Today the bond market is convinced that there will be no more Fed rate hikes. Yet the Fed insists that inflation has not fallen by enough, so that warrants continued monetary restraint; some governors even argue that further rate hikes might be necessary, even as evidence of economic weakness builds. Chalk this up to one more example of how the bond market is usually smarter than the Fed. Fed mistakes like this have been the proximate cause of every recession in my lifetime. This is yet one more reason why individuals—and especially committees like the FOMC—are never as smart as they should be. By extension, bureaucrats are rarely smarter than the collective wisdom of those they are supposed to oversee. Which is why at heart I'm a Libertarian—government should be limited as much as possible.

Simple logic says that if inflation is clearly decelerating, no further rate hikes are necessary. When you apply the brakes when approaching a red light, you don't take the pressure off until after you've stopped—you start easing up before you come to a stop. The evidence in the charts that follow make a strong case for rate cuts starting NOW, because inflation has already declined by enough.

Chart #1

Chart #1 compares the year over year change in the CPI (red) to the 6-mo. annualized change (blue). When inflation dynamics change, that show up first using a shorter time frame. Compared to a year ago, prices are up about 5%, but over the past six months, the CPI is rising at only a 3.3% rate. In the current disinflationary environment, it is essential to look at the rate of change in prices over a shorter time frame— one year is too long.

Chart #2

Chart #2 compares the 6-mo. annualized change in the CPI to the same change in the ex-shelter version of the CPI (shelter costs account for about one-third of the total CPI). Over the past six months, CPI less shelter is up at a mere 1% annualized rate.

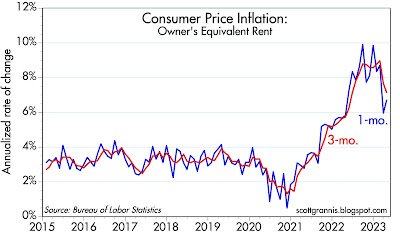

Chart #3

Chart #3 shows the 1- and 3-month annualized rate of change in Owner's Equivalent Rent, the main component of shelter costs in the CPI. By either measure, shelter inflation has peaked and is beginning to decline, but only very recently.

Chart #4

If the Fed doesn't ease up on the monetary brakes soon, we could be seeing some deflation before too long.

Chart #5

Chart #5 shows inflation at the producer level (the first part of the inflation pipeline) over the last year and the last 6 months. Inflation by this measure has collapsed to a mere 0.6% over the past six months!

Chart #6

Chart #7

Charts #6 and #7 are the most important charts that hardly anyone is looking at these days. What they show is that our recent surge in inflation was caused by a surge in deficit spending from 2020 through 2021. As much as $6 trillion of Covid "emergency" spending was effectively monetized, as it accumulated in the nation's savings and deposit accounts (M2). Once people started to spend the money, beginning in early 2022, inflation took off. A ton of extra money was printed, and about a year later, inflation started to rise. Now that the extra money is disappearing, inflation is slowing significantly.

The best news here is that the third round of deficit spending that began last summer, and has now pushed the 12-month deficit from $1 trillion to almost $2 trillion, has not been monetized at all. This all but ensures that inflation is on its way out. The fires of inflation have been extinguished; only embers remain, and they are already flickering out.

How long before the FOMC realizes all this?

43 comments:

Hello, dear Scott!

Thank you so much for your posts! You make difficult things simple)

It off top, but what you think on growing amounts of US debt - it grows more and more, overwhelming in pace any income to budget. Look like it will never end and debt/GDP ratio will grow to the skies and it will take 20-30-40% of budget only to pay the %% not decreasing its huge amount. I guess may be here we have some misunderstanding from the public to the issue. It will be very interesting to hear from you on this.

And again thank you so much for your job and desire to share so priceless information, huge respect!

See: https://www.economist.com/finance-and-economics/2023/03/21/americas-banks-are-missing-hundreds-of-billions-of-dollars

When the reverse-repo facility was set up, Bill Dudley, then the president of the New York Fed, worried it could lead to the “disintermediation of the financial system”.

The FED doesn’t know a debit from a credit.

https://www.nytimes.com/2023/05/06/business/dealbook/bank-crisis-shadow-banks.html

“The I.M.F. has called for tougher regulatory oversight, and U.S. Treasury Secretary Janet Yellen said last month that she wanted to make it easier to designate nonbanks as systemically important,”

The Austrian Business Cycle theory is bunk. Recessions are generated by nonbank disintermediation.

