The evidence supporting multiple Fed rate cuts is now solid.

As I've been documenting for at least the past year, shelter costs, as calculated according to the BLS's flawed methodology, have been artificially raising reported CPI inflation. Abstracting from shelter costs, the year over year change in the CPI has been less than 2% for 10 of the past 13 months, and in June it was 1.8%. This clearly meets and exceeds the bar that Powell set this week, thus opening the door to multiple Fed rate cuts that could begin as early as the July '24 FOMC meeting, and will almost certainly occur at the September 18th meeting and at subsequent meetings.

I'm thinking multiple cuts, more than the 2 ½ cuts that are now priced to occur by the end of this year.

Chart #1

Chart #1 is the one that cements the case for multiple rate cuts. Owners' equivalent rent makes up about one-third of the CPI index, and as the chart shows, this has been adding significantly to the rise in the CPI index until this month. The annualized rate of change in this index for the month of June was 3.37%, which is the lowest rate we have seen April '21.

Chart #2

I've shown Chart #2 repeatedly for the past year or so. The relationship between the year over year change in Owners Equivalent Rent and the year over year change in housing prices continues: 18-month old housing price changes effectively determine today's shelter costs, according to the BLS methodology. The only good news here is that the deceleration in housing prices which began two years ago dictates that the OER component of the CPI will continue to decelerate at least through October of this year.

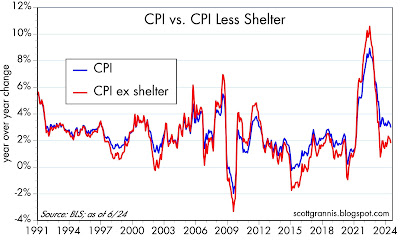

Chart #3

Chart #3 compares the year over year change in the CPI to the same change in the CPI ex-shelter. Note that two typically move together, but over the past year there has been a substantial difference between them. That gap, which has persisted for over one year is completely explained by the OER (shelter) component. Absent shelter costs, the year over year change in the CPI has been less than 2% for 10 of the past 13 months, and it fell to 1.8% in June. The overall CPI is very likely to close the gap by moving lower as shelter inflation continues to decline.

Chart #4

Chart #4 compares the year over year change in the CPI ex-energy (which I have chosen mainly because it is a more stable index and thus provides an easier comparison to interest rates) and the level of 5-yr Treasury yields. Treasury yields tend to track inflation but with a lag that can approach one year or so. With the CPI ex-shelter now down to 1.8% (see the green asterisk in the lower right hand corner of the chart), we might reasonable expect Treasury yields to move substantially lower over the next year or so.

In sum, the Fed has no reason to not lower rates soon. The market fully expects the first rate cut to come at the September FOMC meeting, and another 1 ½ cuts to come by year end. I don't see why the Fed can't move sooner and more forcefully. Inflation has been licked, and interest rate sensitive sectors of the economy are really hurting. Lower rates would provide welcome relief, and it would take a whole lot of cuts to add up to any meaningful stimulus.

Cutting rates now would not be playing politics, since it would not boost the economy by any reasonable measure before the November elections; it would instead be a responsible move to avoid further damage to the economy.

The problem with this analysis is that it does not account for the under reporting of inflation when the lag in housing costs made inflation seem less bad. Just follow the money supply and inflation forecasting will be made easier.

ReplyDeleteM*Vt is a transaction concept, not an income concept. Prices fall when money flows fall. The last half of this year should show deceleration.

ReplyDeleteWe knew this already. Link: George Garvey:

Deposit Velocity and Its Significance (stlouisfed.org)

“Obviously, velocity of total deposits, including time deposits, is considerably lower than that computed for demand deposits alone. The precise difference between the two sets of ratios would depend on the relative share of time deposits in the total as well as on the respective turnover rates of the two types of deposits.”

Contrary to Nobel Prize–winning economist Milton Friedman and Anna J. Schwartz’s “ A Monetary History of the United States, 1867–1960, “there is no “Fool in the Shower”.

Monetary lags are not “long and variable”. The distributed lag effects for both real output and inflation have been mathematical constants for over 100 years.

My “unified theory” is based upon American, Yale Professor Irving Fisher – 1920 2nd edition: “The Purchasing Power of Money”:

“If the principles here advocated are correct, the purchasing power of money — or its reciprocal, the level of prices — depends exclusively on five definite factors:

…“In my opinion, the branch of economics which treats of these five regulators of purchasing power ought to be recognized and ultimately will be recognized as an EXACT SCIENCE, capable of precise formulation, demonstration, and statistical verification.”

Shadow stats gets this right.

The figures used for determining economic flows are non-conforming, as determined by the limitations on all analyses based upon broad statistical aggregates, namely, data is not currently being compiled accurately, or in a manner which conforms to rigid theoretical concepts.

And we knew this already:

ReplyDeleteIn 1931 a commission was established on Member Bank Reserve Requirements. The commission completed their recommendations after a 7 year inquiry on Feb. 5, 1938. The study was entitled “Member Bank Reserve Requirements — Analysis of Committee Proposal”

its 2nd proposal: “Requirements against debits to deposits”

After a 45 year hiatus, this research paper was “declassified” on March 23, 1983. By the time this paper was “declassified”, Nobel Laureate Dr. Milton Friedman had declared RRs to be a “tax” [sic].

Monetarism has never been tried.

"(Bloomberg) -- Bond traders are ramping up bets that the Federal Reserve will cut interest rates by half a percentage point in September instead of the standard quarter-point increment."

ReplyDeleteGrannis has been studying M2 for a long time. He can read more into it than most pundits.

For housing inflation to come down we need a lot of new housing which can only be built and purchased by consumers if interest rates are lower. Hence the reason lower rates will bring lower inflation. Or one of the reasons.

ReplyDeleteThe people in charge of the economy are running it in reverse.

ReplyDeleteJust think. The FED remunerates IBDDs, even though banks don't lend deposits. This destroys the income velocity of funds.

Also, for anyone looking to balance out all those yummy treats with some fitness, don’t forget about the Planet Fitness Student Discount! It’s a great way for students to stay active and healthy while enjoying their favorite seasonal desserts.

ReplyDeleteThis post offers such a thorough and insightful analysis of the potential economic and policy shifts ahead. It's always valuable to hear perspectives on how the Federal Reserve might navigate future challenges. How to Transition Your Skincare Routine for Different Seasons

ReplyDelete