Thanks to today's release of the November 2nd FOMC meeting minutes, we know that the Fed has "pivoted" as expected; they are backing off of their aggressive tightening agenda. Instead of hiking rates another 75 bps at their December 14th meeting, we are likely to see only a 50 bps hike, to 4.5%, and that could well be the last hike of this tightening cycle—which would make it the shortest tightening cycle on record (less than one year). And they might not even raise rates at all in December—that would be my preference.

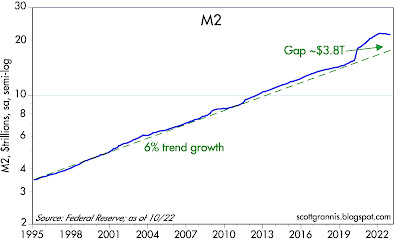

For more than two years I have been one of a handful of economists keeping an eye on the rapid growth of the M2 money supply. Initially I warned that it portended much higher inflation than the market was expecting. But since May of this year I have argued that inflation pressures have peaked: "Many factors have contributed to this: growth in the M2 money supply has been essentially zero since late last year; the stimulus checks have ceased; the dollar has been very strong; commodity prices have been very weak; and soaring interest rates have brought the housing market to its knees. All of these developments mean that the supply of money and the demand to hold it have come back to some semblance of balance." To sum it up, I think the Fed has gotten policy back on track, so there's no need to do more. In fact, the October M2 release showed even more of a slowdown than previously, thus underscoring the need to avoid further tightening.

For a recap of my thinking on all this, here is a short summary of relevant posts:

October '20: On the demand for money and other considerations

March '21: The problem with unwanted money and More signs that inflation is set to increase

July '21: Big changes in inflation and government finances

August '21: Inflation update: this is serious

September '21: Money and inflation update

October '21: Monetary policy is a slow-motion train wreck

November '21: Recession risk is very low, but inflation risk is high

January '22: The bond market is wrong about inflation

Beginning last May I began arguing that we had seen the peak of inflation pressures, thanks to a big decline in the growth of the M2 money supply.

May '22: M2 growth slows: light at the end of the inflation...

August '22: Inflation pressures cool, economic outlook improves

Sep '22: Inflation pressures are in fact cooling ...

I'm still firmly in the inflation-is-falling camp, and it's because of the unprecedented decline in the M2 money supply, coupled with forceful actions on the part of the Fed to bolster money demand with sharply higher interest rates. As a result, I believe we are going to see a gradual decline in inflation over the next year or so.

The following charts round out the story:

Chart #1

Chart #2

Chart #2 shows how the surge in M2 growth was almost entirely driven by massive federal deficit spending from 2020 through late 2021. In effect, the government sent out many trillions in "stimulus" checks to people and most of that money ended up being stashed in bank deposit and savings accounts. The demand for money was intense back then since there was great pandemic-fueled uncertainty and besides, lockdowns left people with little ability to spend money. All that money wasn't a problem until early this year, when the pandemic crisis began to recede. That marked the point when people started to spend the money they had stockpiled, and that spending surge combined with supply-chain bottlenecks to produce a wave of higher prices for nearly everything. In short, an improving outlook and a return of confidence meant that the demand for all that money was evaporating.

Chart #3

(Note: for those who prefer to think in terms of the velocity of money, just invert Chart #3. Velocity is simply the inverse of money demand, and vice versa. Today velocity is definitely picking up. For a longer explanation of this see this post.)

As Milton Friedman taught us, inflation happens when the supply of money exceeds the demand for it. It's critical to understand that rapid growth in M2 from Q2/20 through Q3/21 was not inflationary because the demand for money was very strong during that period. But when the demand for money started to fall early this year, then inflation surged, even though M2 was no longer growing. From this we can infer that the demand for money fell significantly.

Money demand is likely still declining, and money supply is still contracting, but the huge rise in interest rates this year has acted to bolster money demand: earning 4-5% on bank CDs is an incentive to hold on to that money you stashed in the bank—at least some it. The net result of all this is an easing of inflationary pressures. That can be seen already in falling commodity prices and housing prices.

Chart #4

Chart #5

Chart #6

Shall we call this "tightening lite?"

Erudite.

ReplyDeletere: "But since May of this year I have argued that inflation pressures have peaked"

Long-term money flows peaked at about the same time. But they underweight Vt.

Scott, Does the high inflation on most major global markets have any impact on the US efforts???

ReplyDeleteChart #4.