There was a key incremental shift in FED policy this week, hinted at by FRB NY President John Williams, and confirmed by former FRB NY President Bill Dudley:

See below for thread:

https://twitter.com/thecarter758/status/1657180397396951040?s=46&t=RMHlxkwcr5wESIDLrpx9og

It’s hard to be impressed by these “new” policy pronouncements. This is the same Fed that dismissed the huge rise in inflation just a temporary phenomenon. As long as the Fed fails to focus on the money supply and money demand they will make mistakes. Wage growth does not create inflation, for example. Neither does the unemployment rate. Inflation is all about money supply and demand.

Alex Mark, re huge debt burdens. Repaying the debt is not like flushing money down the toilet. It simply takes money from taxpayers and gives it to bond holders. The problem with debt is when it is issued for nonproductive purposes, as happened in 2020-2022. That amounted to a gigantic waste of the economy’s precious resources, by hobbling the economy’s ability to grow in coming years. We’ve already paid a huge price for that debt in the form of inflation.

I recommend reading this post of mine from Dec. ‘12:

https://scottgrannis.blogspot.com/2012/12/debt-musings-and-misconceptions.html

In this same vein, I can’t resist mentioning climate change hysteria. The world has undoubtedly wasted many trillions of dollars on green energy initiatives. These initiatives invariably involve subsidizing, in one form or another, projects and investments that are inefficient. They are inefficient because without subsidies they could not compete with, for example, fossil fuels. It’s equivalent to saying we are going to artificially increase the cost of energy to everyone. That is equivalent to a tax on growth, or a headwind to growth. We have been investing in things that will not produce economic gains.

And as anyone who has studied the topic of climate change should know, the ultimate rewards to attempting to reduce CO2 emissions are difficult if not impossible to quantify. Most likely they are much less than the future cost of adapting to whatever climate changes may occur in the next 30-50 years.

Agree. Agree.

What counts is the spending, not the money supply. It's spending / quantity of goods that equals inflation. Spending with credit or spending with cash, it's all tthe same.

We have the wrong President for these times, whether it's government spending, student loan forgiveness or his illogical climate change fetish.

Jim: What counts is money that is created that is in excess of the money that is demanded. Excess money inevitably leads to too much spending, and that is what causes inflation.

chart #7 is very interesting, thanks for that. but a question, Scott

have you looked at the inflation in the late 70s early 80s period? I dont recall that being driven by monetary policy, but rather by the OPEC oil price shock. was there money printing during then?

During the decade ending in 1964 aggregate monetary demand, the volume and velocity of money, increased at an annual compounded rate of about 6 percent. In the subsequent 9 years, the increase was more than 13 percent, and in 1972-73 nearly 30 percent.

I.e., the FED more than validated OPEC's administered price hike.

The Federal Reserve (BOG), under Chairman William McChesney Martin Jr., re-established WWII stair-step case functioning (and cascading), interest rate pegs thereby using a price mechanism (like President Gerald Ford’s: “Whip Inflation Now”), and abandoning the FOMC’s net free, or net borrowed, reserve targeting position approach (quasi-monetarism), in favor of the Federal Funds “bracket racket” in 1965 (presumably acting in accordance with the last directive of the FOMC, which set a range of rates as guides for open market policy actions).

The effect of tying open market policy to the FED's Funds rate (or some policy peg) was to supply additional (and excessive) complicit reserves to the banking system whenever loan/investment demand (i.e., bank deposits), are increased. And the pressure was always on top of the bracket during this period (the monetization of time deposits).

Scott, we're blessed to have you share your analysis. Thank you, once again, for the effort you make to share your thoughts.

I personally feel that over the last 13 years of reading your posts I've received the equivalent of a BA in economics. Hmmm, likely from a better professor than any college can provide.

We had inflation of 12% for a year (against a Fed target of 2%). It makes sense that we have 1 year of -10% deflation (or 2 years of -5% deflation) to get back to normal. Deflation is a GOOD thing.

Outstanding analysis. I nominate Scott Grannis to be chair of the Federal Reserve.

