Here's my current reading of the economic tea leaves: 1) the September CPI inflation release confirms that ex-energy inflation continues on the 2% per year trend which has prevailed for almost two decades; 2) Small Business Optimism has rebounded strongly and confirms the presence of a V-shaped recovery; 3) very low real interest rates on Treasuries confirm that safety is extremely expensive, Treasuries are a bad deal for investors and a great deal for the federal government; 4) stock prices continue to drift higher, confirming an improving economic and favorable political environment; 5) commodity prices have staged a strong V-shaped recovery, which suggests the global economic outlook has improved dramatically; and 6) TSA throughput says air travel is recovering at only a modest pace (not everything is coming up roses).

Near and dear to my heart, meanwhile, was Apple's unveiling yesterday of its iPhone 12 models. I've been an investor in and a fan of AAPL for a very long time and have had optimistic posts on the company over the years. To my mind, the technological advances and capabilities of Apple's new models are breath-taking, not to mention beautiful to look at. This is one more of many examples of how advanced technology has enriched our lives by orders of magnitude while at the same time becoming accessible to just about anyone. Apple continues to impress, and I'll be ordering a new iPhone 12 Pro Friday morning.

Now for the charts:

Near and dear to my heart, meanwhile, was Apple's unveiling yesterday of its iPhone 12 models. I've been an investor in and a fan of AAPL for a very long time and have had optimistic posts on the company over the years. To my mind, the technological advances and capabilities of Apple's new models are breath-taking, not to mention beautiful to look at. This is one more of many examples of how advanced technology has enriched our lives by orders of magnitude while at the same time becoming accessible to just about anyone. Apple continues to impress, and I'll be ordering a new iPhone 12 Pro Friday morning.

Now for the charts:

Chart #1

Chart #1 plots the ex-energy version of the CPI on a log scale, superimposed on a line that increases at a 2% pace each year. I use ex-energy inflation because energy prices are by far the most volatile component of any inflation index—something the Fed cannot possibly offset or attempt to control. That inflation by this measure has averaged 2% per year for over 17 years is remarkable, although I would prefer to see inflation averaging closer to 1% or less.

Charts #2 and #3 show the impressive results of the September survey of small businesses. Overall optimism has surged in the past few months, as have hiring plans. Despite the still-existing legions of the unemployed, the majority of small businesses report having difficulty filling job vacancies with qualified people. Experience and education are still in demand.

Chart #4

Chart #4 shows the inflation-adjusted yield on 10-yr Treasuries. Nominal yields are a mere 0.7%, and the core rate of CPI inflation (CPI ex food and energy) is currently 1.7%. That leaves an investor with a loss of purchasing power of 1% every year for the next 10 years! (That means a real return of -1%.) This loss of purchasing power obviously hurts the investor, but it's a boon to the US Treasury, which gets to repay its obligations with cheaper dollars. Treasury has issued about $3.5 trillion of new debt since last March, so thanks to very low real interest rates (which are a function of very strong demand for the safety of Treasury notes and bonds) and ongoing inflation, the real burden of that debt will decline by about $35 billion every year for the foreseeable future. Those buying these bonds, of course, will suffer a $35 billion loss.

Chart #5

Chart #5 shows the real and nominal yield on 10-yr Treasuries (blue and red lines) and the difference between the two (green), which is the market's expectation for what CPI inflation will average over the next 10 years: 1.75%. The bond market fully expects nominal yields to remain firmly below the rate of inflation for a very long time. That adds up to either a) tremendous respect for the prowess and power of the Fed, b) a huge amount of risk aversion on the part of the investing public, and/or c) a very negative view of the economy's ability to thrive for the foreseeable future. I'd say the latter two are the obvious choices: risk aversion is very strong and economic optimism is in short supply.

Chart #6

Chart #7

Charts #6 and #7 show that air travel has picked up modestly in the past month to its highest pre-pandemic level. Yet it is still 65% below the levels which prevailed at this time last year. It's a slow takeoff for this industry.

Chart #8

Chart #8 shows the CRB Raw Industrials commodity index, which has staged a complete and V-shaped recovery over the past 5 months. This is a good indication that the global economic outlook has improved rather dramatically in the wake of the Covid shutdown fever which swept almost very country in the world (with a few notable exceptions like Sweden and Switzerland).