ReplyDeleteLink: https://www.youtube.com/watch?v=rDtVABEzcy4

The model is wrong (excludes CB credit), but it shows how IBDDs are used to stoke asset prices.

BOE: "QE is intended to boost the amount of money in the economy directly by purchasing assets, mainly from non-bank financial companies.

QE initially increases the amount of bank deposits those companies hold (in place of the assets they sell). Those companies will then wish to rebalance their portfolios of assets by buying higher-yielding assets, raising the price of those assets and stimulating spending in the economy

Duane (Does the high inflation on most major global markets have any impact on the US efforts?): US inflation is determined by US monetary policy and not by inflation in other economies. If US monetary policy is less inflationary than monetary policies in other countries, then the dollar will tend to rise vis a vis those currencies, and that rise in the dollar’s value will tend to neutralize the higher prices in other countries. We are already seeing that, since the dollar is historically high relative to other major currencies. A stronger dollar acts to neutralize the higher prices in other countries.

ReplyDelete@Salmo Trutta

ReplyDeleteThe youtube video referred to is interesting. It describes the perspective of QE 'working' essentially through asset inflation (unless huge and pushed to the limit of blurring the distance between monetary and fiscal policy ie 2020-2).

However, there is a fatal flaw in the presentation (basic math and the author needs to take into consideration all relevant variables). M2 rose, as mentioned, as a result of QE being mostly transmitted through non-banks and using banks as intermediary, but the author failed to integrate the huge (huge and unprecedented) rise of the TGA account that happened concurrently to the QE on steroids that was deployed in March 2020 and the following months, a rise which resulted in a concurrent negative relative growth in M2. The TGA account was brought down over time (reinjecting M2 in the process) but this phenomenon created distortions in H6 reports over time. The basic math behind M2 reports needs to integrate the huge expansion of commercial banks' balance sheets when their holdings of government debt skyrocketed, causing huge consumer inflation potential. But, for now, this is over:

https://fred.stlouisfed.org/series/USGSEC#0

How fast will inflation fall?

There are some factors suggesting a slow process evolving over a few months but there are factors suggesting a hard (and more rapid) landing:

-this tightening cycle has been the most pronounced ever

-this tightening happened in a slow growth environment

-this tightening is occurring in a deeply inverted environment

-this tightening is occurring in a wildly declining consumer sentiment and leading indicators' environment

@Carl: there is no justification for excluding Treasury balances in the Treasury’s General Fund Account from the assets included in the tabulations of commercial bank accounts (with the exception of WWII). No one has established any unique price effect of federal outlays, as compared to state and local government outlays, or expenditures by the private sector.

ReplyDeleteWe know that to ignore the aggregate effect of money flows on prices is to ignore the sine qua non of the inflation process. And to dismiss the concept of (Vt) by saying it is meaningless because people can only spend their income once, is to ignore the fact that (Vt) is a function of three factors: (1) the number of transactions, (2) the prices of goods & services, & (3) the volume of M.

Inflation analysis cannot be limited to the volume of wages & salaries spent. To do so is to overlook the principal "engine" of inflation, viz., the volume of credit (new money) created by the Reserve & the commercial banks and the expenditure rate (velocity) of these funds. Also overlooked is the effect of the expenditure of the savings of the non-bank public on prices. The (MVt) figure encompasses the total effect of all these money flows.

^Let's stick to the basic argument here.

ReplyDeleteThe author in the youtube video is wrong because he does not see the effects of the factors described above including the effects of moving money in and out of the TGA.

It's simple math. When the Treasury parks money in the TGA, it removes money (M2 etc) from the private system and when money is spent, money (M2) goes back to the private system. Starting in March 2020 and in the following weeks, the TGA went up by 1.4T. Contrary to reverse repo operations which are not recorded as such (accounted for temporary transactions), movements (in and out) of money related to the TGA account are recorded as such by the Fed (simple liability swap, reserves to money in TGA).

If we can't agree about basic math, it will be difficult to elevate the discussion.

Also, since QE is essentially relevant to asset inflation, you have to adjust for these excess reserves in the system when computing M2 velocity. When you do, you find out that money velocity, after a secular trend down, has only flat lined in the last few months and (opinion) will tend to move down if any kind of (needed) deleveraging occurs. Bye bye inflation.

Oh, I agree. But the TGA's spending changes saved deposits into spent deposits. And that is captured in the roc in DDs. Inflation's about to show a big drop. But then it remains elevated.