The more Scott's comments and analysis can be shared with the governors at the Fed and elected officials who can influence the Fed, the better.

In particular, I think the charts showing the inflation trends excluding housing/shelter/OER are particularly valuable. Arguably, the most significant negative impact of the Fed's rate increase (and much higher mortgage rates) is the sharp drop in housing starts and construction in the past year. To ease the inflation/pressure in the housing market, we need more supply of housing, a lot more.

In looking at a chart of housing construction over the past 14 years, ever since the global financial crisis, it is clear that we have a deficit of around 1-2 million units. Lower rates will stimulate more supply and ease the inflationary price pressures that developed from the covid response (people want more space) and the structural deficit. The Fed's excessively high interest rates directly hamper the creation of new housing supply. They need to cut rates ASAP, probably to 4% and then to something near 3.0-3.5%.

Beyond this, there are hidden/unknown risks that are almost certainly building with rates at 5%+. More bank failures are an obvious and important risk, but there are others out there. Maybe it is something like the 1998 LTCM crisis or a sovereign default. The unknown risks are building.

Again, I nominate Scott Grannis to be the next chair of the Fed, ASAP.

Paul Tudor Jones said: "inflation has been declining for 12 straight months and “that’s never happened before in history.”

I think Jones was saying they were decelerating.

Monetary policy is too tight:

https://fedguy.com/probing-lclor/

In the simplistic, popular world, interest rate policy/control would indicate that "monetary policy" (read "interest rate policy") is pretty loose. (Fed Funds vs whichever short term rate you like to use).

Just an amateur observation:

I don't usually look at the "social/personal" aspects of political and other policy makers' statements, but I think J. Powell's recent situation and statements are interesting.

From what I know, Powell is worth hundreds of millions of dollars, so he doesn't need the job. He is doing "public service". In recent statements he has mentioned what his staff has told him (e.g. about transitory inflation, recession probabilities), and gone out of his way to say that his position may differ from his staff.

That is the statement of somebody who is trying to protect their reputation/legacy. I think he wants to be Volcker, so expect a lot of economic damage before he "pivots".

Powell thinks banks are intermediaries between savers and borrowers. But it is a fact, that every time a commercial bank buys securities from, or grants loans to, the nonbank public, it creates new money, somewhere in the payment's system.

So, bank-held savings are stagnant, lost to both consumption and investment, indeed to any type of payment or expenditure. And increase in bank CDs adds nothing to gDp. I.e., banks don't lend deposits, deposits are the result of lending (as anyone who has applied double-entry bookkeeping on a National scale should know).

An increase in bank-held savings causes secular stagnation, a deceleration in the transaction's velocity of funds.

Using interest rate manipulation as its monetary transmission mechanism, under an ample reserves regime, the time-frame of the FOMC’s horizon is 24 hours, rather than 24 months.

Salmo, re "it is a fact, that every time a commercial bank buys securities from, or grants loans to, the nonbank public, it creates new money, somewhere in the payment's system."

This is not true. It is entirely possible for a bank to use money derived from new savings deposits to buy securities from or make loans to the nonbank public without creating new money. Here's how: Depositor A opens a new account at Bank A with $1000 derived from his paycheck (which in turn came from funds deposited by his employer in Bank B). Bank A then buys $500 worth of T-bills and lends $500 to Borrower B. No money is created in this simple example. Money is simply redistributed, with Bank A acting only as an intermediary.

In contrast, money is created in the following example: Bank A makes a $1000 loan to Customer A; in doing so, the bank credits the customer's account with $1000 of newly created money while also adding a $1000 loan as an asset to its balance sheet.

This is an interesting website and source on inflation.

https://truflation.com/

Today's CPI Data by Truflation

The USA Inflation Rate by Truflation is 3.29%, -0.08% change over the last day. Read Methodology

But these guy's methodology, inflation was in double-digits back in July, and now towards 3%.

Also see this, from Oxford Economics....

"the Atlanta Fed’s wage tracker staged the biggest drop in April for any month since the series began in 1997. If that’s not an outlier, the balance of risks could tilt towards a rate cut.

---30---

I gotta say, looks like Scott Grannis is right on this one. Inflation is not the boogyman.It is annoying that Grannis is always right, but what is, is.

