What's good for the world is good for everyone. The more overseas economies produce, the more money they have to purchase goods and services from us. It's a win-win situation. Although the data in these charts is only through last November, it shows that world trade and industrial production is at the very least stable and in some areas gradually picking up, with most of the recent improvements concentrated in the advanced economies.

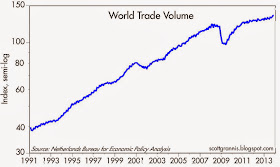

The volume of world trade grew 2.5% in 2011 and only 2% or so in 2012, but in the six months ended November 2013, world trade surged at a 6.7% annualized pace.

As the first two of the three charts above show, world industrial production has been picking up over the past year. In the six months ended November 2013, world industrial production rose at a 4.9% annualized pace. That's reminiscent of the growth rates that prevailed in the generally healthy mid-2000s. As the third chart shows, a good deal of this improvement is coming from a decent recovery in manufacturing activity in the U.S. and Eurozone economies

Industrial production in advanced economies was stagnant in 2011 and 2012 (think Eurozone debt default problems), but things have improved this past year. Industrial production in advanced economies rose at a 4.2% annualized pace in the six months ended November 2013. Manufacturing activity in the U.S. rose at a 6.8% pace in the fourth quarter of last year.

Markets recently have been skittish over fears that Fed tapering is going to be very bad for emerging market economies. In my view, those fears are misplaced. As I noted last week, the problems in Argentina are almost entirely homegrown, and the same can be said in spades for Venezuela. In any event, as the chart above suggests, it's hard to find evidence that the QE era has led to a "bubble" in emerging market economies that threatens to burst. Industrial production in emerging economies has been growing at a relatively constant and unremarkable 4-5% pace for the past several years. They were doing much better in the mid-2000s, when industrial production was rising at 7-10% rates.

As the second of the above charts shows, the Brazilian stock market has been struggling ever since early 2011. If there was an emerging market bubble, it has been deflating for the past 2-3 years.

Markets have also been obsessed with worries of an impending slowdown in China. But as the chart above shows, industrial production in the Asian economies has been growing at a relatively steady 6-7% pace for the past several years. Talk of a China "slowdown" is very relative, since it refers to real GDP growth being "only" 7% instead of 9 or 10%. That kind of "slowdown" was inevitable—China can't grow by 10% a year forever.

See Mark Perry's blog for more charts and commentary on this subject.

Scott, What is your take on the China banking 'problems' we have been hearing about recently.

ReplyDeleteDo you have any cds data on the large China banks that might indicate potential problems?

Liberalism was the age where the securitization of debt that underwrote investing. Beginning in 2008, with QE1, it was the age of in debt we trust; this trust turned out over the long run to be a riskless trade, that made the wily investor wealthy, as the US Fed drove and kept the Ten Year Interest Rate, ^TNX, low.

ReplyDeletePeak debt trade investing is seen in the Chart of AGG, and JNK, BDCS, VCLT, EU, EMB, HYXU, EMLC, and HYMB.

And Peak currency carry trade investing is seen in the Chart of EFA, and EDEN, MES, EWUS, EIRL, GREK, and DFE. And peak pursuit of yield investing, that is yield chasing, which came via both currency carry trade investing and debt trade investing, and is seen in the Chart of DTN, and Leveraged Buyouts PSP, Global Telecom, IST, Smart Grid, GRID, Shipping, SEA, and Water Resources, FIW.

Under the rule of the libertarian despised Creature from Jekyll Island, mankind experienced the Means of Economic Inflationism, that is the Benchmark Interest Rate, ^TNX, driving inflation in both fiat money, defined as Aggregate Credit, AGG, coupled with Major World Currencies, DBV, and Emerging Market Currencies, CEW, as well as fiat wealth, defined as World Stocks, VT, Nation Investment, EFA, and Global Financials, IXG, ever higher.

But when the bond vigilantes gained control of the US Ten Year Note, ^TNX, calling it higher from 2.48, on October 23, 2013, fiat money died in a deflationary extinction event.

