Monday, August 9, 2010

Unemployment claims do not suggest a double-dip

Still catching up on recent developments. Just recently I saw someone claiming that the recent uptick in weekly unemployment claims could be a good indicator of a coming double-dip recession. What? In fact, recently I've seen so many articles and comments from people searching for a double-dip under every rock and around every corner that I am simply amazed. It's become something of an obsession. From my perspective I haven't seen anything yet that would make me concerned about the possibility of a double-dip.

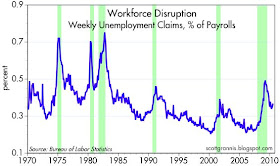

The chart above looks at the 4-week average of claims. I fail to see anything that could be interpreted even remotely as a deterioration in the jobs market. Claims have been essentially flat all year. Sure, it would be better if claims were falling, but holding steady for seven months doesn't point to any weakening of the jobs market.

This next chart compares claims to the number of people working, which is arguably a better way to judge the health of the labor market. While the line has ticked up just a bit in the past few months, it is hardly of a magnitude that is unusual for two series which are not well correlated. There have been many such upticks—and many of them much larger—in recent decades that have not been followed by recession. The bears need to get a grip.

Measures of unemployment have become suspect. For example, consider the US employment to population ratio, which is showing that employment in the US as a percentage of the population continues to decline sharply. More at:

ReplyDeletehttp://wjmc.blogspot.com/2010/08/us-employment-to-population-ratio.html

No one should be deceived into believing the employment picture in the US is somehow improving -- employment in the US as percentage of the population has been plummeting for a decade now...