ReplyDeleteThe question is what happens after the 4th qtr. for R-gDp. Will Xmas spending be big or not?

I doubt it. Is N-gDp about to drop, or is the rise in short-term flows offset by the drop in long-term money flows? It looks like N-gDp will drop and then stocks will crash.

^Freshly released:

ReplyDeletehttps://www.pmi.spglobal.com/Public/Home/PressRelease/d9ef5b8294e24a6f876372b65141b93e

They 'see' economic activity declining now at 1% (annualized).

There was a time earlier in 2022 when GDI and GDP diverged and, unusually, it's the GDI that came to converge with GDP and i wonder if similar dynamics are playing out now with GDPNow.

This comment has been removed by the author.

ReplyDeleteI am hearing the argument that after using the strategic oil reserves to lower prices, they will start refilling it and that will drive up oil prices, along with the Russian sanctions and keep inflation high. Do you think this can cause the Fed to continue to increase rates?

ReplyDeleteFED Wire transactions are up, but volumes are slowing.

ReplyDeletehttps://www.frbservices.org/resources/financial-services/securities/volume-value-stats/quarterly-stats.html

Scott,

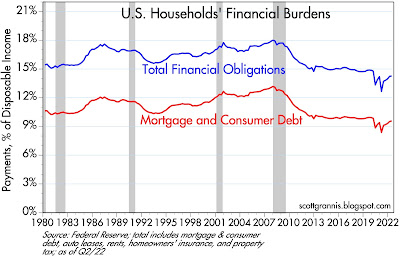

ReplyDeleter.e. Chart #6, do you have a definition or link to the Fed's explanation of what, exactly, constitutes "Consumer Debt."

Bob Wright

Another great post by Scott Grannis.

ReplyDeleteOne curiosity of this cycle was that so many other central banks are in the same boat. Reserve Bank of Australia, Reserve Bank of India, BoE, ECB, Bank Indonesia, you name it.

Everybody except People's Bank of China and Bank of Japan.

Inflation suddenly jumped above 5%, to near double digits, and now they are trying to get it back down.

Something about being a central banker...always late. Lots of smart guys at all those central banks.

Now, many are over-tightening, IMHO.

Thanks Scott.

ReplyDeleteLink to data: https://www.federalreserve.gov/releases/housedebt/default.htm

ReplyDeleteIt’s a two-tiered economy. Personal savings rate down, and 63% of people living paycheck to paycheck.

ReplyDeleteBut M2/gDp is still elevated, i.e., the demand for money balances (spendable money is declining vs. incomes). I.e., velocity is rising.

Money velocity plateaued in August. Money flows are set to drop by c. 46% by Dec.

ReplyDeleteCleveland's CPI nowcast is @ 5.0% - 4th qtr. annualized.

Scott – Do you think it is likely that the Fed will be forced to reverse a majority of its 2022 rate hikes/tightening in 2023? My reasoning:

ReplyDeleteTable 1-1 in the CBO’s Budget and Economic Outlook (released May 2022) projects net interest payments on the US debt from 2022 to 2032. CBO appears to assume about a 1.5 to 2 percent interest rate on treasury securities over that decade. Most of the treasury securities outstanding have a maturity less than 3 years and rates are about 4 percent today. The Net Interest line in Table 1-1 appears to be wildly underestimated.

See https://www.cbo.gov/publication/58147#_idTextAnchor007

The Budget and Economic Outlook: 2022 to 2032 | Congressional Budget Office (cbo.gov)

Just last month the US Treasury announced a massive increase for 4Q22 and 1Q23:

WASHINGTON -- The U.S. Department of the Treasury today announced its current estimates of privately-held net marketable borrowing for the October – December 2022 and January – March 2023 quarters.

• During the October – December 2022 quarter, Treasury expects to borrow $550 billion in privately-held net marketable debt, assuming an end-of-December cash balance of $700 billion. The borrowing estimate is $150 billion higher than announced in August 2022, primarily due to changes to projections of fiscal activity, greater than projected discount on marketable securities, and lower non-marketable financing.

• During the January – March 2023 quarter, Treasury expects to borrow $578 billion in privately-held net marketable debt, assuming an end-of-March cash balance of $500 billion.

See https://home.treasury.gov/news/press-releases/jy1063

Treasury Announces Marketable Borrowing Estimates | U.S. Department of the Treasury

Additionally, the Total Revenue line in Table 1-1 from CBO report appears to be very optimistic. Are tax revenues likely to sustain the big increase from 2021 to 2022 now that all the government spending related to Covid is gone?

