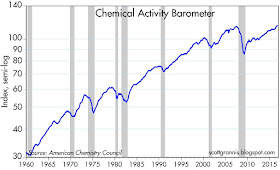

The CAB index is up 4.1% in the past year, for the best showing in the past two years. This suggests that the oil production slump is washing out of the data, and cheaper oil prices are resulting in stronger production of related chemicals.

The year over year change of the 3-month moving average of the index is now up to 3.7%, and a similar measure of industrial production is showing an uptick as well, and that is in line with historical experience—with chemical activity tending to lead industrial production.

I'm not convinced any of this points to a significant acceleration of economic growth. But it does argue convincingly that the economy is not turning down or slumping. Most likely, it just means that the economy is still growing slowly but on the margin it is doing slightly better.

Sooo what the implication. It may imply that the economy is still doing well, but looking back was chemical production a leading indicator for GDP growth?

ReplyDeleteInteresting datapoint, now the heavy lifting is required.

Does not imply the economy is "doing well," only that it is advancing. Under 2% GDP over the past year is not "doing well." No calendar year with 3%+ GDP growth is not "doing well." We have an economy that is crawling, but crawling is movement.

ReplyDeleteJared Dillon recently wrote, "while government numbers tell us the economy is just fine and unemployment is the lowest in years, people aren’t feeling it. I think the 2008 Financial Crisis scarred the US, probably for decades to come. Perhaps that was the moment where we went from being a can-do nation to a can’t-do nation."

I think the scar may have happened earlier with 9/11, and it came in the midst of a major stock market collapse caused by the bursting of the tech bubble, and a recession that came out of that same burst. I would grant that 1995-2000 saw abnormally high growth and that financial markets have been discombobulated since at least 1996, but we had pro-growth policies in the 1980s and 1990s, and those policies really did make a difference. Yes, we had the growth of the personal and desktop computer and the internet. In 1994 we also got introduced to the idea of from welfare to work and that too helped make a difference. Prosperity comes when people produce, and we now have fewer of the population producing than we have had since the late 1970s.

It is not much fun tubing in a pond, but try a river with running water and movement. The US economy is now a pond. We can do better---much better.

we demand more qe

ReplyDeleteI have recently purchased a chemical

ReplyDeleteactivity barometer kit to improve my

investment returns.

I (we) are currently long corn, wheat

and nickel. Wheat is now at a 23 year low

or more.