Chart #9

We finish with Chart #9, which by now is quite familiar to readers. On balance, stock prices have been edging higher over the past several years, but the Vix "fear index" is still elevated. The market is cautious, as it should be, because there still are plenty of unknowns in our future, the most obvious of which is next month's election, and the potentially huge changes in fiscal policy (most disturbing being higher taxes) that could be set in motion as a result. Bloomberg (alert: strong liberal bias) tells me the market is cheering Biden's lead in the polls, but I worry that his pledge to raise taxes and re-regulate the economy (e.g., Green New Deal) would deal a significant blow to our still-struggling economy and the present discounted value of future corporate profits (i.e., stock prices) if he wins.

If I were to guess the election result that is priced in to the market, I would say the market is discounting the polls—which show Biden with a strong lead—and betting that Trump's odds of winning are favorable: a replay of sorts of what happened 4 years ago. My confidence in this assessment is not high, but in my defense I note that 56% of Americans say they are better off today than they were 4 years ago. I also note that the NY Times' science reporter recently noted that "Experts are saying, with genuine confidence, that the pandemic in the United States will be over far sooner than they expected, possibly by the middle of next year." Moreover, the Trump administration's "Operation Warp Speed — the government’s agreement to subsidize vaccine companies’ clinical trials and manufacturing costs — appears to have been working with remarkable efficiency."

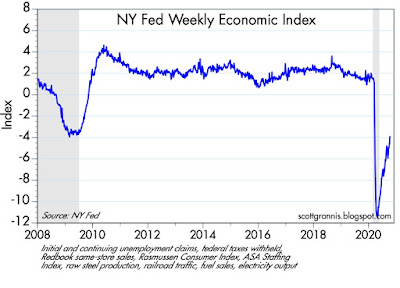

UPDATE (10/15/20): Just discovered this series produced by the NY Federal Reserve, which is a compilation of 10 indicators that are released on a weekly basis, so it's a pretty good coincident indictor of the economy's health. As you can see in Chart #10, things are improving in V-shaped fashion:

Chart #10

Thank you Scott, great post!

ReplyDeleteI'm interested to hear your perspective when Trump loses in 19 days. Will things still be rosy? I strongly suspect that like me, more republicans are voting for Biden than ever before. In my case, I'll vote GOP down the line EXCEPT for POTUS. The US economy is amazingly resilient and I suspect that once DT is out and we have a divided congress, not much will change.

ReplyDelete"That inflation by this measure has averaged 2% per year for over 17 years is remarkable".

ReplyDeleteIt is.

Would it be cynical to wonder if somehow the measurement-method used is modified over time so it would show like this?

The "recovery" began thanks to Trump's stimulus supporting household-demand. Without a second one, there won't be any quick recovery.

ReplyDeleteRight now it seems Trump wants another big one but the GOP resists. So, a Dem win means a massive stimulus which would increase demand again and with it a swift recovery and of course the stock market going up.

About Apple, aren't you concerned that one of its main markets can be turned off in a second?

In any case it seems the equity market likes what it probabilistically sees happening in the election.

ReplyDeleteScott, thanks for the updated post. That chart is fascinating. One thing it suggests is that economic activity is still at the low point of the last recession, in 2008. (I think the potential for a faster recovery is substantial.)

ReplyDeleteAnother is that it supports the late 2009 (and on-going!) contention that the economy was in recovery. I remember the deep skepticism of that time period, and how it contrasted with my own relative confidence, which came in part from observing local businesses and employees, the number of cars in the lots, and at the stores, and on the streets. I also remember finding this blog a couple years later, and appreciating the consistency with which you also expressed confidence in the on-going recovery based upon economic data/evidence.

Flying robot: if you go back and read my posts from late 2008, you will see that initially I was early in calling for a recovery, but some time in March or April 2009 I predicted the bottom in the economy to be mid-year. Nailed it!

ReplyDeleteRoy: re "Would it be cynical to wonder if somehow the measurement-method [for inflation] used is modified over time so it would show like this?"