If the Fed doesn’t reverse in 2023, the US fiscal situation appears to get out of hand very quickly. I’d appreciate any thoughts you have.

Thanks,

Dave

This comment has been removed by the author.

ReplyDeleteScott, any thoughts about a soft landing or are we in for the most talked about recession next year?

ReplyDeletehttps://centerforfinancialstability.org/amfm/Chartsinside_big.gif

ReplyDeletehttps://tsi-blog.com/blog/blog-default/

http://www.shadowstats.com/

When the money stock goes negative.

RJ, Re likelihood of a recession next year:

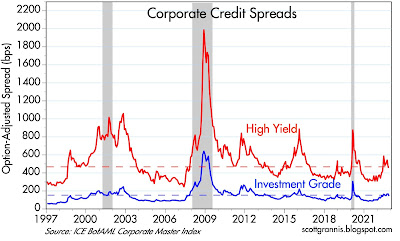

ReplyDeleteIt seems like a solid majority see a recession next year, but I have yet to see convincing evidence. Recessions require a number of factors: rising interest rates, high real interest rates, scarcity of liquidity, rising default rates, bankruptcies, high and rising credit spreads, an inverted yield curve, significant job losses, residential construction contraction, and declining industrial production.

Currently, only three of these factors are present: higher interest rates, an inverted yield curve, and a softening in the housing market. The big difference today relative to past pre-recession periods is the abundance of liquidity, relatively low credit spreads and default rates, relatively robust job gains, and continuing growth in industrial production.

Of course, if the Fed continues to tighten despite numerous signs that it's not needed (falling commodity prices, a weaker dollar, relatively low inflation expectations) then a recession would become more likely.

Before Powell eliminated required reserves, the monetary transmission mechanism (the truistic monetary base), it took a negative rate-of-change in short-term legal reserves to have a recession.

ReplyDeleteThat doesn't work for the money stock. But recessions were also typically associated with negative roc's in short-term money flows. However, the correlations weren't as tight.

Like Scott Grannis opines, with this huge injection of new money, short-term money flows are on a trajectory to not contract for the entire 2023 period.

See also, Mises M2 minus TMS growth rate:

ReplyDeletehttps://mises.org/wire/money-supply-growth-october-fell-39-month-low-recession-now-almost-guaranteed

QUARTERLY ANNUALIZED PERCENT CHANGE

ReplyDeleteCleveland's CPI inflation nowcast is down to 2022:Q4 4.82%

https://www.clevelandfed.org/indicators-and-data/inflation-nowcasting

One thing these other analysts don't do is differentiate between long- and short-term money flows. Short-term money flows are up. Atlanta's gDp nowcast is @ 4.3%. That runs counter to their predictions.

ReplyDeleteThird quarter GDP growth was revised up to 2.9%. N-gDp @ 7.3% (still too high).

ReplyDeleteLink: Daniel L. Thornton, Vice President and Economic Adviser: Research Division, Federal Reserve Bank of St. Louis, Working Paper Series:

“Monetary Policy: Why Money Matters and Interest Rates Don’t”

Thornton: “the interest rate is the price of credit, not the price of money”

“Today “monetary policy” should be more aptly named “interest rate policy” because policymakers pay virtually no attention to money.”

Scott, I find your interpretation of monetary policy concerning.

ReplyDeleteFor example, time and again you have said the Fed has not printed money, that it is just facilitating the demand for money.

(I have to say - as a literary aside - this is like saying the drug dealer is not doing anything wrong, he is just fulfilling the demand).

Although I understand your point that it is not helicopter money - money is not forced on the economy - how you can jump from this to say that it is not (effectively and eventually) printing money seems simply wrong.

There seems to be a hidden assumption in your view that the Fed will eventually unwind the money supply when the money demand falls. However I think we have all suspected, and now know for sure, that this will never happen (ok, very, very unlikely to ever happen).

Now you, or others, may say “look there was no inflation with all the pump priming post great recession”. Ok, let’s think for a second. What normally happens in capitalistic society, especially one now with great technological innovation? Greater efficiencies, i.e. falling prices.

Why didn’t prices fall? Why didn’t we enjoy the full effects of our capitalistic endeavors? Because the Fed was busy printing trillions. This offset the deflation (not a bugaboo) of our productivity. The inflation of the currency cost us trillions in productivity.

