As we enter the home stretch in what could prove to be a monumentally important election, I doubt that any honest observer has strong convictions regarding the election's outcome. The implications for the economy are potentially huge: a second term for Trump arguably could put the economy back on a stronger growth track, while a Biden presidency coupled with a Democratic Senate majority would likely give rise to significant obstacles to growth such as much higher tax rates, more regulatory burdens (e.g., an end to fracking and eventually the entire petroleum industry), enormous compliance costs for green energy initiatives, expanded income redistribution efforts, and a more activist industrial policy. If the market expected a Biden/Democrat sweep, I have to believe that stock prices would have been trending lower in recent months, instead of higher. Yet the polls appear to overwhelmingly support a Biden win, as do the betting markets. In any event, never in my lifetime have we had so personally polarizing a president as Trump, and never before have we seen the mainstream media so vociferously, overwhelmingly, and blatantly in support of the challenger—and so antagonistic to the incumbent.

The personalities of Trump and Biden could not be more opposite. Trump is a hardscrabble billionaire businessman devoid of social graces, while Biden is the epitome of a career politician, albeit one with a checkered past and few if any significant accomplishments. It's not surprising that both have skeletons in their closets, but the Democrats and the press spent most of the last 4 years trying in vain to dig up evidence of Trump's malfeasances while ignoring Biden's. The Democrats went on to impeach Trump over a supposed quid pro quo phone call, but now evidence is surfacing of the Biden family's ties to Chinese business interests and apparent influence peddling. Trump is bursting with energy, while Biden is suffering from old age and the beginnings of dementia. Trump has shaken off the Covid virus while maintaining an active schedule, while Biden has been hunkered down in his basement for months in fear of that same virus. Trump's rallies are many and massive, while Biden's are few and subdued. The "enthusiasm gap" hugely favors Trump, while the polls and the pundits hugely favor Biden. Trump chose a competent and successful person to be his Vice President, while Biden gave the nod to an unliked and unimpressive woman because she ticked the politically correct race and gender boxes. In the end, Biden's strongest selling point is that he is not Trump.

To make matters worse, it's possible that we won't know the results of the election for an unbearably long time. Potential risks cloud the horizon in almost every direction, but the market is not ignoring this. Risk aversion is still abundant and visible, especially in the levels of the Vix index and Treasury yields. And yet the economic statistics of late paint a very promising picture of a V-shaped recovery. I'm cautiously optimistic, as I explain below.

Chart #1

Chart #1 shows how rising fears have accompanied market declines. The Vix index, currently just over 33, is significantly higher than what we have observed during times of relatively tranquility (i.e., 10-15), but substantially less than the panic levels we saw at the outset of the Covid crisis. The market is worried, but not in a panicked sense. 10-yr Treasury yields, however, are very near their lowest level in all of history, as are real yields on TIPS. Inflation expectations, in the meantime, are "normal," averaging about 1.7% for the foreseeable future. Low nominal and real yields are therefore not indicative of deflation fears—they are rather clear signs of a lack of confidence in future growth. I hasten to add that yields are low not because the Fed has made them so; they are low because the demand for Treasuries and safe cash equivalents is intense, and that demand, in turn, can only be driven by the market's strong preference for risk aversion.

Chart #2

Chart #2 shows that new orders for capital goods—the seed corn of future productivity gains and a good barometer of business' confidence in the future—have rebounded strongly in recent months. This proxy for business investment is still relatively weak when viewed from an historical perspective (capex was much strong in previous economic expansions), but on the margin it has increased at an impressive pace of late.

Chart #3

Chart #3 highlights the very strong increases in existing home sales in recent months. The housing market is on fire!

Chart #4

Chart #4 shows impressive strength as well in new home construction. Moreover, home builders have never been so optimistic about the future of residential construction. This foreshadows further impressive gains in housing starts and home sales in the months to come.

Chart #5

I don't normally pay much attention to the regional Fed manufacturing surveys, but as Chart #5 shows, conditions in the Richmond area are rather spectacular. Surely a V-shaped recovery of sorts.

Chart #6

Chart #6 shows a similar pattern—though not quite as strong—in the Dallas Fed manufacturing survey. Both Charts #5 and #6 contain data released yesterday and today.

Chart #7

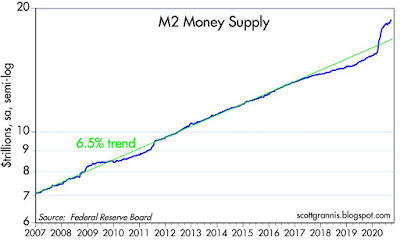

Chart #7 shows an index of non-energy industrial commodity prices. This also reflects a V-shaped recovery of impressive proportions, and it is driven not just by improving conditions in the U.S., but also in global economic activity. If nothing else, this is a good sign that there is no shortage of money in the world these days.

Chart #8

Third quarter GDP numbers will be released on Thursday, and the market is currently expecting a 32% annualized increase in real GDP. I've plotted that result in Chart #8. Even an impressive gain such as this is not enough, however, to erase the losses of the first half of the year. And compared to the long-term trend growth of real GDP (blue line), today's economy is about $4.5 trillion smaller than it otherwise might have been had we not had the slow-growth Obama recovery and the devastating Covid crisis. That translates into a "shortfall" of about 20%. Given our recent history of over a dozen years of sub-par growth mixed with two recessions, it's no wonder the market is having trouble getting optimistic about the future.

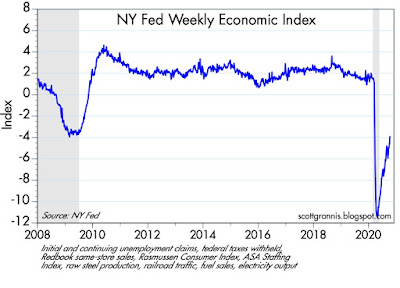

I have not yet succumbed to pessimism, however. My hopes for the future are sustained by 1) the numerous and growing signs of a V-shaped recovery, 2) impressive progress in developing therapeutics and vaccines for Covid, 3) infection and case fatality rates for Covid that are coming in much lower than feared, 3) my enduring belief that the American public will invariably choose growth over redistributionist policies, and 4) the obvious signs of enthusiasm among Trump voters.