Monday, November 16, 2009

Dollar approaches critical levels

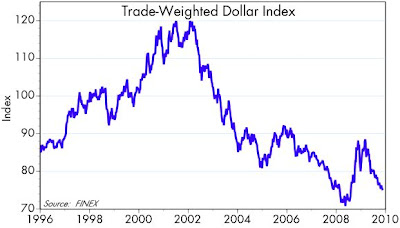

The dollar continues to trade lower, and is now only a few percentage points above its all-time lows against other currencies, both nominally and in inflation-adjusted terms, as shown in these two charts above.

Bernanke's speech this morning provided no comfort for dollar bulls, since once again he all but guaranteed that monetary policy would extraordinarily accommodative for a long time, while also remaining relatively downbeat on the prospects for the U.S. economy. He promised the dollar would remain a strong currency, however, and he noted that the Fed was watching the dollar's value, but he utterly failed to say how the dollar might rise from all-time lows to a level that might be considered strong. He also failed to comment on the significance of gold reaching another all-time high of $1140/oz., and what that says about the dollar's value and the Fed's stewardship of the currency.

A dispassionate observer would undoubtedly conclude from all this that the fundamentals couldn't be much worse for the dollar than they are today: weak economic growth prospects, astoundingly profligate fiscal policy, massively accommodative monetary policy, and an almost total absence of any official concern for the value of the dollar. But the same observer would also note that the dollar's value today is largely consistent with these fundamentals.

So where does that leave us? When the fundamentals are awful and the pricing is awful, then awful things must happen, otherwise the market is going to have to rethink its position. I think that as the dollar approaches its all-time lows the situation is increasingly ripe for some big shocks to consensus thinking. Perhaps the economy isn't as weak as everyone seems to think. Perhaps the Fed won't have to keep short-term rates at zero for another year.

Meanwhile, dollar weakness continues to go hand in hand with equity market strength, as this chart, which I have been showing repeatedly, shows. My theory for why a weak dollar is good for the stock market is that the dollar's weakness is a reflection of a rebound in money velocity, and that in turn is fueling an expansion of economic activity worldwide. There is at least one silver lining to the dollar's otherwise miserable condition.

Subscribe to:

Post Comments (Atom)

7 comments:

Mr. Grannis:

“A dispassionate observer would undoubtedly conclude from all this that the fundamentals couldn't be much worse for the dollar than they are today: weak economic growth prospects, astoundingly profligate fiscal policy, massively accommodative monetary policy, and an almost total absence of any official concern for the value of the dollar.”

Oh so true. Might want to add Hyper-Debt to the equation.

Maybe someone will write a book: “An Inconvenient Dollar”.

This chart over at calculated risk, while designed to show when the Fed usually tightens post recessions, looks scary from a long term perspective when looking at the decreasing bounds at which the Fed has been required to lower rates.

http://4.bp.blogspot.com/_pMscxxELHEg/SrgJWrcjtTI/AAAAAAAAGYc/-FeEjTAsTC0/s1600-h/FedFundsUnemployment.jpg

What comes next, negative rates?

The chart may suggest something to you, but I don't see any implications for where rates will have to be the next time the Fed eases. The Fed mades some huge mistakes during the period represented in that chart, by the way. They tightened too much for too long in the late 1990s, and they eased too much for too long in the 2000s. That sets up a roller-coaster effect that exaggerates subsequent moves but doesn't mandate what should or will happen next.

I am a strong believer in mean reversion. I think the dollar is near the bottom and isn't likely to fall much further. However, it is hard to say how long the dollar will bounce around near the bottom.

I am very puzzled by why the Euro has gotten so much stronger. I am under the impression that the US is ahead of Europe in the recovery.

The euro is stronger because a) the dollar is weaker (and between the two of them you have a huge share of the world's wealth), and b) the ECB has done a better job managing monetary policy than the Fed.

And what makes this Fed or future Feds, any better than past ones?

Feds are only as good as the people and the ideas that guide them.

Post a Comment