… and with the concomitant low interest rates created an asset bubble that no one knows how will end

… and boxed the Fed into a corner with less and less control of the banking system (paying interest/money on a huge amount of reserves - how long can that go on when it is clearly unable to sell or even roll off treasuries).

Please, please respond - or anyone else - if I have made a mistake somewhere?

Thank you, Richard

Richard, re my interpretation of monetary policy and Fed money printing.

ReplyDeleteI think you have missed several key posts on this subject. It's true that many years ago I said the Fed was not printing money, despite Quantitative Easing. Bank reserves expanded greatly, but that is not money printing. In early 2012, however, I became alarmed at the huge expansion of the M2 money supply, and I noted that the Fed has someone "printed" ~$5 trillion, and that this was going to result in a huge increase in inflation. I recapped this in the very post you have supposedly read.

Nevertheless, I have argued (back in 2020) that a significant expansion of the money supply is not necessarily inflationary, if the expansion is accompanied by a significant increase in the demand for money (which is what happened in 2020). That same money supply became inflationary in early 2021 because the demand for money began to decline (as it has done ever since).

Since April of this year I have argued that the huge decline in the growth of M2 (which has now become an outright decline in the level of M2) was a big relief, because it followed in the wake of the cessation of massive government money distribution, which we now know was the source of the big M2 increase. The big decline in commodity prices and the increase in the dollar were further evidence that the Fed had not lost control of the situation and that monetary policy was once again restrictive (i.e., bringing the supply of money and the demand for it back into balance).

I have also argued that the federal debt situation, which is unquestionably ugly (debt being almost 100% of GDP amidst a rising interest rate environment), was nevertheless not yet catastrophic, since until recently debt service payments have been relatively small share of GDP and thus quite manageable.

Thank you Scott. Yes, I was referring to earlier writings - including the 2020 just referenced to in your most recent post “On the demand for money and other considerations”.

ReplyDeleteBut you still seem to say the same thing today, that it is ok for the Fed to fulfill the money demand - just so long as it stops doing so once the money demand stops - as you have said since the beginning of this year.

But this is the essence of the point I am making: that it is not enough for the Fed to stop providing money (Reserves) AFTER it has already provided $5 trillion. To stop future inflation it must actually reduce those Reserves. This has not happened, and is very unlikely to. And therefore the $5 Trillion will eventually - as money demand recedes - find its way into the economy as inflation.

Or in other words, as you have just responded “Bank reserves expanded greatly, but that is not money printing” seems only possible to me if the reserves are in fact taken back (bought back by the Fed) someday. But if they are not bought back (or treasuries sold) then how can this reserve money not go eventually into society (private money) as inflation?

Am I reading what you are saying correctly?

Richard

Paul Volcker was quoted in the WSJ in 1983 that the Fed: “as a matter of principle favors payment of interest on all reserve balances” … "on rounds of equity”. [sic]

ReplyDeleteThis Romulan cloaking device, the payment of interest on IBDDs, vastly exceeded the level of short-term interest rates which is still illegal per the FSRRA of 2006. That's what caused the repo spike in Sept. 2009 (an interest rate inversion). Remember Reg. Q Ceilings that gave nonbanks a 3/4 point interest rate differential in 1966 (during the first "credit crunch")?

When you sterilize excess reserve balances, you're simultaneously increasing the supply of loan funds, LSAPs on sovereigns, while decreasing the demand for Treasuries (taking them off the private funding market).

Bank-held savings, frozen savings, destroys the velocity of circulation (idling more funds). Bank-held savings have a zero payment’s velocity. The FDIC raised insurance rates to unlimited for transaction accounts (like the BOJ), sucking funds out of the nonbanks, inducing nonbank disintermediation.

--Danielle Dimartino Booth’s book: “Fed Up”, pg. 218

“Before the financial crisis, accounts were insured up to the first $100,000 by the FDIC. That limit kept enormous sums in the shadow banking system. After the crisis, the FDIC raised the insured account limit to $250,000. But trillions of dollars still sate outside the traditional banking system. The “safe” money had no place to go expect money market mutual funds and government securities, leading to a shortage of T-Bills and a corresponding drop in yield."

The suppression of interest rates (decline in real rates of interest) boosts relative asset prices. BOE: “QE initially increases the amount of bank deposits (outside money), those bank-holding companies own (in place of the assets they sell). Those companies will then wish to rebalance their portfolios of assets by buying higher-yielding assets, raising the price of those assets and stimulating spending in the economy.”

