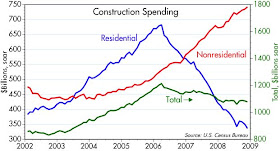

Total construction spending has been flat for most of the past year. The decline in residential construction spending has slowed significantly in recent months, and is now at such a low level compared to the rest of the economy (about 3% of GDP) that further declines, if they occur, are almost irrelevant to the economy's overall health. Many have worried in recent months that nonresidential construction would be the next shoe to drop, but so far that has not occurred. Growth in nonresidential construction has slowed, but it was still growing as of the November data released today.

SLAFX does not look like it has bounced 35 percent since late November. Wondering if this is a commodity or latin america play?

ReplyDeleteSLAFX is a latin american equity fund and not all markets have done as well as Brazil. Argentina for example is only up 33%. SLAFX however should be up at least 3-4% today, putting it up 35% from its November lows.

ReplyDeleteWith so many small businesses closing down, large retailers shutting hundreds of thousands of doors, and empty office buildings everywhere you look, certainly non-residential construction spending is the next shoe to drop?

ReplyDeleteIs it possible to figure out how many months of inventory are currently on the market? Maybe we are reaching an inflection point for the scarcity of real estate or I am not wise enough to know how compnaies can continue to develop commercial projects in this type of market with so much cheap space already available.

Is that an appropriate use of investment capital?

I wouldn't be surprised to see nonresidential construction slump. But by the time it does it may well be the case that residential starts picking up again. In any case, the drag from construction is not likely to be as big going forward as it has been to date.

ReplyDeleteMeanwhile there have been all sorts of changes going on in the economy that we won't know about for many months. I do see macro signs of the beginnings of an upturn in the economy (e.g., commodity prices turning up), even though the micro signs seem to all be negative.

One of the biggest impulses that would get a recovery going, however, would be the simple knowledge that the economy is no longer sinking. That would give a positive jolt to confidence, and that is what is most lacking at this point.

This is exactly what I was thinking...

ReplyDeletehttp://www.nytimes.com/2009/01/05/business/05real.html?em

The real question however is whether this bad news is priced into the market or not. I suspect it is. I suspect the market for commercial mortgage backed securities is pricing in default rates that are much higher than this article mentions.

ReplyDelete