One reason it has not proven to be as fatal as originally feared could be that a significant portion of the world's population was not susceptible to the virus to begin with, due to having "resistance at the T-cell level from other similar coronaviruses like the common cold."

In any event, what was once thought to be a catastrophic pandemic is now understood to be dangerous mainly to the aged and the infirm, leaving the vast majority to pursue their lives as before; not without risk, but not condemned to huddle at home in fear. For many, the virus may even be losing its potency.

The shutdown of the US economy, which I have been calling "the most expensive self-inflicted injury in the history of mankind," is no longer a source of concern either, from the market’s perspective. (But governments may well find themselves in the crosshairs of those angry at the shutdowns; see the recent report condemning the German government's handling of the Covid-19 crisis here.) Many states are reopening, of course, but more importantly, as I've been pointing out since March 19th, key financial market and economic fundamentals have been improving on the margin, at the same time our fear of Covid-19 has been tempered. The May jobs report made it clear that the economy is doing much better than feared. It's changes on the margin, like this, that move the market.

So, as investors we need to forget about Covid-19, the shutdown, and the economy, since these are all on the mend; it's no longer a question of when things start to improve, the question now is how fast they will improve.

Looking ahead, the critical areas of concern, in my mind, are 1) can Trump recover from his currently depressed levels of approval and go on to beat Biden in November, thus avoiding the economically-disastrous policies (e.g., higher taxes, increased regulation, and multiple "green" initiatives) that Biden is proposing? and 2) can the Fed react to the dramatic improvement in the economy—and the rebound in confidence which is sure to follow—by raising interest rates in a timely fashion and thereby averting an unexpected surge in inflation?

I have already begun to address this second question here, here, and here, and at the bottom of this post, but more observation is clearly needed. I will begin to address the first question in the months to come. In the meantime it is still important to track key measures of financial and economic fundamentals, some of which I update in the following charts:

Chart #1

In Chart #1, the Vix index is a good proxy for the market's level of fear. What we have seen in recent months is a perfect inverse correlation between fear and equity prices. Fear rises, prices fall; fear declines, prices rise.

Chart #2

Chart #2 shows two market-based indicators which tend to track the market's outlook for economic activity. 10-yr Treasury yields have fallen to record lows, driven by collapsing estimates of economic activity. Similarly, the ratio of copper to gold prices (which tends to increase when the market's economic growth expectations increase) recently fell to record lows but has since rebounded. Together, these two indicators seem to be signaling a major turn for the better in the market's expectation for economic growth.

Chart #3

TSA screenings continue to rise, and are up 240%, on a 7-day moving average basis, from their April all-time lows. There is still lots of room for improvement, since at this time last year screenings were averaging about 2.38 million per day. But it's clear that activity is increasing significantly on the margin.

Chart #4

Chart #4 shows Bloomberg's index of US airline stock prices, which has turned up significantly the past few days. American Airlines stock is up 65% in the past three days. Wow. Confidence in the future is improving dramatically.

Chart #5

Chart #5 shows the spread between High Yield and Investment Grade Credit Default Swap Spreads, commonly referred to as the "junk spread," or the additional yield that investors demand to move from the relative safety of investment grade to the more risky high sector sector of the corporate bond market. These spreads have decline significantly in a relatively short period of time. The Covid-19 credit crisis has reversed dramatically. This is another way of saying that investors' confidence is returning.

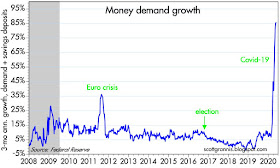

Chart #6

Chart #7

Chart #6 shows the 3-month annualized rate of change in money demand, for which, as a proxy, I use the sum of bank demand and savings deposits. These deposits pay almost nothing, and thus are attractive to economic actors only as a store of value, since they are relatively default-free and liquid. These deposits have increased by $1.8 trillion (+16%) since March 9th. Not coincidentally, this is almost exactly equal to the recent $1.7 trillion increase in excess bank reserves (which reflects, in turn, the Fed's recent purchases of securities), as shown in Chart #7. What this means is the Fed's purchases have gone almost completely to support the public's sudden, increased demand for safe money.

