Wednesday, September 23, 2009

Dollar nearing a critical level

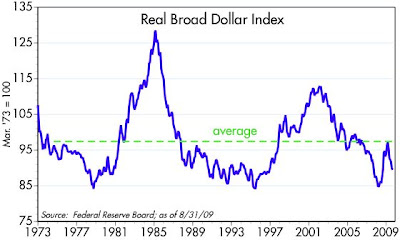

This chart is arguably the best way to look at the dollar's value vis a vis the currencies of our trading partners, because it uses a very large basket of currencies and makes adjustments for cross-border inflation differentials. As you can see, the dollar is about 7% above its all-time low, a level that has provided solid support three times in the past.

In today's world of floating currencies, almost every currency rises and falls against other currencies at one time or another. But a currency that is persistently weak or continually falling relative to others presents a problem. If the dollar's value were to continue to fall to new lows, eventually this would trigger rising inflation pressures. Indeed, supply-siders usually assume that any significant decline in a currency's value (particularly against gold) is a sign of easy money and therefore rising inflation risk. That's because inflation can be defined as the loss of purchasing power of a unit of currency.

Weak and falling currencies are also bad for growth, since they scare away investment. Who wants to invest in a country if there exists the real possibility that one's investment will be eroded by a falling currency? At the very least investors require special incentives (i.e., premiums) to invest in an economy with a weak currency.

Weak currencies are symptomatic of a variety of factors: easy money, weak economic growth prospects, lack of confidence, weak currency demand, and bad fiscal policies (e.g., wasteful spending, high tax rates). Strong currencies, on the other hand, typically reflect tight monetary policy, strong growth prospects, confidence, strong currency demand, and good fiscal policies.

So as the dollar nears its all-time low and the Fed is concluding its deliberations, the world wants to know what the Fed thinks about the weak dollar. If the Fed is unconcerned about the dollar because it is only worried about engineering a recovery, that will be bad news for the dollar and it will likely test its lows.

This next chart compares the dollar to the euro (it goes back in time by using the DM as a proxy for what the euro would have been worth). The green line represents the inflation-adjusted level of the exchange rate that would theoretically make prices in the U.S. and Europe roughly equal. Again we see that the dollar is with 5-10% of its all-time low (1.60) against the euro.

I'm guessing that the Fed is not going to make a fuss over the dollar, and that it will therefore continue to decline. But before too long, either the Fed will have to pay attention or the world will suddenly come to reasses its opinion of the U.S. economy and the Fed's monetary policy.

At this point I doubt that the dollar will make new lows, even though there is no shortage of problems weighing on the dollar: easy money, bad fiscal policies, falling dollar demand (i.e., rising money velocity), weak growth prospects, and a general lack of confidence. I'm inclined to be a contrarian when everything seems pointed in the same direction and valuations reflect an extreme.

There are two things that could turn the dollar around at this point, and I would expect to see one or both surface before the end of the year: 1) a Fed that becomes concerned over the dollar's weakness, and is thus willing to tighten policy sooner than expect, and/or 2) a growing perception that the U.S. economy is not as weak as so many seem to think. (This latter development will rebound to the first, since a stronger-than-expected economy would give the Fed plenty of cover to tighten policy.) I see plenty of signs that the economy is doing better than most people give it credit for, and I see no reason the economy can't grow at a 3-4% rate for the next few years.

Subscribe to:

Post Comments (Atom)

3 comments:

I agree that US Dollar is a medium term buy versus the Euro, albeit the short term outlook remain favorable to the Euro. As I have argued in my post on the Euro/Dollar exchange rate Euro is becoming too overvalued against the Us Dollar due to its new role as a financing currency in carry trades operations. However this is situation is likely to reverse as soon economic activity would come back to a "normal" activity or also in the case of new crisis due to its role during "fly to safety".

best regards

Matteo

"it goes back in time by using the DM as a proxy for what the euro would have been worth"

If you're using the synthetic Euro data from Bloomberg, it's based on the consituent currencies, not just "DM as a proxy".

MW: I'm simply using the initial DM/euro conversion rate. The DM was always the best-behaved of the constituent currencies, so I'm sticking to that.

Post a Comment