ReplyDeleteI seriously doubt it, but I don't fault your skepticism. Always be skeptical of numbers. In any event, I've been a skeptic for the past 40 years and have yet to discover any evidence of the government manipulating statistics. There are too many numbers that are inter-related. Fudging the data in one place would reveal inconsistencies in other places. Conspiracies are almost impossible when more than a few people are involved, and the same goes for government stats.

Roy, re the significance of further stimulus. If the market is pinning its hopes on another round of stimulus, then the market will be disappointed. As a matter of conviction and principles, I don't think government spending "stimulates" anything. In fact, I predicted in 2009 that Obama's trillion dollar stimulus would be ineffective, and in the end would actually act to produce a sub-par recovery, which is exactly what happened. When the government consumes resources (whether to launch shovel ready infrastructure projects or to redistribute income) the economy as whole loses. The private sector can almost always spend the money in a better and more efficient manner.

ReplyDeleteThe $3 trillion of "stimulus" we got following March only served to supply T-bill equivalents to all those who increased their savings. It was something the Fed had to do, and the government borrowed the money to accommodate the Fed. All that happened was that money was "distributed" from swollen checking and savings account to those individuals and businesses who were suddenly left stranded. It was like a bridge loan. It kept the financial system from imploding.

If any further stimulus is needed, it should be in the form of increased incentives to work and invest (e.g., lower tax rates) and reduced regulatory burdens.

Taking money from one pocket and putting it in another is not stimulus. An economy cannot borrow its way to prosperity.

Roy, re Apple: there's always a risk of something going wrong. Could China put a halt to sales of Apple products and services? I suppose so, but China is not a major market for the company. And we could always threaten to retaliate by shutting out Chinese products. Thanks to burgeoning world trade, the world is so interconnected that it's foolish for anyone to shut down trade with anyone else; everyone loses. Of course politicians can be and often are stupid, so yes, there's a risk of a Black Swan event. You just have to live with—no magical solutions other than to hide out in cash.

ReplyDeleteScott,

ReplyDeleteThank you for the elaborate replies.

Regarding inflation, I'm certainly not implying conspiracy or anything in that realm.

More like:

https://www.brookings.edu/blog/up-front/2018/07/25/measuring-inflation-whats-changed-over-the-past-20-years-what-hasnt/

https://www.investopedia.com/articles/07/consumerpriceindex.asp

I think it's obvious that various departments are infatuated with a nice flat-line and despise volatility.

Regarding the stimulus, households got money straight into their pockets (regardless of the source). This surely increased demand and supported the recovery (while a lot of it was saved and paid for external supply, hence low impact on inflation).

There's no doubt there is some recovery underway, the only question is how fast will it get us back to the starting point. Supporting household demand means it's going to happen faster.

The world is not in short need of supply, other than perhaps food. Apple is not in need of cash.

Optionality: vaccine or treatment.

As for Apple, their recent event was prohibited from being broadcast! It can not be defined as a Black Swan anymore. Surely there are other options than Apple or Cash. Like, other companies.

Another great post by Scott Grannis.

ReplyDeleteThe election? Wall Street, Hollywood, Silicon Valley and the globalists (and the media) are backing "Beijing Joe" Biden.

I personally think Biden is not great for the economy, but evidently others are not concerned.

I have an iMac Pro, and Apple makes terrific products.

What's fascinating about AAPL is that for years it traded at a PE of 10 and then VOILA it stated to trade like aa true growth stock! The idiosyncrasies of the stock market...Tim Cook has done an amazing "Job".

ReplyDeleteI watched Biden's Town Hall last night. One thing was made crystal clear I thought: Biden is very old and not capable of enduring the rigors of the office he seeks. The Dems should never have chosen someone so old, and Biden's handlers should never have agreed to a 90 minute appearance: Biden began running out of gas and rambling at the 60 minute mark.

ReplyDeleteAnother thing also became clear: a vote for Biden is really a vote for Harris, since she would most likely assume the presidency before his term finishes. Harris is much fitter, but she is not made of presidential timber—far from it.

The way to think about Trump is to not listen to anything he says or tweets; focus instead on his ability to get things done. As someone once said, "I hate everything about Trump except all of his policies." Well, maybe not all of his policies, but his list of accomplishments is impressive: significant tax cuts, massive deregulation, huge numbers of judicial appointments, three supreme court appointments (ACB looks like the best by far), getting NATO countries to pony up, Middle East peace agreement, getting tough with China, getting out of the Paris Accord, ending wars, getting tough with Iran and terrorists, record-breaking improvement in real household incomes (prior to Covid), lowest black unemployment rate ever, energy independence.

