Monday, October 12, 2009

Dollar update

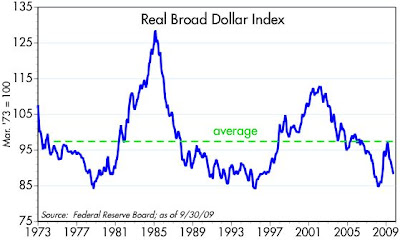

Here are two versions of the dollar's value against other currencies. The first compares the dollar in nominal terms to a trade-weighted basket of major currencies (Euro, Yen, Pound, Canadian dollar, Swedish Krona, and Swiss franc), while the second compares the dollar in inflation-adjusted terms to a very large trade-weighted basket of almost all currencies.

By either measure, the dollar is very weak and looks to be trending lower. The dollar is weighed down by extremely accommodative monetary policy, by profligate fiscal policy, by the specter of increasing regulatory burdens, by high unemployment and weak economic growth, and by the prospect of trillion-dollar deficits for as far as the eye can see.

Everyone knows this, though—it's all on the front pages every day—and that arouses my contrarian instincts. With the dollar's value against other currencies and against gold near the bottom of historical ranges, it is undeniably cheap. It could get cheaper still (and I'm reminded here of Art Laffer's admonition that fiat currencies have no intrinsic value and can therefore be in perpetual decline), but selling the dollar at this point implies considerable risk.

When tons of bad news is hitting the tape everyday, and the value of the asset in question has fallen to historical lows, to be bearish on the asset requires a firm conviction that things are going to go from very bad to really, really bad. For the dollar to rise you don't need to see good news, you just need to see news that is not awful. Mere bad news might suffice to keep the dollar from falling further. Modestly good news, such as an early move by the Fed to raise interest rates even by a little bit, or news which shows the economy is likely to simply avoid a double-dip recession, or news which indicates just the tiniest rightward shift in fiscal policy, might be enough to push the dollar higher.

It's hard to fight the tape on this, but I continue to believe that the long-run prospects for the dollar are favorable. I think the economy is doing better than most give it credit for, I think the Fed is going to move sooner than most expect, and I think that policies in Washington are going to turn out to be less awful than the market fears. I'm not saying that everything is going to turn rosy, merely that I don't see things getting worse forever.

Subscribe to:

Post Comments (Atom)

10 comments:

I thought the mantra was "don't fight the Fed"?

Until proven otherwise, and aside from the 2008 panic, your charts prove a good case that since 2000, the Fed could care less if the dollar rides to the depths.

I am not fighting the Fed and using ULE as one tool to do it...

Perhaps in this case the Fed is the tape...

You have a profitable but very crowded trade

Scott.

In light of all the postive data on the margin, how do you reconcile the evaporating tax revenues to cities, counties, and states in September?

Do you think significant cutbacks from municipal spending could provide headwinds for a continued recovery?

Tax revenues are a lagging indicator of the state of the economy. I think cutbacks in city and state spending are for the most part already factored in. In any event, they are also lagging indicators. When did a politician ever correctly anticipate the direction of the economy? Politicians almost always react to conditions; they are rarely proactive.

I expect the dollar to climb only on bad news about other currencies. That seems quite possible, cause whole global market is shaky.

Scott,

You are dead on about politicians having little clue.....history is replete with examples.

Do you think all this chatter about the dollar losing its reserve status is simply chatter....if not, is it something we should be paying attention to and why?

It doesn't surprise me that the dollar is being trash-talked. After all it is very weak and neither the Fed nor the Obama administration appear to be in the least concerned. This is another factor weighing down the dollar: benign neglect.

However, I don't think the dollar is on the verge of losing its reserve status.

Just wait for all the multi-national companies to report earnings this week. The week dollar is helping the companies tremendously, and their earnings will be through the roof. Weak dollar looks to be good news for American corporations. After all corporate profits are what really drive the economy.....as you regularly state, Scott.

Scott, what about the debt? We are approaching 100% of GDP. The next big legislative agenda (post-health care) will be HUGE tax increases in response to the next "crisis" to be highlighted by the media and government--debt.

That means, any shoots of recovery we see now will be stomped on when we see massive tax increases.

What you then have left is Argentina...like you always mention. No growth, with high inflation (from doubling of monetary based and loss of demand for dollars worldwide).

Marxism is expenssive. They're going to have to pay for it all (health care, stimulas 2, tarp, cap and tax, handing out money to Chicago for 'youth violence', passing out money in detroit, extending unemployment, et al)

I think I'll be wiping my proverbial butt with greenbacks soon. But other than gold (and maybe commodities) I don't know where I should put my dollars.

Federal debt is still way less than 100% of GDP, although it is headed in that direction. Italy and Japan had debt ratios in excess of GDP for many years. A big government sector and a lot of debt is a prescription for painfully slow growth (which is basically what I am expecting), but it is not necessarily a prescription for disaster.

Also, I think it is premature to conclude that Obama is going to get his full agenda passed. I see big problems ahead for healthcare and cap and trade. I see an impressive rise in anti-government, anti-higher tax sentiment. I think things will end up better than most fear.

Post a Comment