No, all monetary savings originate within the banks, within the payment's system. Demand deposits are just shifted to time deposits. There is a one-to-one correspondence between demand and time, as demand deposits are shifted into time deposits, demand deposits shrink dollar-for-dollar. Bank credit remains unaltered.

There has just been a redistribution of bank deposits in your example. New deposits were created with the purchase of securities and granting of the loan.

See: "The Case Against Commercial Bank Savings Accounts" "The Bankers Magazine"

Leland Pritchard, Ph.D., Economics, Chicago 1933, M.S. Statistics, Syracuse

Commercial Banks and Financial Intermediaries: Fallacies and Policy Implications--a comment - Journal of Political Economy, Vol. LXVIII, No. 5, October 1960

The Economics of the Commercial Bank Savings-Investment Process in the U.S. - PADOVA

(1) Professor Paul F. Smith: “Optimum Rate on Time Deposits, “The Journal of Finance, December 1962, 622-633.

(2) David A. Alhadeff and Charlotte P. Alhadeff: “A Note on Bank Earnings and Savings Deposit Rate Policy,” The Journal of Finance, September 1959, 407 footnote.

(3) Lester v. Chandler: “Should Commercial banks accept savings deposits?” Conference on Savings and Residential Financing 1961 Proceedings, United States Savings and loan league, Chicago, 1961, 42, 43.

(4) Dean Carson “Bank Earnings and he Competition for Savings Deposits, “ The Journal of Political Economy December 1959, 580-88; Board of Governors, “Member Bank Operating Ratios” Federal Reserve Bulletin, July 1960, 811.

(5) Horace Secrist, Banking Ratios, Stanford University Press, 1930, 154-55

(6) Joseph Aschheim: “Commercial Banks and Financial Intermediaries: Fallacies and Policy Implications, “The Journal of Political Economy, February 1959, 59-71

(7) Postwar Banking Developments in New York State, 1958, Chapter 3, “Impact of Savings Institutions on Commercial Banks.”

(8) Savings and Mortgage Division of the American Bankers Association, supra, 1951

(9) Federal Reserve Bank of Boston: Functional Cost Analysis, 1959, summarized in: Monthly Review, January 1961 “What Makes for a More Profitable Bank?”

(10) Savings and Mortgage Division, American Bankers Association. Plan for the Determination of Profit or Loss of Savings Accounts in Commercial Banks, New York, 1951.

(11) “Profit or Loss From Time Deposit Banking”, Banking and Monetary Studies, Comptroller of the Currency, United States Treasury Department, Irwin, 1963, pp. 369-386

(12) Federal Reserve Bulletin, December 1956, p. 1301and February 1952, 136-137; and 1956 Annual Report, Federal Deposit Insurance Corporation, 83-84

(13) Commercial Banks and Financial Intermediaries Fallacies and Policy Implications, Journal of Political Economy, October 1960

(14) Savings and Loan Fact Book Chicago: United States Savings and Loan League, 1960, pp. 21,22,79,80,88,90

(15) The Case Against Commercial Bank Savings Accounts, Leland J. Pritchard, The Bankers Magazine

(16) The Nature of Bank Credit, The American Economic Review, June 1946, pp. 311-23

(17) The Economics of the Commercial Bank Savings-Investment Process in the United States, 1969 Leland Pritchard

(18) “Should Commercial banks accept savings deposits?” Conference on Savings and Residential Financing 1961 Proceedings, United States Savings and loan league, Chicago, 1961, 42, 43.]

Princeton Professor Dr. Lester V. Chandler, Ph.D., Economics Yale, theoretical explanation was:

1961 - “that monetary policy has as an objective a certain level of spending for gDp, and that a growth in time (savings) deposits involves a decrease in the demand for money balances, and that this shift will be reflected in an offsetting increase in the velocity of demand deposits, DDs.”

Chandler’s conjecture was correct from 1961 up until 1981.

Thus, the saturation of DD Vt (end game) according to Corwin D. Edwards, professor of economics. [Edwards attended Oxford University in England on a Rhodes scholarship and earned a doctorate in economics at Cornell University. He spent a year teaching at Cambridge University in England in 1932. He taught at New York University in 1954, the Chicago School from 1955-1963, the University of Virginia, and the University of Oregon from 1963-1971.]