No disputing accomplishments during the last 3.5 years. Still, the question of Trump reminds me of Bobby Knight at Indiana. Unquestionably accomplished, but he could not stop himself from being a complete ass even after "zero tolerance" line drawn. At some point the University could not bear the constant disruption any longer. It's not just Trump - but also that everyone else has gone insane with Trump Derangement Syndrome. Democrats - insane. Press - insane. Too many conservatives that can't call bullshit when they should - insane.

ReplyDeleteAt this point the only coherent thing I see is to support a Republican Senate - and towards that donated to Susan Collins and Joni Ernst. I pass on both Biden and Trump.

- Joe Biden is going to get at least 350 electoral votes, maybe even over 400.

ReplyDelete- Democrats will wind up with 52-55 seats in the senate

- Democrats will gain 10-20 seats in the house

- Joe Biden's health is just fine for a 77-year-old. Those expecting him to be gone in less than 4 years are going to be disappointed

- Donald Trump, on the other hand, will likely be dead or incapacitated within 4 years. A vote for Donald Trump is largely a vote for Mike Pence

I too watched Biden's town hall last night, and while he was struggling with his stutter a lot, I was actually fairly impressed how well he was able to discuss detailed policies.

I'm curious to know what folks think the impact will be of the breaking Hunter Biden e-mail/laptop scandal which points to systemic corruption in the Biden family. If you've never heard of it it's because Twitter and Facebook have blocked it. But do some googling and you'll find out.

ReplyDeleteI was enjoying the October 16 Grannis comment until the "grade inflation" of Trump's accomplishments. Trunp's accomplishments, which I detailed in two very long articles in my former economics newsletter ... include government spending growing a lot, along with deficits, and negotiations with China were a disaster. The "wall" is far from finished, and corporate tax cuts should have been saved for DURING a recession. When you include value added taxes, total taxes on US corporations were competitive with other developed nations BEFORE the tax cuts.

ReplyDeleteWhat about the Biden crime family of grifters? No Republican would be allowed to get away with this multi-million dollar influence peddling. Not just Hunter, also Joe Biden's two brothers and sister -- all selling "influence" with the Biden Obama administration.The Bidens make the Clintons look like beginners in the crime world !

I have my latest Biden article on my politics blog;

www.ElectionCircus.blogspot.com

I started laughing after reading John A's pipedream comment. Hey John, Biden is so dishonest that this libertarian voted for a Republican president for the first time since 1980. I gave up on Dumbocrats in 1972.

Wait until the 3Q Real GDP comes out before the election with 24 to 32 percent growth. Unlike last quarter, the left biased media will carefully explain the real growth was multiplied by four, which is not honest. Of course that sane methodology WAS honest last quarter! Leftists are so predictable.

When Q2 GDP came out, all the Trump apologists (including Trump himself if I recall correctly) went to great lengths to point out that the "real" GDP decline was only about 1/4 of the headline number. When Q3 GDP comes out, you can be sure the Trump apologists will completely forget about the annualized aspect of it they tried telling everyone 3 months ago, and shout at the top of their lungs what a great number the 30-something % gain is. If the leftists tell everyone that's an annualized number and the "real" number is only about 1/4 of the headline number, they are doing nothing more than reminding Trump and his fanboys what they said 3 months ago.

ReplyDeleteCompletely lost respect for Biden when I saw him crookedly brag about withholding US billions regarding the treatment of his son.

ReplyDeleteRegarding the Biden family - it's awful. Agree with Cliff Claven that no republican would get away with that. It should matter a lot, but the voters that are sick of Trump don't care about anything else. Segue - the Obamas went from broke to centi-millionaires. The Clintons too. Oh, and what about genius Al Gore! (Someone help me with Republicans that have grifted to the scale of these dear leaders.) With Obama, it's particularly ironic considering his preaching about how the rich didn't earn it themselves, and chastising about being greedy. Their wealth 100% comes from celebrity earned from the White House (public servant!), and nothing else. It's unseemly. Honestly if he (and she) wasn't so self righteous I'd say what the hell, but it's fairly disgusting.

