Don't jump to conclusions based on one month's number.

The Final Demand version of the Producer Price Index rose 0.6% in February, and that was twice the amount the market expected to see. A Bloomberg headline this morning said "Bond Yields Jump as Hot Inflation Curbs Fed Wagers." Worse still, the full version of the PPI rose 1.4% in February. OMG!

Well, the reality is VERY different, as these two charts show.

Chart #1

Chart #1 shows the level of the Producer Price Index. As the line in the upper right-hand corner suggests, prices have been unchanged since June '22. Monthly datapoints jump up and down quite a bit, but on balance, prices are going nowhere. In fact, the PPI is down 0.2% since June '22. Want more? Prices for unprocessed goods for intermediate demand (another subset of the PPI) have plunged by 31% since June '22.

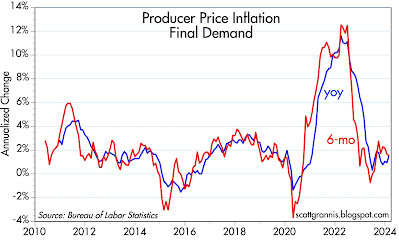

Chart #2

Chart #2 shows the 6-mo. annualized and year over year change in the Final Demand version of the PPI—the one that has given the market the willies this morning. What do we see? The year over year change in this measure of inflation today is 1.55%, and it has been less than 2% since April '23.

Inflation at the producer level has not been a concern for many months. It's effectively dead.

If the Fed gurus have any sense at all, they will realize that there was nothing in today's news that would argue against a cut in short-term rates.

PREACH!

ReplyDeleteRent is still going up. N-gDp is too fast.

ReplyDeleteThe Fed tends to fight the last war.

ReplyDeletePersonally, I would rather see 3% inflation as measured and economic growth, than 2% inflation and a stagnant economy.

Yes, housing is a national catastrophe, spelled out every month for renters and most buyers.

Somehow property zoning needs to be killed off, and go to free markets...but that is a tall order.

Data quality is always a big issue. There are 3-4 rent price indices and they are up to a couple percent apart in their estimate of rental inflation. There's also the timeliness aspect of data quality.

ReplyDeletePeople forget that the Case-Shiller index was only introduced in ~ 1980. There are some estimates of nation-wide residential real estate prices that pre-date that, but their quality is also hard to know.

I am guessing the Fed (Powell) likes inflation to look a bit high at this point in the cycle so they can say they still need to fight inflation.

“The Pandemic Housing Boom increased the price of starter homes a whopping 45%.” Unless you include asset prices, you mis-judge inflation.

ReplyDeleteBernanke brought down real-estate prices by a long-term contractionary money policy. Rent will converge with house prices. The FED needs to continue with its tight money policy. But interest rates have little to do with a change in either Vt or M, i.e., money flows.

The FED's technical staff doesn't know a debit from a credit, etc. The FED will cut their administered rates when the O/N RRP facility empties out. And @ 413.877, we are close to that date.

ReplyDeleteInsurance companies have been raising prices more than 3%. It's pushing up apartment rent and condo fees. It's pushing up shelter costs.

ReplyDelete