Edwards: "It seems to be quite obvious that over time the “demand for money” cannot continue to shift to the left as people buildup their savings deposits; if it did, the time would come when there would be no demand for money at all”

Thus, as Dr. Leland J. Pritchard, Ph.D. Chicago - Economics, M.S Statistics, Syracuse predicted after the passage of (1) the DIDMCA of March 31st 1980, i.e., coinciding with his prediction of the inevitable (2) "time bomb", the widespread introduction of new demand drafts, that money velocity had reached a permanently high plateau.

Professor emeritus Pritchard never minced his words, and in May 1980 pontificated that:

“The Depository Institutions Monetary Control Act will have a pronounced effect in reducing money velocity”.

I.e., the complete deregulation of interest rates for the commercial bankers.

Edwards: “if savings accumulate outside the banking system in intermediaries, they quickly become invested”.

Edwards: “If people are trying to save out of their incomes and why choose, from their standpoint, to invest this in savings deposits, obviously this saving is going to be lost to investment unless the banking system expands”

Prichard: “From the standpoint of the DFIs, the monetary savings practices of the public are reflected in the velocity of their deposits and not in their volume. Whether the public saves or dis-saves, chooses to hold their savings in the DFIs (commercial banks) or to transfer them to NBFIs (nonbank conduits) will not, per se, alter the total assets or liabilities of the DFIs nor alter the forms of these assets and liabilities. The lending capacity of the payment’s System is determined by monetary policy, not the savings practices of the public.

Economist John O’Donnell said of the U.S. Golden Era in Economics: “increased money velocity financed about two-thirds of a growing GNP, while the increase in the actual quantity of money has finance only one-third. In other words, the ratio of the money supply to GNP has fallen

Scott Grannis: Your "demand for money" corroborates this.

Dear Scott,

It seems you travel frequently. If you find yourself in London, my firm, J.Stern jsternco.com

would be pleased to entertain you. Your commentary is respected in these parts.

Clay Tompkins

Clay: Thanks for your kind words. I have fond memories of all the time I spent in London and all the people I met there before I retired from Western Asset in 2007. I haven’t been back since 2008, but I certainly hope to before too long.

It's astonishing that economists can't tell the difference between a bank, and the system.

"I'm glad to see, upon reading on, that Prof. Summers explains himself in the comments. Still, I was taken aback upon first seeing this tweet by him attributing SVB's troubles to its having done what all banks always do!"

The source of interest-bearing deposits is a shift from other bank deposits, directly or indirectly via the currency market (never more than a short-term situation), or through the banks undivided profits accounts. An increase in time deposits depletes demand deposits, dollar for dollar. Loans = deposits.

Saver-holders never transfer their savings outside of the payment's system unless they hoard currency or convert to other national currencies, as anyone who has applied double-entry bookkeeping on a national scale should already know. The O/N RRP facility now being an exception.

The principal ways to reduce the volume of bank deposits is for the saver-holder to use his funds for the payment of a bank loan, interest on a bank loan for the payment of a banks service, or for the purchase from their banks of any type of commercial bank security obligation, e.g., bank stocks, debentures, etc.

Example:

If you can get the Fed's research staff to define their terms correctly (the current figures have some errors), and if you learned how to add and subtract, can differentiate a credit from a debit, viz., know the factors that affect bank deposits, i.e. can construct your own figures, e.g., net change in figures from 1939 to 1973. What was handy:

Loans and investments

Cash & Due from banks

Misc. Assets

Total Assets – Total liabilities -& Net worth

Demand deposits

Time deposits

Interbank deposits

Misc. Liabilities

Capital Accounts

Borrowings (principally E-$s)

Currency outside the banks

Gold Reserves

Treasury currency

Reserve Bank credit

Then quite possibly, the light bulb will go off.

-------------------

Actual net expansion of commercial bank credit = 643.1

Total increase in time and demand deposits and borrowings = 649.5

Hi Scott,

with respect to your comments related to "climate change", may I recommend the reading of my (free) e-book that will support your views from a scientific standpoint.

One can get it here for free: https://patricepoyet.org/

It is also available on "Researchgate" with 21,063 Reads & 135 Recommendations and various other places.

Thanks for your work.