ReplyDeleteI am deeply disappointed, even concerned, that suffocating a bona-fide story is now OK in US media.

ReplyDeleteIf you are a Biden-supporter, that is fine. I encourage people to look into politics and have viewpoints. All good.

But banning a story, or dismissing it without investigation, defines what happened to the Hunter Biden-laptop story.

The Twitters, Youtubes, Facebooks are the town squares of today. If you want to go down to the town square, get up on a soapbox, distribute flyers and pamphlets, then good. I support you.

Twitter, Youtube, Facebook are deciding that, "No, you cannot distribute flyers in town square."

For overt hate speech, I think we have to make some compromises, and perhaps overt hate speech is best suffocated. Tricky issue, slippery slope.

But the Hunter Biden-laptop story is miles away from overt hate speech.

The response of the Biden camp to the laptop story is as weasel-y as one would expect from any (Donk or 'Phant) political camp when confronted with an inconvenient story.

The NYT and WaPo have decided it is more important to be "woke" than the tell it like it is, and then let the chips fall where they may.

When Wall Street, Hollywood and Silicon Valley all agree on something...well, you might might to ponder what is Biden offering. Some sort of identity politics-globalist confection.

The establishment'Phants are not much prettier.

How did we get to the point when a Donald Trump looks relatively appealing?

The big techs that are "platforms" for info/news, etc., need to be re-regulated.

ReplyDeleteThe FIRST TIME they deleted ("censored") a message is the point that they became "content" publishers (they edit). So, we are about 20 years late already.

This is a new technology, which has been predictably challenging for the regulators. (similar difficulties occurred with the railroad and steel industries, by the way). When it becomes obvious that there's a problem, the smart change course. The FCC, SEC, etc., need to get involved. It will take a lot of complex effort.

These companies are monopolies. Monopoly is a predictable part of a free market and needs regulation to handle.

Anarcho-capitalism (anarcho-libertarianism) is not a practical concept.

You should not HAVE to ignore what someone says or tweets to form an opinion. Words matter. Every person reading this blog knows damn well that if Trump were a CEO of a public company has ass would have been fired a long time ago. Moreover, a POTUS has a huge responsibility to set a standard that many follow. Without question as Randy pointed out, his petulant behavior transcends politics and infects all media.

ReplyDeleteI will-with reluctance, vote Dem for the first time in my 64 year old life BUT vote GOP for senate. I have a hard time believing I'm in a significant minority.

Trump is the blueprint for a successful US Presidency, and a successful economy that benefits ALL Americans.

ReplyDeleteYou have to be ignorant of lots of facts to deny that.

This is the reason he cannot be allowed to continue in power by the treasonous DC establishment.

Trump has shown the way to American greatness. Unabashed Pro America.

More accomplishments for the most people than any President of my lifetime with more opposition from govt agencies, media and foreign enemies than any President of my lifetime. Every single power base is against him except the Voters. Even the RINOs hate him. They are in on it.

And Trump is the ONLY US President of my lifetime to keep ALL his campaign promises, and never do anything counter to his election narrative. Powerful.

Trump's policies created the most prosperity for the most people in the shortest time of any President of my lifetime.

I love what he says & Tweets, because he loves America and calls out dishonesty directly and forcefully. Brutally.

Its about time. All in the face of an illegal coup attempt.

Many of us who have known ALL about the DC corruption want this EXACT behavior from our President.

MANY true Americans want a strong nation with the equal justice for ALL that Trump promotes, rather than a reduction of US sovereignty and intertwining in world government with racist BLM/antifa nonsense. We like elected servants and Rule of Law with the rights of the minority protected in a Constitutional Republic instead of a democracy of mob rule and unelected bureaucrats in charge.

He is the first POTUS of my lifetime totally committed to the Constitution and the little guy, and I do believe he will never let us down. He certainly hasn't so far. Barack never had the kind of enthusiasm we see at the countless Trump rallies everywhere. Not even close.

He is the only human being I can think of to have the thick skin, backbone and personal skill set to fight these bastards, ENDURE THESE ATTACKS, and never ever ever back down...while staying on task. It has been amazing to watch his focus. Amazing and admirable. Traitors used the full force of the CIA, FBI and DOJ to try and bring him down. He has prevailed.

