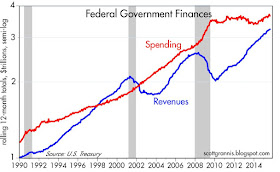

Six years ago the world was shocked by federal budget deficits that were forecast to be over $1 trillion per year for as far as the eye could see. Well, we've come a long way since then. By the end of next month, the federal budget deficit for the current fiscal year is likely to be about $420 billion, a mere 2% of GDP. If present trends continue (spending growth of 5% per year and revenue growth of 8%), next year's budget deficit could be as little as $380 billion, or just 1.7% of GDP. The secret to this remarkable change of fiscal fortunes? Spending restraint, coupled with booming individual and corporate income tax receipts. In short, a relative shrinkage of the public sector and a healthy expansion of the private sector.

These are impressive fundamentals which support the near-term outlook for the economy. They also offer the promise of even better things to come, since the government can easily "afford" to experiment with lower marginal tax rates on individuals and corporations.

Over the past six years, federal government spending has increased at a mere 1% annualized rate. Relative to GDP, spending has declined from 23.6% of GDP to 20.6%, which is right in line with its post-war average. Leviathan has been tamed, at least for now. Meanwhile, federal government revenues have increased at a 7% annualized rate. Relative to GDP, revenues have increased from 15% of GDP to 18.2% of GDP, which is also in line with its post-war average.

Individual income taxes (including capital gains taxes) and corporate income taxes have been the major drivers of revenue growth. Payroll taxes have been growing by a modest 4-5% per year, in line with the increase in jobs and personal incomes. Estate and gift taxes, in contrast, have declined by one-third over the past seven years, and in the past year they have totaled less than $20 billion, a puny 0.11% of GDP. (This is so small it would hardly register on the chart.) If we abolished the death tax, the impact on the deficit would be trivial—equivalent to a rounding error. Why can't we get rid of this tax? Our economy surely spends more trying to minimize this tax than the government receives from the tax—making it an absurd endeavor and a deadweight loss which hurts us all.

Balance the federal budget by axing federal agencies such as HUD, Labor, Education, Commerce and USDA. Then cut "national security" spending in half.

ReplyDeleteCut FICA taxes.

The beast may have lost a scale or two, but government still takes 38% of all we produce. Up from 6% a century ago. The beast is far from tamed. It is a sleeping...no waking...giant that will not be restrained. This is man's history. If we don't put the beast back in its cage soon, it will devour us.

ReplyDeleteThe fact that we haven't significantly cut payroll taxes in these lean employment times gives lie to what each of the two major parties say. For the GOP, it undermines their schtick that they're for lower taxes. For the Dems, it undermines their schtick that they're for the little guy.

ReplyDeleteIn short, cutting payroll taxes should be easy, politically. But these ne'er-do-well parties are just asinine. They can't even do the easy things.

Benjamin, as per usual, I agree with your suggestions. I'd also cut corporate taxes as well as individual income taxes. And legalize all drugs (which, in addition to ending a Constitutional atrocity, would improve the nation's financial picture by materially decreasing the massive cost of incarceration while generating pretty significant revenue, assuming a tax regime a la alcohol).

Mathew-- thank you and I agree that people have the right, however lamentable, to consume whatever recreational drugs or alcohol they desire.

ReplyDeleteBy the way, here's a funny one: you do not have the right to consume alcohol in the United States. You have permission granted to you by your state or local government. Even after Prohibition, there were dry States and there were dry counties up into the 1970s.

I also agree with you that the threat to commercial freedoms and prosperity comes from both parties, and it is very hard to tell which party is worse.

Thank you for graphing the major tax components. Personal Income tax and social security tax seem to be up considerably since the great recession, but I keep reading that personal income at least for nonsupervisory workers has not gone up much. The Social Security tax caps at a certain income, modestly above $100,000 a year, so the increase in social security revenues cannot just be one clever investment advisor raking in his $10 million. I believe all the numbers are true, but there is just enough cognitive dissonance that I wonder if I see clearly what the numbers mean.

ReplyDeleteGeorge: With regards to what to believe, I think the one statistic that doesn't lie is taxes paid. When taxes paid—especially social security taxes, which as you note do not reflect the salaries of the rich—go up, it's virtually certain that incomes are going up. When people talk about how personal incomes have not gone up or have gone up very little, this ignores the fact that, increasingly, people's total compensation is coming in the form of things other than "salaries:" e.g., benefits such as 401k matching contributions, health insurance, compensatory time off, frequent flyer miles.

ReplyDelete