the public in the hopes it would forestall a depression. But as the economy began to open in early 2021, the demand for money began to fall and that fueled a surge in inflation—demand for goods and services outstripped the supply. The Fed failed to react to this dynamic at first, (saying inflation was just "transitory") but then began tightening in earnest in early 2022.

Chart #2

Chart #2 is evidence that the surge in M2 was caused by excessive, debt-fueled government spending. M2 surged just as the federal deficit surged. Declining deficits removed the source of M2 growth beginning in early 2021. We are fortunate that the second surge in deficit spending, which began about a year ago, has not resulted in any increase in M2. Deficits are no longer being monetized. Thank goodness. And so far, there has been no return of Covid panic.

Chart #3

Currency in circulation comprises about 10% of M2. As Chart #3 shows, currency growth also surged in the wake of Covid, only to retreat. The excesses of the Covid era are fading.

Chart #4

Chart #4 shows the growth of real GDP (blue line) as it compares to two different trend rates of growth (green and red). From the 1960s until 2007, real GDP grew on average by about 3.1% per year. Following the Great Recession, it has only grown by about 2.2% per year. What caused such a huge change? I think it is the result of 1) excessive government regulation and spending, 2) higher tax burdens, and 3) increased social welfare spending (transfer payments). Whatever the cause, the economy has experienced sub-par growth for over two decades. Things are unlikely to improve unless we reverse the causes of sub-par growth, and that's not about to happen anytime soon.

Chart #5

Chart #5 shows the quarterly annualized rate of growth of the GDP deflator, which is the broadest and most timely indicator of inflation available. During the second quarter of this year, prices throughout the economy rose at a mere 1.7% rate, well below the Fed's professed target. Memo to Fed: pass this chart around the office!

Chart #6

Chart #6 looks at the level of 5-yr real and nominal yields, and the difference between them (green line), which is the rate of inflation the market expects to prevail over the next 5 years. Inflation expectations are well grounded, and have fallen in the past year or so—thanks to the Fed's decision to jack interest rates up. One important conclusion thus appears: interest rates are higher not because of inflation fears, but because of the Fed's actions. And the Fed's actions appear to be driven meaningfully by mistaken worries that the economy might prove to be too strong and thus inflation might remain too high. Balderdash: the economy is still experiencing sub-par growth even as inflation has plunged. Growth didn't cause inflation, deficit spending that was monetized did, and it's not happening anymore.

UPDATE (Sept. 29):

Chart #7

Chart #7 shows the 6-mo. annualized change in the Personal Consumption Deflator and its Core (ex-food and energy) version, both of which were released this morning. The former is a broader measure of inflation than the CPI, and its weightings change dynamically as the economy changes (not so with the CPI, which is why it is a flawed measure). It is up at a 2.6% annualized rate. The latter is the Fed's favorite measure of inflation, and it is up at a 3.0% rate; but on a 3-mo. annualized basis, it is up only 2.2%. Inflation is rapidly approaching the Fed's target—why can't they acknowledge this? Why is the market so nervous?

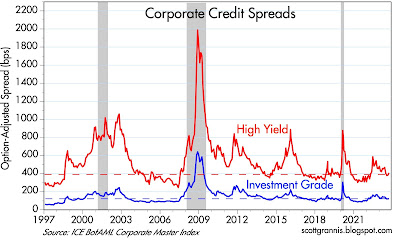

Chart #8

Chart #8 shows credit spreads for investment grade and high-yield corporate debt, as of yesterday. By any measure, credit spreads are relatively low, and that implies a healthy economic outlook. There is no sign whatsoever here of an impending recession. This chart also directly refutes the idea—apparently embraced by our addled Fed—that economic weakness is necessary to bring inflation down. Since inflation peaked in mid-2022, investment grade spreads have fallen from 171 bps to 123 bps, and high yield spreads have fallen from 600 bps to 409 bps. Both of those declines imply a much-improved economic outlook at the same time as inflation was falling from 8-9% to less than 3%.