Note also that the first three episodes of Quantitative Easing did not correspond with any sudden increase in money demand on the part of the public (the growth of money demand as shown in Chart was somewhat elevated from 2008 through 2013, but not sudden, as we have seen recently). Thus, the initial rounds of QE were mainly designed to accommodate the banking industry's demand for safe assets (e.g., bank reserves), because banks needed to shore up their balance sheets in the wake of the near-collapse of the global banking industry. This time around, QE efforts have largely accommodated the public's demand for safe assets.

Going forward, all eyes will be watching the aftermath of the recent gigantic increase in demand and savings deposits. How long will the public want to maintain these outsized deposits? When optimism returns and the demand for money declines, where will the $1.8 trillion go? The only way that money can "disappear" is if the Fed reverses its asset purchases—by selling securities and absorbing/extinguishing bank reserves in the process. If the Fed doesn't reabsorb the money it has created as the demand for that money declines, then the unwanted money will find its way into asset prices and the general price level (i.e., rising inflation). Recent increases in stock prices could be an early sign of declining money demand, but it is too early to come to that conclusion, especially since, as I noted in my previous post, the market in general does not appear to be overly optimistic.

Germany sees the light:

ReplyDeleteSome of the report’s key passages are:

* The dangerousness of Covid-19 was overestimated: probably at no point did the danger posed by the new virus go beyond the normal level.

* The people who die from Corona are essentially those who would statistically die this year, because they have reached the end of their lives and their weakened bodies can no longer cope with any random everyday stress (including the approximately 150 viruses currently in circulation).

* Worldwide, within a quarter of a year, there has been no more than 250,000 deaths from Covid-19, compared to 1.5 million deaths [25,100 in Germany] during the influenza wave 2017/18.

* The danger is obviously no greater than that of many other viruses. There is no evidence that this was more than a false alarm.

* A reproach could go along these lines: During the Corona crisis the State has proved itself as one of the biggest producers of Fake News.

***

The report focuses on the “manifold and heavy consequences of the Corona measures” and warns that these are “grave”.

More people are dying because of state-imposed Corona-measures than they are being killed by the virus.

The reason is a scandal in the making:

A Corona-focused German healthcare system is postponing life-saving surgery and delaying or reducing treatment for non-Corona patients.

https://www.powerlineblog.com/archives/2020/06/german-report-blasts-shutdown.php

As with many things, the first thing decision makers should do is make the "safest" decision- in this case- some isolation and lockdown.

ReplyDeleteAs information changes, actions should change. This is where the mistakes often happen due to human error coupled with political pressure.

The lockdowns should have changed after ~3-4 weeks, with partial opening at that time. However, the bureaucrats (which is what Fauci et.al. have become- it is breathtaking to behold)- covered their @$$es at the expense of the economy. The dems of course bought in for obvious reasons.

It's too bad, and very damaging to the economy of every country involved.

The "experts" we have now are actually very damaging to the country- economics, medical, military leaders- they have all been corrupted by the bureaucratic, political and other pressures. It is very bad for the countries.

The "lock-downs" should never have occurred. The whole situation has been ludicrous ending in more bureaucracy and loss of basic civil liberties.

ReplyDeleteInteresting legislation that will shortly be in your pocket or hand at all times if you choose (or are quasi forced because normal human transactions will become impossible to achieve without).

https://www.youtube.com/watch?v=qFUyZWw7qoc

* The dangerousness of Covid-19 was overestimated: probably at no point did the danger posed by the new virus go beyond the normal level.

ReplyDelete- Please see an excess mortality chart. Even with the social distancing/lockdowns, these charts are clear evidence that Covid19 is an extreme case of this kind of illness. One can find this kind of chart easily with an internet search (the data are not dependent on classification of the deaths as Covid19- many more people have died during this episode than normal). It is not as lethal as the earlier flu epidemics such as "Spanish Flu".

* Lockdowns/social distancing are part of public health actions. The courts have litigated these actions (again www search), and found that certain liberties may be limited during times of great danger.

Neither Biden nor Trump is much to crow about.

ReplyDeleteIn 2016, I voted for Donald Trump because I could not believe that any candidate could possibly be worse than a lying, incompetent, career criminal like Hillary Clinton. What I got was 40M unemployed, schools, churches and businesses closed, a shattered hospital system, trillions in funny money and riots. Maybe I should have just sat 2016 out.

