I have yet to see any meaningful steps taken by the PIIGS to rein in the size and scope of government, and thus I don't think the Eurozone crisis is a thing of the past. But the Eurozone, with the help of the ECB, has made great progress in reducing the risk of a near-term blowup. Markets everywhere are breathing a sigh of relief for what should prove to be more than a temporary, if not a complete, reprieve.

U.S. swap spreads remain quite low, signifying that systemic risk is low, the financial system has plenty of liquidity, and the outlook for the economy is likely to be improving, if only modestly. Eurozone swap spreads are still somewhat high, but they have declined significantly so far this year.

Euro basis swap spreads have been good leading indicators of this improvement, since they show that Eurozone banks are no longer having much difficulty in accessing dollar liquidity. This may also signify that capital flight out of the Eurozone is moderating. Taken together, these spreads show that liquidity in the Eurozone financial system has improved remarkably, and systemic risk has declined significantly. The likelihood of a near-term disaster is thus much lower. The Eurozone has bought itself a good chunk of time to work out its problems.

Zeroing in on individual countries, we see that 2-yr Spanish and Italian yields have dropped considerably in just the past week or so. They are not out of the woods yet, but the market is judging that near-term default risk has declined quite a bit.

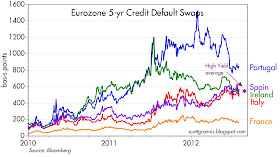

5-yr CDS show a somewhat different story, since they are driven by the longer-term outlook. We don't see a whole lot of improvement of late, and that makes sense because these countries haven't yet fixed their underlying problems, even as they have made great strides towards remaining solvent for the near-term. Note how French 2-yr yields are almost zero, but French CDS are trading around 150 bps—even the long-term outlook for France remains somewhat suspect. For reference, I've included the current rate on generic 5-yr high-yield corporate CDS, which is trading around 550 bps. Spain, Italy, and Ireland are all considered to be about as risky as the typical junk bond. That sounds a lot worse than it really is, since junk bonds have been excellent investments in recent years, almost matching the total return on the S&P 500 since the rally started in early March 2009 (98% vs. 121%).

This comment has been removed by the author.

ReplyDeleteI concur with Scott's analysis -- the chances of a near-term collapse of the Eurozone is definitely down -- the suffering has only just begun however -- once austerity kicks in across the southern flank of Europe, the four horsemen will soon follow -- more at:

ReplyDeletehttp://wjmc.blogspot.com/2012/03/four-horsemen.html

The problem with economic instabliity is the political instablity that always accompanies the former...

Scott -

ReplyDeleteWhy do you suppose the European and American stock markets react positively when the EU, ECB, etc. hint that they will buy Spanish or Italian or whose-ever bonds thus enabling those countries to take-on even more debt? And similarly, why are the US markets so enthusiastic about QE 3?

If added to a country's debt burden by "printing money" is such a bad idea, why do the stock market participants seem to applaud it?

Because it is better than a worsening recession / depression? Just curious about this seeming paradox.

A devaluation of the dollar and euro is clearly being reflected in the bond yields, which are terrifyingly low -- the only question is how the devaluations will be resolved economically -- but anyway you look at the numbers, dollar and euro values have to decline -- the only safe havens left are equities -- even precious metal are suspect at this point -- equities are grotesquely undervalued in the face of the coming devaluation of the dollar and euro, whether that devaluation comes in the form of inflation or currency reform -- austerity is too late...

ReplyDeleteYeah, nothing to see in Europe, move on...

ReplyDeleteAccording to these charts, France can borrow money for almost nothing. So can Japan.

ReplyDeleteCan anyone explain this? Seems like we have a global glut of capital.

Scott Grannis: Why is copper tanking? Down to 2007 levels and falling.

ReplyDeleteIs copper tanking? Let's see....

ReplyDeleteCopper is up 164% relative to its level at the end of 2008, and it is up 450% relative to its level near the end of 2001. In both cases it is up many multiples of the increase in the CPI over the same period.

However, it is down 26% from its all-time high early last year.

That doesn't qualify as "tanking" in my dictionary. I would think it's more like a very modest correction.

Since the beginning of June bond yields have not followed stock prices upward. Most people on the net say bonds are always right. So do bonds correct or does the stock market?

ReplyDeleteScott G:

ReplyDeleteAccording to this chart, copper is about where it was in 2006, and has been trending down of late.

Is it "tanking"?

I guess for investors who were long copper, it is "tanking." The language is strong, but circumstances could be stronger...

http://www.indexmundi.com/commodities/?commodity=copper&months=120