He is the first POTUS of my lifetime to completely earn my vote, and make me feel 100% confident in voting for him, with NO reservations, whatsoever. Never had that in my life before. He is the right man at the right time to preserve the Republic.

He's backed up everything he said.

Lets see if the coming election RIG prevails, or if Truth and Justice prevails.

In a fair election, Trump wins in a landslide. Enthusiasm gap is biggest in modern history.

Biden is a decades long pathological liar and grifter. Email revelations show massive corruption that fits with his own bragging about his Quid Pro Quo deal in Ukraine (as just one example.)

"I graduated first in my class"

"I was the first person in my family to go to college"

"I earned a scholarship"

"I graduated with three degrees"

"I brought back manufacturing jobs"

"I was raised in a black church"

"A drunk driver killed my wife"

All Biden's "Dad teaching Joey" stories are lies. Not one has the ring of Truth. He lies every time he opens his mouth.

He gropes little girls and invades personal space like nobody I have ever seen in decent society.

His wife is a bald faced liar, too. DC has corrupted their souls, and they dont even know it.

The most accurate historic stock market indicators predict a Trump victory, along with the uncannily accurate Stony Brook Primary vote indicator. These have always proved more reliable than oversampled propaganda polls. In other words, if Trump does NOT win, it would go against overwhelming historical precedent, and there is something rotten in DC. The polls are there to make the RIG look legit.

We will just have to see what happens.

Regarding again Scott's question: "I'm curious to know what folks think the impact will be of the breaking Hunter Biden e-mail/laptop scandal"

ReplyDeleteI asked a family member that gets her news primarily from NYT. She spends at least an hour a day reading the online version. She said she heard something vaguely, but nothing could be worse than Trumps secret dealings with Russia.

So.. there you have it from intelligent people that rely on the NYT.

Maybe the Senate or Justice Department will get some traction with it - but lacking clear evidence Joe himself received benefit, seems unlikely.

This comment has been removed by the author.

ReplyDeleteScott,

ReplyDeleteGreat post - really appreciate all of your posts!

Interested in your thoughts on the following from Charles Gave:

- The US has long been the only country able to settle its current account deficit in its own currency.

- Something like $1 trillion in foreign central bank reserves have gone missing in the last seven years.

- Charles Gave believes these central banks are using their excess dollars to buy gold rather than store them at the Fed.

- The result will be a collapsed banking multiplier outside the US, and lower international velocity of money.

- France did something similar in the late 1920s/early 1930s and it helped cause the Great Depression.

- The world monetary order is effectively reverting to a gold standard.

Thanks!

Tom

Scott,

ReplyDeleteGreat post - really appreciate all of your posts!

Interested in your thoughts on the following from Charles Gave:

- The US has long been the only country able to settle its current account deficit in its own currency.

- Something like $1 trillion in foreign central bank reserves have gone missing in the last seven years.

- Charles Gave believes these central banks are using their excess dollars to buy gold rather than store them at the Fed.

- The result will be a collapsed banking multiplier outside the US, and lower international velocity of money.

- France did something similar in the late 1920s/early 1930s and it helped cause the Great Depression.

- The world monetary order is effectively reverting to a gold standard.

Thanks!

Tom

RE: Biden scandel- it won't change anything. There are no undecided voters. It's all about getting out your base. If your voting for Biden, you're either voting for the far left agenda or against trump. Nobody's voting for Biden. Some are voting for Trump, but most are either voting for the party or against the far left agenda. Who will get out the base to vote?

ReplyDeleteWho is going to win the election?

ReplyDeleteWell here's something we can all agree with; I can hardly wait for the election to be over and a winner declared and excepted by the loser-come what may.

ReplyDeleteThis comment has been removed by a blog administrator.

ReplyDeleteThis comment has been removed by a blog administrator.

ReplyDeleteThis comment has been removed by a blog administrator.

ReplyDeleteThis comment has been removed by a blog administrator.

ReplyDeleteThis comment has been removed by a blog administrator.

ReplyDeleteThis comment has been removed by a blog administrator.

ReplyDeleteThis comment has been removed by a blog administrator.

ReplyDelete