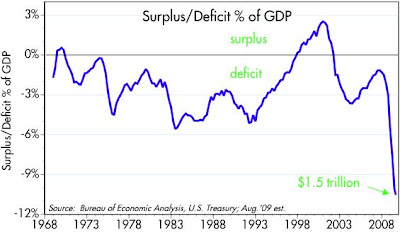

John Stossel had a nice piece yesterday on reason.com that outlines what Obama should have said to Congress the other night. If the numbers above paint a grim picture, then the long-term budget outlook looks downright catastrophic. Excerpts:

In 1964, President Johnson won a landslide victory—quite similar to mine. His election also brought liberals into Congress. The next year, they created the first government-run health care plan: Medicare.

They meant well, but unfortunately, this was the height of fiscal irresponsibility. I know Medicare is popular with the elderly. Of course it is. Everyone likes getting free things. But it is unsustainable.

Retirees believe that their Medicare bills are paid from a "trust fund" that was created with deductions from their paychecks. But this is a politician's lie.

In truth, our predecessors spent every penny of those contributions immediately. They spent them on wars and pork that helped them get re-elected. The money for current retirees' health care is taken from today's workers.

This Ponzi scheme worked for a while. But then ... the average life span increased from 71 to 78 years. When Medicare began, there were five workers for every Medicare recipient. Now there are only four. And by 2030, the Board of Medicare Trustees expects there to be just 2.4. Unless millions of new young workers suddenly arrive from some other planet, there is no way that there will be enough workers to pay the Medicare benefits that we politicians have promised. Medicare's unfunded liability is $37 trillion.

Therefore, today I apologize for defending the absurd health care bills that have emerged from your committees—proposals that would add trillions of dollars of additional debt to an already unsustainable system.

The only way to avoid Medicare's collapse is to get retired people onto private insurance plans that they pay for themselves.

And the only way to address our overall budget deterioration is to rein in spending and entitlement programs, not to keep expanding them.

Scott,

ReplyDeleteI agree with you completely on this issue.

However, with bankers now cutting off credit to millions of businesses and raising interest rates on tens of millions of individuals....how can we expect tax receipts to grow in the future if we are now a highly leveraged almost exclusively domestic consumption economy and consumption is cutting back sharply through higher savings?

And if revenues don't grow....what are we going to to with the 100,000,000 million Americans dependent on entitlements and those service providers depdendent on entitlement payments?

What are our choices at this point?

Scott:

ReplyDeleteI live in Illinois and I see signs that says, purchase a home, condo, multi unit, $500 dollars down and you get $8000.00 back. IT'S FREE MONEY. This "free money" comes from you and me and the rest of Americans who pay taxes. But I guess these people are entitled to this "free money"

Alstry,

ReplyDeleteHere is how we do it in simple terms.

Find & vote in fiscally responsible candidates. Freeze all spending. Means test SS & Medicare and pay back those above the line what they put in plus 3% interest.

Then go to work eliminating ineffective spending. Then pass a Constitutional Amendment eliminating the "general welfare clause" from the Constitution as it applies to any future spending AND repeal the 16th Amendment (income tax).

Finally, institute a consumption based tax to fund a much smaller government and begin to pay down the debt.

Scott,

ReplyDeleteNow would be a swell time for The Messiah to start cutting all that waste from Medicaid he says he can find that will pay for his health care swindle.

This comment has been removed by the author.

ReplyDeleteJay: government handout programs are an abomination and should be forbidden. It steals money from my pocket and yours and gives it to someone else who may or may not be deserving. Our Founding Fathers would be rolling over in their graves if they could see this.

ReplyDeleteScott,

ReplyDeleteNot only would our founding fathers have turned over in their grave....but they would likely ask to have their burial site moved.

Since all of entitlement spending is deficit spending these days...if we cut out entitlements completely, what effect would it have on GDP?

In the highly unlikely event that all transfer payments were to cease, GDP accounting would not register the change at all. That's because government transfer payments are not counted in the GDP numbers. What is counted are the expenditures of those who receive the transfer payments. Stop making transfer payments, and the people who are funding the payments would have more money to spend, thus making up for those who had less.

ReplyDeleteScott,

ReplyDeleteBut we are now borrowing to make those transfer payments...so really the money is no longer coming from taxpayers....simply deficits through fractional reserve banking.

So if we stopped making those payments, those people couldn't spend....and that would not be a bad thing.....but wouldn't it have profound impact on our GDP.

Borrowing is simply one way of getting money from person A in order to give money to person B. It doesn't create any new demand. So not borrowing money from A would not destroy any demand.

ReplyDeleteBut if we didn't borrow and nand out welfare....the welfare recipients would have no way to spend money.

ReplyDeleteThe issue is not demand for analyzing impact on GDP, I am sure welfare recipients' demand would increase linearly with the amount of money we handed them.

If the U.S. borrowed $10 Trillion dollars and increased welfare checks 10X....it seems likely demand by welfare recipients would increase 10X and the GDP would increase by $9 trillion.

The only problem would be the massive debt obligation on the citizens backs after the funds were spent.

It just seems like in America, demand always equals peoples ability to borrow money and lenders willingness to lend or government's willingness to hand out welfare checks.

alstry: if the government borrows money and then turns around and hands out welfare checks, that cannot possibly create new demand. It only shifts demand from those who bought the government bonds to the welfare recipients. Transfer payments, I repeat, do not add to GDP. Borrowing does not create new demand.

ReplyDeleteScott,

ReplyDeleteI think where the confusion might be coming in is I am focusing more on velocity than than demand, and that makes my presentation opaque.

If the welfare recipient goes out and spends the money that increases the velocity of that spend versus the purchaser of the bond who would have simply saved the money.

Since we are now a consumption based economy, if everyone simply became savers, we would not have much of an economy relative to what we have today.

Hopefully this clarifies things a bit.....in other words, by transferring money from savers to spenders, it has a stimulative effect on GDP.

Scott:

ReplyDeleteThe sign says this is an FHA program. What is going to happen to these $500 down properties 3 years from now, another financial system collapse? If you do not have more than 500 to purchase a propety maybe you should be a renter. If ever you want a picture of the sign, I have one.

alstry: you have a good point about how the recipients of federal transfer payments may be more likely to spend money than the people who are buying Treasury debt. There are indeed signs that the velocity of money is picking up. But is that the result of increased transfer payments, or is it the result of natural healing forces in the economy? I think it's the latter. I see many signs that the demand for money is declining (i.e., velocity is rising): the dollar is falling, and gold, equities and commodities are rising. The economy is picking up because money is circulating faster. Confidence is one thing driving higher velocity. Super-low interest rates from the Fed also have a powerful impact on the demand for money; who wants to hold tons of money in a money market fund that pays zero?

ReplyDeleteJay: If we have another financial market collapse then we are all in deep doo-doo. But if we don't, then those who have purchased things with lots of leverage at depressed prices are going to be looking very smart. The Fed is practically begging people to borrow money, and you should never fight the Fed.

ReplyDeleteMinsky's moment. We are definitely planting the seeds of future calamity.

ReplyDeleteNothing has changed except the risks have become more concentrated.

Minksy seems to be prophetic, but I think he is too quick to conclude that capitalism contains the seeds of its own destruction, or that market collapses are inevitable in any capitalist economy. To me the root cause of evil is government intervention in markets. I'm not suggesting that we won't have problems in the future, just that we need to recognize that bad policies can carry with them a terrible price that will likely be paid in the future. It may take many years for the housing market to bubble up and then collapse, but that is bound to happen if the government continues to pursue policies designed to make housing "affordable."

ReplyDelete