And don't forget, that c. 1 trillion in new bank capital, Basel III requirements, destroyed c. 1 trillion in the money stock.

Basel’s Capital Curse - Smart Future (vfu.bg)

Scott, what level of rates do you expect going forward?

ReplyDeleteAtlanta gDp nows' downgrade: latest estimate: 2.8 percent — December 1, 2022 Now a recession seems imminent in the 1st qtr. of 2023.

ReplyDeleteWith the personal savings rate decline, dis-savings, the economy looks to fall off a cliff in the 1st qtr.

https://fred.stlouisfed.org/series/PSAVERT

Richard, re "reserve money." Bank reserves are not money. They cannot be spent by anyone. They exist only on the Fed's balance sheet. Bank reserves are for all intents and purposes equivalent to T-bills; they are risk-free and they pay a floating rate of interest. Banks acquire reserves by selling Treasuries and MBS to the Fed. Bank reserves. Think of reserves as equivalent to very short-term bonds. Banks sell Bonds to the Fed, the Fed pays the banks with Reserves (very short-term bonds).

ReplyDeleteBanks of course can use their currently plentiful supply of bank reserves as collateral for expanding their lending, but only to the degree that they believe that lending to the private sector (instead of lending to the Fed, which is what bank reserves entail) is more attractive on a risk-adjusted basis. Bank lending acts to expand the M2 money supply—only banks can increase the money supply. The fact that M2 is now shrinking thus suggests that banks are not increasing their lending despite holding plentiful reserves.

The Fed's task, if they want to tighten monetary conditions without reducing the supply of reserves, is to set the interest rate they pay on reserves at a level that discourages banks from making new loans to the private sector. There is mounting evidence that they have achieved this already.

In the past, an abundant supply of bank reserves (such as we have today) would create a powerful incentive for banks to expand their lending, because bank reserves (prior to late-2008) paid no interest. Holding reserves was thus totally unprofitable, and that is why banks held only as much reserves as they were required to do in order to collateralize their lending. But today is different: reserves pay interest and thus they are an asset for banks just as loans to the private sector are assets.

Under the new regime which began in late 2008, we are beginning to see that it might indeed be better for the Fed to pay interest on reserves rather than making reserves and liquidity scarce. Instead of a shortage of liquidity, we just have to deal with higher interest rates. That's not so disruptive, but it can achieve the same end, which is to keep the supply of money and the demand for it in balance.

"Bank reserves are not money. They cannot be spent by anyone."

ReplyDeleteAgain, with QE since GFC, this is not correct. Most QE was completed with non-banks which means yes reserves are created but also a new deposit at the commercial bank that has the non-bank as a client. This new money (additional M2) can be spent. Because this new money was derived from the sale (swap) of a Treasury security, it will tend to be channeled into another investing asset (leading to asset inflation and speculation) but it could be spent to buy a car or something. This probably happened somehow to some degree (some consumer inflation pressure) through some kind of wealth effect.

"The fact that M2 is now shrinking thus suggests that banks are not increasing their lending despite holding plentiful reserves."

Again, such assertion requires to dissect the sources of changes in M2. Mr. Kasriel does that well today:

https://www.haver.com/comment/comment.html?c=221201SP.html

Loans and leases are still growing and doing their part for M2 growth but, as Salmo Trutta just suggested, it looks like this is about to fall off a cliff.

Kasriel has always had a few screws loose. And you can account for: "Most QE was completed with non-banks". And that does increase both inside and outside money.

ReplyDeleteReserves represent "clearing balances". As such, they have some reserve velocity.

Reserves are earning assets. And as Scott Grannis says, they are risk free, and have a floating rate of remuneration.

This comment has been removed by the author.

ReplyDeleteThank you very much Scott (I appreciate you spending your time - we are all too? busy unfortunately and going over this one more time - I am sure many, many times for you - is trying).

ReplyDeleteHowever … (of course…ha!)

Can I please get clear though on just a couple more things (or anyone else who knows the answers):

- Can banks use Reserves as collateral to buy Treasuries? (either on the open market or directly from the Treasury, via their primary dealers)? That is, just as with bank loans (at least when there was a Reserve requirement), can banks create money to purchase Treasuries if they have the Reserves? This seems very important to get clear on.

- And, if so, do they do this?

- And if they do do this, is it done with leverage (as dealers are normally allowed to do - I assume something around 10X)?

