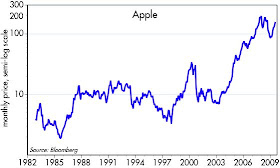

In after-market trading today following another blowout earnings release, AAPL is up to $158, almost double its price when I first recommended it in mid-January. At that time the street was worried about Steve Jobs' health, but I thought the company was well-positioned to prosper on its own. Apple's secret is a culture of excellence and industrial design that has little or no parallel in the industrial world. Excellent software and excellent hardware, including the iPhone, make an unbeatable combination. As I said back then, if you don't want to buy the stock, at least buy one of Apple's products and see for yourself.

At this point I don't see any serious competition. Windows 7 may end up being a lot better than the failed Windows Vista, but it doesn't look to be much more than an able competitor to Apple's Leopard OS that came out a few years ago. The big problem Microsoft faces with Windows 7 is that the IT folks and many consumers will be very slow on the uptake, having been burned with Vista. Plus, it will require new hardware for many. I'm willing to bet that a lot of folks will give Macs and the iPhone a try, rather than struggling through yet another Windows software and hardware upgrade.

Apple's latest revision to its OS will come out this September, before Windows 7 is released, and it will not require new hardware. Indeed, it promises to run much faster on most existing Macs, and will reportedly save 7 GB of hard drive space. Simpler, smaller, and faster is always better than bloat.

Apple stands to continue to gain market share for the foreseeable future in the personal computer, business computer, and smart phone markets, having already captured most of the MP3 player market. With its operating leverage applied to significant market share gains, AAPL should continue to be a money machine, at the same time it thrills the world with technological marvels that are also stunning to look at.

Full disclosure: I am long AAPL at the time of this writing.

I took your advice and bought during the March lows!! :):):)

ReplyDelete