Best regards,

Patrice

Poyet, P., 2022. The Rational Climate e-Book: Cooler is Riskier. The Extended 2nd Edition, October 5th, 174 Figures, 261 Equations, 2432 references, 655 pp., e-ISBN 978-99957-1-929-6

It seems like the economy is floating on the fiscal (over-) stimulation from all the Covid + "Inflation Reduction Act" nonsense (read textbook Keynesian/MMT over-stimulation). Do the M2 and other monetary measures capture that "extra fiscal money"?

It also seems like the economy is at high risk of recession when that fiscal stimulation ends.

Right now, my market indicators were on a lot of buy signals (stocks) in October, which then cooled off in April with some sell signals. Buy signals for bonds came in April. So, for now what I watch is pretty much "neutral"- which means no bad bear market yet. (Note- that in 2022, I got a bunch of correct sell signals for risk assets between Jan and April. In late 2020, I got a correct buy signal for commodities, too.)

The next few weeks to months will be very telling.

Patrice Poyet, re your Rational Climate book. I downloaded and perused it, and it didn’t take me long to reach the conclusion that your book is quite impressive, not only in length but in substance. Very impressive! I hope many more will read it, as it’s a valuable contribution to climate science.

Lots of interplay between different celestial factors. Currently there is heightened earthquake activity and subsequent volcanic activity. Isn't that heating the earth?

Atlanta gDpNow's latest R-gDp estimate: 2.9 percent — May 17, 2023

There's just too much money in the economy. But there's a steady deceleration in long-term money flows (proxy for inflation).

01/1/2023 ,,,,, 0.499

02/1/2023 ,,,,, 0.429

03/1/2023 ,,,,, 0.353

04/1/2023 ,,,,, 0.339

05/1/2023 ,,,,, 0.295

06/1/2023 ,,,,, 0.234

07/1/2023 ,,,,, 0.211

08/1/2023 ,,,,, 0.206

09/1/2023 ,,,,, 0.215

10/1/2023 ,,,,, 0.197

11/1/2023 ,,,,, 0.195

12/1/2023 ,,,,, 0.166

The deceleration is likely to be faster because I plugged in a steady increase in money.

https://truflation.com/

Today's CPI Data by Truflation

The USA Inflation Rate by Truflation is 2.98%, -0.05% change over the last day.

---30---

Well, everyone has their own methodology...but this is interesting.

The Reserve Bank of Australia as a 2% to 3% inflation band target (and generally excellent results).

If the US would adopt such a band, the Fed could say the pressure is off already.

Scott, I know you're a "glass half full" kind of guy but riddle me this; with both sides of government completely undisciplined with budgets (admittedly the left more than the right-but only slightly) how the HELL do we ever get to a point where lower interest rates prevail again? Moreover, is it not axiomatic that uncontrolled debt=higher interest payments=higher long term rates=lower economic growth due to higher borrowing costs? the US has NEVER been in this position before except post WW2 and we had the discipline to actually CUT spending then. We all know that ain't gonna happen-by either party.

re: "If the US would adopt such a band, the Fed could say the pressure is off already."

https://fred.stlouisfed.org/series/RRPONTSYD/

The O/N RRP facility represents a surplus of funds (a monetary policy blunder). If the FED didn't pay the counterparties 5.15% interest, then short-term rates would be negative.

There have now been 12 boom/busts in real-estate in the U.S. since WWII. The busts have all been triggered by a flawed monetary policy, a correction for a loose monetary policy.

Contrary to Dr. George Selgin, banks don’t lend deposits. Deposits are the result of lending. Thus, banks can’t attract outside savings to fund their assets. All bank-held savings originate in the system, shifted from previously created deposits. I.e., bank lending is determined by monetary policy, not the savings practices of the nonbank public.

The deregulation of interest rates has caused a consolidation of the banks. Section 11(b) of the Banking Act of 1933 should never have been amended. And it was amended due to the American Banker Association’s politics, a partisan group.

steve, re debt and interest rates. I am unaware of any data which support the idea that more indebtedness brings higher interest rates. Indeed, since WWII, the debt/GDP ratio of the US has been generally inversely correlated with the level of interest rates (i.e., more debt is associated with lower rates, less debt with higher interest rates). Interest rates are ultimately determined by inflation and central bank policies.

Salmon -

I do not think you refuted Scott's example.

Moreover, your references are not anywhere on the interenet, at least those listed in your comment time stamped 11:54am.

Post a Comment