- If these things are all true, then Reserves are certainly part of the real, private economy - as they are used to finance the purchase of Treasuries (as well as make bank loans). Reserves may not be money, but they can create money. So what’s the difference?

Moreover, unlike bank loans which only temporarily create money until they are paid back, Treasuries bought by the Fed (through the banks), permanently create money - unless the Fed sells back (or rolls out of) these Treasuries.

Are these things correct?

Thank you. Richard

The net inventory of government debt securities at primary dealers hovers around 400-500B and total debt held by public is around 24.3T so, even if leveraged, this inventory is not significant especially since the inventory tends to stay relatively stable over time.

ReplyDeleteIn order to answer your other questions, look at the level of total US commercial banks' assets over GDP, over time.

“Remember that "excess reserves" is an accounting concept, not a physical item. The physical item (asset) is deposits at Fed Res Banks. These deposits may be used to satisfy statutory reserve requirements; any "excess" deposits are labeled as "excess reserves." This terminology dates from the 1920s, and I find it obsolete.” – Dr. Richard Anderson, former Senior Economist and V.P. FRB-STL

ReplyDelete“Money banking textbooks written before 2008 are "now obsolete", as the Fed now has the ability to pay interest on excess reserves, he said in response to an audience question.” – Vice Chairman FOMC - William DUDLEY

Monetary policy (per William Dudley, Vice Chairman & a permanent member of the FOMC), seeks “an IOeR rate consistent with the (1) amount of required reserves, (3) money supply & (3) commercial bank credit outstanding"

---------------------

Remunerated IBDDs, interbank demand deposits held at one of the 12 District Reserve banks and owned by the member commercial banks, are assets defined by economists to be outside-of-the properties normally assigned to the money aggregates. IBDDs are not a medium of exchange. They do not circulate outside of the inter-bank market. They do not require Basel regulatory capital (though are assessed by the DIF). They are not subject to reserve ratio or deposit classification requirements. IBDDs no longer represent “high powered money”.

link: https://www.forbes.com/sites/stevekeen/2016/02/12/hey-joe-banks-cant-lend-out-reserves/?sh=49650ce13660

ReplyDeleteSee: https://www.federalreserve.gov/pubs/feds/2010/201044/201044pap.pdf

ReplyDelete"The Effects of Bank Capital on Lending: What Do We Know, and What Does it Mean?"

Richard, some answers: "Can banks use Reserves as collateral to buy Treasuries? " No. The primary function of reserves is to collateralize deposits. Nowadays, banks hold a lot more reserves than are needed to do that, because reserves pay interest and are thus equivalent to having lent money to the Fed. Reserves are an asset just like loans are. When banks sell Treasuries to the Fed, the Fed "pays" for them with reserves. Reserves can't be used to buy anything in the real economy. If the Fed shrinks the supply of reserves, they do this by selling Treasuries to banks in exchange for reserves, which then "disappear."

ReplyDeleteBanks are uniquely able to create money by lending to the public. I apply for a loan, and the bank credits my account with money they create. Given the huge amount of excess reserves now held buy banks, banks theoretically have an almost unlimited ability to create money (by lending to the public). But they haven't done this. Banks like to hold extra reserves these days because reserves are considered to be high quality assets, and thus they strengthen banks' balance sheets.

Scott,

ReplyDeleteFED proxy rate is higher than the effective one.

https://www.frbsf.org/economic-research/indicators-data/proxy-funds-rate/

@Adam

ReplyDeleteWhat's the theory behind this proxy rate? Synchronicity is not causation.

The personal savings rate is so low, that any Xmas splurge will trigger a recession.

ReplyDeletehttps://fred.stlouisfed.org/series/PSAVERT

It's insane. Powell doesn't know a bank from a nonbank. The way you stop inflation is to decrease the volume of legal reserves. That historical evidence is clear. But Powell eliminated them (for the bankers of course).

ReplyDeleteIt's total myopia. “Yes, I hold that commercial banks are credit intermediaries and not just credit creators” -- George Selgin

Never are the banks intermediaries in the savings -> investment process. Every time a DFI makes a loan to, or buys securities from, the non-bank public, it creates new money - demand deposits, somewhere in the system. I.e., deposits are the result of lending and not the other way around. The DFIs could continue to lend even if the non-bank public ceased to save altogether.

Savings transferred through the nonbanks never leaves the payment's system. Savings transferred through the nonbanks doesn't decrease the size of the payment's system. The NBFIs are the DFI's customers.

