Yesterday I suggested that the July jobs increase reported today was likely to be better than expected, and that proved to be the case (+172K private sector jobs vs. 110K expected). I based that guess on the observation that this year's growth in jobs as reported in the household survey has been much stronger than reported by the establishment survey, and that perhaps it was time for the establishment survey to "catch up" to the household survey. That indeed happened, and as it turns out, the household survey reported a decline in jobs, thus narrowing the gap between the two from both sides. Splitting the difference between the two surveys is a strategy I've always favored, and doing so puts the growth rate of jobs somewhere in the range of 1.5–2.2%. That's just about what the pace of jobs growth was in the 2004-2006 period, in fact. In any event, no matter how you slice and dice these numbers, jobs are growing and there is absolutely no sign of a recession.

Those in the public sector will disagree, however, since public sector jobs have been contracting for the past three years, with no end in sight. The folks at Brookings lament this fact, but they fail to recognize that there are still many more public sector jobs today than there were in 2000, whereas the number of private sector jobs has barely risen at all. Public sector jobs are declining because of public sector bloat that is being painfully reduced, and we will all be better off as a result, once the dust settles. It's also appropriate to note that wealth is created in the private sector, so that's where it is important to see the growth in jobs.

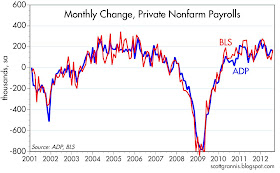

UPDATE: Today's jobs report also served to vindicate the ADP report from last Wednesday.

UPDATE: Today's jobs report also served to vindicate the ADP report from last Wednesday.

Two leading indicators inside the payroll numbers...temporary help

ReplyDeleteservices and truck transportation

are well above their 12 month moving

average....also the construction employment to nonfarm payroll employment is at a 66 year low...whoa

nellie when construction reemerges

Since February of this year, the household survey has shown an increase of 135,000 jobs over a 5 month period. That averages out to 27,000 jobs per month. That is stall speed.

ReplyDeleteThe only reliable figure in my opinion is Establishment table B1 line two, on the left, non-seasonally adjusted. This is going along the seasonal pattern just fine which expects no job growth in the summer time. And so it is, we had no job growth according to these figures. And we didn’t have any decline from the seasonal pattern either.

ReplyDeleteWe only get job growth when we see numbers in excess of the seasonal pattern. We had it earlier this year, now we don’t.

These creeps at the BLS have been playing the market and politics so long they are buried in a morass of adjustments with every month trying to get out of the bind they put themselves into.

If inventory is building, you don’t get layoffs from goods producing industries. I’ll be watching for sales growth and inventory figures in manufacturing and goods producing for an indicator of how things are going job wise. Crappy service jobs are good for the economy in that it is so very much better than not having them but they are not very simulative.

I am not trying to throw cold water on what Scott is saying about the rate of job growth overall. I am happy for it and don't think it is going to ramp up faster than this. I do think the population will growth faster than job growth and this is reported as such in this months report.

Creeps at the BLS?? Ever heard of ARIMA??? If not then you really don't know how statistics are

ReplyDeletestudied...no conspiracy just statistical errors...

The employment (versus the unemployment numbers) came in as expected -- no significant change from the previous month -- given the continuing economc horror of America, now is a good time to buy equities at bargain prices -- everyone with 30-year plus investment horizon is in a window of opportunity -- old people with shorter investment horizons have lost the initiative in today's economy...

ReplyDeleteJapan also has had spurts of slow growth (mostly associated with its QE program of 2001-6) since 1992.

ReplyDeleteIf that is success, then the Fed is successful.

Japan has had minor deflation for 20 years.

Japan has underperformed every other developed nation in that time frame, including statist France and Italy.

Set the bar low enough, and you can say the Fed is doing its job.

I sense power is shifting to China, nearly palpably. They concert their efforts on economic growth and trade relations, and "slow growth" there is 8 percent a year.

Our Fed is obsessed with ultra-low inflation rates and our government with fantastically expensive military adventures, or food stamps for fat people.

The on going debate between stock bulls and bears is in progress. I've recently written about this on my blog, so please give it a read and vote which one you are. It will be very interesting to see the final result.

ReplyDelete"Public sector jobs are declining because of public sector bloat that is being painfully reduced, and we will all be better off as a result, once the dust settles."

ReplyDeleteWish I could believe that.

A year or so ago, I saw an article entitled "Who Will Pay for the Wars?"

Now we know: public sector workers.

The NBER uses four coincidental datum to pinpoint recessions: personal income, retail sales, non-farm payrolls, and industrial production. See a great treatment of this at dshort.com.

ReplyDeleteIt seems to me there should be something for the service sector of the economy. I wonder what that could be.

Looking at the bottom graph, the steep growth in public sector jobs during the Bush administration really masked a crummy job growth record for the private sector.

ReplyDeleteI believe that the public sector could be quickly drawn down by passing a constitutional amendment that limits government salaries to uniformed workers exclusively -- everyone else (i.e., teachers, politicians, FBI agents, administrators, and political staffs) would be required to work as volunteers -- we need to get Americans focused first on building their estate and retirement in the private sector -- those who succeed in that effort would be ideal candidates for voluntary public service jobs as they enter their elder years -- teachers should all be replaced with the Internet -- the US could save trillions of dollars over the balance of the 21st century by limiting public sector employment to jobs that require uniforms...

ReplyDeleteCopper prices are where they were in 2007, and headed south.

ReplyDeleteNot sure what this means, but in the past Scott Grannis has put great importance in the metal, and its price.

Not in labor force: +334.000 (m/m)

ReplyDeleteOne quick way to create jobs in America would be to index real working wages to global standards -- the fact that high quality Chinese workers will work in high tech manufacturing/assembly jobs may in fact, be the index -- once America labor is indexed to global wage standards, manufacturing will eagerly reenter the US -- it's that simple...

ReplyDeleteGet latest goverment and private job updates with naukrinews and carry your carrier in right direction.

ReplyDelete