• Politicians have never solved a problem that politicians did not first create.

• If the answer to our problems is a politician, then we are thoroughly screwed.

More excellent blogging from Scott Grannis.

ReplyDeleteI think I disagree with this:

If the Fed doesn't reabsorb the money it has created as the demand for that money declines, then the unwanted money will find its way into asset prices and the general price level (i.e., rising inflation). ---SG

First, global asset markets are about $300 to $400 trillion, if you add up property, bonds and equities. So I think the Fed's balance sheet is rather unimpressive on the global scale, and the market for Treasuries is global.

So what about old-fashioned demand-pull inflation? Globally, we see almost every industry is glutted with capacity and the world is glutted with capital. So I think demand-pull inflation is out of the cards.

Various markets do have a problem with property zoning, including such places as Hong Kong, London, New York and the West Coast of the United States. And in these markets you may see property inflation and the solution to that, of course, is free markets, that is the unzoning in a property.

Decriminalize new housing production and we can lick the housing shortage too. I would call housing the cost-push source of rather limited inflation in the US.

World Health Organization spokeswoman announces that

ReplyDelete• asymptotic transmission of SARS-CoV2 is rare,

• tight contact tracing and quarantining of the sick is the best way to suppress SARS-CoV2

Bloomberg news and video:

WHO Says Symptomless Spread Is ‘Rare,’ in Jolt to Virus Efforts

https://www.bloomberg.com/news/articles/2020-06-09/who-says-symptomless-spread-is-rare-in-jolt-to-virus-efforts

Exactly what rationale is left for Fauci and the CDC to cling to as an explanation of the lockdown? Zero!

”Never in the course of human history has so much damage been done to so many by so few.”

ReplyDeleteNo asymptotic transmission -> social distancing unnecessary -> lockdown unnecessary -> everything the government put the country through since March has been completely unnecessary.

Excerpts:

“If asymptomatic spread proves to not be a main driver of coronavirus transmission, the policy implications could be tremendous. A report from the U.S. Centers for Disease Control and Prevention published on April 1 cited the “potential for presymptomatic transmission” as a reason for the importance of social distancing.

“These findings also suggest that to control the pandemic, it might not be enough for only persons with symptoms to limit their contact with others because persons without symptoms might transmit infection,” the CDC study said.

To be sure, asymptomatic and presymptomatic spread of the virus appears to still be happening, Van Kerkhove said but remains rare. That finding has important implications for how to screen for the virus and limit its spread.

“What we really want to be focused on is following the symptomatic cases,” Van Kerkhove said. “If we actually followed all of the symptomatic cases, isolated those cases, followed the contacts and quarantined those contacts, we would drastically reduce” the outbreak.“

https://www.cnbc.com/2020/06/08/asymptomatic-coronavirus-patients-arent-spreading-new-infections-who-says.html

I don't know maybe Covid 19 was overstated, on the other hand, a lot of people (not in their 90s) are still in hospital and very sick. Not a sexy headline. There is no doubt that for many it just speed up a process that was well advanced, and that up here in Canada, nearly 80% of those who died were in their 80s.

ReplyDeleteHowever, first, this thing is not finished yet, cases are rising again in 14 states! America doesn't have a health care system (case and point a guy who spent 5 days in ICU got a $500k hospital bill). Call it bad luck if you will

The other issue is the young who recover don't all seem to fully recover!

Also 20/20 vision with hindsight is not a very useful barometer of anything.

Finally, yeah $1.8 trillion in inflation is something serious -- just look at the stock market -- Nasdaq is trading at a 150 p/e

Approx 7% of people aged between 45 and 65 who contract Covid are hospitalized. This does not happen to this age group with the flu. As those between 45 and 65 (approx 85 million people) are the heart of the skilled workforce, going back to work has significant risks.

ReplyDeleteRegarding "the disease is disappearing", how can one make judgements as to the transmissibility of a disease when we have in fact had a shut down (social distancing)?

Another little reported fact (or very likely fact - confirmed by two studies so far): if you are blood type A+ (approx 1/3 of the population), you are some 45% more likely to die than the averages. Conversely, O Type (also about 1/3 of the population) correspondingly has a rate of 35% less likely to die. There is no hypothesis at this point. Richard