Banks aren't intermediaries. Banks are credit creators, not credit transmitters. The economy is being run in reverse.

The very slow decline in inflation is because Powell eliminated required reserves. Velocity has been rising at the same time money has been falling.

ReplyDeleteDaniel L. Thornton, May 12, 2022:

“However, on March 26, 2020, the Board of Governors reduced the reserve requirement on checkable deposits to zero. This action ended the Fed’s ability to control M1. In February 2021 the Board redefined M1 so that M1 and M2 are very nearly identical. Consequently, it makes little sense to distinguish between them. In any event, the checkable deposit portion of M2 cannot be controlled now because there are no longer reserve requirements on these deposits. Here is the reason the Fed cannot control these deposits.”

Some Thoughts About Inflation and the Feds Ability to Control It.pdf (dlthornton.com)

Money flows have risen largely as a result of deleveraging, consumer downsizing, & continuing balance sheet restructuring. I.e., during this process, the transactions velocity has risen because of dis-saving, where e.g., interest-bearing accounts have been converted into transaction accounts. Velocity should reverse its trend in 2023.

Thank you very much Scott. And thank you Carl, and Salmo.

ReplyDeleteOk, so if Reserves cannot be used by banks to leverage the purchase of Treasuries, where do banks get the money (trillions of) to purchase Treasuries - that they then in turn sell to the Fed?

Sorry, but I cannot get a hold of this.

There's only a capital constraint, the SLR, on the purchase of Treasuries and the increase in IBDDs (selling of securities to the FRB-NY's "trading desk", Reserve bank).

ReplyDeleteRe "where do banks get the money (trillions of) to purchase Treasuries - that they then in turn sell to the Fed?"

ReplyDeleteTypically, banks use deposit inflows to buy Treasuries, which they then sell to the Fed in exchange for bank reserves.

Thank you Salmo. Ok I am getting somewhere.

ReplyDeleteI see SLR means Statutory (or Supplementary) Liquidity Ratio, which I believe is currently 5%.

Ok, so for each additional $1 of capital a bank has, it is able to buy $20 of securities.

So, let’s say the Fed wants to buy $20 of treasuries:

The bank will need $1 in excess capital to go out and buy $20 of treasuries in order to then sell them back to the Fed. But, since the Fed pays the bank in Reserves (outside money) the bank does not get back the $20 on its balance sheet. Right?

Thus, it will not be able to go out and purchase another $20 of treasuries (to immediately sell to the Fed) until it has acquired another $1 of capital. Is that correct?

If that is correct, it would seem that each time the Fed buys treasuries it is taking $1 of capital out of a banks’ balance sheet and not replacing it.

So where do the banks keep getting capital to finance the purchase, even at 20 to 1, of the trillions in treasuries that the Fed has bought?

(of course the US Treasury is pumping the money right back out into the economy but it takes time for a sliver of that to filter back into a bank’s capital).

Have I gone off the road?

Richard

You're in an area where I have little expertise. But banks raise capital through retained earnings.

ReplyDelete"Typical items featured in the book value of shareholders' equity include preferred equity, common stock, paid-in capital, retained earnings, and accumulated comprehensive income"

https://www.investopedia.com/terms/b/bank-capital.asp

It's interesting that the composition of bank credit changed in early Feb 2022 when interest rate rises started to accelerate.

ReplyDeletehttps://fred.stlouisfed.org/series/DGS10

https://fred.stlouisfed.org/series/TASACBW027NBOG

Thank you Salmo. In view of your response I assume then that banks do need additional capital every time they purchase and resell securities to the Fed, i.e. every time they sell treasuries to the Fed, they get Reserves 1 for 1, which, as I now know, cannot be used as collateral for new purchases of treasuries. They must, therefore, go out and find new capital - or have more retained earnings - to finance each additional purchase, and resale to the Fed.

ReplyDeleteBut banks cannot quickly increase their retained earnings (at least not at the pace that the Fed buys treasuries), nor do banks want to raise capital disadvantageously, so, again, I wonder how they get more capital to finance these Fed facilitations …

Explanation of FED proxy rate.

ReplyDeleteChoi, Jason, Taeyoung Doh, Andrew Foerster, and Zinnia Martinez. 2022. “Monetary Policy Stance Is Tighter than Federal Funds Rate.” FRBSF Economic Letter 2022-30, November 7.

The FED "proxy rate" is wrong. The correlation is bad.

ReplyDelete