Monday, August 9, 2010

Recent commodity correction is over

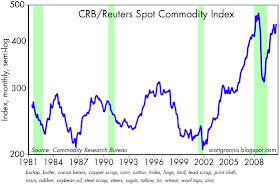

As this chart shows, the commodity correction that started last May has now been completely reversed. This index of non-energy-related spot commodity prices is now at a post-recession high, and it is only 7% below its all-time high, registered in mid-2008.

This means that a) monetary policy is accommodative and inflation risks are not negligible, and/or b) global economic growth is at least strong enough to keep the U.S. economy from suffering a double-dip recession. In other words, the market is overly concerned about the health of the U.S. economy. As a corollary, it also means that should the Fed fail to announce some form of further monetary ease at the conclusion of tomorrow's FOMC meeting, this would not be a reason to turn bearish. Any market selloff would therefore be a buying opportunity.

S&P 500 1/05/2004 1122.....12 mo ttm GAAP earnings 54.69

ReplyDeleteEarnings yield 4.87%

Moody's Baa yield 6.68%

8/06/2010 S&P 500 1122 12 mo ttm GAAP earnings 66.68

Earnings yield 5.94%

Moody's Baa yield 5.85%

Valuations are indeed reasonable. Not as good as in mid - late May when the pessimists' talking points were 'the end is near for the Euro...and we're next'.

ReplyDeleteAlso not as good as in mid June through July when the 'doom of the day' was...Double Dip!!

Now, the pessimists are pounding the podium over....Deflation! We're Japan! (we used to be Argentina or Rhodesia...apparantly things have improved).

All along, the equity markets have been quietly advancing. Many bargains like Verizon at $25 (now near $30) and McDonalds at $66 (now at $72) and many others have been snapped up. The market is still reasonably priced...but many of the real bargains are gone.

Tomorrow the Fed meets and if the market is expecting a big QE2 announcement and does not get it (which is what I am expecting) then the profit takers may go to work taking the market back down. When the pessimists grab the headlines with their next catchy phrased equivalent of 'it's a DEATH CROSS!' then maybe the bargains will be back and great companies will get truly cheap again. If so, I'll be snapping a few up.

By the way, Bro. Thanks for the snippits. Always love to se 'em.