Then fiat wealth died the week of January 24, 2014, as investors derisked out of debt trade investments and deleveraged out of currency carry trade investments, forcing World Stocks, VT, Nation Investment, EFA, and Global Financials, IXG, lower in another deflationary extinction event.

The Benchmark Interest Rate, ^TNX, was the Means of Economic Inflationism, but after the pivotal event of October 23, 2013, it is now the Means of Economic Destructionism, establishing economic deflation and economic recession, terminating economic inflation and economic growth. and its metrics such as World Trade Volume, World Industrial Production, and US, Eurozone, Asian Economies, and Emerging Economies Industrial Production.

Furthermore from January 24, 2014 onward, disinvestment out of liberalism debt trade investments, and currency carry trade investments will begin to be active factors of economic deflation, turning the aforementioned economic metrics ever downward, until all of liberalism's economic experience be totally pulverized as foretold in bible prophecy of Daniel 7:7.

Europe is the poster region for an era of falling prices, traditionally bad news for equities shares, as it crimps profits and curbs economic growth by causing companies to lay off workers, which in turn causes demand destruction, and completes a perverse cycle of economic deflation.

With both fiat money and fiat wealth dead, the world has fully PIVOTED from the paradigm and age of liberalism, into that of authoritarianism, which will be an universe and epoch of economic deflation and economic recession, the likes of which the world has never seen.

Bust always follow boom. Now after five years of money market capitalism, the tail risk of Global ZIRP is economic deflation and economic recession, she is presented in bible prophecy of Revelation 17: 1-5; and she is going to be a xxx xxxx, as she is the scarlet beast, full of names of blasphemy, having seven heads and ten horns, and upon her forehead a name written, Mystery, Great Babylon, the mother of the xxxxxxx, and of the abominations of the earth.

I hate to say it, but the commie central bank, the PBoC, has done a better job than Western central banks...ergo China grew throughout global recession...and is an engine of growth today...the Bank of Japan finally gets it...the Fed is stodgy... the ECB murdering Europe...

ReplyDeleteThis comment has been removed by the author.

ReplyDeleteIf everything is going so well in the economy, how come so many people are not feeling it...? I fear having a prosperous economy that disenfranchises so many people along the way that a revolution results -- prosperity leading to revolution is not an economic success model...

ReplyDeleteSgt, just yesterday the Bank of China wrote off 1/2 billion in bad loans. There is billions of bad loans waiting to be discharged one way or another. i suspect going forward, we shall hear how the commie central bank will bail out their banking and shadow banking system.

ReplyDeleteDoes anyone remember how the Chicomms cornered the cotton market, only to discover that cotton can not be stored indefinitely and the stock had to be sold at a loss?

They have manufactured a high GNP only through the use of central planning, and will pay the price in the coming years.

Just like Gentia, do you trust their numbers? For that matter, trust any government and you shall soon become the ward of the state.

Dr McKibbin is correct, this is a phone recovery and disenfranchisement is the preface for riots and revolution.

The Dictator now has firm control over WDC along with his concerts in the Senate.

http://blogs.marketwatch.com/capitolreport/2014/01/28/another-false-dawn-for-u-s-economy-roach-warns/?mod=MW_home_latest_news

ReplyDeleteWe are not alone in this thinking.

The world markets are struggling as well with no positive growth or leadership from the anchor ship America.

PS: I have learned from Scott's blog that bond investors are eager to remain indifferent as to the politics that surround economics -- one sign of that indifference is to generalize weak market/investor sentiments (which are tightly laced with politics) as simply irrational -- let's face it, bond investors generally view market sentiments as somehow misguided and misaligned with the "reality" of financial economic thinking -- the tensions between politics and economics are as polarized as I have seen in many years -- in the mean time, bonds are the nexus of economics in America while Main Street USA is pillaged in detail -- watch for flagship stores a malls to announce sudden closures later in 2014.

ReplyDeletePPS: I am told that one idea to save malls may be to convert store stalls into healthcare services suites to be occupied by physicians and the like -- people will then travel to malls to acquire outpatient medical services -- interesting...

ReplyDelete